China Car Finance Market Growth, Trends, Size, Share, Revenue, Challenges and Future Scope 2032

China Car Finance Market Size- By Category of Vehicles, By Ownership of Vehicles, By Category of Lenders, By Loan Tenure- Regional Outlook, Competitive Strategies and Segment Forecast to 2032

| Published: Mar-2023 | Report ID: AMIN2372 | Pages: 1 - 107 | Formats*: |

| Category : Automotive & Transportation | |||

- The credit infrastructure and credit rating systems in China have been improved. A strong credit infrastructure enables lenders to analyse borrower risk more precisely, increasing the number of consumers who may obtain auto finance. Credit systems' continued development and sophistication may have a favourable effect on the auto finance industry.

- Internet penetration: The significant driver behind the increased demand for used cars in China, and subsequently the demand for used car financing, has been the widespread adoption of the internet, particularly its penetration across the country.

- Opportunities: Fintech advancements, including online lending platforms, mobile payment solutions, and digital banking, are poised to create opportunities for the growth in China's car finance market. These technologies are set to simplify loan applications, improve accessibility, and offer tailored financing choices, enhancing overall convenience for consumers. The rise of shared mobility, encompassing car-sharing and ride-hailing services, is gaining popularity, potentially leading to increased demand for fleet financing and innovative financing models designed for shared mobility providers. Also, the Chinese government is actively supporting the automotive sector through various policies, including tax incentives and subsidies, fostering a conducive environment for financial institutions to offer appealing car financing options to consumers.

- Challenges: There are hurdles to overcome, including limited consumer knowledge about car financing choices and elevated borrowing costs for certain individuals. Additionally, the global recession induced by the COVID-19 pandemic is expected to have a significant impact on the automotive industry, particularly concerning the diminished credit capacity of banks and financial institutions. This reduced capacity is likely to hinder the introduction of new lease agreements and, consequently, restrain the global car leasing market.

| Report Metric | Details |

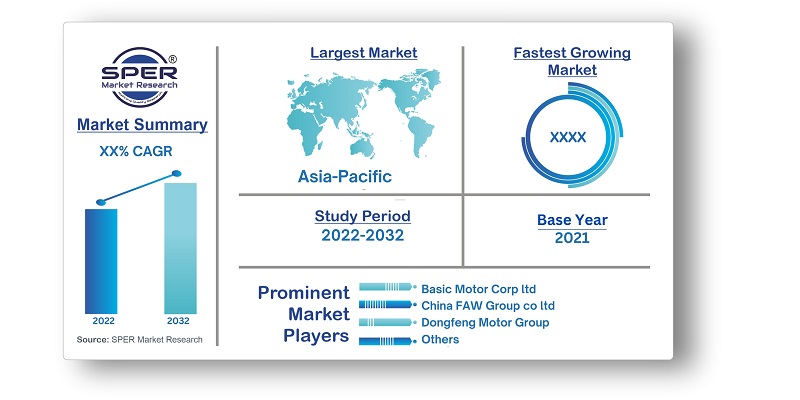

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Category of Vehicles, By Ownership of Vehicles, By Category of Lenders, By Loan Tenure. |

| Regions covered | North China, Northeast China, East China, South China, Central China, Southwest China, Northwest China |

| Companies Covered | Basic Motor Corp ltd, BYD Auto Finance Company Limited, BYD CO ltd, Changan Auto Finance Co Ltd, Chery HuiYin Motor Finance Service, China FAW Group co ltd, Dongfeng Motor Group, Dongfeng Nissan Finance Co, GAC- Toyota Motor Finance (China) Co, Genius Auto Finance Co Ltd, Great Wall Motor Co ltd, Herald International Financial Leasing Co Ltd, SAIC Motor Corp ltd, SAIC Motor Financial Holding Management Co, SOFINCO Automobile Finance Co Ltd, Volkswagen Finance Private Limited. |

- Auto Loan Brokers

- Auto Manufacturers

- Automobile Dealerships

- Banks and Financial Institutions

- Corporate Fleet Managers

- Credit Rating Agencies

- Individual Car Buyers

- Insurance Companies

- Leasing Companies

- Online Lending Platforms

- Others

| By Category of Vehicles: |

|

| By Ownership of Vehicles: |

|

| By Category of Lenders: |

|

| By Loan Tenure: |

|

- Size of China Car Finance Market (FY’2019-FY’2032)

