Food Certification Market Introduction and Overview

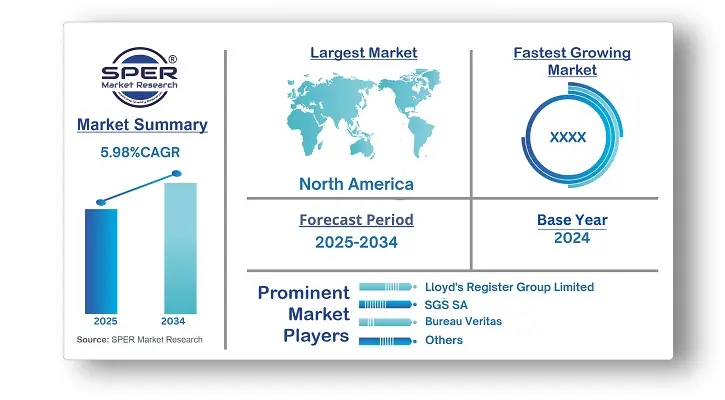

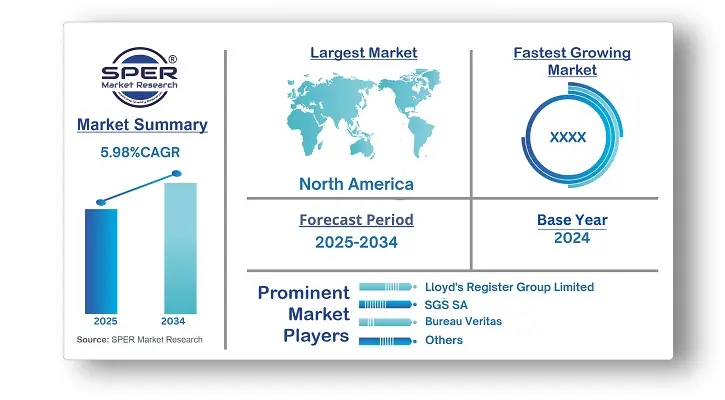

According to SPER Market Research, the Global Food Certification Market is estimated to reach USD 10.32 billion by 2034 with a CAGR of 5.98%.

The report includes an in-depth analysis of the Global Food Certification Market, including market size and trends, product mix, Applications, and supplier analysis. Rising consumer awareness of food safety, quality, and sustainability is driving growth in the food certification business. Organic labelling, ISO, and HACCP certifications, among others, guarantee adherence to strict food safety laws and boost consumer confidence in brands. Market growth is also fuelled by the rising demand for clean-label, organic, and non-GMO products. Cross-border compliance also requires uniform certificates due to the globalization of the food sector. High certification fees, intricate regulatory structures, and drawn-out approval procedures, however, provide difficulties for companies, particularly small-scale manufacturers. Additionally impeding industry expansion are fraudulent certificates and a lack of customer awareness in underdeveloped nations. Block chain technology and artificial intelligence (AI)-powered traceability solutions present encouraging prospects in spite of these obstacles.

By Type Insights

Food Certification is classified into four categories based on Type: ISO 22000 - Food Safety Management System, BRCGS, Halal Certification, GMP+/FSA. The food certification market was dominated by the ISO 22000 category. Improved food safety, which lowers the danger of infection, is one of the many advantages of obtaining ISO 22000 food certification. Additionally, it reassures other consumers and stakeholders about the safety of food.

By End User Industry Insights

The market for Food Certification is divided based on End User Industry, including Meat, Poultry, and Seafood Products, Dairy Products, Infant Food, Beverages, Bakery and Confectionery Products. The food certification market was dominated by the dairy product segment. Testing for protein, bacterial count, lipid content, and other criteria is part of the standards for dairy products. Dairy product certification allows consumers to guarantee quality and improves marketing opportunities for producers. During the projection period, the processed and packaged food category is anticipated to expand at a quick pace.

By Regional Insights

The market for food certification was dominated by North America. The region's market is expanding thanks to a number of government initiatives and growing consumer awareness of food safety. Bureau Veritas assists all participants in the food chain in North America with food safety certification and auditing. Food safety certification is also aided by a qualified food safety quality auditor (CFSQA).

Market Competitive Landscape

The market for food certification is very competitive, with a wide range of certifying bodies, auditors, and consultants operating worldwide. Important participants provide a broad range of certification services that address sustainability, quality, and food safety issues. Some of the key market players are Lloyd's Register Group Limited, SGS SA, Underwriters Laboratories Inc., Dekra SE, TÃœV SÃœD AG, Bureau Veritas, AsureQuality Limited, Intertek Group plc, DNV GL Group AS, ALS Limited.

Recent Developments:

In April 2024, Leeds-based entrepreneur Aihtsham Rashid developed Hurayra Pet chow, a new brand of 100% halal-certified pet chow, in response to the dearth of options available on the market.

In February 2024, Giant Food established the CPR certification program for nearby enterprises and associations.

In August 2023, Sattvik Certification presented the Singapore Buddhist Codex for vegetarian and vegan food rules and regulations.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By End User Industry |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Lloyd's Register Group Limited, SGS SA, Underwriters Laboratories Inc., Dekra SE, TÃœV SÃœD AG, Bureau Veritas, AsureQuality Limited, Intertek Group plc, DNV GL Group AS, ALS Limited.

|

Key Topics Covered in the Report

- Global Food Certification Market Size (FY’2021-FY’2034)

- Overview of Global Food Certification Market

- Segmentation of Global Food Certification Market By Type (ISO 22000 - Food Safety Management System, BRCGS, Halal Certification, GMP+/FSA)

- Segmentation of Global Food Certification Market By End User Industry (Meat, Poultry, and Seafood Products, Dairy Products, Infant Food, Beverages, Bakery and Confectionery Products)

- Statistical Snap of Global Food Certification Market

- Expansion Analysis of Global Food Certification Market

- Problems and Obstacles in Global Food Certification Market

- Competitive Landscape in the Global Food Certification Market

- Details on Current Investment in Global Food Certification Market

- Competitive Analysis of Global Food Certification Market

- Prominent Players in the Global Food Certification Market

- SWOT Analysis of Global Food Certification Market

- Global Food Certification Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Food Certification Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Food Certification Market

7. Global Food Certification Market, By Type 2021-2034 (USD Million)

7.1. ISO 22000 - Food Safety Management System

7.2. BRCGS

7.3. Halal Certification

7.4. GMP+/FSA

8. Global Food Certification Market, By End User Industry 2021-2034 (USD Million)

8.1. Meat, Poultry, and Seafood Products

8.2. Dairy Products

8.3. Infant Food

8.4. Beverages

8.5. Bakery and Confectionery Products

9. Global Food Certification Market, 2021-2034 (USD Million)

9.1. Global Food Certification Market Size and Market Share

10. Global Food Certification Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. ALS Limited

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. AsureQuality Limited

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Bureau Veritas

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Dekra SE

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. DNV GL Group AS

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Intertek Group plc.

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Lloyd's Register Group Limited

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. SGS SA

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. TÃœV SÃœD AG

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Underwriters Laboratories Inc.

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.