Bahrain Facility Management Market Introduction and Overview

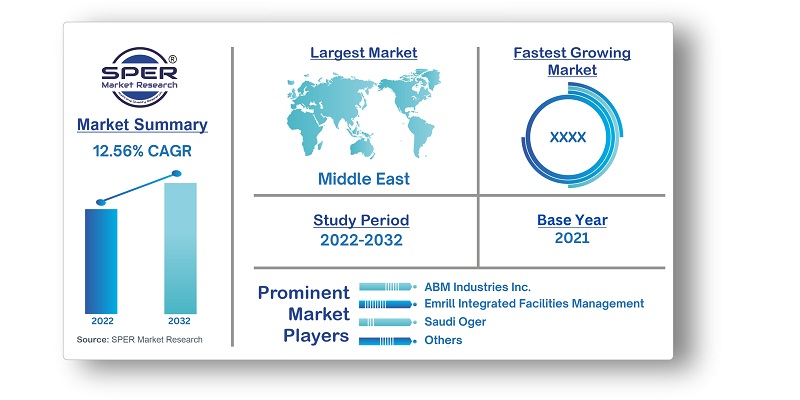

According to SPER Market Research, the Bahrain Facility Management Market is estimated to reach USD 6.04 billion by 2032 with a CAGR of 12.56%.

The report includes an in-depth analysis of the Bahrain Facility Management Market, including market size and trends, product mix, distribution channels, and supplier analysis. Facility management combines people, location, process, and technology to ensure that the physical environment performs properly. Furthermore, facility management is the coordination of a facility's activities in order to boost the overall effectiveness of the business. Facility management is employed in a range of business sectors, including retail, education, and healthcare, depending on the needs of the firm. The key reason for the increase in demand for facility management services was the construction industry's continued expansion as a result of the government's increasing number of tenders for the development of Bahrain's infrastructure.

- Diyar Al Muharraq and Seef Properties, a well-known integrated real estate development company in the Kingdom of Bahrain, inked a deal that enables Seef Properties to offer full facility management services for the "Souq Al Baraha" project. The largest integrated residential city in the Bahraini Kingdom is called Diyar Al Muharraq.

- Stantec and Bahrain's National Oil and Gas Authority (NOGA) collaborated to develop protocols and guidelines for the sustainable use of treated sewage effluent (TSE) by offering facility management and consulting services.

Market Opportunities and Challenges

Bahrain Facility Management market offers a variety of opportunities and challenges. An increasing number of tenders issued by the government for the development of Bahrain's infrastructure led to the continued expansion of the construction industry, which in turn caused a surge in demand for facility management services. This is due to the increasing demand from the populace, which was the primary driver of facility management's higher revenue. Bahrain's facilities management market is highly fragmented, with both large and small companies offering both hard and soft services.

However, Despite these advancements, there are very few government initiatives in Bahrain. The entry barriers are minimal, and there are very few organized companies in the FM services industry. The unorganized market is severely fragmented, and numerous businesses provide cleaning services. Inflation is also a source of concern for FM firms.

Furthermore, many facility management companies have been fiercely competing for market leadership while maintaining the highest levels of quality, practices, and standards. Some of the top companies in Bahrain's facility management sector include Johnson Control, Dream Group, EFS, MAF, and others.

Market Competitive Landscape

The Bahrain facility management market is extremely fragmented due to the existence of multiple competitors of various sizes in a highly competitive market. ABM Industries Inc., Almoayyed Contracting, ASF Facility Management, CBRE Bahrain WLL, EFS Facility Management Bahrain W.L.L., Elite Facility Management Co., Emrill Integrated Facilities Management, Etisalat FM services, Farnek, GEMS Industrial Services W.L.L., Imdaad, Iris Property Management W.L.L, these are some of the market key players of facility management in Bahrain.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Type, By Service, By Offering Type, By Industry, By End User, By Sector, By Provider Type, By Size of Organization |

| Regions covered | Muharraq Region, Northern Bahrain, Southern Bahrain, The Capital Region |

| Companies Covered | ABM Industries Inc., Almoayyed Contracting, ASF Facility Management, CBRE Bahrain WLL, EFS Facility Management Bahrain W.L.L., Elite Facility Management Co., Emrill Integrated Facilities Management, Etisalat FM services, Farnek, GEMS Industrial Services W.L.L., Imdaad, Iris Property Management W.L.L., Johnson Controls Inc., Metropolitan Holding Co W.L.L., Reliance Facilities Management, Royal Ambassador Property and Facility Management Co., Saudi Oger, Turner Facilities Management Ltd. |

