Global Laundry Detergents Pods Market Introduction and Overview

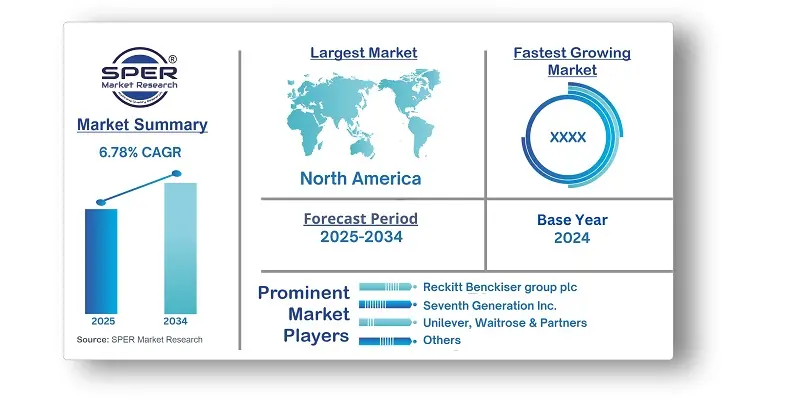

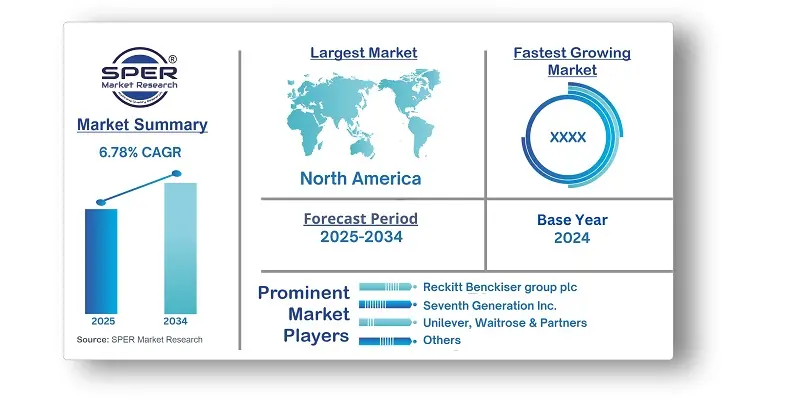

According to SPER Market Research, the Global Laundry Detergents Pods Market is estimated to reach USD 23.19 billion by 2034 with a CAGR of 6.78%.

The report includes an in-depth analysis of the Global Laundry Detergents Pods Market, including market size and trends, product mix, Applications, and supplier analysis. The global laundry detergent pods market has expanded significantly, driven mostly by customer desire for convenience and efficiency in laundry care. These pre-measured pods make the washing procedure easier, removing the need for manual dosing and decreasing waste. Furthermore, innovations in product formulations, such as the use of biodegradable and eco-friendly materials, have attracted environmentally concerned consumers, accelerating market growth. However, the market confronts challenges, including safety worries about accidental ingestion by children, which has prompted calls for more child-resistant packaging and public awareness campaigns. Furthermore, the environmental impact of plastic pod packing has prompted sustainability concerns, prompting producers to look into alternate packaging options.

By Product Insights

Global laundry detergent pods market is divided into two products that are Non-Biological and Biological. Non-biological laundry detergent pods had the highest market revenue share in 2024. The rising emphasis on water conservation has resulted in an increase in low-water washing methods, which can cause detergent residue buildup on garments. This residue may cause allergic responses and skin irritations, particularly in children and those with sensitive skin. In contrast, enzyme-free non-biological laundry capsules are thought to be a more skin-friendly option, and their lower cost compared to biological alternatives is predicted to have a substantial influence.

By Distribution Channel Insights

Global laundry detergent pods market is distributed through mainly three segments in distribution channel, that are Hypermarket/Supermarkets, Convenience stores and Online. Supermarkets and hypermarkets dominated the market in 2024, with a sizable proportion. Supermarkets and hypermarkets stock a variety of laundry detergent pod brands, letting customers to compare and select based on their preferences. These retail shops appeal to price-conscious customers by offering one-stop shopping, competitive pricing, and frequent promotions. Prominent in-store placement raises brand awareness and encourages spontaneous purchases, making it the favored channel for laundry detergent pod sales globally.

