Africa Logistics and Warehousing Market Introduction and Overview

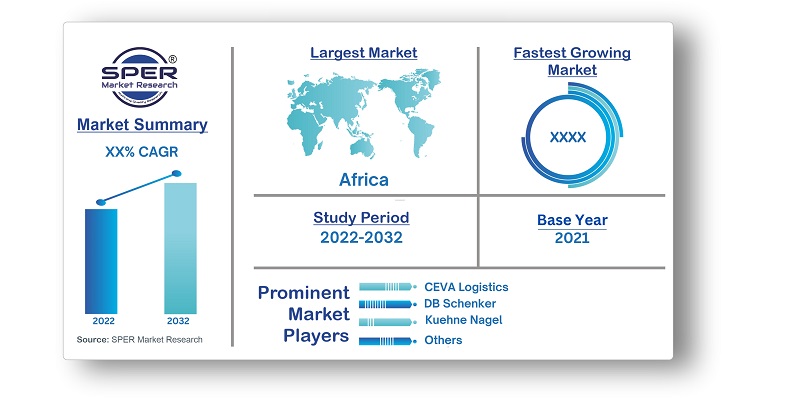

According to SPER Market Research, the Africa Logistics and Warehousing Market is estimated to reach USD XX billion by 2032 with a CAGR of XX%.

The report includes an in-depth analysis of the Africa Logistics and Warehousing market, including market size and trends, product mix, distribution channels, and supplier analysis. Logistics and warehousing encompass the essential processes involved in managing the movement, storage, and distribution of goods. Logistics entails the planning, coordination, and execution of the supply chain, including transportation, inventory management, and order fulfillment. Its goal is to ensure that products are delivered to the right place, at the right time, and in the right condition. Warehousing focuses on the physical storage and handling of goods within a facility, involving activities like receiving, storing, picking, packing, and shipping. Both logistics and warehousing play a critical role in optimizing the flow of goods, enhancing efficiency, minimizing costs, and meeting customer demands in various industries.

- The growth of the infrastructure and construction sector serves as the primary catalyst for the long-term expansion of the logistics and warehousing market. This has led to a series of developments in the country, resulting in increased trade and warehousing activities across the continent.

- The market in Africa will be boosted by investments in advanced technology solutions, including autonomous logistics, real-time tracking, and automation. These investments aim to enhance customer service by providing improved efficiency and effectiveness in logistics operations.

Market Opportunities and Challenges

There are numerous opportunities and difficulties in the African logistics and warehousing business. African countries need effective logistics and warehousing solutions due to the continent's fast urbanization, population expansion, and rising consumer demand.

- Opportunities in the market include the following:

- Infrastructure growth: Ports, airports, and road networks are among the many infrastructure projects currently underway across the continent. These innovations open up possibilities for warehouse and logistics operations to grow.

- E-commerce expansion: The expansion of e-commerce in Africa is driving up demand for reliable warehousing and logistics services. Effective order fulfillment, last-mile delivery, and inventory management are required due to the rise in online retailers and digital platforms.

- Market challenges:

- Infrastructure gaps: Poor transportation facilities, such as roads, railroads, and ports, impede the efficient flow of commodities and drive up the cost of transportation. For markets to expand, infrastructure gaps must be filled.

- A fragmented logistics landscape is present in Africa, where there are many small-scale businesses in the sector. Cross-border coordination of operations and the development of common procedures might be difficult.

Market Competitive Landscape

In many African countries, there are a limited number of dominant international freight forwarding companies, while local players often rely on third-party logistics due to insufficient infrastructure and capital. This trend is expected to continue in the future. The industry is experiencing growth in terms of technology, efficiency, and service offerings, but pricing remains a challenge as high logistic costs can negatively impact the manufacturing sector's contribution to the GDP. Key transportation players in Africa include Bollore Africa Logistics, CEVA Logistics, DB Schenker, DHL, DSV Panalpine, Kuehne Nagel, Maersk.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Service Mix, By Mode of Service, By Type of Warehouses, By End Users

|

| Regions covered | Botswana, Namibia, Tanzania, Uganda, Kenya, Nigeria, South Africa, Rest of Africa

|

| Companies Covered | Bollore Africa Logistics, CEVA Logistics, DB Schenker, DHL, DSV Panalpine, Kuehne Nagel, Maersk

|

COVID-19 Impact on Africa Logistics and Warehousing Market

The logistics industry has been directly affected by the COVID-19 pandemic, particularly in terms of the flow, storage, and transfer of goods. Unlike air and water transportation, road transportation has been relatively less impacted by the effects of the pandemic on the logistics sector. The demand for pharmaceuticals and vaccines has significantly increased during this time, leading to a greater need for refrigerated warehouses to store these temperature-sensitive products. The repercussions of COVID-19 on the warehouse sector are expected to be substantial and enduring. The ongoing emergence of COVID-19 variants and surges in different parts of the world has posed challenges to the global supply chain and labor availability.