COVID-19 Impact on Bahrain Facility Management Market

As a result of the COVID-19 epidemic, the Bahrain Facility Management Market is expected to decline slightly. Because the majority of the virus outbreak's people were not local, the first lockdown resulted in a labor shortage for FM enterprises. Furthermore, as the country's infrastructure spending developed more slowly, certain cities, like Manama and Al Muharraq, implemented lockdown measures. there are very few government initiatives in Bahrain. Entry barriers are low, and there are just a few organized players in the FM services industry.

Key Target Audience

- Commercial and Residential Property Owners/Managers

- Corporate Clients

- Government Entities

- Healthcare Facilities

- Educational Institutions

- Hospitality Industry

- Shopping Malls and Retail Centers

Our in-depth analysis of the Bahrain Facility Management Market includes the following segments:

|

By Type:

|

Inhouse Facility Management

Outsourced Facility Management

|

|

By Service:

|

Catering

Cleaning

Property

Security

Support

Others

|

|

By Offering Type:

|

Hard Services

Soft Services

|

|

By Industry:

|

Organized

Unorganized

|

|

By End User:

|

Commercial

Industrial

Public Sector

Residential

Others

|

Key Topics Covered in the Report

- Bahrain Facility Management Market Size (FY’2022-FY’2032)

- Overview of Bahrain Facility Management Market

- Segmentation of Bahrain Facility Management Market By Type (In house Facility Management, Outsourced Facility Management)

- Segmentation of Bahrain Facility Management Market By Service (Catering, Cleaning, Property, Security, Support, Others)

- Segmentation of Bahrain Facility Management Market By Offering Type (Hard Services, Soft Services)

- Segmentation of Bahrain Facility Management Market By Industry (Organized, Unorganized)

- Segmentation of Bahrain Facility Management Market By End User (Commercial, Industrial, Public Sector, Residential, Others)

- Segmentation of Bahrain Facility Management Market By Sector (Banking, Education, Healthcare, Hospitality, Housing, Real Estate, Others)

- Segmentation of Bahrain Facility Management Market By Provider Type(Bundled Service Providers, Integrated FM (IFM) service providers, Single Service Providers)

- Segmentation of Bahrain Facility Management Market By Size of Organization (Small and medium-sized businesses, Large enterprises)Statistical Snap of Bahrain Facility Management Market

- Expansion Analysis of Bahrain Facility Management Market

- Problems and Obstacles in Bahrain Facility Management Market

- Competitive Landscape in the Bahrain Facility Management Market

- Impact of COVID-19 and Demonetization on Bahrain Facility Management Market

- Details on Current Investment in Bahrain Facility Management Market

- Competitive Analysis of Bahrain Facility Management Market

- Prominent Players in the Bahrain Facility Management Market

- SWOT Analysis of Bahrain Facility Management Market

- Bahrain Facility Management Market Future Outlook and Projections (FY’2022-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the Bahrain Facility Management Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4.Heat map analysis

