Global Autonomous Agriculture Equipment Market Introduction and Overview

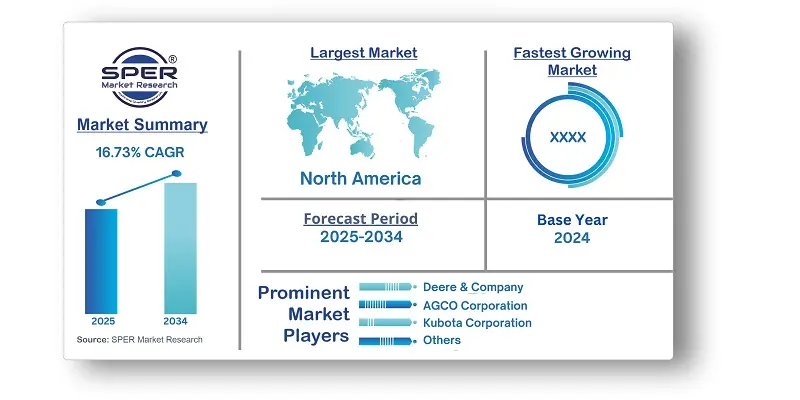

According to SPER Market Research, the Global Autonomous Agriculture Equipment Market is estimated to reach USD 35.65 billion by 2034 with a CAGR of 16.73%.

The report includes an in-depth analysis of the Global Autonomous Agriculture Equipment Market, including market size and trends, product mix, Applications, and supplier analysis. The Autonomous Agriculture Equipment Market was valued at USD 7.59 billion in 2024 and is expected to grow at a CAGR of 16.73% from 2025 to 2034. Labor shortages in the farming sector, along with an aging rural population, are driving market growth, prompting farmers to seek automated solutions to maintain and increase production. This change is accelerated by the rapid development of artificial intelligence, machine learning, and sensor technologies, which are significantly boosting the capabilities and dependability of autonomous equipment.

By Product Insights

Unmanned Aerial Vehicles (UAVs) dominated the target market and generated the highest income. UAVs provide flexibility and efficiency in agricultural operations, especially for monitoring and data collection. Their capacity to quickly cover big areas and access tough terrain makes them ideal for precision agriculture methods. UAVs outfitted with powerful sensors and imaging technology give farmers with high-resolution information on crop health, soil conditions, and insect infestations, allowing for focused interventions and resource optimisation. The relatively modest initial investment compared to bigger autonomous ground vehicles has boosted UAV deployment across a range of farm sizes.

By Automation Insights

The completely autonomous segment is likely to experience the most rapid growth in the coming years. The increase can be due to advances in artificial intelligence, machine learning, and sensor technologies, which have considerably improved the capabilities of fully autonomous systems, allowing them to handle complicated agricultural tasks with little human interaction. This enhanced sophistication tackles workforce constraints in agriculture while also increasing operational efficiency and production. The ability to operate fully autonomous equipment 24 hours a day, seven days a week enhances farm output and resource utilization.

Regional Insight

North America's autonomous farm equipment market contributes significantly to the worldwide industry. This is the result of a combination of technological leadership, excellent economic conditions, and structural factors in the agricultural industry. The region's excellent technology environment, which includes strong research and development skills in robotics, artificial intelligence, and precision agriculture, has promoted early adoption and innovation in autonomous agricultural equipment. Large-scale farming operations, which are common in North America, are a good testing ground and market for autonomous solutions since they offer large efficiency gains and cost reductions. The region's serious labour shortages in agriculture have expedited the transition to automation.

Market Competitive Landscape

The Autonomous Agriculture Equipment Market is dominated by established players such as Deere & Company, CNH Industrial, AGCO Corporation, Kubota Corporation, CLAAS KGaA mbH, Yanmar Co, Ltd, as well as a number of small and medium-sized companies. The agricultural machinery and technology business is dominated by a number of corporations that have achieved success via continual innovation, technological improvement, and global market presence. These companies play an important role in modernizing conventional farming techniques by providing contemporary solutions that improve production, efficiency, and sustainability.

