Endoscopic Vessel Harvesting Systems Market Introduction and Overview

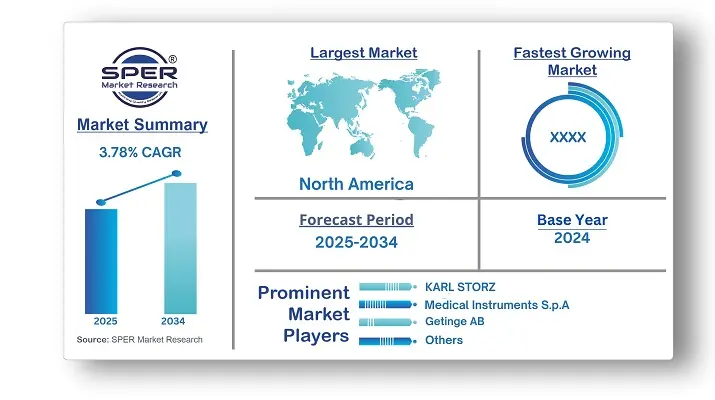

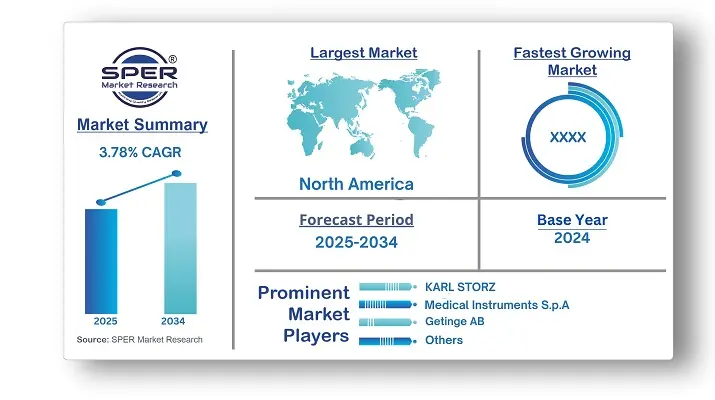

According to SPER Market Research, the Global Endoscopic Vessel Harvesting Systems Market is estimated to reach USD 230.26 million by 2034 with a CAGR of 3.78%.

The report includes an in-depth analysis of the Global Endoscopic Vessel Harvesting Systems Market, including market size and trends, product mix, Applications, and supplier analysis. The rising global incidence of cardiovascular diseases like peripheral and coronary artery disease, combined with a growing preference for less invasive vein harvesting techniques due to their advantages over traditional methods, is a significant trend. This is further amplified by the increasing global geriatric population. However, The Endoscopic Vessel Harvesting Systems market faces challenges such as high equipment and procedural costs, along with limited reimbursement policies. Additionally, the need for specialized training and a steep learning curve hinders widespread adoption, especially in low-resource settings.

By Product: In 2024, the disposable segment held the largest share of the market, driven by its ability to reduce cross-contamination and infection risks, aligning with increasing awareness and stricter regulations around hospital-acquired infections. These single-use solutions ensure sterility for each procedure, enhancing patient safety and regulatory compliance. They also streamline hospital workflows by eliminating the need for complex and costly sterilization processes linked to reusable tools. Meanwhile, the reusable segment is expected to witness the fastest growth, fueled by the benefits of minimally invasive techniques, better patient outcomes, and overall cost-efficiency.

By Application: The coronary artery disease (CAD) segment led the market in 2024, driven by the growing need for accurate and efficient diagnosis and monitoring of CAD patients. These devices support healthcare providers in evaluating heart function, diagnosing the condition, and formulating effective treatment strategies. Utilizing technologies such as electrocardiograms, echocardiograms, stress tests, chest X-rays, and coronary angiography, CAD devices allow clinicians to analyze the heart’s electrical activity.

By Regional Insights:

North America led the global endoscopic vessel harvesting system market, driven by its substantial healthcare infrastructure and robust industry growth. The region's dominance is supported by the high prevalence of chronic diseases, rapid adoption of advanced medical technologies, and an aging population. For example, stroke remains a major health concern in the U.S., with ischemic strokes making up the vast majority of cases. Meanwhile, the Asia Pacific region is projected to experience the fastest market growth, fueled by lifestyle-related factors such as poor diet and reduced physical activity, which are increasing the incidence of cardiovascular conditions.

