Voltage Regulator Market Introduction and Overview

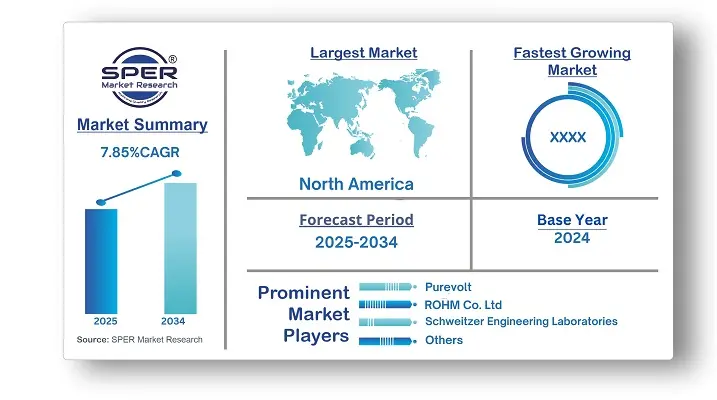

According to SPER Market Research, the Europe Voltage Regulator Market is estimated to reach USD 1632.42 million by 2034 with a CAGR of 7.85%.

The report includes an in-depth analysis of the Europe Voltage Regulator Market, including market size and trends, product mix, Applications, and supplier analysis. The European voltage regulator market was valued at USD 766.71 million in 2024 and is expected to increase at a compound annual growth rate (CAGR) of about 7.85% from 2025 to 2034. The market for voltage regulators will be supported by the rising adoption rate of electric vehicles and the complexity of automotive electronics. The industry's demand curve will be shaped in part by the population's ongoing growth and the speed at which cities are becoming more populated. Additionally, the industry's potential will be accelerated by the growing trend towards sustainability and environmental consciousness, which is shown in the increased usage of renewable energy.

By Product Insights

In 2024, the market was dominated by linear voltage regulators. These systems' efficiency and performance advantages, especially in battery-operated devices and Internet of Things applications, are the reasons for their growing popularity. The industry landscape will benefit from rising consumer emphasis on energy efficiency in tandem with rising living standards. A reliable electrical infrastructure is required due to the growing use of industrial automation and robotics in manufacturing and other industries, which improves business opportunities.

By Phase Insights

The market for single phase voltage regulators is expected to develop at a steady pace until 2034. These voltage regulators ensure that electronic equipment runs effectively and safely by reducing the risks related to voltage fluctuations. Additionally, the business is rising as a result of the increasing focus on home automation systems and the continual progress of smart home technologies.

Regional Insights

In 2024, the market for voltage regulators was dominated by France. The industry landscape is set to be improved by the robust growth of the digital economy and the ongoing expansion of data IT infrastructure. Additionally, a favourable business environment will be created by stringent government rules and regulations intended to improve the standard and dependability of power provision.

Market Competitive Landscape

Siemens is a well-known industry leader in providing reliable and inventive solutions for a variety of industries. With a long history, the company is well-known for its high-quality products and innovative innovations. Siemens provides a diverse range of offerings, including industrial equipment, automation systems, and energy solutions.

Recent Developments:

Eaton announced in March 2023 the development of its Vehicle Group's customisable low-voltage electrical components to meet the growing power and control demands of off-highway applications like as construction and agricultural. These tough products demonstrate Eaton's dedication to addressing shifting industry requirements and electrification trends.

Toshiba Electronic Devices & Storage Corporation introduced the TCR1HF series of regulators in May 2023. These regulators offer high voltage capability, a wide input voltage range, and low stand-by current consumption. They support input voltages from 4V to 36V and are suitable for various applications, including USB PD. Toshiba aims to expand the TCR1HF series to meet different application requirements.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Voltage, By Product, By Phase, By Application |

| Regions covered | France, Germany, Italy, Spain, United Kingdom, Rest of Europe |

| Companies Covered | ABB, Analog Devices, Eaton, General Electric, Infineon Technologies AG, J. Schneider Elektrotechnik GmbH, Legrand, Microchip Technology Inc, Purevolt, Renesas Electronics Corporation, ROHM Co. Ltd, Schweitzer Engineering Laboratories, Inc.

|

Key Topics Covered in the Report

- Europe Voltage Regulator Market Size (FY’2021-FY’2034)

- Overview of Europe Voltage Regulator Market

- Segmentation of Europe Voltage Regulator Market By Voltage (≤ 40 kVA, > 40 kVA to 250 kVA, > 250 kVA)

- Segmentation of Europe Voltage Regulator Market By Product (Linear, Switching)

- Segmentation of Europe Voltage Regulator Market By Phase (Single Phase, Three Phase)

- Segmentation of Europe Voltage Regulator Market By Application (Residential, Commercial, Industrial)

- Statistical Snap of Europe Voltage Regulator Market

- Expansion Analysis of Europe Voltage Regulator Market

- Problems and Obstacles in Europe Voltage Regulator Market

- Competitive Landscape in the Europe Voltage Regulator Market

- Details on Current Investment in Europe Voltage Regulator Market

- Competitive Analysis of Europe Voltage Regulator Market

- Prominent Players in the Europe Voltage Regulator Market

- SWOT Analysis of Europe Voltage Regulator Market

- Europe Voltage Regulator Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Europe Voltage Regulator Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Europe Voltage Regulator Market

7. Europe Voltage Regulator Market, By Voltage (USD Million) 2021-2034

7.1. ≤ 40 kVA

7.2. > 40 kVA to 250 kVA

7.3. > 250 kVA

8. Europe Voltage Regulator Market, By Product (USD Million) 2021-2034

8.1. Linear

8.2. Switching

9. Europe Voltage Regulator Market, By Phase (USD Million) 2021-2034

9.1. Single Phase

9.2. Three Phase

10. Europe Voltage Regulator Market, By Application (USD Million) 2021-2034

10.1. Residential

10.2. Commercial

10.3. Industrial

11. Europe Voltage Regulator Market, (USD Million) 2021-2034

11.1. Europe Voltage Regulator Market Size and Market Share

12. Europe Voltage Regulator Market, By Region, (USD Million) 2021-2034

12.1. France

12.2. Germany

12.3. Italy

12.4. Spain

12.5. United Kingdom

12.6. Rest of Europe

13. Company Profile

13.1. ABB

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Analog Devices

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Eaton

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. General Electric

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Infineon Technologies AG

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. J. Schneider Elektrotechnik GmbH

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Legrand

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Microchip Technology Inc

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Purevolt

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Renesas Electronics Corporation

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. ROHM Co. Ltd

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Schweitzer Engineering Laboratories, Inc

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links