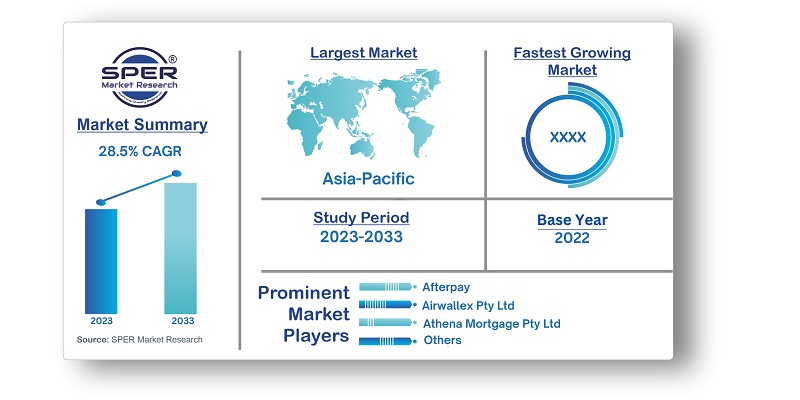

Australia Fintech Market Growth, Trends, Size, Revenue, Share, Challenges and Future Competition

Australia Fintech Market Size- By Technology, By Deployment Mode, By Application, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jul-2023 | Report ID: BFSI2325 | Pages: 1 - 109 | Formats*: |

| Category : BFSI | |||

- Strong Digital Infrastructure: Australia has a strong digital infrastructure, including high levels of mobile and internet access, which gives fintech businesses a stable basis on which to build and effectively distribute their goods and services. The development of mobile-based financial solutions has also been aided by the high rate of smartphone use in the nation.

- Increasing Customer Adoption: Australian customers are rapidly embracing fintech solutions and demonstrating a rising hunger for digital financial services. Consumer behaviour is changing as a result of fintech businesses' provision of ease, accessibility, and personalised user experiences. Australian customers are becoming more and more interested in robo-advisors, peer-to-peer lending platforms, and digital payment alternatives.

- Open Banking: The Australian Consumer Data Right (CDR) framework's adoption opens up a lot of possibilities for fintech firms. It gives customers access over their financial data and enables fintech companies to create cutting-edge products based on this data, including tailored financial services, comparison websites, and data-driven lending and investing products.

- Digital Payments and Mobile Wallets: As these services become more widely used in Australia, fintech firms have the chance to innovate in this market. There is an expanding demand for safe, practical, and user-friendly payment options as contactless payments, peer-to-peer transfers, and mobile payment applications become more popular.

- Cybersecurity and Data Privacy: The management of sensitive financial data and growing dependence on technology make cybersecurity and data privacy major obstacles for fintech businesses. Constant investment and care are needed to provide strong security measures, safeguard consumer information, and keep ahead of developing cyber threats.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Technology, By Deployment Mode, By Application, By End User |

| Regions covered | New South Wales, Queensland, South Australia, Tasmania, Victoria, Western Australia, Others |

| Companies Covered | Afterpay, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, Divipay Pty Ltd, Judo Bank Pty Ltd, mx51 Pty Ltd, PTRN Pty Ltd, Stripe Inc., Wise Australia Pty Ltd, Zeller Australia Pty Ltd. |

- Corporates and Enterprises

- Financial Institutions

- Investors

- Regulators and Government Bodies

- Retail Consumers

- Small and Medium-sized Enterprises (SMEs)

- Unbanked and Underbanked Individuals

| By Technology: |

|

| By Deployment Mode: |

|

| By Application: |

|

| By End User: |

|

- Australia Fintech Market Size (FY’2023-FY’2033)

- Overview of Australia Fintech Market

- Segmentation of Australia Fintech Market By Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Data Analytics, Robotic Process Automation, Others)

- Segmentation of Australia Fintech Market By Deployment Mode (Cloud, On-Premises)

- Segmentation of Australia Fintech Market By Application (Insurance and Personal Finance, Loans, Payments and Fund Transfer, Wealth Management, Others)

- Segmentation of Australia Fintech Market By End User (Banking, Insurance, Securities, Others)

