Automated Algo Trading Market Growth, Size, Trends, Revenue, Demand and Future Competition

Automated Algo Trading Market- By Component, By Deployment, By Enterprise Size, By Application- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jul-2023 | Report ID: BFSI2334 | Pages: 1 - 237 | Formats*: |

| Category : BFSI | |||

- Increasing Use of Advanced Analytics: As big data and advanced analytics tools become more accessible, businesses are utilizing data-driven insights to strengthen their Automated Algo trading market approaches. Leveraging analytics allows for real-time monitoring, risk evaluation, and scenario analysis, leading to more informed decision-making and enhanced financial outcomes.

- Demands for Regulatory Compliance: The changing regulatory environment places stringent requirements on financial institutions, making robust Automated Algo Trading Market practices essential. Adhering to regulations like Basel III, IFRS 9, and Dodd-Frank Act necessitates the adoption of advanced risk management methods and the maintenance of sufficient capital reserves.

- Opportunities:

- Increasing demand for efficient, quick, and reliable order execution: Big brokerage houses and institutional investors are increasingly adopting automated algo trading to reduce trading costs. The appeal of automated algo trading lies in its ability to facilitate quicker and smoother order execution, making it favorable for exchanges. Moreover, it allows investors and traders to swiftly capitalize on small price fluctuations, resulting in faster profit generation. As a consequence, the growing demand for efficient trading mechanisms fuels the growth of the automated algo trading market, as it empowers users to execute trades rapidly.

- Challenges:

- Despite the growing popularity of automated algo trading, there are various factor that are likely to challenge market growth during the forecast period. Sudden system failure, erroneous network connectivity, imperfect algorithms, and time lags in order and executions associated with automated algo trading solution. Also, lack of availability of modern facilities and poor awareness about automated algo trading across various emerging nation is also limiting the market growth.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

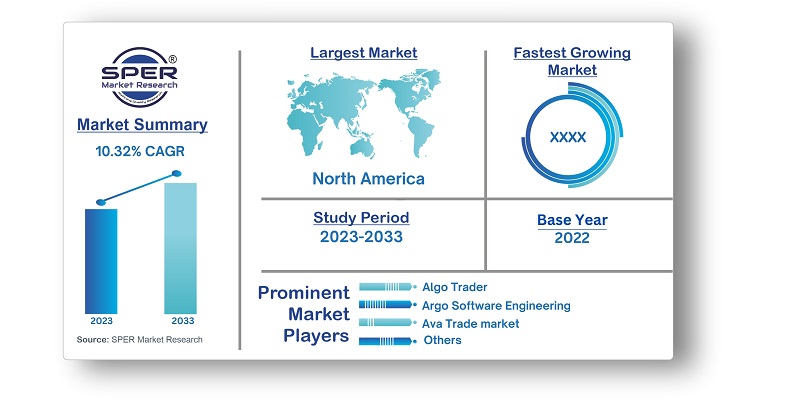

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Component, By Deployment, By Enterprise Size, By Application |

| Regions covered | Asia-Pacific, Middle East and Africa, Europe, North America, Latin America |

| Companies Covered | Algo Trader, Argo Software Engineering, Ava Trade market, India algo, LEHNER INVESTENT, Myalgoate technologies LLP, Ninja Trade, Quant connect, Symphony, VIRTU Financial Inc., Others |

- Exchange Operators

- Financial Analysts and Portfolio Managers

- High-Frequency Trading (HFT) Firms

- Individual Traders and Retail Investors

- Institutional Investors

- Investment Banks and Brokerages

- Market Makers

- Proprietary Trading Firms

- Quantitative Analysts (Quants

- Systematic Traders

- Others

| By Component: |

|

| By Deployment Mode: |

|

| By Enterprise Size: |

|

| By Application: |

|

- Global Automated Algo Trading Market Size (FY’2023-FY’2033)

- Overview of Global Automated Algo Trading Market

- Segmentation of Global Automated Algo Trading Market By Component (Services, Software)

- Segmentation of Global Automated Algo Trading Market By Deployment (Cloud, On-Premise)

- Segmentation of Global Automated Algo Trading Market By Enterprise Size (Large Enterprise, Small & Medium Enterprise)

- Segmentation of Global Automated Algo Trading Market By Application (Liquidity Detection, Statistical Arbitrage, Trade execution)