Recent Developments:

At the Commodity Classic exhibition in February 2024, John Deere unveiled a large selection of new agricultural equipment. This includes high-horsepower autonomous tractors, C-Series air carts designed to increase seeding productivity, Hagie STS sprayers with AI-enabled weed detecting technology, and new S7 Series features. The introduction emphasizes John Deere's commitment to providing customer-focused solutions and developing agricultural technology to meet evolving market demands.

In February 2024, Naïo Technologies and CAMSO collaborated to create agricultural robots with electrically powered tracks, improving buoyancy, accessibility, and flexibility while lowering carbon emissions. Naïo's expertise in autonomy technologies and CAMSO's material knowledge combine to offer soil-friendly, high-performance solutions. This alliance aims to boost productivity, promote decarbonization, and protect natural resources and soil.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By

Automation, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East

& Africa |

| Companies Covered | Deere

& Company, CNH Industrial, AGCO Corporation, Kubota Corporation, CLAAS KGaA

mbH, Yanmar Co., Ltd, Raven Industries, Naio Technologies, AgEagle Aerial

Systems Inc, Mahindra & Mahindra, AGROBOT. |

Key Topics Covered in the Report

- Global Autonomous Agriculture Equipment Market Size (FY’2021-FY’2034)

- Overview of Global Autonomous Agriculture Equipment Market

- Segmentation of Global Autonomous Agriculture Equipment Market By Product (Tractors, Harvesting Equipment, Irrigation Equipment, Livestock Equipment, Haying & Forage Equipment, Spraying Equipment, Unmanned Aerial Vehicles)

- Segmentation of Global Autonomous Agriculture Equipment Market By Automation (Partially autonomous, Fully Autonomous)

- Segmentation of Global Autonomous Agriculture Equipment Market By Application Channel (Field Farming, Horticulture, Dairy Farming & Livestock Management, Others)

- Statistical Snap of Global Autonomous Agriculture Equipment Market

- Expansion Analysis of Global Autonomous Agriculture Equipment Market

- Problems and Obstacles in Global Autonomous Agriculture Equipment Market

- Competitive Landscape in the Global Autonomous Agriculture Equipment Market

- Details on Current Investment in Global Autonomous Agriculture Equipment Market

- Competitive Analysis of Global Autonomous Agriculture Equipment Market

- Prominent Players in the Global Autonomous Agriculture Equipment Market

- SWOT Analysis of Global Autonomous Agriculture Equipment Market

- Global Autonomous Agriculture Equipment MarketFuture Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3.Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Autonomous Agriculture Equipment Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Autonomous Agriculture Equipment Market

7. Global Autonomous Agriculture Equipment Market, By Product (USD Million) 2021-2034

7.1. Tractors

7.2. Harvesting Equipment

7.3. Irrigation Equipment

7.4. Livestock Equipment

7.5. Haying & Forage Equipment

7.6. Spraying Equipment

7.7. Unmanned Aerial Vehicles (UAVs)

7.8. Others

8. Global Autonomous Agriculture Equipment Market, By Automation (USD Million) 2021-2034

8.1. Partially autonomous

8.2. Fully Autonomous

9. Global Autonomous Agriculture Equipment Market, By Application (USD Million) 2021-2034

9.1. Field Farming

9.2. Horticulture

9.3. Dairy Farming & Livestock Management

9.4. Others

10. Global Autonomous Agriculture Equipment Market, (USD Million) 2021-2034

10.1. Global Autonomous Agriculture Equipment Market Size and Market Share

11. Global Autonomous Agriculture Equipment Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. AgEagle Aerial Systems Inc

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. AGCO Corporation

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. AGROBOT

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. CLAAS KGaA mbH

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. CNH Industrial

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Deere & Company

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Kubota Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Mahindra & Mahindra

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Naio Technologies

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Raven Industries

12.10.1. Company details

12.10.2.Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Yanmar Co

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links