Automotive Driver Monitoring System Market Introduction and Overview

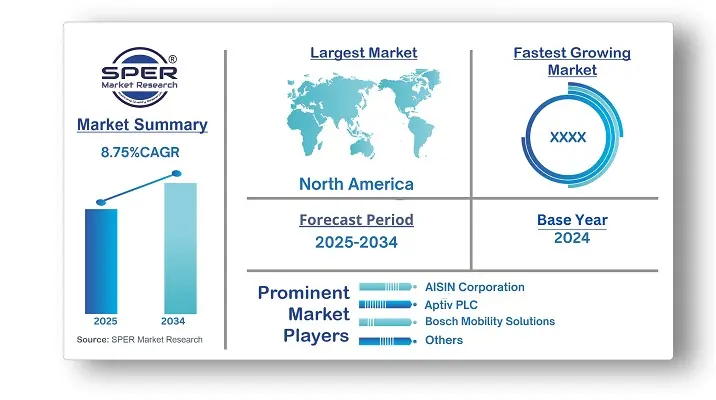

According to SPER Market Research, the Global Automotive Driver Monitoring System Market is estimated to reach USD 6.29 billion by 2034 with a CAGR of 8.75%.

The report includes an in-depth analysis of the Global Automotive Driver Monitoring System Market, including market size and trends, product mix, Applications, and supplier analysis. Automotive Driver Monitoring System Market size was valued at USD 2.72 billion in 2024 and is estimated to register a CAGR of over 8.75% between 2025 and 2034. The industry's growth is supported by government regulations aimed at reducing road traffic injuries. Additionally, the rising demand for advanced features like blink monitoring, facial recognition, steering angle sensors, heart rate monitoring, and pre-collision systems is driving market development. Strict regulations and the requirement for driver monitoring will probably accelerate industry expansion.

By Technology Insights

Based on technology, the market is divided into camera-based, sensor-based, and hybrid. The hybrid segment is expected to have the largest market share by 2034. Hybrid DMS offers higher precision and dependability in understanding driver behavior and condition by combining data from sensors like cameras, infrared sensors, steering wheel sensors, and biometric monitors. The flexibility of hybrid DMS enables them to adapt to various driving conditions, improving user experience and safety.

By Sales Channel Insights

Based on sales channels, the automotive driver monitoring system market is divided into OEM and aftermarket. In 2024, the OEM segment had the biggest market share. Manufacturers are encouraged to offer DMS as standard or optional equipment due to increased customer focus on road safety and the demand for advanced safety features. Meeting consumer safety expectations enhances a brand's image and competitiveness. DMS can help OEMs differentiate themselves by offering unique features, boosting sales through innovative technology.

Regional Insights

North America dominated the worldwide automotive driver monitoring system market in 2024, accounting for its largest revenue. North America is the centre of technological innovation, particularly in the automotive industry. Advances in artificial intelligence, machine learning, and sensor technologies have enabled the construction of increasingly complex DMS with greater accuracy and dependability.

Market Competitive Landscape

The Driver Monitoring System Market is growing quickly due to advances in automotive technology and a focus on road safety. There is high demand because of concerns about driver distraction, fatigue, and vehicle safety. Companies in this market are innovating to improve driver experience and meet new regulations. The competitive landscape includes established companies with strong technological skills and research. Many automotive manufacturers are teaming up with tech firms to develop better driver monitoring solutions. Factors like product range, geographic reach, technological progress, and partnerships affect competition. Bosch stands out as a leader by offering innovative products that use advanced sensors and AI for real-time driver behavior assessment.

Recent Developments:

Qualcomm Technologies, Inc. and Robert Bosch GmbH introduced a central vehicle computer in January 2024 that integrates entertainment and advanced driver assistance system (ADAS) functions into a single system-on-a-chip (SoC). The Flex SoC is used in Bosch's vehicle computer, which enhances user experiences and boosts DMS system performance by processing camera, radar, and ultrasonic data.

Rosmerta introduced an AI-based driver monitoring system in February 2024 that uses dual cameras, IR blasters, GPS with SIM connectivity, and G-sensors to revolutionise vehicle safety. By monitoring and analysing crucial driving parameters in real time, this cutting-edge technology ensures improved driver attention and safety.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By System, By Vehicle, By Technology, By Sales Channel, By End-User |

| Regions covered | AISIN Corporation, Aptiv PLC, Bosch Mobility Solutions, Cipia Vision Ltd, Continental |

| Companies Covered | AISIN Corporation, Aptiv PLC, Bosch Mobility Solutions, Cipia Vision Ltd, Continental AG, Denso Corporation, Ficosa International S.A, Harman International Industries, Inc, Infineon Technologies AG, Johnson control, Jungo Connectivity Ltd, Magna International Inc.

|

Key Topics Covered in the Report

- Global Automotive Driver Monitoring System Market Size (FY’2021-FY’2034)

- Overview of Global Automotive Driver Monitoring System Market

- Segmentation of Global Automotive Driver Monitoring System Market By System (Eye Tracking System, Facial Recognition System, Steering Behavior Monitoring System, Heart Rate Monitoring System, In-Cabin Monitoring System)

- Segmentation of Global Automotive Driver Monitoring System Market By Vehicle (Passenger cars, Light Commercial Vehicles, Heavy Commercial Vehicles)