6. Competitive Landscape

6.1. Bahrain Facility Management Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Bahrain Facility Management Market

7. Bahrain Facility Management Market, By Type, 2019-2032 (USD Million)

7.1. Inhouse Facility Management

7.2. Outsourced Facility Management

7.2.1. Single Facility Management

7.2.2. Bundled Facility Management

7.2.3. Integrated Facility Management

8. Bahrain Facility Management Market, By Service, 2019-2032 (USD Million)

8.1. Catering

8.2. Cleaning

8.3. Property

8.4. Security

8.5. Support

8.6. Others

9. Bahrain Facility Management Market, By Offering Type, 2019-2032 (USD Million)

9.1. Hard Services

9.2. Soft Services

10. Bahrain Facility Management Market, By Industry, 2019-2032 (USD Million)

10.1. Organized

10.2. Unorganized

11. Bahrain Facility Management Market, By End User, 2019-2032 (USD Million)

11.1. Commercial

11.2. Industrial

11.3. Public Sector

11.4. Residential

11.5. Others

12. Bahrain Facility Management Market, By Sector, 2019-2032 (USD Million)

12.1. Banking

12.2. Education

12.3. Healthcare

12.4. Hospitality

12.5. Housing

12.6. Real Estate

12.7. Others

13. Bahrain Facility Management Market, By Provider Type, 2019-2032 (USD Million)

13.1. Bundled Service Providers

13.2. Integrated FM (IFM) service providers

13.3. Single Service Providers

14. Bahrain Facility Management Market, By Size of Organization, 2019-2032 (USD Million)

14.1. Small and Medium-Sized Businesses

14.2. Large Enterprises

15. Bahrain Facility Management Market, By Region, 2019-2032 (USD Million)

15.1. Bahrain Facility Management Size and Market Share by Region (2019-2025)

15.2. Bahrain Facility Management Size and Market Share by Region (2026-2032)

15.3. Muharraq Region

15.4. Northern Bahrain

15.5. Southern Bahrain

15.6. The Capital Region

16. Company Profiles

16.1. ABM Industries Inc.

16.1.1. Company details

16.1.2. Financial outlook

16.1.3. Product summary

16.1.4. Recent developments

16.2. Almoayyed Contracting

16.2.1. Company details

16.2.2. Financial outlook

16.2.3. Product summary

16.2.4. Recent developments

16.3. ASF Facility Management

16.3.1. Company details

16.3.2. Financial outlook

16.3.3. Product summary

16.3.4. Recent developments

16.4. CBRE Bahrain WLL

16.4.1. Company details

16.4.2. Financial outlook

16.4.3. Product summary

16.4.4. Recent developments

16.5. EFS Facility Management Bahrain W.L.L.

16.5.1. Company details

16.5.2. Financial outlook

16.5.3. Product summary

16.5.4. Recent developments

16.6. Elite Facility Management Co.

16.6.1. Company details

16.6.2. Financial outlook

16.6.3. Product summary

16.6.4. Recent developments

16.7. Emrill Integrated Facilities Management

16.7.1. Company details

16.7.2. Financial outlook

16.7.3. Product summary

16.7.4. Recent developments

16.8. Etisalat FM services

16.8.1. Company details

16.8.2. Financial outlook

16.8.3. Product summary

16.8.4. Recent developments

16.9. Farnek

16.9.1. Company details

16.9.2. Financial outlook

16.9.3. Product summary

16.9.4. Recent developments

16.10. GEMS Industrial Services W.L.L.

16.10.1. Company details

16.10.2. Financial outlook

16.10.3. Product summary

16.10.4. Recent developments

16.11. Imdaad

16.11.1. Company details

16.11.2. Financial outlook

16.11.3. Product summary

16.11.4. Recent developments

16.12. Iris Property Management W.L.L.

16.12.1. Company details

16.12.2. Financial outlook

16.12.3. Product summary

16.12.4. Recent developments

16.13. Johnson Controls Inc.

16.13.1. Company details

16.13.2. Financial outlook

16.13.3. Product summary

16.13.4. Recent developments

16.14. Metropolitan Holding Co W.L.L.

16.14.1. Company details

16.14.2. Financial outlook

16.14.3. Product summary

16.14.4. Recent developments

16.15. Reliance Facilities Management

16.15.1. Company details

16.15.2. Financial outlook

16.15.3. Product summary

16.15.4. Recent developments

16.16. Royal Ambassador Property and Facility Management Co.

16.16.1. Company details

16.16.2. Financial outlook

16.16.3. Product summary

16.16.4. Recent developments

16.17. Saudi Oger

16.17.1. Company details

16.17.2. Financial outlook

16.17.3. Product summary

16.17.4. Recent developments

16.18. Turner Facilities Management Ltd.

16.18.1. Company details

16.18.2. Financial outlook

16.18.3. Product summary

16.18.4. Recent developments

17. List of Abbreviations

18. Reference Links

19. Conclusion

20. Research Scope