Industrial Evaporator Market Growth, Size, Trends, Demand, Revenue, Share and Future Outlook

Industrial Evaporator Market Size- By Construction Type, By Functionality, By End User Industry, By Product Type- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Sep-2023 | Report ID: MACH2351 | Pages: 1 - 224 | Formats*: |

| Category : Equipment and Machinery | |||

- April 2022: A Lone Star Funds subsidiary purchased SPX Flow, Inc.

- May 2019: Smurfit Kappa won a contract to Veolia Water Technologies for the provision of cutting-edge HPD systems at the Sangüesa mill in Northern Spain.

- February 2019: The VACUDEST XS Clearcat wastewater treatment system was introduced by H2O GmbH. Through its significant COD reduction, it enables almost oil-free distillate that exceeds stringent criteria.

- Opportunities: Industrial evaporator producers have potential thanks to the industrialization of developing nations: In the developing world, industrialization is happening quickly, which might be good for the demand for industrial evaporators. Asian nations like China, India, and Japan are seeing an increase in foreign industrial investment as a result of technical development and other favourable conditions. Industrialization in the Asia-Pacific region has advanced significantly faster than on any other continent.

- Challenges: Lack of skilled workforce: Industrial evaporators must be manufactured and operated by skilled workers. There are a number of factors contributing to the absence of a qualified workforce, including students' negative attitudes towards manufacturing occupations and their lack of technological skills. The issue of labour shortages still exists even if the manufacturing sector has essentially resumed operations since Covid.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

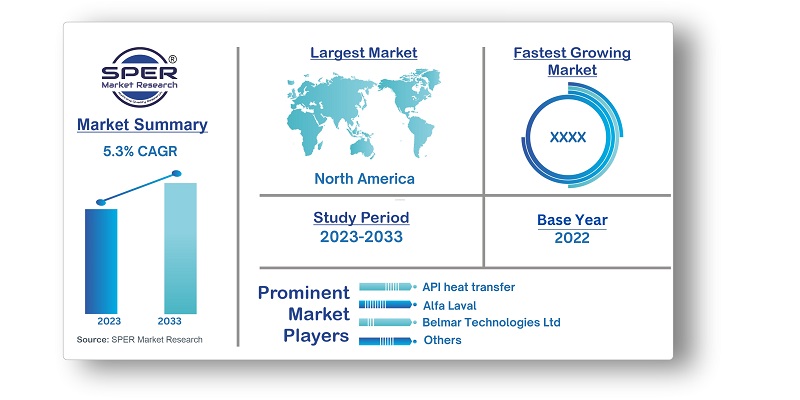

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Construction Type, By Functionality, By End User Industry, By Product Type |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Companies Covered | API heat transfer, Alfa Laval, Belmar Technologies Ltd., Beverage Air, Buchi, Coilmaster Corporation, Colmac Coil Manufacturing, Inc., De Dietrich Process Systems, Daikin industries, EVAPCO, GEA Group AG, Hebei Leheng Energy Saving Equipment Co, Ingersoll Rand, Johnson controls, JEOL Ltd., Praj Industries Ltd., SPX Flow Inc., SUEZ Water Technologies & Solutions, Saltworks Technologies Inc., SMI Evaporative Solutions, Veolia Water Technologies, Others |

- Chemical Manufacturers

- Chemical Process Engineers

- Energy Sector

- Environmental Engineering Firms

- Food and Beverage Producers

- Manufacturing Companies

- Mining and Minerals Industry

- Petrochemical Industry

- Pharmaceutical Manufacturers

- Plant Managers and Operations Teams

- Water Treatment Plants

- Others

| By Construction Type: |

|

| By Functionality: |

|

| By End User Industry: |

|

| By Product Type: |

|

- Size of Global Industrial Evaporator Market (FY’2023-FY’2033)

- Overview of Global Industrial Evaporator Market

- Segmentation of India Dental Clinic Market By Construction Type (Shell & tube evaporators, Plate evaporators)

- Segmentation of India Dental Clinic Service Market By Functionality (Falling film evaporators, Rising film evaporators, Forced circulation evaporators, Agitated thin film evaporator, Mechanical vapor recompression, Others)

- Segmentation of India Dental Care Service Market By End User Industry (Pharmaceutical, Chemical and petrochemical, Electronics and semiconductors, Pulp & paper, Food & beverage, Automotive, Others)

- Segmentation of India Dental Care Service Market By Product Type (Portable industrial evaporator, Stationary industrial evaporator)

- Statistical Snap of Global Industrial Evaporator Market

- Global Industrial Evaporator Market Growth Analysis

- Problems and Challenges in Global Industrial Evaporator Market

- Global Industrial Evaporator Market Competitive Landscape

- Impact of COVID-19 and Demonetization on Global Industrial Evaporator Market

- Details on Recent Investment in Global Industrial Evaporator Market

- Competitive Analysis of Global Industrial Evaporator Market

- Major Players in the Global Industrial Evaporator Market

- SWOT Analysis of Global Industrial Evaporator Market

- Global Industrial Evaporator Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Global Industrial Evaporator Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Global Industrial Evaporator Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Industrial Evaporator Market

7.1. Global Industrial Evaporator Market Value Share and Forecast, By Construction Type, 2023-20337.2. Shell & tube evaporators7.3. Plate evaporators

