Egypt Logistics and Warehousing Market Overview

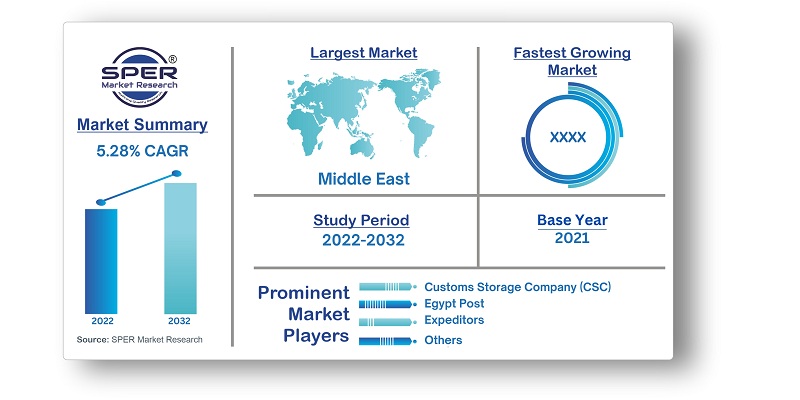

According to SPER Market Research, the Egypt Logistics and Warehousing Market is estimated to reach USD 75.46 billion by 2032 with a CAGR of 5.28%.

Egypt's location is of enormous strategic importance for international trade due to its closeness to three continents and control of the Suez Canal. Massive expenditures have been made to upgrade the infrastructure, with a focus on the logistics and transportation industry in particular. Over the past few years, the Egyptian logistics and warehousing market has shown consistent expansion. The development of the Suez Canal, continuous infrastructure investment, FDI attraction, and the government's emphasis on export promotion are the key drivers of the rise. Since the political crisis, the logistics industry has seen significant growth. Due to increased ease of doing business in the nation and the return of trade volumes to pre-crisis levels, the market is currently highly competitive with both domestic and foreign firms. International freight services have also been launched by domestic businesses. International businesses are making significant investments in seaports and airports and establishing logistics hubs there. It is anticipated that e-commerce organisations would switch from using captive logistics to 3PL firms as the e-commerce sector expands. International firms will begin purchasing domestic firms in order to increase their market share and consolidate the industry.

Impact of COVID-19 on the Egypt Logistics and Warehousing Market

The COVID-19 epidemic has had a direct impact on logistics companies, which are involved in the flow, storage, and transfer of commodities. Logistics companies enable trade and commerce and assist companies in getting their products to clients as an essential component of value chains both domestically and beyond international borders. The market for logistics and warehousing will benefit from increased industrial activity, rising foreign investment, efforts to expand exports, and the inflow of foreign businesses into Egypt. The vast infrastructure projects the government has been working on, particularly with relation to the transportation infrastructure, have been a big contributor to the market's continuous expansion. Real-time tracking, WMS, warehouse automation, and the usage of drones for delivery are upcoming innovations in the logistics sector. The logistics market will expand significantly as a result of rising overseas commerce and investment as well as technological advancements.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Business Model, By Type of Storage, By Contract Type, By End User, By Courier, Express and Parcel Market, By Delivery Time, By Mode of Payment, By Location of Orders, By Third Party Logistics |

| Regions covered | The Eastern Egypt, The Nile valley and delta, The Sinai Peninsula, The Western Egypt |

| Companies Covered | Agility, Aramex, Customs Storage Company (CSC), DB Schenker, DHL, DSV Panalpina, Egypt Post, Expeditors, FedEx-TNT, Kuehne, Logistica, Nacita, Nagel, OCL Egypt, UPS |

Egypt Logistics and Warehousing Market Segmentation:

1. By Business Model:

- B2B

- B2C

- C2C

- Cold Storage

- ICD/CFS

- Industrial/Retail

2. By Type of Storage:

- Closed Normal

- Cold Storage

- Open Yard

- Temperature Controlled

3. By Contract Type:

4. By End User:

- Automotive

- Consumer and Retail

- Food and Beverages

- Healthcare

- Others

5. By Courier, Express and Parcel Market:

- International and Domestic CEP (Revenue)

- International CEP

- Domestic CEP

- Air and Ground CEP (Revenue)

- Air CEP

- Ground CEP

6. By Delivery Time:

- 2 Day Delivery

- Day Delivery

- More Than 3 Day Delivery

7. By Mode of Payment:

- Cash on Delivery

- Online Payment

8. By Location of Orders:

9. By Third Party Logistics:

- Freight Forwarding

- Warehousing

10. By Region:

- The Eastern Egypt

- The Nile valley and delta

- The Sinai Peninsula

- The Western Egypt

Key Topics Covered in the Report:

- Size of Egypt Logistics and Warehousing Market (FY’2019-FY’2032)

- Overview of Egypt Logistics and Warehousing Market

- Segmentation of Egypt Logistics and Warehousing Market By Business Model (B2B, B2C, C2C, Cold Storage, ICD/CFS, Industrial/Retail)

- Segmentation of Egypt Logistics and Warehousing Market By Type of Storage (Closed Normal, Cold Storage, Open Yard, Temperature Controlled)

- Segmentation of Egypt Logistics and Warehousing Market By Contract Type (Contract, Integrated)

- Segmentation of Egypt Logistics and Warehousing Market By End User (Automotive, Consumer and Retail, Food and Beverages, Healthcare, Others)

- Segmentation of Egypt Logistics and Warehousing Market By Courier, Express and Parcel Market (International and Domestic CEP, Air and Ground CEP)

- Segmentation of Egypt Logistics and Warehousing Market By Delivery Time (2 Day Delivery, 3 Day Delivery, More Than 3 Day Delivery)

