China Logistics and Warehousing Market Growth, Size, Revenue and Future Opportunities 2032

China Logistics and Warehousing Market Size- By Mode of Service, By Type of Load, By Business Model, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2032

| Published: Jan-2023 | Report ID: AMIN2304 | Pages: 1 - 103 | Formats*: |

| Category : Automotive & Transportation | |||

- In order to promote the growth of the logistics market in the coming years, the government has introduced several initiatives aimed at enhancing the country's infrastructure.

- The increasing prominence of the retail and FMCG industry in the country will drive the demand for storage warehouses and transportation and logistics services. The industry is expected to undergo a digital transformation with the implementation of technologies such as cloud logistics, drone facilities, automation, and other innovative solutions. This shift towards digitalization will further propel the growth of the industry.

- Opportunities:

- Increasing E-Commerce Sector: The enormous prospects for logistics and warehousing services are provided by China's developing e-commerce sector. The demand for sophisticated logistics solutions is being driven by the rising requirement for effective last-mile delivery, order fulfillment, and warehouse facilities.

- Infrastructure Development: Opportunities for logistics and warehousing businesses are made possible by the Chinese government's focus on infrastructure development, particularly the expansion of transportation networks and logistics parks. Other transportation initiatives, such as the Belt and Road Initiative, improve connectivity and ease international trade.

- Challenges:

- Market fragmentation: There are many small and medium-sized businesses (SMEs) in China's logistics and warehousing market, which is very fragmented. Market participants face difficulties due to intense rivalry and the necessity for consolidation.

- Regulations and licensing requirements for logistics operations, such as warehousing and transportation, are complicated in China. For new businesses, navigating the regulatory environment and ensuring compliance can be difficult.

-009480114072023.jpg)

| Report Metric | Details |

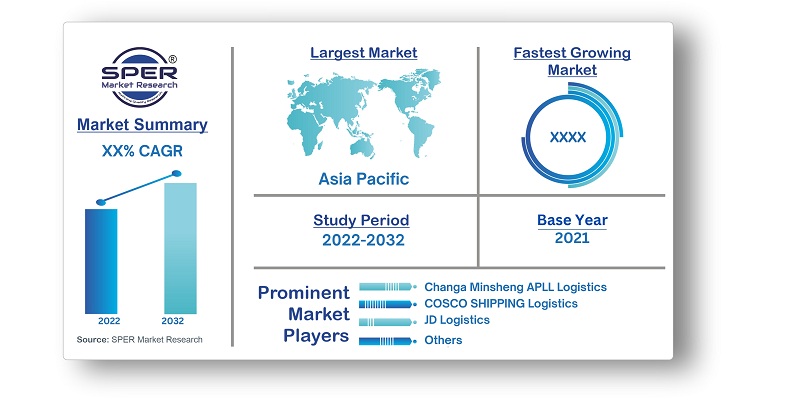

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Mode of Service, By Type of Load, By Business Model, By End User |

| Regions covered | East China, Middle China, North China, Northeast China, Northwest China, South China, Southwest China. |

| Companies Covered | Aneng Logistics, Changa Minsheng APLL Logistics, China Logistics Property Holdings, COSCO SHIPPING Logistics, DCH Holdings Ltd., Deppon Logistics, Fujian Shengfeng, HOAU Logistics Co., JD Logistics, Kerry Logistics, Leaping Express Group, Maple Tree Logistics, Shandong Jiayi Logistics Co., Shanghai Zeyi Logistics, Sinotrans Hi-Tech Logistics, Tianjin Datian Group, Topone Logistics, Topwin Logistcs, Vanke (VX Logistics Properties), Yuancheng Group Co Ltd, Yuantong Express Co. (YTO) |

- 3PL Companies

- Consultancy Companies

- E Commerce Logistics Companies

- Express Delivery Logistics Companies

- Freight Forwarding Companies

- Logistics/Warehousing Companies

- Real Estate Companies/ Industrial Developers

- Others

| By Mode of Service: |

|

| By Type of Load: |

|

| By Business Model: |

|

| By End User: |

|

- China Logistics and Warehousing Market Size (FY’2022-FY’2032)

- Overview of China Logistics and Warehousing Market

- Segmentation of China Logistics and Warehousing Market By Mode of Service (Air Freight, Rail Freight, Road Freight, Sea Freight)

- Segmentation of China Logistics and Warehousing Market By Type of Load (Full Truckload, Low Than Truckload)

- Segmentation of China Logistics and Warehousing Market By Business Model (Cold Storage, Grain Storage, IFS/ICD, Industrial Retail)

- Segmentation of China Logistics and Warehousing Market By End User (Agriculture, Non- Agriculture, FMCG Products, Commodities, Pharmaceutical and Medical Devices, Automotive Products, Electronics, Others)

