Commercial Radars Market Introduction and Overview

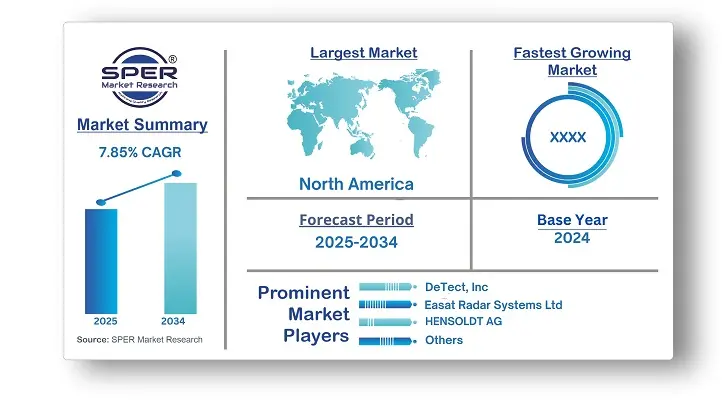

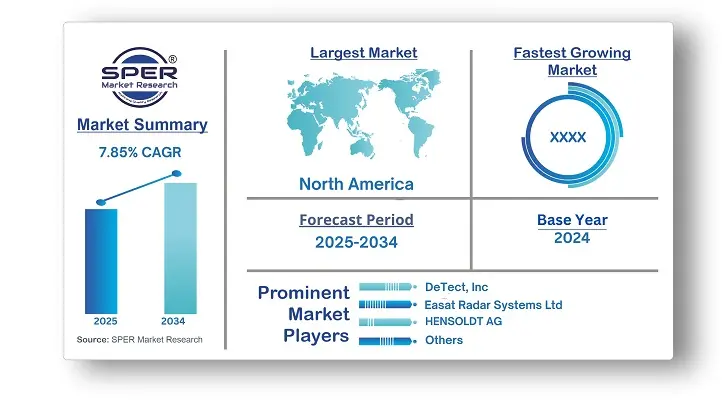

According to SPER Market Research, the Global Commercial Radars Market is estimated to reach USD 14.79 billion by 2034 with a CAGR of 7.85%.

The report includes an in-depth analysis of the Global Commercial Radars Market, including market size and trends, product mix, Applications, and supplier analysis. The growing need for improved surveillance, air traffic control, and weather monitoring is driving the growth of the commercial radar industry. Radar systems are essential for improved safety, navigation, and situational awareness in a variety of industries, including defense, automotive, marine, and aviation. Radar system technical improvements, the growing popularity of autonomous vehicles, and rising security concerns are some of the main motivators. Radar capabilities are also improved by combining AI and IoT. But obstacles to industry expansion include issues including expensive development costs, legal restrictions, and electromagnetic spectrum congestion. Despite these obstacles, the demand for commercial radar systems is growing globally due to ongoing innovation and the requirement for accurate detection and monitoring.

By Component Insights

Commercial Radars is classified into five categories based on Component: Antenna, Transmitter, Duplexer, Receiver, Signal & Data Processors and Phased Array. The biggest revenue share was generated by the antenna category. Since it transmits and receives electromagnetic waves that enable the radar system to identify and locate objects, the antenna is an essential component of commercial radars. Over the course of the projected period, signal and data processors are expected to record the quickest CAGR. Radar signals can be processed by signal and data processors to retrieve vital target information.

By Platform Insights

The market for Commercial Radars is segmented based on Platform, including Naval, Land, Airborne and Space. The land platform is in charge. For border security and defense applications, land-based radar systems are essential for surveillance and monitoring. Over the course of the projected period, the naval platform is expected to record the fastest CAGR. Compact size, cost-effectiveness, ease of installation, and user-friendly interfaces are the typical characteristics of commercial radar systems for maritime platforms.

By Frequency Insights

The market for Commercial Radars is segmented based on Frequency, including HF/VHF/UHF, L, S and C, X, K, Ku and Ka. The major frequency section is S. S-band radar systems are perfect for situations where extended-range detection is crucial because they are known to monitor targets over long distances and during challenging atmospheric conditions. The fastest CAGR is predicted for the X frequency sector. Because of their shorter wavelength, X-band radar systems, which run at frequencies between 8 and 12 GHz, are renowned for their capacity to detect microscopic particles.

By Application Insights

The market for Commercial Radars is segmented based on Applications, including Air Traffic Control & Navigation, Airspace Monitoring, Sea Traffic Control & Navigation, Automotive, Remote Sensing & Weather Observation and Ground Traffic Control. Navigation and air traffic control held the most market share. Commercial radars, air traffic control, and navigation applications use a variety of technologies and surveillance systems to guarantee the safe and effective movement of aircraft. It is projected that during the predicted period, airspace monitoring would have the quickest CAGR. Airspace surveillance and monitoring, weather monitoring, airport perimeter security, aircraft collision warning, navigation, and more all depend on commercial radars.