- Statistical Snap of Australia Fintech Market

- Expansion Analysis of Australia Fintech Market

- Problems and Obstacles in Australia Fintech Market

- Competitive Landscape in the Australia Fintech Market

- Impact of COVID-19 and Demonetization on Australia Fintech Market

- Details on Current Investment in Australia Fintech Market

- Competitive Analysis of Australia Fintech Market

- Prominent Players in the Australia Fintech Market

- SWOT Analysis of Australia Fintech Market

- Australia Fintech Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

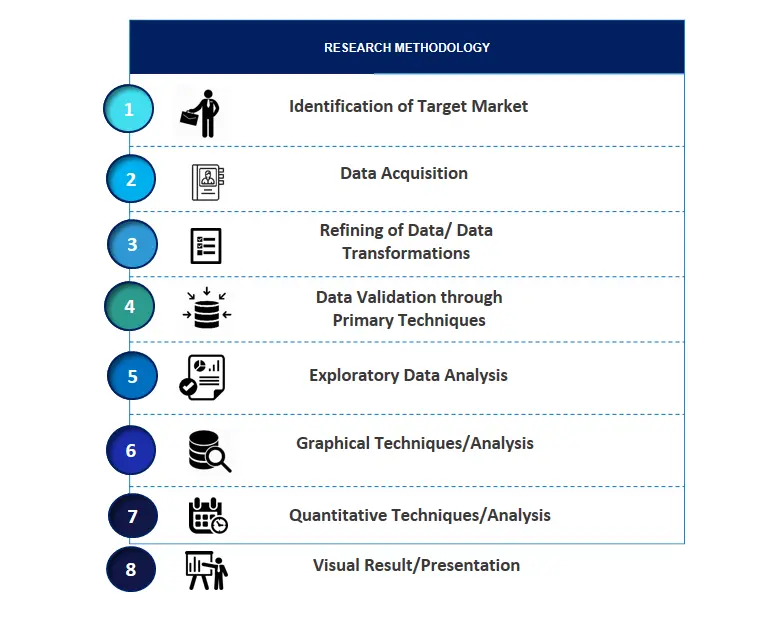

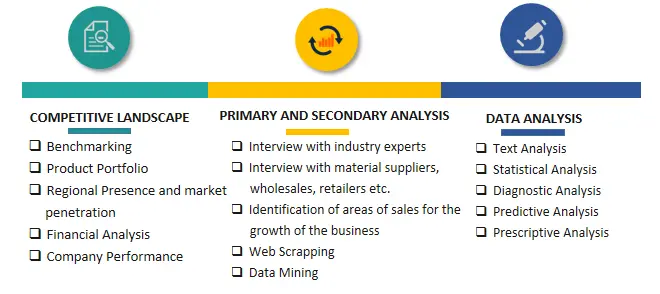

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Australia Fintech Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Australia Fintech Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Australia Fintech Market

7.1. Australia Fintech Market Value Share and Forecast, By Technology, 2023-20337.2. Application Programming Interface (API)7.3. Artificial Intelligence (AI)7.4. Blockchain7.5. Data Analytics7.6. Robotic Process Automation (RPA)7.7. Others

8.1. Australia Fintech Market Value Share and Forecast, By Deployment Mode, 2023-20338.2. Cloud8.3. On-Premises

9.1. Australia Fintech Market Value Share and Forecast, By Application, 2023-20339.2. Insurance and Personal Finance9.3. Loans9.4. Payments and Fund Transfer9.5. Wealth Management9.6. Others

10.1. Australia Fintech Market Value Share and Forecast, By End User, 2023-203310.2. Banking10.3. Insurance10.4. Securities10.5. Others

11.1. Australia Fintech Market Size and Market Share

12.1. Australia Fintech Market Size and Market Share By Technology (2019-2026)12.2. Australia Fintech Market Size and Market Share By Technology (2027-2033)

13.1. Australia Fintech Market Size and Market Share By Deployment Mode (2019-2026)13.2. Australia Fintech Market Size and Market Share By Deployment Mode (2027-2033)

14.1. Australia Fintech Market Size and Market Share By Application (2019-2026)14.2. Australia Fintech Market Size and Market Share By Application (2027-2033)

15.1. Australia Fintech Market Size and Market Share By End User (2019-2026)15.2. Australia Fintech Market Size and Market Share By End User (2027-2033)

16.1. Australia Fintech Market Size and Market Share By Region (2019-2026)16.2. Australia Fintech Market Size and Market Share By Region (2027-2033)16.3. New South Wales16.4. Queensland16.5. South Australia16.6. Tasmania16.7. Victoria16.8. Western Australia16.9. Others

17.1. Afterpay17.1.1. Company details17.1.2. Financial outlook17.1.3. Product summary17.1.4. Recent developments17.2. Airwallex Pty Ltd17.2.1. Company details17.2.2. Financial outlook17.2.3. Product summary17.2.4. Recent developments17.3. Athena Mortgage Pty Ltd17.3.1. Company details17.3.2. Financial outlook17.3.3. Product summary17.3.4. Recent developments17.4. Divipay Pty Ltd17.4.1. Company details17.4.2. Financial outlook17.4.3. Product summary17.4.4. Recent developments17.5. Judo Bank Pty Ltd17.5.1. Company details17.5.2. Financial outlook17.5.3. Product summary17.5.4. Recent developments17.6. mx51 Pty Ltd17.6.1. Company details17.6.2. Financial outlook17.6.3. Product summary17.6.4. Recent developments17.7. PTRN Pty Ltd17.7.1. Company details17.7.2. Financial outlook17.7.3. Product summary17.7.4. Recent developments17.8. Stripe Inc.17.8.1. Company details17.8.2. Financial outlook17.8.3. Product summary17.8.4. Recent developments17.9. Wise Australia Pty Ltd17.9.1. Company details17.9.2. Financial outlook17.9.3. Product summary17.9.4. Recent developments17.10. Zeller Australia Pty Ltd.17.10.1. Company details17.10.2. Financial outlook17.10.3. Product summary17.10.4. Recent developments17.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.