- Statistical Snap of China Logistics and Warehousing Market

- Expansion Analysis of China Logistics and Warehousing Market

- Problems and Obstacles in China Logistics and Warehousing Market

- Competitive Landscape in the China Logistics and Warehousing Market

- Impact of COVID-19 and Demonetization on China Logistics and Warehousing Market

- Details on Current Investment in China Logistics and Warehousing Market

- Competitive Analysis of China Logistics and Warehousing Market

- Prominent Market Players in the China Logistics and Warehousing Market

- SWOT Analysis of China Logistics and Warehousing Market

- China Logistics and Warehousing Market Future Outlook and Projections (FY’2022-FY’2032)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1 Research data source

2.1.1 Secondary data2.1.2 Primary data2.1.3 SPER’s internal database2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers4.1.2 Restraints4.1.3 Opportunities4.1.4 Challenges

4.2. COVID-19 Impacts of the China Logistics and Warehousing Market

5.1. SWOT analysis

5.1.1 Strengths5.1.2 Weaknesses5.1.3 Opportunities5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape5.2.2 Economic landscape5.2.3 Social landscape5.2.4 Technological landscape5.2.5 Environmental landscape5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers5.3.2 Bargaining power of Buyers5.3.3 Threat of Substitute5.3.4 Threat of new entrant5.3.5 Competitive rivalry

5.4.Heat map analysis

6.1. China Logistics and Warehousing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in China Logistics and Warehousing Market

7.1. Air Freight7.2. Rail Freight7.3. Road Freight7.4. Sea Freight

8.1. Full Truckload8.2. Low Than Truckload

9.1. Cold Storage9.2. Grain Storage9.3. IFS/ICD9.4. Industrial Retail

10.1. Road Freight Forwarding Market

10.1.1. Agriculture

10.1.2. Non- Agriculture

10.1.2.1. Commodities10.1.2.2. FMCG Products10.1.2.3. Electronic Equipments10.1.2.4. Chemicals10.1.2.5. Automotive Products10.1.2.6. Pharmaceutical Products

10.2. Warehousing Market

10.2.1. FMCG Products10.2.2. Commodities10.2.3. Agricultural Products10.2.4. Pharmaceutical and Medical Devices10.2.5. Automotive Products10.2.6. Electronics10.2.7. Others

11.1. China Logistics and Warehousing Size and Market Share by Region (2019-2025)11.2. China Logistics and Warehousing Size and Market Share by Region (2026-2032)11.3. East China11.4. Middle China11.5. North China11.6. Northeast China11.7. Northwest China11.8. South China11.9. Southwest China

12.1. Aneng Logistics

12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments

12.2. Changa Minsheng APLL Logistics

12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments

12.3. China Logistics Property Holdings

12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments

12.4. COSCO SHIPPING Logistics

12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments

12.5. DCH Holdings Ltd

12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments

12.6. Deppon Logistics

12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments

12.7. Fujian Shengfeng

12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments

12.8. HOAU Logistics Co.

12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments

12.9. JD Logistics

12.9.1. Company details12.9.2. Financial outlook12.9.3. Product summary12.9.4. Recent developments

12.10. Kerry Logistics

12.10.1. Company details12.10.2. Financial outlook12.10.3. Product summary12.10.4. Recent developments

12.11. Leaping Express Group

12.11.1. Company details12.11.2. Financial outlook12.11.3. Product summary12.11.4. Recent developments

12.12. Maple Tree Logistics

12.12.1. Company details12.12.2. Financial outlook12.12.3. Product summary12.12.4. Recent developments

12.13. Shandong Jiayi Logistics Co.

12.13.1. Company details12.13.2. Financial outlook12.13.3. Product summary12.13.4. Recent developments

12.14. Shanghai Zeyi Logistics

12.14.1. Company details12.14.2. Financial outlook12.14.3. Product summary12.14.4. Recent developments

12.15. Sinotrans Hi-Tech Logistics

12.15.1. Company details12.15.2. Financial outlook12.15.3. Product summary12.15.4. Recent developments

12.16. Tianjin Datian Group

12.16.1. Company details12.16.2. Financial outlook12.16.3. Product summary12.16.4. Recent developments

12.17. Topone Logistics

12.17.1. Company details12.17.2. Financial outlook12.17.3. Product summary12.17.4. Recent developments

12.18. TopwinLogistcs

12.18.1. Company details12.18.2. Financial outlook12.18.3. Product summary12.18.4. Recent developments

12.19. Vanke (VX Logistics Properties)

12.19.1. Company details12.19.2. Financial outlook12.19.3. Product summary12.19.4. Recent developments

12.20. Yuancheng Group Co Ltd.

12.20.1. Company details12.20.2. Financial outlook12.20.3. Product summary12.20.4. Recent developments

12.21. Yuantong Express Co. (YTO)

12.21.1. Company details12.21.2. Financial outlook12.21.3. Product summary12.21.4. Recent developments

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.