Market Competitive Landscape:

The Endoscopic Vessel Harvesting Systems Market has a moderate level of consolidation. Key players include MAQUET Holding B.V. & Co. KG, CARDIO MEDICAL GmbH, Terumo Cardiovascular Group, Med Europe S.r.l. (Elite Life Care), LivaNova plc. (Sorin and Cyberonics), , Saphena Medical, KARL STORZ, Medical Instruments S.p.A, Saphena Medical, Inc., Getinge AB, Olympus Corporation.

Recent Developments:

Getinge AB hosted a Vessel Harvesting (EVH) Summit in Singapore in May 2024. The event included panel discussions where four clinicians shared their experiences and insights on Endoscopic Vessel Harvesting (EVH), addressing surgical ergonomics, patient factors, emergency procedures, technical details, and general recommendations.

In December 2023, the Innovative Health Initiative awarded a grant of around USD 7.28 million (Euro 6.5 million) to COMBINE-CT, a public-private partnership, to support advancements in the diagnosis and treatment of coronary artery disease. This funding will support the development of innovative solutions designed to enhance the precision and effectiveness of diagnosing the condition, while also expanding and improving available treatment options for patients.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | MAQUET Holding B.V. & Co. KG, CARDIO MEDICAL GmbH, Terumo Cardiovascular Group, Med Europe S.r.l. (Elite Life Care), LivaNova plc. (Sorin and Cyberonics), , Saphena Medical, KARL STORZ, Medical Instruments S.p.A, Saphena Medical, Inc., Getinge AB, Olympus Corporation.

|

Key Topics Covered in the Report

- Global Endoscopic Vessel Harvesting Systems Market Size (FY’2021-FY’2034)

- Overview of Global Endoscopic Vessel Harvesting Systems Market

- Segmentation of Global Endoscopic Vessel Harvesting Systems Market By Product (Disposable, Re-usable)

- Segmentation of Global Endoscopic Vessel Harvesting Systems Market By Application {(Coronary Artery Disease (CAD), Peripheral Artery Disease (PAD)}

- Statistical Snap of Global Endoscopic Vessel Harvesting Systems Market

- Expansion Analysis of Global Endoscopic Vessel Harvesting Systems Market

- Problems and Obstacles in Global Endoscopic Vessel Harvesting Systems Market

- Competitive Landscape in the Global Endoscopic Vessel Harvesting Systems Market

- Details on Current Investment in Global Endoscopic Vessel Harvesting Systems Market

- Competitive Analysis of Global Endoscopic Vessel Harvesting Systems Market

- Prominent Players in the Global Endoscopic Vessel Harvesting Systems Market

- SWOT Analysis of Global Endoscopic Vessel Harvesting Systems Market

- Global Endoscopic Vessel Harvesting Systems Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Endoscopic Vessel Harvesting Systems Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Endoscopic Vessel Harvesting Systems Market

7. Global Endoscopic Vessel Harvesting Systems Market, By Product, (USD Million) 2021-2034

7.1. Disposable

7.2. Re-usable

8. Global Endoscopic Vessel Harvesting Systems Market, By Application, (USD Million) 2021-2034

8.1. Coronary Artery Disease (CAD)

8.2. Peripheral Artery Disease (PAD)

9. Global Endoscopic Vessel Harvesting Systems Market, (USD Million) 2021-2034

9.1. Global Endoscopic Vessel Harvesting Systems Market Size and Market Share

10. Global Endoscopic Vessel Harvesting Systems Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. MAQUET Holding B.V. & Co. KG

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. CARDIO MEDICAL GmbH

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Terumo Cardiovascular Group

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Med Europe S.r.l. (Elite Life Care)

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. LivaNova plc. (Sorin and Cyberonics)

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Saphena Medical, Inc.

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Getinge AB

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Olympus Corporation

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Saphena Medical

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. KARL STORZ

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Medical Instruments S.p.a

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links