Functional Safety Market Introduction and Overview

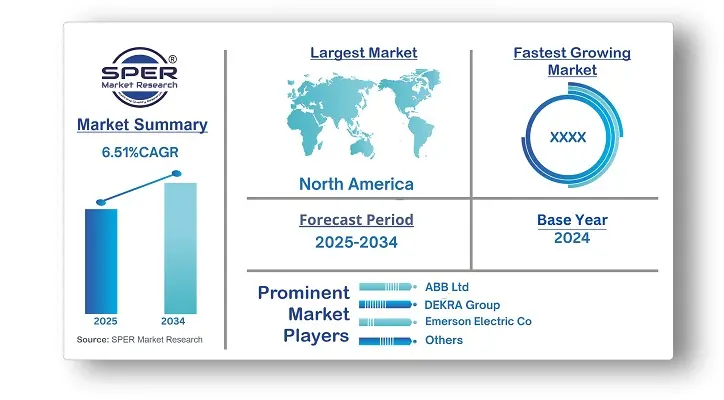

According to SPER Market Research, the Global Functional Safety Market is estimated to reach USD 12.25 billion by 2034 with a CAGR of 6.51%

The report includes an in-depth analysis of the Global Functional Safety Market, including market size and trends, product mix, Applications, and supplier analysis. The market for functional safety is expanding quickly due to stricter safety standards and greater automation in sectors including manufacturing, energy, and automobiles. Strong safety measures are required to avoid system failures and risks as Industry 4.0, IoT, and AI-based systems become more widely used. Additionally, businesses are compelled to invest in functional safety solutions by regulatory requirements like ISO 26262 and IEC 61508. The requirement for qualified specialists, complicated certification procedures, and the high cost of implementation are obstacles, nevertheless. Despite these obstacles, the market is still growing due to improvements in safety technology and a greater emphasis on risk management, which guarantees safe and dependable operations in vital applications.

By Device Insights

Functional Safety is classified into seven categories based on Device: Safety Sensors, Safety Modules, Valves, Programmable Safety Systems, Safety Switches, Actuators and Emergency Stop Devices. The market leader was the safety sensors section. The need for sophisticated safety sensors with real-time monitoring, predictive maintenance, and remote diagnostics capabilities is being driven by the expanding use of IoT and Industry 4.0 technologies. Because industrial operations are becoming more complicated and advanced safety solutions are becoming more and more necessary, the programmable safety systems category is expected to develop at the quickest CAGR.

By Systems Insights

The market for Functional Safety is segmented based on Systems, including Emergency Shutdown Systems, Fire & Gas Monitoring Controls, Turbo machinery Controls Systems, Burner Management Systems, High Integrity Pressure Protection Systems, Distributed Control Systems, Supervisory Control and Data Acquisition Systems. The category with the highest revenue share was Emergency Shutdown Systems (ESD). The ESD segment's adoption is being driven by an increased emphasis on operational safety across sectors. During the forecast period, the turbo machinery controls systems segment is anticipated to have substantial expansion. In many industries, including petrochemicals, power generation, oil and gas, and aerospace, turbo machinery which includes turbines, compressors, and pumps is essential.

By Industry Insights

The market for Functional Safety is divided into many Industry, including Oil & Gas, Power Generation, Chemicals, Food & Beverages, Pharmaceuticals, Automotive, and Railways. The market leader with the biggest revenue share was the oil and gas sector. This is explained by the fact that oil and gas operations are extremely risky. Over the course of the projected period, the automotive segment is anticipated to rise at a quick CAGR. The automobile industry's need for cutting-edge functional safety technology is being driven by the rising demand for connected and driverless cars.

By Regional Insights

North America held the largest market share. The need for sophisticated functional safety solutions that can guarantee safe and dependable operations in complex environments is being driven by the growth of AI and ML applications across sectors. North American businesses are using AI and ML to improve safety procedures, maximize operational effectiveness, and reduce risks in a variety of industries, including manufacturing, automotive, and healthcare.

