Electric Light Commercial Vehicle Market Introduction and Overview

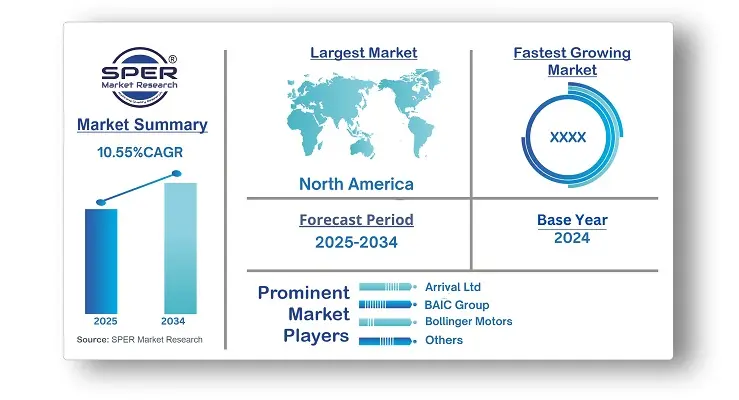

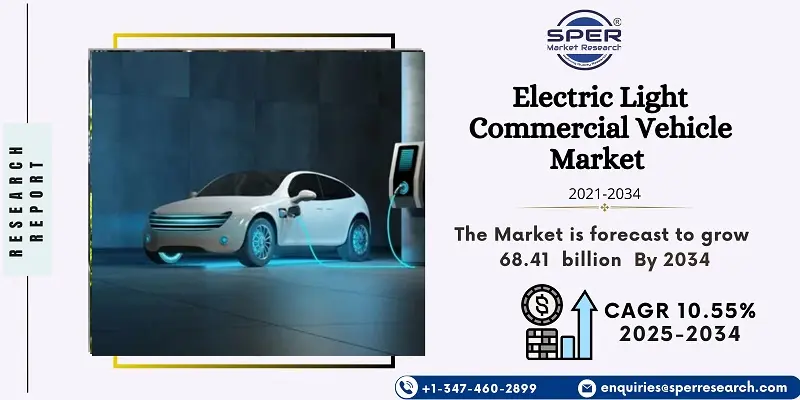

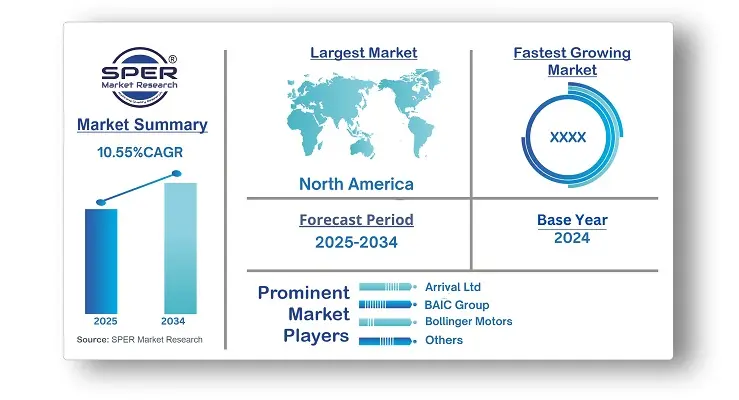

According to SPER Market Research, the Global Electric Light Commercial Vehicle Market is estimated to reach USD 68.41 billion by 2034 with a CAGR of 10.55%.

The report includes an in-depth analysis of the Global Electric Light Commercial Vehicle Market, including market size and trends, product mix, Applications, and supplier analysis. Electric Light Commercial Vehicle Market size was valued at USD 25.09 billion in 2024 and is estimated to register a CAGR of over 10.55% between 2025 and 2034. Electric light commercial vehicles are becoming more and more popular due to the need to reduce carbon emissions and growing environmental consciousness. Businesses and governments face pressure to address climate change, leading to scrutiny of transportation-related emissions. Electric vehicles emit zero tailpipe emissions, helping to reduce the carbon footprint. As a result, businesses align with environmental regulations by choosing electric light commercial vehicles to show their commitment to sustainability.

- In April 2024, B-ON and Chery Group formed a joint venture to launch a new Pelkan electric light commercial vehicle in mainland Europe by mid-year. B-ON will use its sales and aftersales network, while Chery will provide engineering and manufacturing support.

- In December 2023, Mahindra & Mahindra (M&M) planned to launch its electric four-wheeler commercial vehicles in 2025, broadening its range of electric three-wheeler cargo vehicles. The company intends to enter the competitive market and focus on cleaner technologies like CNG and electrification, especially for Light Commercial Vehicles (LCVs) under 3. 5 tons.

By Vehicle InsightsThe market is divided into three vehicle categories: light-duty vehicles, vans, and pickup trucks. The pickup vehicle segment held the biggest market share in 2024. The introduction of high-performance pickup trucks is accelerating growth in the electric light commercial vehicle market's pickup truck category. These vehicles combine the functionality and versatility of typical pickup trucks with the environmental benefits of electric propulsion. With strong performance characteristics such as power, torque, and towing capacity, they appeal to customers looking for both functionality and sustainability.