- Statistical Snap of Global Automated Algo Trading Market

- Expansion Analysis of Global Automated Algo Trading Market

- Problems and Obstacles in Global Automated Algo Trading Market

- Competitive Landscape in the Global Automated Algo Trading Market

- Impact of COVID-19 and Demonetization on Global Automated Algo trading Market

- Details on Current Investment in Global Automated Algo Trading Market

- Competitive Analysis of Global Automated Algo Trading Market

- Prominent Players in the Global Automated Algo Trading Market

- SWOT Analysis of Global Automated Algo Trading Market

- Global Automated Algo Trading Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Global Automated Algo Trading Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Global Automated Algo Trading Market-Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Automated Algo Trading Market

7.1. Global Automated Algo Trading Market Value Share and Forecast, By Component, 2023-20337.2. Services7.3. Software

8.1. Global Automated Algo Trading Market Value Share and Forecast, By Deployment, 2023-20338.2. Cloud8.3. On-Premise

9.1. Global Automated Algo Trading Market Value Share and Forecast, By Enterprise Size, 2023-20339.2. Large Enterprise9.3. Small & Medium Enterprise

10.1. Global Automated Algo Trading Market Value Share and Forecast, By Application, 2023-203310.2. Liquidity Detection10.3. Statistical Arbitrage10.4. Trade execution

11.1. Global Automated Algo Trading Market Size and Market Share

12.1. Global Automated Algo Trading Market Size and Market Share By Component (2019-2026)12.2. Global Automated Algo Trading Market Size and Market Share By Component (2027-2033)

13.1. Global Automated Algo Trading Market Size and Market Share By Deployment (2019-2026)13.2. Global Automated Algo Trading Market Size and Market Share By Deployment (2027-2033)

14.1. Global Automated Algo Trading Market Size and Market Share By Enterprise Size (2019-2026)14.2. Global Automated Algo Trading Market Size and Market Share By Enterprise Size (2027-2033)

15.1. Global Automated Algo Trading Market Size and Market Share By Application (2019-2026)15.2. Global Automated Algo Trading Market size and Market Share By Application (2027-2033)

16.1. Global Automated Algo Trading Market Size and Market Share By Region (2019-2026)16.2. Global Automated Algo Trading Market Size and Market Share By Region (2027-2033)16.3. Asia-Pacific16.3.1. Australia16.3.2. China16.3.3. India16.3.4. Japan16.3.5. South Korea16.3.6. Rest of Asia-Pacific16.4. Europe16.4.1. France16.4.2. Germany16.4.3. Italy16.4.4. Spain16.4.5. United Kingdom16.4.6. Rest of Europe16.5. Middle East and Africa16.5.1. Kingdom of Saudi Arabia16.5.2. United Arab Emirates16.5.3. Rest of Middle East & Africa16.6. North America16.6.1. Canada16.6.2. Mexico16.6.3. United States16.7. Latin America16.7.1. Argentina16.7.2. Brazil16.7.3. Rest of Latin America

17.1. Algo Trader17.1.1. Company details17.1.2. Financial outlook17.1.3. Product summary17.1.4. Recent developments17.2. Argo Software Engineering17.2.1. Company details17.2.2. Financial outlook17.2.3. Product summary17.2.4. Recent developments17.3. Ava Trade market17.3.1. Company details17.3.2. Financial outlook17.3.3. Product summary17.3.4. Recent developments17.4. India algo17.4.1. Company details17.4.2. Financial outlook17.4.3. Product summary17.4.4. Recent developments17.5. LEHNER INVESTENT17.5.1. Company details17.5.2. Financial outlook17.5.3. Product summary17.5.4. Recent developments17.6. Myalgoate technologies LLP17.6.1. Company details17.6.2. Financial outlook17.6.3. Product summary17.6.4. Recent developments17.7. Ninja Trade17.7.1. Company details17.7.2. Financial outlook17.7.3. Product summary17.7.4. Recent developments17.8. Quant connect17.8.1. Company details17.8.2. Financial outlook17.8.3. Product summary17.8.4. Recent developments17.9. Symphony17.9.1. Company details17.9.2. Financial outlook17.9.3. Product summary17.9.4. Recent developments17.10. VIRTU Financial Inc.17.10.1. Company details17.10.2. Financial outlook17.10.3. Product summary17.10.4. Recent developments17.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.