Market Competitive Landscape

The functional safety market's competitive environment is defined by a blend of well-established and up-and-coming firms that prioritize technical innovation. Businesses are spending more money on research and development in order to provide cutting-edge safety solutions that adhere to strict international safety standards and laws. Some of the key market players are ABB Ltd., DEKRA Group, Emerson Electric Co, Endress+Hauser Management AG, General Electric Company, HIMA Paul Hildebrandt GmbH, Honeywell International Inc., Omron Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, Modelwise, Ascent Labs.

Recent Developments:

In October 2023, Rockwell Automation Inc. indicated intentions to exhibit its most current services, systems, hardware, and industrial software at the Automation Fair 2023, which will take place at the Boston Convention and Exhibition Center. The GuardLogix L85ES controller, the 432ES GuardLink EtherNet/IP Adapter, and the Flex 5000 I/O were among the functional security products on display throughout the event.

In April 2023, The NX-EIP201 EtherNet/IPTM devices and the NX502 automation & programmable safety systems have been released worldwide by OMRON Corporation. Advanced information and safety control are provided by these controllers. When changing production lines, they save lead times and minimize resource disposal losses by utilizing OMRON's advanced information processing and big capacity memory.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Device, By Systems, By Industry |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ABB Ltd., DEKRA Group, Emerson Electric Co, Endress+Hauser Management AG, General Electric Company, HIMA Paul Hildebrandt GmbH, Honeywell International Inc., Omron Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, Modelwise, Ascent Labs. |

Key Topics Covered in the Report

- Global Functional Safety Market Size (FY'2021-FY'2034)

- Overview of Global Functional Safety Market

- Segmentation of Global Functional Safety Market By Device (Safety Sensors, Safety Modules, Valves, Programmable Safety Systems, Safety Switches, Actuators, Emergency Stop Devices)

- Segmentation of Global Functional Safety Market By Systems (Emergency Shutdown Systems, Fire & Gas Monitoring Controls, Turbo machinery Controls Systems, Burner Management Systems, High Integrity Pressure Protection Systems, Distributed Control Systems, Supervisory Control and Data Acquisition Systems)

- Segmentation of Global Functional Safety Market By Industry (Oil & Gas, Power Generation, Chemicals, Food & Beverages, Pharmaceuticals, Automotive, Railways)

- Statistical Snap of Global Functional Safety Market

- Expansion Analysis of Global Functional Safety Market

- Problems and Obstacles in Global Functional Safety Market

- Competitive Landscape in the Global Functional Safety Market

- Details on Current Investment in Global Functional Safety Market

- Competitive Analysis of Global Functional Safety Market

- Prominent Players in the Global Functional Safety Market

- SWOT Analysis of Global Functional Safety Market

- Global Functional Safety Market Future Outlook and Projections (FY'2025-FY'2034)

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Functional Safety Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Functional Safety Market

7. Global Functional Safety Market, By Device 2021-2034 (USD Million)

7.1. Safety Sensors

7.2. Safety Modules

7.3. Valves

7.4. Programmable Safety Systems

7.5. Safety Switches

7.6. Actuators

7.7. Emergency Stop Devices

8. Global Functional Safety Market, By Systems 2021-2034 (USD Million)

8.1. Emergency Shutdown Systems

8.2. Fire & Gas Monitoring Controls

8.3. Turbo machinery Controls Systems

8.4. Burner Management Systems

8.5. High Integrity Pressure Protection Systems

8.6. Distributed Control Systems

8.7. Supervisory Control and Data Acquisition Systems

9. Global Functional Safety Market, By Industry 2021-2034 (USD Million)

9.1. Oil & Gas

9.2. Power Generation

9.3. Chemicals

9.4. Food & Beverages

9.5. Pharmaceuticals

9.6. Automotive

9.7. Railways

10. Global Functional Safety Market, 2021-2034 (USD Million)

10.1. Global Functional Safety Market Size and Market Share

11. Global Functional Safety Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ABB Ltd.

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Ascent Labs

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. DEKRA Group

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Emerson Electric Co.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Endress+Hauser Management AG

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. General Electric Company

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. HIMA Paul Hildebrandt GmbH

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Honeywell International Inc.

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Omron Corporation

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Rockwell Automation Inc.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.