GLP-1 Prescriber Pulse: Key Insights from HCP Survey

Our recent quantitative survey of U.S. healthcare providers reveals accelerating adoption of GLP-1 therapies and a clear shift toward broader cardiometabolic use. Below is a high-level view of the major trends shaping the rapidly evolving obesity and metabolic-care landscape.

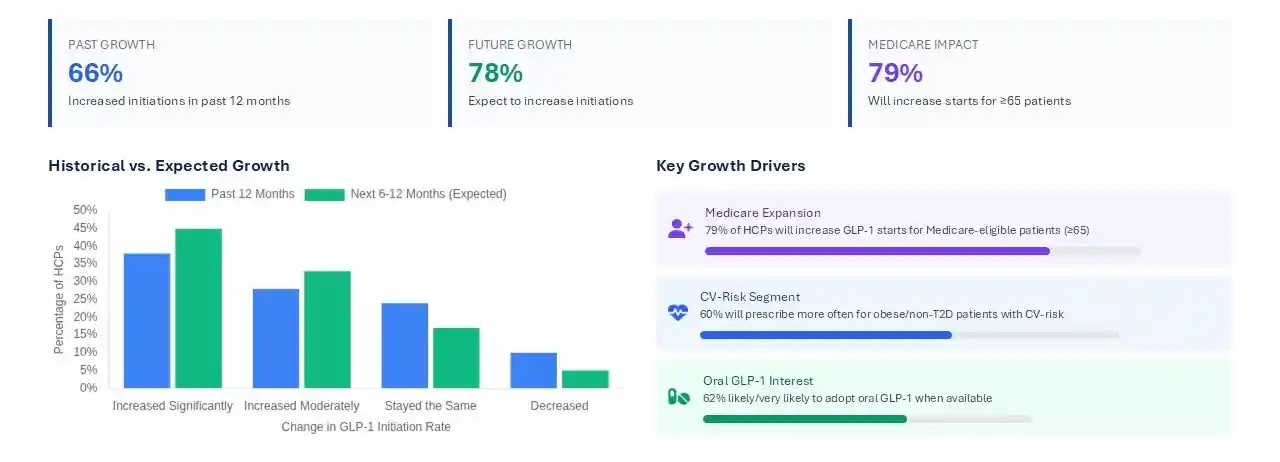

GLP-1 momentum continues to strengthen

A strong majority of HCPs report increased GLP-1 initiation over the past year, and nearly 80% expect prescribing to continue rising. This reflects growing clinical confidence and expanding applicability across cardiometabolic populations.

Impact: A proactive prescriber mindset is increasing pressure on payers to update coverage policies.

New White House pricing & access reforms expected to unlock demand

HCPs anticipate significant growth among Medicare-eligible patients and adults with obesity plus CV-risk — two major expansion segments.

Impact: Signals a shift toward recognizing obesity and cardiometabolic risk as core clinical priorities.

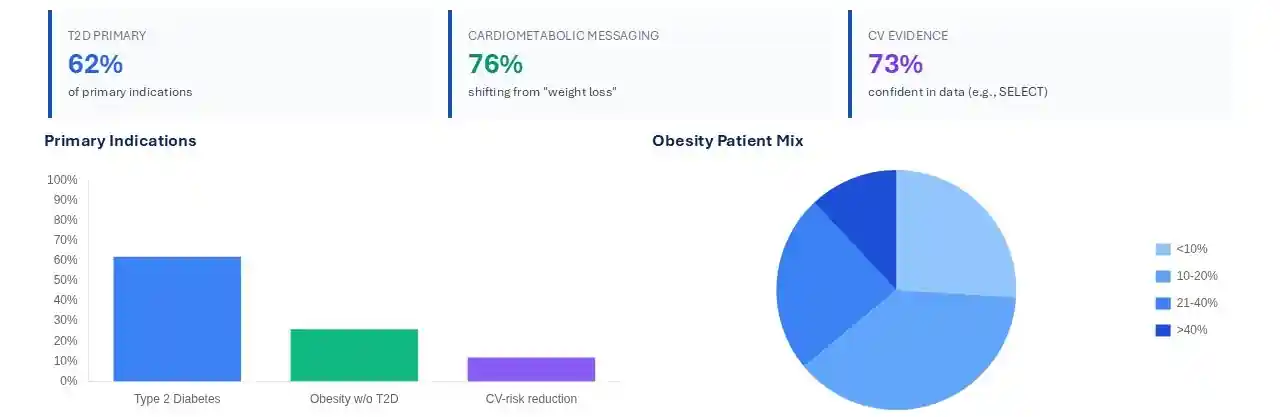

Expanding Indications & Patient Populations

Clinical framing is shifting: Beyond weight loss to cardiometabolic prevention

Most providers plan to emphasize CV-risk reduction when discussing GLP-1 therapy, supported by confidence in emerging outcomes data.

Impact: This reframing aligns with payer value metrics and strengthens the case for coverage expansion.

Treatment duration is lengthening

Providers expect patients to stay on therapy for 12–24+ months to sustain cardiometabolic benefits and reduce weight-regain risk.

Impact: Reinforces GLP-1s as chronic-disease management tools, not short-term interventions.

Obesity-only patients represent a growing share

Obesity without T2D is steadily rising as a treatment population, driven by broadening indications and improving access.

Impact: Significant runway remains for market expansion beyond diabetes.

Oral GLP-1s will be a major catalyst

More than 60% of HCPs say they are likely to adopt oral formulations once available — citing easier onboarding and improved adherence.

Impact: Oral options are expected to expand primary-care penetration and overall market size.

Growth Momentum & Future Outlook

Pricing changes will increase switching

Most providers expect to switch between GLP-1 brands in response to price and copay shifts.

Impact: Manufacturers will need stronger contracting and value-based differentiation as brand loyalty weakens.

Access barriers persist despite policy gains

Prior authorization and plan restrictions remain the top barrier to broader adoption.

Impact: Simplified workflows and payer–provider coordination will be essential.

Clinical capacity and operational strain are rising

Monitoring requirements create moderate-to-high workload for many clinics, prompting nearly 80% of providers to plan for additional support resources.

Impact: Practices will require scalable workflows as demand increases.

Specialty differences matter

- Primary Care: Most sensitive to administrative burden and workflow friction

- Endocrinology: Highest confidence and strongest growth expectations

- Cardiology/Obesity Medicine: Most supportive of non-T2D and CV-focused indications

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.