Australia Car Leasing and Rental Market Overview

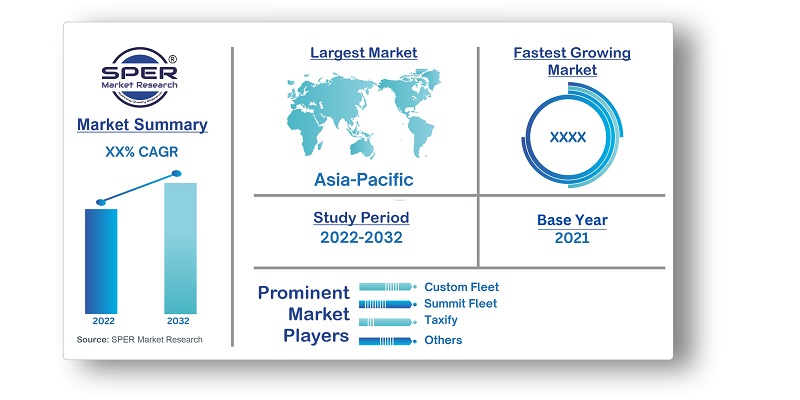

According to SPER Market Research, the Australia Car Leasing and Rental Market is estimated to reach USD xx billion by 2032 with a CAGR of xx%.

The Australian car leasing market was found to be in a late growth stage and experiencing erratic expansion. Low growth in the car lease business was mostly caused by low growth in new vehicle sales and the collapse of the mining industry during that time. During the recent years, the leasing segment's fleet size and revenue both increased, for the industry. Operating lease is the only type of lease that the leasing industry uses; finance lease is not a factor.

The Australian car rental market was observed to be rising, with consistent rise year over year. During the five-year forecast period, increasing inbound tourism, the depreciation of the Australian dollar, and heavy usage by business end users were some of the key reasons promoting development in vehicle rental transactions in Australia. In recent years, the rental segment's fleet size and revenue from rentals both increased.It was discovered that the hailing market was expanding steadily year after year and was currently in its growth phase. When cab aggregators entered the market to compete with the local taxi sector, the market had only recently been formed. Due to the stable legal framework involving ride sharing, new players were able to enter the market during this time. This led to a significant increase in the number of rides and the size of the operating fleet of taxis. In terms of cab aggregator fleet size and income accruing to cab aggregating businesses, the market expanded.

Impact of COVID-19 on the Australia Car Leasing and Rental Market

Even if Covid-19 has had a substantial impact on the leasing business, growth is still anticipated. However, less so than in typical circumstances. Covid-19 has various repercussions for automobile lease dealers. First, there is a decline in global public demand for new cars. Most likely, due to society's closing, a large number of people now work from home and have less need for a car. Perhaps another factor contributing to the lack of demand for new cars is people's economic circumstances. Additionally, the lock-down made it difficult for many dealers to obtain vehicles for their clients. The market is anticipated to bounce back and expand at an average annual growth rate on the other side of COVID-19. The leasing sector is expected to continue growing and succeeding notwithstanding Covid-19. We anticipate watching the leasing sector's growth with interest and are confident it will proceed favorably.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Type of Car, By Rental Purpose, By Booking Mode, By Hailing Purpose, By End User

|

| Regions covered | New South Wales, Queensland, South Australia, Tasmania, Victoria, Western Australia, Others

|

| Companies Covered | Avis Australia, Budget Australia, Custom Fleet, DiDi, Eclipx Group, Europcar Australia, GoCatch, Hertz Australia, LeasePlan Australia, Ola, ORIX, SG Fleet, Summit Fleet, Taxify, Thrifty Australia, Toyota Fleet Management, Uber

|

Target Audience-

- Automobile and Mobility Organizations.

- Cab Aggregators or Ride Sharing Companies

- Car Dealers

- Car Rental Companies

- Car Sharing Companies

- Consumer Finance Organizations

- End User Industries

- Fleet Management Organizations

Australia Car Leasing and Rental Market Segmentation:

1. By Type of Car:

2. By Rental Purpose:

3. By Booking Mode:

4. By Hailing Purpose:

5. By End User:

- Construction and Engineering

- Government

- Logistics and Utility Industry

- Mining

- Telecommunications

- Others

6. By Region:

- New South Wales

- Queensland

- South Australia

- Tasmania

- Victoria

- Western Australia

- Others

Key Topics Covered in the Report:

- Size of Australia Car Leasing and Rental Market (FY’2019-FY’2032)

- Overview of Australia Car Leasing and Rental Market

- Segmentation of Australia Car Leasing and Rental By Type of Car (Luxury, Sedan, SUV, Ute, LCVs)

- Segmentation of Australia Car Leasing and Rental Market By Rental Purpose (Business, Leisure)

- Segmentation of Australia Car Leasing and Rental Market By Booking Mode (Offline, Online)

- Segmentation of Australia Car Leasing and Rental Market By Hailing Purpose (Airport, Leisure, Office)