Key Target Audience

- Freight Forwarding Companies

- Freight Forwarding Consultancy Companies

- Contact Logistics Companies

- Warehousing Companies

- Warehousing Consultancies

- Venture Capitalists, PE

- Freight Tech Companies

- Others

Our in-depth analysis of the Africa Logistics and Warehousing Market includes the following segments:

|

By Service Mix:

|

Courier and Parcel Activities

Freight Forwarding

Warehousing

|

|

By Mode of Service:

|

Air Freight

Rail Freight

Road Freight

|

|

By Type of Warehouses:

|

Open

Closed

Cold Storage

|

|

By End Users:

|

Automotive

Consumer Retail

Food and Beverages

Healthcare

Others

|

Key Topics Covered in the Report

- Africa Logistics and Warehousing Market Size (FY’2022-FY’2032)

- Overview of Africa Logistics and Warehousing Market

- Segmentation of Africa Logistics and Warehousing Market By Service Mix (Courier and Parcel Activities, Freight Forwarding, Warehousing)

- Segmentation of Africa Logistics and Warehousing Market By Mode of Service (Air Freight, Rail freight, Road Freight)

- Segmentation of Africa Logistics and Warehousing Market By Type of Warehouse (Open, Closed, Cold Storage)

- Segmentation of Africa Logistics and Warehousing Market By End Users (Automotive, Consumer Retail, Food and Beverages, Healthcare, Others)

- Statistical Snap of Africa Logistics and Warehousing Market

- Expansion Analysis of Africa Logistics and Warehousing Market

- Problems and Obstacles in Africa Logistics and Warehousing Market

- Competitive Landscape in the Africa Logistics and Warehousing Market

- Impact of COVID-19 and Demonetization on Africa Logistics and Warehousing Market

- Details on Current Investment in Africa Logistics and Warehousing Market

- Competitive Analysis of Africa Logistics and Warehousing Market

- Prominent Market Players in the Africa Logistics and Warehousing Market

- SWOT Analysis of Africa Logistics and Warehousing Market

- Africa Logistics and Warehousing Market Future Outlook and Projections (FY’2022-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the Africa Logistics and Warehousing Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4. Heat map analysis

6. Competitive Landscape

6.1 Africa Logistics and Warehousing Manufacturing Base Distribution, Sales Area, Product Type

6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Africa Logistics and Warehousing Market

7. Africa Logistics and Warehousing Market, By Service Mix, 2019-2032 (USD Million)

7.1 Courier and Parcel Activities

7.2 Freight Forwarding

7.3 Warehousing

8. Africa Logistics and Warehousing Market, By Mode of Service, 2019-2032 (USD Million)

8.1 Air Freight

8.2 Rail Freight

8.3 Road Freight

9. Africa Logistics and Warehousing Market, By Type of Warehouses, 2019-2032 (USD Million)

9.1 Open

9.2 Closed

9.3 Cold Storage

10. Africa Logistics and Warehousing Market, By End Users, 2019-2032 (USD Million)

10.1 Automotive

10.2 Consumer Retail

10.3 Food and Beverages

10.4 Healthcare

10.5 Others

11. Africa Logistics and Warehousing Market, By Region, 2019-2032 (USD Million)

11.1 Africa Logistics and Warehousing Market Size and Market Share by Region (2019-2025)

11.2 Africa Logistics and Warehousing Market Size and Market Share by Region (2026-2032)

11.3 Botswana

11.4 Namibia

11.5 Tanzania

11.6 Uganda

11.7 Kenya

11.8 Nigeria

11.9 South Africa

11.10 Rest of Africa

12.Company Profiles

12.1 Bollore Africa Logistics

12.1.1 Company details

12.1.2 Financial outlook

12.1.3 Product summary

12.1.4 Recent developments

12.2 CEVA Logistics

12.2.1 Company details

12.2.2 Financial outlook

12.2.3 Product summary

12.2.4 Recent developments

12.3 DB Schenker

12.3.1 Company details

12.3.2 Financial outlook

12.3.3 Product summary

12.3.4 Recent developments

12.4 DHL

12.4.1 Company details

12.4.2 Financial outlook

12.4.3 Product summary

12.4.4 Recent developments

12.5 DSV Panalpine

12.5.1 Company details

12.5.2 Financial outlook

12.5.3 Product summary

12.5.4 Recent developments

12.6 Kuehne Nagel

12.6.1 Company details

12.6.2 Financial outlook

12.6.3 Product summary

12.6.4 Recent developments

12.7 Maersk

12.7.1 Company details

12.7.2 Financial outlook

12.7.3 Product summary

12.7.4 Recent developments

13.List of Abbreviations

14.Reference Links

15.Conclusion

16.Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.