Automotive Acoustic Engineering Services Market Introduction and Overview

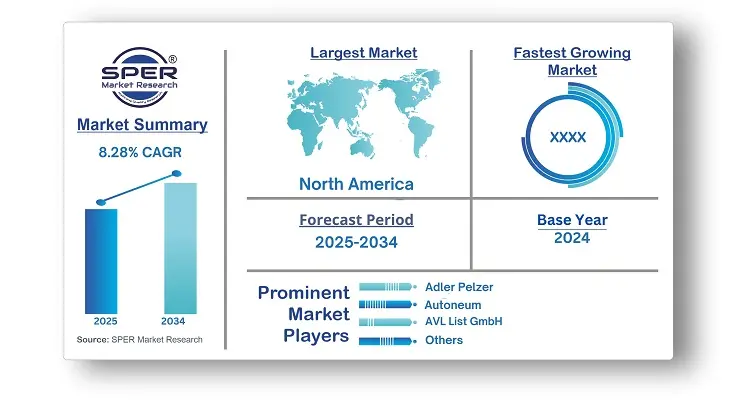

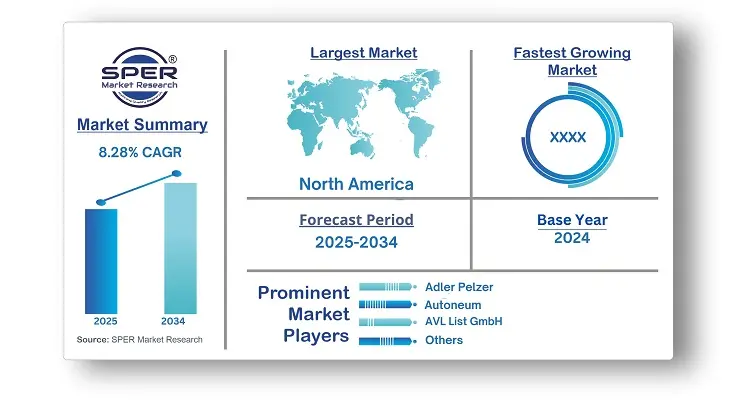

According to SPER Market Research, the Global Automotive Acoustic Engineering Services Market is estimated to reach USD 13.2 billion by 2034 with a CAGR of 8.28%

The report includes an in-depth analysis of the Global Automotive Acoustic Engineering Services Market, including market size and trends, product mix, Applications, and supplier analysis. The automotive acoustic engineering services market was estimated to be worth USD 5.96 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of about 8.28% from 2025 to 2034. The strict regulatory rules on vehicle noise are driving the demand for automotive acoustic engineering services. Governments throughout the world are enacting stricter regulations to fight noise pollution from automobiles. Automobile manufacturers hire acoustic engineering service providers to ensure compliance and avoid penalties. These professionals help them design cars that meet noise emission regulations, identify and address noise sources throughout the vehicle, create and implement noise reduction measures, and conduct testing and certification to assure compliance with legislation.

By Offering Insights

Based on offerings, the market is split into physical and virtual. The virtual segment is expected to generate the most revenue by 2034. Virtual testing is much cheaper than physical testing. It reduces the need for prototypes, expensive testing facilities, and excessive resources. This allows automakers to revise designs and test noise reduction methods more frequently while staying on budget. Virtual tests can be finished much faster than real tests. Simulations can be done quickly, enabling fast feedback and design changes, and allowing engineers to adjust parameters and examine noise levels effectively.

By Vehicle Insights

The automotive acoustic engineering services market is divided into passenger and commercial vehicles. In 2024, passenger vehicles held the largest market share, as passenger cars and SUVs make up a larger portion of vehicle production.

Consumers want a quiet and comfortable driving experience in passenger cars, increasing the demand for services that minimize Noise, Vibration, and Harshness (NVH) compared to commercial vehicles, which focus on utility. Additionally, passenger cars must meet stricter

noise emission standards, requiring manufacturers to use acoustic engineering services for compliance.

Regional Insights

North America will have the highest revenue for automotive acoustic engineering services in 2024. This growth is due to the presence of major car manufacturers, suppliers, and engineering companies. The United States government is enforcing higher noise pollution standards for vehicles, requiring automakers to hire acoustic experts to ensure compliance. Companies in North America are investing in testing facilities, software, and materials for noise reduction and vibration management, driven by the need to follow noise guidelines and certification processes.