- Segmentation of Global Automotive Driver Monitoring System Market By Technology (Camera-based, Sensor-based, Hybrid)

- Segmentation of Global Automotive Driver Monitoring System Market By Sales Channel (OEM, Aftermarket)

- Segmentation of Global Automotive Driver Monitoring System Market By End-User (Automotive manufacturers, Government, Individuals, Fleet operators, Others)

- Statistical Snap of Global Automotive Driver Monitoring System Market

- Expansion Analysis of Global Automotive Driver Monitoring System Market

- Problems and Obstacles in Global Automotive Driver Monitoring System Market

- Competitive Landscape in the Global Automotive Driver Monitoring System Market

- Details on Current Investment in Global Automotive Driver Monitoring System Market

- Competitive Analysis of Global Automotive Driver Monitoring System Market

- Prominent Players in the Global Automotive Driver Monitoring System Market

- SWOT Analysis of Global Automotive Driver Monitoring System Market

- Global Automotive Driver Monitoring System Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

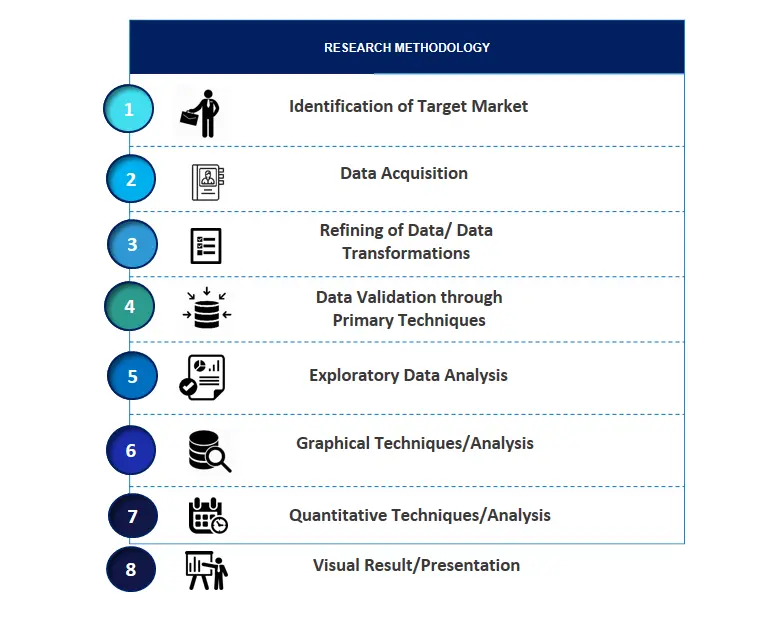

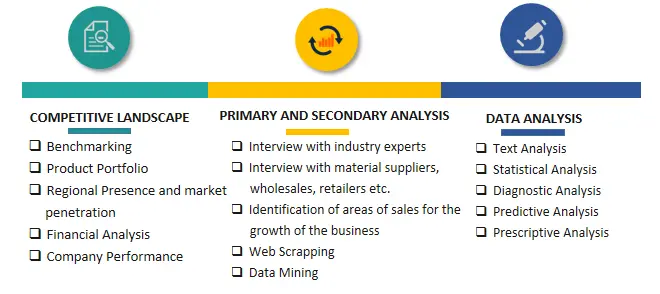

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Automotive Driver Monitoring System Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Automotive Driver Monitoring System Market

7. Global Automotive Driver Monitoring System Market, By System (USD Million) 2021-2034

7.1. Eye tracking system

7.2. Facial recognition system

7.3. Steering behavior monitoring system

7.4. Heart rate monitoring system

7.5. In-cabin monitoring system

7.6. Others

8. Global Automotive Driver Monitoring System Market, By Vehicle (USD Million) 2021-2034

8.1. Passenger cars

8.2. Light Commercial Vehicles (LCVs)

8.3. Heavy Commercial Vehicles (HCVs)

9. Global Automotive Driver Monitoring System Market, By Technology (USD Million) 2021-2034

9.1. Camera-based

9.2. Sensor-based

9.3. Hybrid

10. Global Automotive Driver Monitoring System Market, By Sales Channel (USD Million) 2021-2034

10.1. OEM

10.2. Aftermarket

11. Global Automotive Driver Monitoring System Market, By End-User (USD Million) 2021-2034

11.1. Automotive manufacturers

11.2. Government

11.3. Individuals

11.4. Fleet operators

11.5. Others

12. Global Automotive Driver Monitoring System Market, (USD Million) 2021-2034

12.1. Global Automotive Driver Monitoring System Market Size and Market Share

13. Global Automotive Driver Monitoring System Market, By Region, (USD Million) 2021-2034

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. AISIN Corporation

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Aptiv PLC

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. Bosch Mobility Solutions

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Cipia Vision Ltd

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. Continental AG

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. Denso Corporation

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. Ficosa International S.A

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. Harman International Industries, Inc

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Infineon Technologies AG

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. Johnson control

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Jungo Connectivity Ltd

14.11.1. Company details

14.11.2. Financial outlook

14.11.3. Product summary

14.11.4. Recent developments

14.12. Magna International Inc

14.12.1. Company details

14.12.2. Financial outlook

14.12.3. Product summary

14.12.4. Recent developments

14.13. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links