- Overview of China Car Finance Market

- Segmentation of China Car Finance Market By Category of Vehicles (Passenger Vehicles, Commercial Vehicles)

- Segmentation of China Car Finance Market By Ownership of Vehicles (New Vehicles, Used Vehicles)

- Segmentation of China Car Finance Market By Category of Lenders (NBFCs, Universal and Commercial Banks, Captives)

- Segmentation of China Car Finance Market By Loan Tenure (12-24 Months, 25-48 Months, 49-60 Months)

- Statistical Snap of China Car Finance Market

- China Car Finance Market Growth Analysis

- Problems and Challenges in China Car Finance Market

- China Car Finance Market Competitive Landscape

- Impact of COVID-19 and Demonetization on China Car Finance Market

- Details on Recent Investment in China Car Finance Market

- Competitive Analysis of China Car Finance Market

- Major Players in the China Car Finance Market

- SWOT Analysis of China Car Finance Market

- China Car Finance Market Future Outlook and Projections (FY’2019-FY’2032)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1 Research data source2.1.1 Secondary data2.1.2 Primary data2.1.3 SPER’s internal database2.1.4 Premium insight from KOL’s2.2 Market size estimation2.2.1 Top-down and Bottom-up approach2.3 Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1 Drivers4.1.2 Restraints4.1.3 Opportunities4.1.4 Challenges4.2. COVID-19 Impacts of the China Car Finance Market

5.1. SWOT analysis5.1.1 Strengths5.1.2 Weaknesses5.1.3 Opportunities5.1.4 Threats5.2. PESTEL analysis5.2.1 Political landscape5.2.2 Economic landscape5.2.3 Social landscape5.2.4 Technological landscape5.2.5 Environmental landscape5.2.6 Legal landscape5.3. PORTER’S five forces analysis5.3.1 Bargaining power of suppliers5.3.2 Bargaining power of Buyers5.3.3 Threat of Substitute5.3.4 Threat of new entrant5.3.5 Competitive rivalry5.4. Heat map analysis

6.1 China Car Finance Manufacturing Base Distribution, Sales Area, Product Type6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in China Car Finance Market

7.1. Passenger Vehicles7.2. Commercial Vehicles

8.1. New Vehicles8.2. Used Vehicles

9.1. NBFCs9.2. Universal and Commercial Banks9.3. Captives

10.1. 12-24 Months10.2. 25-48 Months10.3. 49-60 Months

11.1. China Car Finance Market Size and Market Share by Region (2019-2025)11.2. China Car Finance Market Size and Market Share by Region (2026-2032)11.3. North China11.4. Northeast China11.5. East China11.6. South China 11.7. Central China11.8. Southwest China11.9. Northwest China

12.1. Basic Motor Corp ltd12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments12.2. BYD Auto Finance Company Limited12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments12.3. BYD CO ltd12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments12.4. Changan Auto Finance Co Ltd12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments12.5. Chery HuiYin Motor Finance Service12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments12.6. China FAW Group co ltd12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments12.7. Dongfeng Motor Group12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments12.8. Dongfeng Nissan Finance Co12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments12.9. GAC- Toyota Motor Finance (China) Co12.9.1. Company details12.9.2. Financial outlook12.9.3. Product summary12.9.4. Recent developments12.10. Genius Auto Finance Co Ltd12.10.1. Company details12.10.2. Financial outlook12.10.3. Product summary12.10.4. Recent developments12.11. Great Wall Motor Co ltd12.11.1. Company details12.11.2. Financial outlook12.11.3. Product summary12.11.4. Recent developments12.12. Herald International Financial Leasing Co Ltd12.12.1. Company details12.12.2. Financial outlook12.12.3. Product summary12.12.4. Recent developments12.13. SAIC Motor Corp ltd12.13.1. Company details12.13.2. Financial outlook12.13.3. Product summary12.13.4. Recent developments12.14. SAIC Motor Financial Holding Management Co12.14.1. Company details12.14.2. Financial outlook12.14.3. Product summary12.14.4. Recent developments12.15. SOFINCO Automobile Finance Co Ltd12.15.1. Company details12.15.2. Financial outlook12.15.3. Product summary12.15.4. Recent developments12.16. Volkswagen Finance Private Limited12.16.1. Company details12.16.2. Financial outlook12.16.3. Product summary12.16.4. Recent developments

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.