8.1. Global Industrial Evaporator Market Value Share and Forecast, By Functionality, 2023-20338.2. Falling film evaporators8.3. Rising film evaporators8.4. Forced circulation evaporators8.5. Agitated thin film evaporator8.6. Mechanical vapor recompression8.7. Others

9.1. Global Industrial Evaporator Market Value Share and Forecast, By End User Industry, 2023-20339.2. Pharmaceutical9.3. Chemical and petrochemical9.4. Electronics and semiconductors9.5. Pulp & paper9.6. Food & beverage9.7. Automotive9.8. Others

10.1. Global Industrial Evaporator Market Value Share and Forecast, By Product Type, 2023-203310.2. Portable industrial evaporator10.3. Stationary industrial evaporator

11.1. Global Industrial Evaporator Market Size and Market Share

12.1. Global Industrial Evaporator Market Size and Market Share By Construction Type (2019-2026)12.2. Global Industrial Evaporator Market Size and Market Share By Construction Type (2027-2033)

13.1. Global Industrial Evaporator Market Size and Market Share By Functionality (2019-2026)13.2. Global Industrial Evaporator Market Size and Market Share By Functionality (2027-2033)

14.1. Global Industrial Evaporator Market Size and Market Share By End User Industry (2019-2026)14.2. Global Industrial Evaporator Market Size and Market Share By End User Industry (2027-2033)

15.1. Global Industrial Evaporator Market Size and Market Share By Product Type (2019-2026)15.2. Global Industrial Evaporator Market Size and Market Share By Product Type (2027-2033)

16.1. Global Industrial Evaporator Market Size and Market Share By Region (2019-2026)16.2. Global Industrial Evaporator Market Size and Market Share By Region (2027-2033)16.3. Asia-Pacific16.3.1. Australia16.3.2. China16.3.3. India16.3.4. Japan16.3.5. South Korea16.3.6. Rest of Asia-Pacific16.4. Europe16.4.1. France16.4.2. Germany16.4.3. Italy16.4.4. Spain16.4.5. United Kingdom16.4.6. Rest of Europe16.5. Middle East and Africa16.5.1. Kingdom of Saudi Arabia16.5.2. United Arab Emirates16.5.3. Rest of Middle East & Africa16.6. North America16.6.1. Canada16.6.2. Mexico16.6.3. United States16.7. Latin America16.7.1. Argentina16.7.2. Brazil16.7.3. Rest of Latin America

17.1. API heat transfer17.1.1. Company details17.1.2. Financial outlook17.1.3. Product summary17.1.4. Recent developments17.2. Alfa Laval17.2.1. Company details17.2.2. Financial outlook17.2.3. Product summary17.2.4. Recent developments17.3. Belmar Technologies Ltd.17.3.1. Company details17.3.2. Financial outlook17.3.3. Product summary17.3.4. Recent developments17.4. Beverage Air17.4.1. Company details17.4.2. Financial outlook17.4.3. Product summary17.4.4. Recent developments17.5. Buchi17.5.1. Company details17.5.2. Financial outlook17.5.3. Product summary17.5.4. Recent developments17.6. Coilmaster Corporation17.6.1. Company details17.6.2. Financial outlook17.6.3. Product summary17.6.4. Recent developments17.7. Colmac Coil Manufacturing, Inc.17.7.1. Company details17.7.2. Financial outlook17.7.3. Product summary17.7.4. Recent developments17.8. De Dietrich Process Systems17.8.1. Company details17.8.2. Financial outlook17.8.3. Product summary17.8.4. Recent developments17.9. Daikin industries17.9.1. Company details17.9.2. Financial outlook17.9.3. Product summary17.9.4. Recent developments17.10. EVAPCO17.10.1. Company details17.10.2. Financial outlook17.10.3. Product summary17.10.4. Recent developments17.11. GEA Group AG17.11.1. Company details17.11.2. Financial outlook17.11.3. Product summary17.11.4. Recent developments17.12. Hebei Leheng Energy Saving Equipment Co17.12.1. Company details17.12.2. Financial outlook17.12.3. Product summary17.12.4. Recent developments17.13. Ingersoll Rand17.13.1. Company details17.13.2. Financial outlook17.13.3. Product summary17.13.4. Recent developments17.14. Johnson controls17.14.1. Company details17.14.2. Financial outlook17.14.3. Product summary17.14.4. Recent developments17.15. JEOL Ltd.17.15.1. Company details17.15.2. Financial outlook17.15.3. Product summary17.15.4. Recent developments17.16. Praj Industries Ltd.17.16.1. Company details17.16.2. Financial outlook17.16.3. Product summary17.16.4. Recent developments17.17. SPX Flow Inc.17.17.1. Company details17.17.2. Financial outlook17.17.3. Product summary17.17.4. Recent developments17.18. SUEZ Water Technologies & Solutions17.18.1. Company details17.18.2. Financial outlook17.18.3. Product summary17.18.4. Recent developments17.19. Saltworks Technologies Inc.17.19.1. Company details17.19.2. Financial outlook17.19.3. Product summary17.19.4. Recent developments17.20. SMI Evaporative Solutions17.20.1. Company details17.20.2. Financial outlook17.20.3. Product summary17.20.4. Recent developments17.21. Veolia Water Technologies17.21.1. Company details17.21.2. Financial outlook17.21.3. Product summary17.21.4. Recent developments17.22. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.