By Application Insights

Global laundry detergent pods market is distributed through mainly two application, such as Household and Commercial. Household applications accounted for the majority of market revenue in 2024. IFB, Whirlpool, and Panasonic, among other washing machine makers, recommend utilizing laundry detergent pods to help machines last longer. The dense liquid contains no slow-dissolving components that could become caught in various parts of the washing machine, causing a buildup that reduces the machine's effectiveness. Celebrity endorsements and promotions by social media influencers have boosted product acceptance in the household sector.

By Regional Insights

The North American laundry detergent pods market dominated the worldwide laundry detergent pods market in terms of revenue share in 2024. The region's market growth is driven by rising demand for quick and easy-to-use washing solutions, as well as increased consumer environmental awareness. People in the region are looking for environmentally friendly and sustainable washing solutions that promote energy efficiency and prevent water waste. As a result of this trend, natural and biodegradable laundry detergent pods are becoming increasingly popular.

Market Competitive Landscape

Global laundry detergent pods market is very competitive, with top companies focusing on product innovation, organic certifications, and strategic collaborations to increase market share. Some of the key market players are Reckitt Benckiser group plc, Seventh Generation Inc., Unilever, Waitrose & Partners, Ecozone, Church & Dwilight Co. Inc., Proctor & Gamble, Henkel AG & Co. KGaA, The Clorox Company, Colgate-Palmolive Company.

Recent Developments:

In May 2024, Given that the detergent business is expanding at a rapid pace in many parts of the world, Unilever recently announced the global introduction of its most environmentally friendly laundry capsule. The washing capsule works best in short, cold cycles.

In July 2022, Unilever's most well-known laundry brand (also known as Persil, Skip, and OMO) has revealed a new capsule to help decarbonize the washing process and increase cleaning performance.

In June 2022, Henkel has announced plans to merge its laundry, home care, and beauty care operations into Henkel Consumer Brands by the beginning of 2023. A multi-platform consumer platform is meant to be created by combining resources.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Distribution Channel, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Reckitt Benckiser group plc, Seventh Generation Inc., Unilever, Waitrose & Partners, Ecozone, Church & Dwilight Co. Inc., Proctor & Gamble, Henkel AG & Co. KGaA, The Clorox Company, Colgate-Palmolive Company |

Key Topics Covered in the Report

- Global Laundry Detergents Pods Market Size (FY’2021-FY’2034)

- Overview of Global Laundry Detergents Pods Market

- Segmentation of Global Laundry Detergents Pods Market By Product (Non-Biological, Biological)

- Segmentation of Global Laundry Detergents Pods Market By Distribution Channel (Hypermarket/Supermarkets, Convenience stores, Online, Other Distribution Channels)

- Segmentation of Global Laundry Detergents Pods Market By Application (Household, Commercial)

- Statistical Snap of Global Laundry Detergents Pods Market

- Expansion Analysis of Global Laundry Detergents Pods Market

- Problems and Obstacles in Global Laundry Detergents Pods Market

- Competitive Landscape in the Global Laundry Detergents Pods Market

- Details on Current Investment in Global Laundry Detergents Pods Market

- Competitive Analysis of Global Laundry Detergents Pods Market

- Prominent Players in the Global Laundry Detergents Pods Market

- SWOT Analysis of Global Laundry Detergents Pods Market

- Global Laundry Detergents Pods Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Laundry Detergents Pods Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Laundry Detergents Pods Market

7. Global Laundry Detergents Pods Market, By Product 2021-2034 (USD Million)

7.1. Non-Biological

7.2. Biological

8. Global Laundry Detergents Pods Market, By Distribution Channel 2021-2034 (USD Million)

8.1. Hypermarkets & Supermarkets

8.2. Convenience Stores

8.3. Online

8.4. Other Distribution Channels

9. Global Laundry Detergents Pods Market, By Application 2021-2034 (USD Million)

9.1. Household

9.2. Commercial

10. Global Laundry Detergents Pods Market, 2021-2034 (USD Million)

10.1. Global Laundry Detergents Pods Market Size and Market Share

11. Global Laundry Detergents Pods Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Reckitt Benckiser Group plc

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Seventh Generation Inc.

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Unilever

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Waitrose & Partners

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Ecozone

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Church & Dwilight Co. Inc.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Proctor & Gamble

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Henkel AG & Co. KGaA

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. The Clorox Company

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Colgate-Palmolive Company

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.