By Dimension Insights

The market for Commercial Radars is divided based on Dimension, including 2D, 3D, 4D. The majority of the market is 2D. 2D radar systems can calculate a target object's horizontal angle with respect to the radar unit thanks to the azimuth angle detection feature. The segment with the fastest predicted CAGR is 3D. The rise of 3D commercial radars is mostly driven by the growing need for security and surveillance systems across a range of sectors, including defense, maritime, and aviation.

By Regional Insights

The highest revenue share came from North America. The need for weather monitoring and forecasting, growing security concerns, and rising demand for air travel have all contributed to the market's recent expansion. The regional market is expanding as a result of rising investments in radar technology for improving security across multiple industries.

Market Competitive Landscape

To obtain a competitive advantage, major players in the commercial radar market are constantly developing cutting-edge and novel technologies. To improve the performance, accuracy, and dependability of their radar systems, major players in the commercial radar market are making significant investments in research and development. Some of the key market players are DeTect, Inc., Easat Radar Systems Ltd., ELDIS Pardubice and s.r.o., HENSOLDT AG, Indra Sistemas, S.A., Leonardo S.p.A, NEC Corporation, RTX, Terma and Thales.

Recent Developments:

In September 2023, The U.S. Air Force's B-52 bomber currently has an Active Electronically Scanned Array (AESA) radar installed thanks to a partnership between RTX and Boeing. The user may generate exact GPS coordinates with the radar system to launch guided missiles on time and with accuracy.

In March 2023, DeTect, Inc. established its longest-range X-band surveillance radar, the HARRIER BAR300, which uses solid-state technology to ensure high performance and reliability and is designed for long-range coastal surveillance applications, drone operations beyond visual line-of-sight, bird monitoring, and extensive airspace security.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Component, By Platform, By Frequency, By Application, By Dimension |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | DeTect, Inc., Easat Radar Systems Ltd., ELDIS Pardubice and s.r.o., HENSOLDT AG, Indra Sistemas, S.A., Leonardo S.p.A, NEC Corporation, RTX, Terma and Thales.

|

<

Key Topics Covered in the Report- Global Commercial Radars Market Size (FY’2021-FY’2034)

- Overview of Global Commercial Radars Market

- Segmentation of Global Commercial Radars Market By Component (Antenna, Transmitter, Duplexer, Receiver, Signal & Data Processors, Phased Array)

- Segmentation of Global Commercial Radars Market By Platform (Naval, Land, Airborne, Space)

- Segmentation of Global Commercial Radars Market By Frequency (HF/VHF/UHF, L, S, C, X, K, Ku, Ka)

- Segmentation of Global Commercial Radars Market By Application (Air Traffic Control & Navigation, Airspace Monitoring, Sea Traffic Control & Navigation, Automotive, Remote Sensing & Weather Observation, Ground Traffic Control)

- Segmentation of Global Commercial Radars Market By Dimension (2D, 3D, 4D)

- Statistical Snap of Global Commercial Radars Market

- Expansion Analysis of Global Commercial Radars Market

- Problems and Obstacles in Global Commercial Radars Market

- Competitive Landscape in the Global Commercial Radars Market

- Details on Current Investment in Global Commercial Radars Market

- Competitive Analysis of Global Commercial Radars Market

- Prominent Players in the Global Commercial Radars Market

- SWOT Analysis of Global Commercial Radars Market

- Global Commercial Radars Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Commercial Radars Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Commercial Radars Market

7. Global Commercial Radars Market, By Component 2021-2034 (USD Million)

7.1. Antenna

7.2. Transmitter

7.3. Duplexer

7.4. Receiver

7.5. Signal & Data Processors

7.6. Phased Array

8. Global Commercial Radars Market, By Platform 2021-2034 (USD Million)

8.1. Naval

8.2. Land

8.3. Airborne

8.4. Space

9. Global Commercial Radars Market, By Frequency 2021-2034 (USD Million)

9.1. HF/VHF/UHF

9.2. L

9.3. S

9.4. C

9.5. X

9.6. K

9.7. Ku

9.8. Ka

10. Global Commercial Radars Market, By Application 2021-2034 (USD Million)

10.1. Air Traffic Control & Navigation

10.2. Airspace Monitoring

10.3. Sea Traffic Control & Navigation

10.4. Automotive

10.5. Remote Sensing & Weather Observation

10.6. Ground Traffic Control

11. Global Commercial Radars Market, By Dimension 2021-2034 (USD Million)

11.1. 2D

11.2. 3D

11.3. 4D

12. Global Commercial Radars Market, 2021-2034 (USD Million)

12.1. Global Commercial Radars Market Size and Market Share

13. Global Commercial Radars Market, By Region, 2021-2034 (USD Million)

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. DeTect, Inc.

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Easat Radars Systems Ltd.

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. ELDIS Pardubice, s.r.o.

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. HENSOLDT AG

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

1.5. Indra Sistemas, S.A.

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. Leonardo S.p.A

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. NEC Corporation

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. RTX

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Terma

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. Thales

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.