Construction Generator Sets Market Introduction and Overview

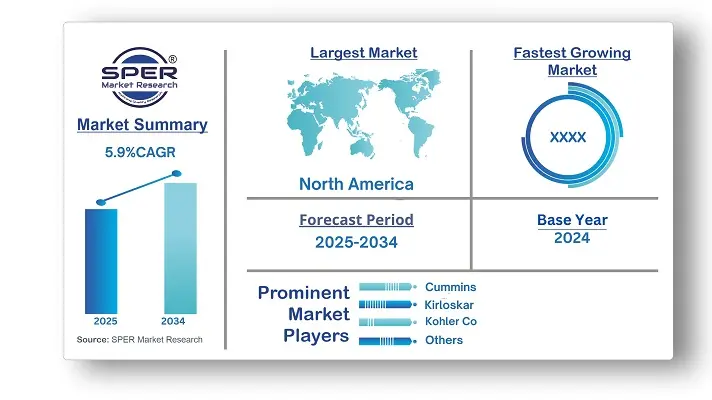

According to SPER Market Research, the Global Construction Generator Sets Market is estimated to reach USD 15.47 billion by 2034 with a CAGR of 5.9%.

The report includes an in-depth analysis of the Global Construction Generator Sets Market, including market size and trends, product mix, Applications, and supplier analysis. The market for construction generator sets is expanding as a result of growing urbanization, infrastructure development, and the demand for dependable power supplies at building sites. These generator sets guarantee continuous workflow by providing both primary and backup power for heavy equipment, lights, and sites activities. Growing investments in residential and commercial real estate, smart city initiatives, and government infrastructure expansion programs are the main drivers of market growth. The transition to renewable energy sources, strict pollution rules, and unpredictable fuel prices all obstacles, though. Market adoption is also impacted by high maintenance costs and worries about noise pollution.

By Fuel Insights

Construction Generator Sets is classified into two categories based on Fuel: Diesel, Gas. The industry leader is gas generator sets. A consumer shift toward sustainable energy solutions is being fueled by the growing emphasis on cost savings and energy efficiency, which is increasing demand for items in this industry. One of the main drivers of this industry development is the rising acceptance of decentralized power generation, particularly in isolated and off-grid areas. A favorable situation is also being created by government incentives, rules, and the industry's dedication to environmental sustainability.

By Application Insights

The market for Construction Generator Sets is segmented based on Applications, including Standby, Peak Shaving and Prime/Continuous. The prime power generator application category dominates the construction generator sets market. In the years to come, the gensets business is expected to be greatly impacted by stricter environmental restrictions, a focus on cost reduction, a priority on energy efficiency, and an emphasis on cleaner energy sources. These generator sets stand out among other alternative power sources and are becoming more widely acknowledged for their strategic importance and ubiquity in addressing unavoidable power shortages.

By Power Rating Insights

The market for Construction Generator Sets is divided based on Power Rating, including ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, > 750 kVA. The market share of construction generator sets rated between 330 and 750 kVA is the largest. The growing number of infrastructure development and construction projects, along with the growing demand for reliable backup power solutions, is anticipated to propel the widespread adoption of these units. Business growth will also be fueled by the increase in population density and urbanization, as well as the growth of commercial and retail areas.

By Regional Insights

The market for construction generator sets is dominated by North America. The need for grid resilience following severe weather events like hurricanes and winter storms is driving greater demand for backup power solutions, which is expected to improve the business climate. Furthermore, the adoption of cleaner and more efficient power systems will be facilitated by technology improvements and the paradigm change in emissions reduction.

Market Competitive Landscape

The industry's competitive landscape is being addressed by the top corporations by giving priority to economies of scale, brand recognition, technology improvements, and marketing techniques. Cummins is a well-known maker of engines and gensets, among other power generation equipment. Generator sets, or gensets for short, are basically an engine and alternator (generator) fitted together to produce energy. Some of the key market players are Cummins, Inc., Kirloskar, Kohler Co., Generac Power Systems, Inc., Yamaha Motor Co., Ltd., Powerica Limited, Sterling and Wilson Pvt. Ltd., HIMOINSA, Caterpillar, Atlas Copco AB.

Recent Developments:

In December 2023, Dual Fuel Kits for Diesel Generators, which Kirloskar maintained would be implemented, provide a revolutionary solution for India's growing power requirements. With cutting-edge features including an electronic controller for smooth fuel transition, dual-fuel mode performance optimization, and fuel mixture flexibility, they offer a more affordable and environmentally friendly option. This idea demonstrates environmental responsibility while providing businesses with incentives in line with the Indian government's drive for better energy alternatives.

In August 2023, The CPCB IV+ compatible generators were launched by Mahindra Powerol. They said it's a joy to interact with their GOEM partners at this event, which is being held at Pune's innovative Chakan Plant. This is a step in the right direction for the company's environmental concern.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Fuel, By Application, By Power Rating |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Cummins, Inc., Kirloskar, Kohler Co., Generac Power Systems, Inc., Yamaha Motor Co., Ltd., Powerica Limited, Sterling and Wilson Pvt. Ltd., HIMOINSA, Caterpillar, Atlas Copco AB.

|

Key Topics Covered in the Report

- Global Construction Generator Sets Market Size (FY’2021-FY’2034)

- Overview of Global Construction Generator Sets Market

- Segmentation of Global Construction Generator Sets Market By Fuel (Diesel, Gas)

- Segmentation of Global Construction Generator Sets Market By Application (Standby, Peak Shaving, Prime/Continuous)

- Segmentation of Global Construction Generator Sets Market By Power Rating (≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, > 750 kVA)

- Statistical Snap of Global Construction Generator Sets Market

- Expansion Analysis of Global Construction Generator Sets Market

- Problems and Obstacles in Global Construction Generator Sets Market

- Competitive Landscape in the Global Construction Generator Sets Market

- Details on Current Investment in Global Construction Generator Sets Market

- Competitive Analysis of Global Construction Generator Sets Market

- Prominent Players in the Global Construction Generator Sets Market

- SWOT Analysis of Global Construction Generator Sets Market

- Global Construction Generator Sets Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Construction Generator Sets Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Construction Generator Sets Market

7. Global Construction Generator Sets Market, By Fuel 2021-2034 (USD Million)

7.1. Diesel

7.2. Gas

8. Global Construction Generator Sets Market, By Application 2021-2034 (USD Million)

8.1. Standby

8.2. Peak Shaving

8.3. Prime/Continuous

9. Global Construction Generator Sets Market, By Power Rating 2021-2034 (USD Million)

9.1. ≤ 50 kVA

9.2. > 50 kVA - 125 kVA

9.3. > 125 kVA - 200 kVA

9.4. > 200 kVA - 330 kVA

9.5. > 330 kVA - 750 kVA

9.6. > 750 kVA

10. Global Construction Generator Sets Market, 2021-2034 (USD Million)

10.1. Global Construction Generator Sets Market Size and Market Share

11. Global Construction Generator Sets Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Aggreko

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Ashok Leyland

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Atlas Copco AB

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Caterpillar

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Champion Power Equipment

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Deere & Company

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. FG Wilson

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Generac Power Systems, Inc.

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Greaves Cotton Limited

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. HIMOINSA

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.