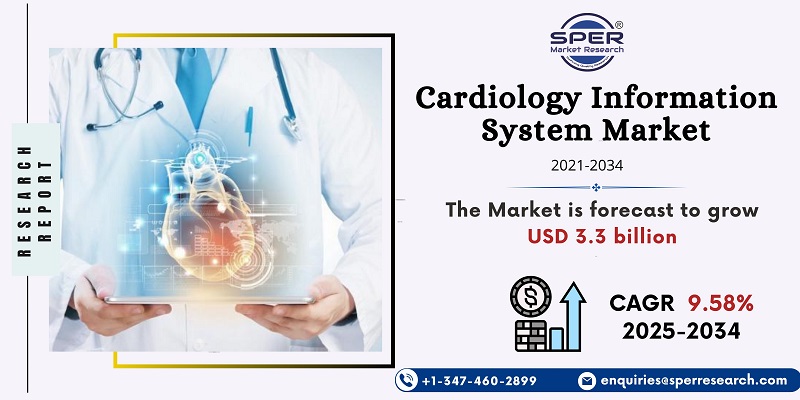

Global Cardiology Information System Market Introduction and Overview

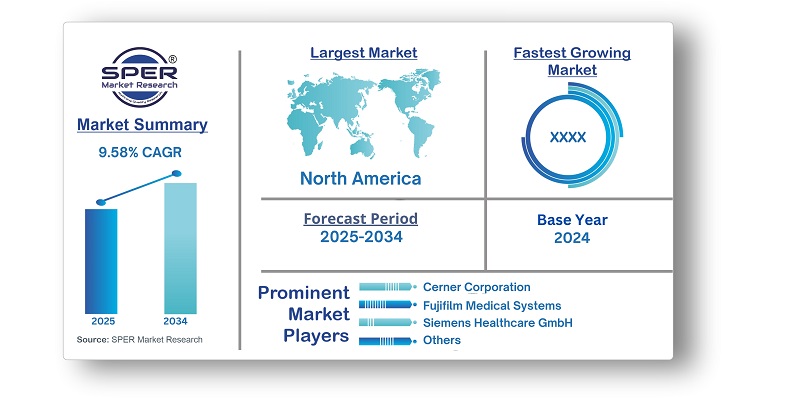

According to SPER Market Research, the Global Cardiology Information System Market is estimated to reach USD 3.3 billion by 2034 with a CAGR of 9.58%.

The report includes an in-depth analysis of the Global Cardiology Information System Market, including market size and trends, product mix, Applications, and supplier analysis. The growing challenges in cardiovascular care—such as handling vast amounts of data, retrieving information efficiently, and maintaining comprehensive patient history records—are driving the need for advanced solutions like Electronic Health Records (EHR), which support effective data analysis. Additionally, the growing demand for effective data management solutions in cardiac settings significantly contributes to this rapid growth. However, challenges in cardiovascular care include managing large volumes of patient data, ensuring accurate and timely data retrieval, and maintaining complete medical histories. These issues hinder efficient diagnosis, treatment planning, and long-term patient monitoring.

By System:

The Cardiovascular Information System (CVIS) segment generated the most revenue in 2024 and is expected to experience the most rapid compound annual growth rate (CAGR) going forward. CVIS supports efficient data analysis, helping physicians make quicker, more accurate treatment decisions compared to CPACS. Originally known as Cardiology Picture Archiving and Communication System (CPACS), CVIS evolved to store comprehensive patient data, including medical images, records, X-rays, and lab results, leading to higher adoption and significant market growth.

By Application:

The web-based segment holds a leading position in the cardiovascular information system market due to its ease of access and flexibility. It eliminates the need for local installations, allowing healthcare professionals to log in from various locations using their credentials. Data is securely stored on protected servers, ensuring safety and backups. High awareness and cost-effectiveness have contributed to the widespread global adoption of web-based CVIS solutions.

By Regional Insights:

The high incidence of heart disease in North America has positioned it as the leading market for cardiovascular information systems. Data from the Centers for Disease Control and Prevention indicates that heart disease is the primary cause of mortality for most racial and ethnic groups in the United States. In 2021, it accounted for roughly one in five deaths nationwide, claiming a life about every 33 seconds, totaling nearly 695,000 fatalities.

Market Competitive Landscape:

The market demonstrates a moderately consolidated competitive environment. Some of the key participants in the market include Cerner Corporation, Fujifilm Medical Systems, Inc., Siemens Healthcare GmbH, Philips Healthcare, GE Healthcare, Cisco Systems, LUMEDX Corporation, Digisonics, Inc., and Honeywell Life Care Solutions.

Recent Developments:

Oracle Corporation's September 2023 launch of enhanced healthcare solutions for cardiology, neurology, and oncology significantly boosted its sales. The updates included cloud-based EHR functionalities, generative AI services, and public APIs designed to support CIS and other healthcare applications.

In April 2022, FUJIFILM Healthcare Corporation, in collaboration with Emory Healthcare facilities, implemented Fujifilm’s Synapse Cardiology PACS version 7 to support the storage, processing, and analysis of cardiac and vascular imaging.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Mode of Operation,

By System |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East

& Africa |

| Companies Covered | Cerner

Corporation, Fujifilm Medical Systems, Inc., Siemens Healthcare GmbH, Philips

Healthcare, GE Healthcare, Cisco Systems, LUMEDX Corporation, Digisonics, Inc.,

and Honeywell Life Care Solutions. |

Key Topics Covered in the Report

- Global Cardiology Information System Market Size (FY’2021-FY’2034)

- Overview of Global Cardiology Information System Market

- Segmentation of Global Cardiology Information System Market By Mode Of Operation (Web-based, Cloud-based, On-site)

- Segmentation of Global Cardiology Information System Market By System (CVIS, CPACS)

- Statistical Snap of Global Cardiology Information System Market

- Expansion Analysis of Global Cardiology Information System Market

- Problems and Obstacles in Global Cardiology Information System Market

- Competitive Landscape in the Global Cardiology Information System Market

- Details on Current Investment in Global Cardiology Information System Market

- Competitive Analysis of Global Cardiology Information System Market

- Prominent Players in the Global Cardiology Information System Market

- SWOT Analysis of Global Cardiology Information System Market

- Global Cardiology Information System Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Cardiology Information System Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Cardiology Information System Market

7. Global Cardiology Information System Market, By Mode Of Operation, (USD Million) 2021-2034

7.1. Web-based

7.2. Cloud-based

7.3. On-site

8. Global Cardiology Information System Market, By System, (USD Million) 2021-2034

8.1. CVIS

8.2. CPACS

9. Global Cardiology Information System Market, (USD Million) 2021-2034

9.1. Global Cardiology Information System Market Size and Market Share

10. Global Cardiology Information System Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Philips Healthcare

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. GE Healthcare

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Cisco Systems

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Fujifilm Medical Systems, Inc.

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Siemens Healthcare GmbH

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Cerner Corporation

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. LUMEDX Corporation

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Digisonics, Inc.

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Honeywell Life Care Solutions

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.