- Segmentation of Australia Car Leasing and Rental Market By End User (Construction and Engineering, Government, Logistics and Utility Industry, Mining, Telecommunications, Others)

- Statistical Snap of Australia Car Leasing and Rental Market

- Growth Analysis of Australia Car Leasing and Rental Market

- Problems and Challenges in Australia Car Leasing and Rental Market

- Competitive Landscape in the Australia Car Leasing and Rental Market

- Impact of COVID-19 and Demonetization on Australia Car Leasing and Rental Market

- Details on Recent Investment in Australia Car Leasing and Rental Market

- Competitive Analysis of Australia Car Leasing and Rental Market

- Major Players in the Australia Car Leasing and Rental Market

- SWOT Analysis of Australia Car Leasing and Rental Market

- Australia Car Leasing and Rental Market Future Outlook and Projections (FY’2019-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the Australia Car Leasing and Rental Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4. Heat map analysis

6. Competitive Landscape

6.1 Australia Car Leasing and Rental Manufacturing Base Distribution, Sales Area, Product Type

6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Australia Car Leasing and Rental Market

7. Australia Car Leasing and Rental Market, By Type of Car, 2019-2032 (USD Million)

7.1 Luxury

7.2 Sedan

7.3 SUV

7.4 Ute

7.5 LCVs

8. Australia Car Leasing and Rental Market, By Rental Purpose, 2019-2032 (USD Million)

8.1 Business

8.2 Leisure

9. Australia Car Leasing and Rental Market, By Booking Mode, 2019-2032 (USD Million)

9.1 Offline

9.2 Online

10. Australia Car Leasing and Rental Market, By Hailing Purpose, 2019-2032 (USD Million)

10.1 Airport

10.2 Leisure

10.3 Office

11. Australia Car Leasing and Rental Market, By End User, 2019-2032 (USD Million)

11.1 Construction and Engineering

11.2 Government

11.3 Logistics and Utility Industry

11.4 Mining

11.5 Telecommunications

11.6 Others

12. Australia Car Leasing and Rental Market, By Region, 2019-2032 (USD Million)

12.1 Australia Car Leasing and Rental Size and Market Share by Region (2019-2025)

12.2 Australia Car Leasing and Rental Size and Market Share by Region (2026-2032)

12.3 New South Wales

12.4 Queensland

12.5 South Australia

12.6 Tasmania

12.7 Victoria

12.8 Western Australia

12.9 Others

13. Company Profiles

13.1 Avis Australia

13.1.1 Company details

13.1.2 Financial outlook

13.1.3 Product summary

13.1.4 Recent developments

13.2 Budget Australia

13.2.1 Company details

13.2.2 Financial outlook

13.2.3 Product summary

13.2.4 Recent developments

13.3 Custom Fleet

13.3.1 Company details

13.3.2 Financial outlook

13.3.3 Product summary

13.3.4 Recent developments

13.4 DiDi

13.4.1 Company details

13.4.2 Financial outlook

13.4.3 Product summary

13.4.4 Recent developments

13.5 Eclipx Group

13.5.1 Company details

13.5.2 Financial outlook

13.5.3 Product summary

13.5.4 Recent developments

13.6 Europcar Australia

13.6.1 Company details

13.6.2 Financial outlook

13.6.3 Product summary

13.6.4 Recent developments

13.7 GoCatch

13.7.1 Company details

13.7.2 Financial outlook

13.7.3 Product summary

13.7.4 Recent developments

13.8 Hertz Australia

13.8.1 Company details

13.8.2 Financial outlook

13.8.3 Product summary

13.8.4 Recent developments

13.9 LeasePlan Australia

13.9.1 Company details

13.9.2 Financial outlook

13.9.3 Product summary

13.9.4 Recent developments

13.10 Ola

13.10.1 Company details

13.10.2 Financial outlook

13.10.3 Product summary

13.10.4 Recent developments

13.11 ORIX

13.11.1 Company details

13.11.2 Financial outlook

13.11.3 Product summary

13.11.4 Recent developments

13.12 SG Fleet

13.12.1 Company details

13.12.2 Financial outlook

13.12.3 Product summary

13.12.4 Recent developments

13.13 Summit Fleet

13.13.1 Company details

13.13.2 Financial outlook

13.13.3 Product summary

13.13.4 Recent developments

13.14 Taxify

13.14.1 Company details

13.14.2 Financial outlook

13.14.3 Product summary

13.14.4 Recent developments

13.15 Thrifty Australia

13.15.1 Company details

13.15.2 Financial outlook

13.15.3 Product summary

13.15.4 Recent developments

13.16 Toyota Fleet Management

13.16.1 Company details

13.16.2 Financial outlook

13.16.3 Product summary

13.16.4 Recent developments

13.17 Uber

13.17.1 Company details

13.17.2 Financial outlook

13.17.3 Product summary

13.17.4 Recent developments

14. List of Abbreviations

15. Reference Links

16. Conclusion

17. Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.