Market Competitive Landscape

Siemens AG and Schaeffler Engineering dominate the market, with a considerable market share. Siemens has developed digital twin solutions for acoustic analysis, leveraging its Simcenter portfolio and IoT technology. These solutions create virtual models of vehicle systems and components, allowing for the predictive assessment of noise and vibration performance throughout the product lifecycle.

Recent Developments:

In January 2024, BlackBerry introduced QNX Sound, a comprehensive audio and acoustics innovation platform for Software Defined Vehicles (SDVs). This platform seeks to transform the in-vehicle audio experience by including advanced audio processing, noise cancellation, and acoustic management technologies.

February 2023: Warwick Acoustics commercialised its automotive in-car audio technology, with the goal of improving overall sound quality while reducing the use of rare-earth elements in production. This unique technique helps to a more sustainable and environmentally friendly automobile sector.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Process, By Solution, By Vehicle, By Offering, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Adler Pelzer, Autoneum, AVL List GmbH, Bertrandt AG, Catalyst Acoustics, Continental AG, EDAG Engineering, Roechling Group, Schaeffler Engineering, Siemens AG. |

Key Topics Covered in the Report

- Global Automotive Acoustic Engineering Services Market Size (FY’2021-FY’2034)

- Overview of Global Automotive Acoustic Engineering Services Market

- Segmentation of Global Automotive Acoustic Engineering Services Market By Process (Designing, Development, Testing)

- Segmentation of Global Automotive Acoustic Engineering Services Market By Solution (Calibration, Vibration, Simulation)

- Segmentation of Global Automotive Acoustic Engineering Services Market By Vehicle (Passenger Vehicle, Commercial Vehicle)

- Segmentation of Global Automotive Acoustic Engineering Services Market By Offering (Physical, Virtual)

- Segmentation of Global Automotive Acoustic Engineering Services Market By Application (Interior, Body & structure, Powertrain, Drivetrain)

- Statistical Snap of Global Automotive Acoustic Engineering Services Market

- Expansion Analysis of Global Automotive Acoustic Engineering Services Market

- Problems and Obstacles in Global Automotive Acoustic Engineering Services Market

- Competitive Landscape in the Global Automotive Acoustic Engineering Services Market

- Details on Current Investment in Global Automotive Acoustic Engineering Services Market

- Competitive Analysis of Global Automotive Acoustic Engineering Services Market

- Prominent Players in the Global Automotive Acoustic Engineering Services Market

- SWOT Analysis of Global Automotive Acoustic Engineering Services Market

- Global Automotive Acoustic Engineering Services Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Automotive Acoustic Engineering Services Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Automotive Acoustic Engineering Services Market

7. Global Automotive Acoustic Engineering Services Market, By Process (USD Million) 2021-2034

7.1. Designing

7.2. Development

7.3. Testing

8. Global Automotive Acoustic Engineering Services Market, By Solution (USD Million) 2021-2034

8.1. Calibration

8.2. Vibration

8.3. Simulation

8.4. Others

9. Global Automotive Acoustic Engineering Services Market, By Offering (USD Million) 2021-2034

9.1. Physical

9.2. Virtual

10. Global Automotive Acoustic Engineering Services Market, By Vehicle (USD Million) 2021-2034

10.1. Passenger vehicle

10.2. Commercial vehicle

11. Global Automotive Acoustic Engineering Services Market, By Application (USD Million) 2021-2034

11.1. Interior

11.2. Body & structure

11.3. Powertrain

11.4. Drivetrain

12. Global Automotive Acoustic Engineering Services Market, (USD Million) 2021-2034

12.1. Global Automotive Acoustic Engineering Services Market Size and Market Share

13. Global Automotive Acoustic Engineering Services Market, By Region, (USD Million) 2021-2034

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. Adler Pelzer

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Autoneum

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. AVL List GmbH

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Bertrandt AG

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. Catalyst Acoustics

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. Continental AG

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. EDAG Engineering

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. Roechling Group

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Schaeffler Engineering

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. Siemens AG

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.10.5. Recent developments

14.11. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links