- Segmentation of Egypt Logistics and Warehousing Market By Mode of Payment (Cash on Delivery, Online Payment)

- Segmentation of Egypt Logistics and Warehousing Market By Location of Orders (Intra City, Inter City)

- Segmentation of Egypt Logistics and Warehousing Market By Third Party Logistics (Freight Forwarding, Warehousing)

- Statistical Snap of Egypt Logistics and Warehousing Market

- Growth Analysis of Egypt Logistics and Warehousing Market

- Problems and Challenges in Egypt Logistics and Warehousing Market

- Competitive Landscape in the Egypt Logistics and Warehousing Market

- Impact of COVID-19 and Demonetization on Egypt Logistics and Warehousing Market

- Details on Recent Investment in Egypt Logistics and Warehousing Market

- Competitive Analysis of Egypt Logistics and Warehousing Market

- Major Players in the Egypt Logistics and Warehousing Market

- SWOT Analysis of Egypt Logistics and Warehousing Market

- Egypt Logistics and Warehousing Market Future Outlook and Projections (FY’2019-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the Egypt Logistics and Warehousing Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4.Heat map analysis

6. Competitive Landscape

6.1. Egypt Logistics and Warehousing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Egypt Logistics and Warehousing Market

7. Egypt Logistics and Warehousing Market, By Business Model, 2019-2032 (USD Million)

7.1. B2B

7.2. B2C

7.3. C2C

7.4. Cold Storage

7.5. ICD/CFS

7.6. Industrial/Retail

8. Egypt Logistics and Warehousing Market, By Type of Storage, 2019-2032 (USD Million)

8.1. Closed Normal

8.2. Cold Storage

8.3. Open Yard

8.4. Temperature Controlled

9. Egypt Logistics and Warehousing Market, By Contract Type, 2019-2032 (USD Million)

9.1. Contract

9.2. Integrated

10. Egypt Logistics and Warehousing Market, By End User, 2019-2032 (USD Million)

10.1. Automotive

10.2. Consumer and Retail

10.3. Food and Beverages

10.4. Healthcare

10.5. Others

11. Egypt Logistics and Warehousing Market, By Courier, Express and Parcel Market, 2019-2032 (USD Million)

11.1. International and Domestic CEP (Revenue)

11.1.1. International CEP

11.1.2. Domestic CEP

11.2. Air and Ground CEP (Revenue)

11.2.1. Air CEP

11.2.2. Ground CEP

12. Egypt Logistics and Warehousing Market, By Delivery Time, 2019-2032 (USD Million)

12.1. 2 Day Delivery

12.2. 3 Day Delivery

12.3. More Than 3 Day Delivery

13. Egypt Logistics and Warehousing Market, By Mode of Payment, 2019-2032 (USD Million)

13.1. Cash on Delivery

13.2. Online Payment

14. Egypt Logistics and Warehousing Market, By Location of Orders, 2019-2032 (USD Million)

14.1. Intra City

14.2. Inter City

15. Egypt Logistics and Warehousing Market, By Third Party Logistics, 2019-2032 (USD Million)

15.1. Freight Forwarding

15.2. Warehousing

16. Egypt Logistics and Warehousing Market, By Region, 2019-2032 (USD Million)

16.1. Egypt Logistics and Warehousing Size and Market Share by Region (2019-2025)

16.2. Egypt Logistics and Warehousing Size and Market Share by Region (2026-2032)

16.3. The Eastern Egypt

16.4. The Nile valley and delta

16.5. The Sinai Peninsula

16.6. The Western Egypt

17. Company Profiles

17.1. Agility

17.1.1. Company details

17.1.2. Financial outlook

17.1.3. Product summary

17.1.4. Recent developments

17.2. Aramex

17.2.1. Company details

17.2.2. Financial outlook

17.2.3. Product summary

17.2.4. Recent developments

17.3. Customs Storage Company (CSC)

17.3.1. Company details

17.3.2. Financial outlook

17.3.3. Product summary

17.3.4. Recent developments

17.4. DB Schenker

17.4.1. Company details

17.4.2. Financial outlook

17.4.3. Product summary

17.4.4. Recent developments

17.5. DHL

17.5.1. Company details

17.5.2. Financial outlook

17.5.3. Product summary

17.5.4. Recent developments

17.6. DSV Panalpina

17.6.1. Company details

17.6.2. Financial outlook

17.6.3. Product summary

17.6.4. Recent developments

17.7. Egypt Post

17.7.1. Company details

17.7.2. Financial outlook

17.7.3. Product summary

17.7.4. Recent developments

17.8. Expeditors

17.8.1. Company details

17.8.2. Financial outlook

17.8.3. Product summary

17.8.4. Recent developments

17.9. FedEx-TNT

17.9.1. Company details

17.9.2. Financial outlook

17.9.3. Product summary

17.9.4. Recent developments

17.10. Kuehne

17.10.1. Company details

17.10.2. Financial outlook

17.10.3. Product summary

17.10.4. Recent developments

17.11. Logistica

17.11.1. Company details

17.11.2. Financial outlook

17.11.3. Product summary

17.11.4. Recent developments

17.12. Nacita

17.12.1. Company details

17.12.2. Financial outlook

17.12.3. Product summary

17.12.4. Recent developments

17.13. Nagel

17.13.1. Company details

17.13.2. Financial outlook

17.13.3. Product summary

17.13.4. Recent developments

17.14. OCL Egypt

17.14.1. Company details

17.14.2. Financial outlook

17.14.3. Product summary

17.14.4. Recent developments

17.15. UPS

17.15.1. Company details

17.15.2. Financial outlook

17.15.3. Product summary

17.15.4. Recent developments

18. List of Abbreviations

19. Reference Links

20. Conclusion

21. Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.