Electroencephalography Devices Market Introduction and Overview

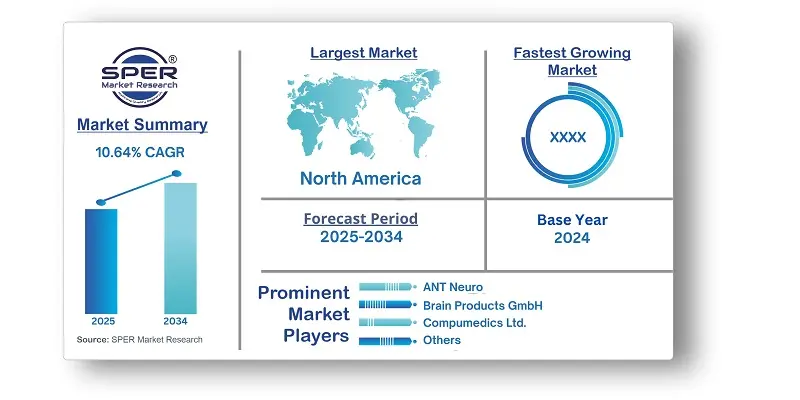

According to SPER Market Research, the Global Electroencephalography Devices Market is estimated to reach USD 3.68 billion by 2034 with a CAGR of 10.64%.

The report includes an in-depth analysis of the Global Electroencephalography Devices Market, including market size and trends, product mix, Applications, and supplier analysis. The global Electroencephalography (EEG) Devices Market is driven by the rising prevalence of neurological disorders such as epilepsy, Alzheimer's disease, and sleep disorders. Increasing demand for non-invasive brain monitoring, advancements in wearable EEG technology, and growing adoption in research and clinical applications further boost market growth. However, challenges such as high device costs, limited accessibility in developing regions, and data interpretation complexities hinder adoption. Additionally, concerns over signal accuracy and standardization issues pose obstacles. Despite these challenges, technological innovations and expanding healthcare infrastructure continue to drive market expansion globally.

By Type Insights

In 2024, the largest share was held by the standalone devices segment. Due to their mobility and ease of use, these devices can function independently without the need for further hardware or connections, making them appropriate for a variety of environments, such as clinics, hospitals, and research labs. Individual EEG devices are becoming more and more popular due to the growing need for remote patient monitoring and point-of-care diagnostics. Furthermore, the market is being driven by technological breakthroughs that have enhanced its performance and dependability.

By Application Insights

In 2024, the segment with the biggest share was disease diagnosis. In order to diagnose a number of neurological conditions, including epilepsy, Alzheimer's disease, and Parkinson's disease, EEG equipment are essential. For example, the number of people with Parkinson's disease has increased from 3 million to over 6 million in the last 25 years, according to the University of Florida Health in February 2024. Through 2040, it is expected to double again. The need for EEG equipment for disease diagnosis is anticipated to be driven by the increasing frequency of these conditions and the growing understanding of the value of early diagnosis.

By Product Insights

In 2024 the 32-channel EEG sector held the biggest market share. Its expansion can be ascribed to the device's improved spatial resolution and diagnostic capabilities. The need for EEG devices with additional channel capacity is growing as medical professionals look for more thorough understandings of brain activity. In February 2024, for example, Neurotechnology's improved BrainAccess EEG products demonstrated new 32-channel technology, additional software features, and improved headgear.

By Regional Insights

North American market for electroencephalography devices led the global market. Improved insurance coverage and rising rates of sleep and neurodegenerative diseases are important factors propelling regional growth. Furthermore, growth is anticipated to be supported by strong distribution networks of top vendors and cutting-edge healthcare infrastructure. The use of these devices for diagnosing neurological disorders has increased in the United States due to favorable payment regulations. The dominance of the regional market has also been strengthened by government agencies that fund research and development in illnesses of the brain and nervous system, such as the National Institute of Neurological illnesses and Stroke (NINDS).

Market Competitive Landscape

The market for electroencephalography devices is extremely competitive, with major competitors including Cadwell Industries, Inc., Electrical Geodesics, Inc., and Medtronic having prominent positions. Some of the key market players are ANT Neuro, Brain Products GmbH, Compumedics Ltd., Electrical Geodesics, Inc., Lifelines Neuro, Medtronic, Micromed, Mitsar, Natus Medical, Inc., Neurosoft, Nihon Kohden America, Inc.

Recent Developments:

In January 2024, In order to use EEG biomarkers in its Phase II research for Major Depressive Disorder (MDD), Gate partnered with Beacon. Participants in the research are anticipated to undergo exploratory EEG and sleep assessments using Beacon's Dreem 3S headband device. The Phase II study of Gate's zelquistine is planned to start in the middle of 2024 with the goal of improving knowledge and possible therapies for MDD.

In Janurary 2024, Brain Scientific sold its EEG brain monitoring equipment and technologies to Aditxt, a U.S. biotechnology business. The purchase included a portfolio of 16 patents, including a portable NeuroEEG and a disposable NeuroCap.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type,By Application, By Product |

| Regions covered | North America, LatinAmerica, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ANT Neuro, Brain Products GmbH,Compumedics Ltd., Electrical Geodesics, Inc., Lifelines Neuro, Medtronic,Micromed, Mitsar, Natus Medical, Inc., Neurosoft, Nihon Kohden America, Inc. |

Key Topics Covered in the Report

- Global Electroencephalography Devices Market Size (FY’2021-FY’2034)

- Overview of Global Electroencephalography Devices Market

- Segmentation of Global Electroencephalography Devices Market By Type (Portable, Standalone)

- Segmentation of Global Electroencephalography Devices Market By Application (Trauma & Surgery, Disease Diagnosis)

- Segmentation of Global Electroencephalography Devices Market By Product (32-Channel, Multichannel)

- Statistical Snap of Global Electroencephalography Devices Market

- Expansion Analysis of Global Electroencephalography Devices Market

- Problems and Obstacles in Global Electroencephalography Devices Market

- Competitive Landscape in the Global Electroencephalography Devices Market

- Details on Current Investment in Global Electroencephalography Devices Market

- Competitive Analysis of Global Electroencephalography Devices Market

- Prominent Players in the Global Electroencephalography Devices Market

- SWOT Analysis of Global Electroencephalography Devices Market

- Global Electroencephalography Devices Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Electroencephalography Devices Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Electroencephalography Devices Market

7. Global Electroencephalography Devices Market, By Type 2021-2034 (USD Million)

7.1. Standalone Devices

7.2. Portable Devices

7.3. Wearable Devices

8. Global Electroencephalography Devices Market, By Application 2021-2034 (USD Million)

8.1. Trauma & Surgery

8.2. Disease Diagnosis

8.3. Anesthesia Monitoring

8.4. Sleep Monitoring

8.5. Others

9. Global Electroencephalography Devices Market, By Product 2021-2034 (USD Million)

9.1. 8-channel EEG

9.2. 21-channel EEG

9.3. 25-channel EEG

9.4. 32-channel EEG

9.5. 40-channel EEG

9.6. Multichannel EEG

10. Global Electroencephalography Devices Market, 2021-2034 (USD Million)

10.1. Global Electroencephalography Devices Market Size and Market Share

11. Global Electroencephalography Devices Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ANT Neuro

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Brain Products GmbH

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Compumedics Ltd.

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Electrical Geodesics, Inc.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Lifelines Neuro

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Medtronic

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Micromed

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Mitsar

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Natus Medical, Inc.

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Neurosoft

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Nihon Kohden America, Inc.

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.