By Application Insights

Based on application, the electric LCV market is categorized into commercial and industrial. The commercial segment accounted for the largest market share in 2024. Stringent emissions regulations and sustainability goals are key drivers for adopting electric light commercial vehicles in commercial uses. Governments are enforcing strict emissions standards and providing incentives to encourage cleaner transportation. Corporate sustainability efforts also lead businesses to seek eco-friendly solutions, making electric vehicles appealing for reducing carbon footprints and meeting regulations.

Regional Insights

In 2024, Asia Pacific held the greatest market share for electric light commercial vehicles worldwide. The Asia Pacific region's growing need for last-mile delivery services has been fuelled by the exponential rise of e-commerce platforms and the associated spike in online purchasing. The demand for effective and quick delivery solutions has increased as more and more customers choose the ease of online buying.

In order to guarantee timely delivery to clients' doorsteps, last-mile delivery—the last segment of the supply chain—is essential. In order to handle crowded urban areas and satisfy the rising demand for quick and environmentally friendly delivery services, companies are investing in electric light commercial vehicles.

Market Competitive Landscape

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Vehicle, By Propulsion, By GVW, By Application |

| Regions covered | Arrival Ltd, BAIC Group, Bollinger Motors, BYD Motors Inc, Dongfeng Motor Corporation, Ford |

| Companies Covered | Arrival Ltd, BAIC Group, Bollinger Motors, BYD Motors Inc, Dongfeng Motor Corporation, Ford Motor Company, Fuso, General Motors Company, Groupe Renault, Maxus (SAIC Motor Corporation), Mercedes-Benz, Nissan Motor Company Ltd, Rivian Automotive LLC, Stellantis N.V.

|

Key Topics Covered in the Report

Global Electric Light Commercial Vehicle Market Size (FY’2021-FY’2034)

Overview of Global Electric Light Commercial Vehicle Market

Segmentation of Global Electric Light Commercial Vehicle Market By Vehicle (Light-duty Trucks, Vans, Pickup Trucks)

Segmentation of Global Electric Light Commercial Vehicle Market By Propulsion (BEV, FCEV, HEV, PHEV)

Segmentation of Global Electric Light Commercial Vehicle Market By GVW (Below 6,000 lbs, 6,001 lbs- 10,000 lbs, 10,001 lbs - 14,000 lbs)

Segmentation of Global Electric Light Commercial Vehicle Market By Application (Commercial, Industrial)

Statistical Snap of Global Electric Light Commercial Vehicle Market

Expansion Analysis of Global Electric Light Commercial Vehicle Market

Problems and Obstacles in Global Electric Light Commercial Vehicle Market

Competitive Landscape in the Global Electric Light Commercial Vehicle Market

Details on Current Investment in Global Electric Light Commercial Vehicle Market

Competitive Analysis of Global Electric Light Commercial Vehicle Market

Prominent Players in the Global Electric Light Commercial Vehicle Market

SWOT Analysis of Global Electric Light Commercial Vehicle Market

Global Electric Light Commercial Vehicle Market Future Outlook and Projections (FY’2025-FY’2034)

Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Electric Light Commercial Vehicle Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Electric Light Commercial Vehicle Market

7. Global Electric Light Commercial Vehicle Market, By Vehicle (USD Million) 2021-2034

7.1. Light-duty trucks

7.2. Vans

7.3. Pickup trucks

8. Global Electric Light Commercial Vehicle Market, By Propulsion (USD Million) 2021-2034

8.1. BEV

8.2. FCEV

8.3. HEVs

8.4. PHEVs

9. Global Electric Light Commercial Vehicle Market, By GVW (USD Million) 2021-2034

9.1. Below 6,000 lbs

9.2. 6,001 lbs- 10,000 lbs

9.3. 10,001 lbs - 14,000 lbs

10. Global Electric Light Commercial Vehicle Market, By Application (USD Million) 2021-2034

10.1. Commercial

10.2. Industrial

11. Global Electric Light Commercial Vehicle Market Forecast, 2021-2034 (USD Million)

11.1. Global Electric Light Commercial Vehicle Market Size and Market Share

12. Global Electric Light Commercial Vehicle Market, By Region, 2021-2034 (USD Million)

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Arrival Ltd

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. BAIC Group

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

1.3. Bollinger Motors

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. BYD Motors Inc

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Dongfeng Motor Corporation

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Ford Motor Company

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Fuso

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. General Motors Company

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Groupe Renault

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Maxus (SAIC Motor Corporation)

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Mercedes-Benz

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Nissan Motor Company Ltd

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Rivian Automotive LLC

13.13.1. Company details

13.13.2. Financial outlook

13.13.3. Product summary

13.13.4. Recent developments

13.14. Stellantis N.V

13.14.1. Company details

13.14.2. Financial outlook

13.14.3. Product summary

13.14.4. Recent developments

13.15. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links