Mapping Oncologist Perceptions in NMIBC

Unlocking NMIBC Innovation: US Leads the Charge While EU4 Navigates Payer Hurdles

The treatment landscape for non-muscle invasive bladder cancer (NMIBC) is evolving rapidly as global oncologists navigate BCG shortages and new therapeutic breakthroughs. With novel agents like Adstiladrin® and TAR-200 emerging, regional differences between the United States and EU4 markets (Germany, France, Italy, Spain) highlight how innovation and policy shape patient outcomes.

BCG: Still the Backbone, but Shortages Drive Change

For decades, BCG immunotherapy has been the gold standard for high-risk NMIBC. Its immune-stimulating properties have made it highly effective—but limited global supply has created major treatment challenges. In both the US and EU4, clinicians report significant BCG shortages, forcing many to seek alternatives.

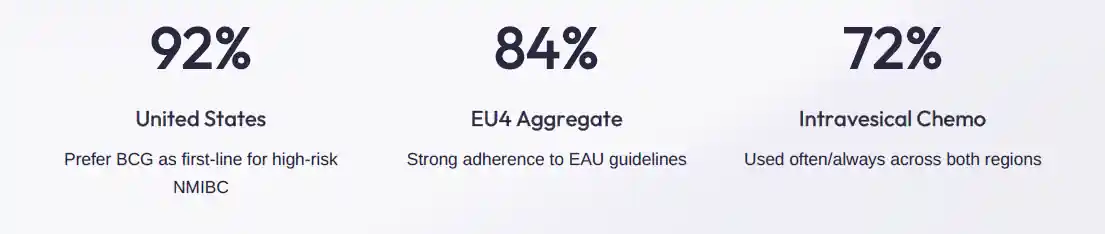

In the US, about 64% of oncologists say shortages have affected their practice, prompting broader use of intravesical chemotherapy agents like mitomycin and gemcitabine. Similarly, 56% of EU4 oncologists report shortages, with Spain and Italy being hit hardest. As a result, intravesical chemotherapy has become a critical bridge therapy in both regions, used by 72% of clinicians.

Strategic Implications

US Oncologists: Leading with Agility and Innovation

The United States continues to set the pace in adopting novel NMIBC therapies. While 92% of oncologists still use BCG first-line, 64% are already leveraging PD-1 inhibitors like Keytruda® for BCG-unresponsive carcinoma in situ (CIS). This rapid adoption reflects FDA’s flexible approval processes and strong clinical trial access.

Moreover, 72% of US oncologists express readiness to adopt emerging gene and intravesical therapies such as Adstiladrin® and TAR-200. Though challenges like reimbursement (68%) and limited long-term data (52%) persist, US payers are adapting , accelerating coverage decisions for promising therapies. The nation’s agile regulatory system and data-driven approach make it a hotbed for early adoption and patient-centered innovation.

EU4 Oncologists: Guideline-Driven but Facing Payer Barriers

Across the EU4, adoption trends tell a more cautious story. 84% of oncologists continue to follow EAU guidelines, prioritizing BCG as first-line therapy. PD-1 inhibitor uptake is significantly lower—only 48% use Keytruda®, with Italy leading at 50% and Germany trailing at 43%.

The main challenge? Reimbursement delays. Each EU4 country has distinct health technology assessment (HTA) processes that demand strong evidence of both clinical efficacy and cost-effectiveness. As a result, even after EMA approval, new NMIBC therapies often wait months or years for national-level reimbursement. 72% of surveyed clinicians cite payer delays as their top barrier to innovation.

Still, there’s optimism. 56% of EU4 oncologists show openness to novel therapies, especially in Italy and France, where enthusiasm for gene therapy and immuno-oncology combinations is growing. Once payers and guidelines align, adoption is expected to accelerate swiftly.

BCG Dominance Across All Markets

New Frontiers: Gene and Drug Delivery Therapies

The future of NMIBC care lies in next-generation therapies designed to overcome BCG limitations. Adstiladrin®, a gene therapy delivering interferon alfa-2b directly into bladder cells, has demonstrated 50%+ complete response rates in BCG-unresponsive patients. Its FDA approval marks a historic milestone, with European approvals anticipated once cost-effectiveness data mature.

Meanwhile, TAR-200, an innovative intravesical delivery system, continuously releases gemcitabine within the bladder for several weeks. This steady, localized drug exposure minimizes recurrence risk and enhances patient convenience—especially valuable in overburdened European clinics.

Other breakthrough candidates, like CG0070 (an oncolytic adenovirus) and N-803 (Anktiva®), are redefining BCG-unresponsive therapy by boosting immune activation. Their early results suggest a coming era where combination immunotherapies may replace radical surgery for many patients.

Bridging the Innovation Gap

Ultimately, both regions share a common goal—better patient outcomes through sustainable innovation. The US thrives on speed, with streamlined approvals and payer flexibility enabling early access to transformative treatments. The EU4, while slower, ensures equity, safety, and long-term system sustainability through rigorous data validation.

The way forward involves real-world evidence generation, payer collaboration, and educational outreach to align stakeholders and accelerate adoption. As BCG shortages persist, both markets have an opportunity to reimagine NMIBC care—shifting from reactive substitution to proactive innovation.

The future of bladder cancer treatment is closer than we think. With gene therapy, smart drug delivery, and immuno-oncology converging, a new era of bladder preservation and patient empowerment is within reach.

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.