Garbage Truck Market Introduction and Overview

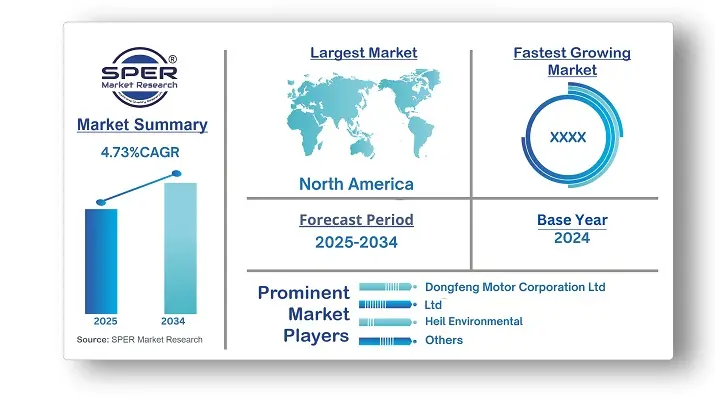

According to SPER Market Research, the Global Garbage Truck Market is estimated to reach USD 24.27 billion by 2034 with a CAGR of 4.73%.

The report includes an in-depth analysis of the Global Garbage Truck Market, including market size and trends, product mix, Applications, and supplier analysis. The Garbage Truck Market was valued at USD 15.29 billion in 2024 and is expected to grow at a CAGR of more than 4.73% between 2025 and 2034, owing to global industrialisation and stringent regulatory requirements aimed at proper waste management and environmental sustainability. Industries generate a large volume of garbage, demanding efficient disposal methods.

- In December 2023, WIN Waste Innovations revealed Boston's first fleet of electric garbage trucks, a significant step forward in the city's waste management infrastructure and sustainability initiatives.

- Fairfax County announced its pioneering venture in September 2023, launching the region's first all-electric garbage truck, a significant step forward in sustainable waste management operations.

By Truck Insights

The truck market is divided into three categories: front loader, rear loader, and side loader. The rear loader category dominated the market in 2024. The rear loader segment had a significant increase in 2024, thanks to its practicality and versatility. Rear loading vehicles excel in urban and suburban environments, navigating narrow streets and tiny places while efficiently collecting rubbish. Their user-friendly design and effective loading procedures make them the favoured choice of trash management businesses around the world. With an emphasis on optimising collection routes and increasing productivity, rear loader trucks maintain their market dominance.

By Fuel Type Insights

The garbage truck market is divided into three fuel categories: diesel, gasoline, and electric. Because of its strong performance and efficiency, the diesel segment is expected to grow at the fastest CAGR between 2025 and 2034. Diesel-powered garbage trucks have exceptional torque and towing capability, which is critical for efficiently transporting huge goods. Furthermore, diesel engines are known for their longevity and dependability, making them suitable for the tough chores of waste collection and disposal. With tight emission rules driving innovation in diesel technology, these vehicles continue to dominate the market.

Regional Insights

Asia Pacific dominated the global garbage truck market in 2024. Rapid urbanisation and infrastructure development are driving growth in the Asia Pacific market. The region's growing economies drive demand for effective waste management systems. Asia Pacific has a large manufacturing base and an increasing emphasis on technological innovation, resulting in a major market share. Its contributions to trash management transcend borders, influencing global practices and standards for sustainable waste disposal. Asia Pacific's significance in the sector continues to grow.

Get more information on this report: Download Free Sample PDF

Market Competitive Landscape

Mack Trucks (AB Voloo), XCMG Group, held significant market share in 2024. These companies are expanding their market presence through strategic initiatives and investments. By using technological advancements, they enhance their products to meet the changing needs of waste management. Developing electric and hybrid garbage trucks helps address environmental issues and provides cost-effective solutions. Partnerships with municipalities and waste management firms strengthen their presence in local markets, boosting sales and client relationships.

Ongoing marketing strategies and participation in industry events raise brand awareness in the garbage truck sector. By showcasing the reliability, efficiency, and sustainability of their products, they attract new customers. Investments in distribution networks and after-sales services ensure comprehensive support for customers, solidifying the companies' reputation and market presence.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Fuel Type, By Technology, By End-User |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe |

| Companies Covered | Dongfeng Motor Corporation Ltd, FULONGMA GROUP Co.,Ltd, Heil Environmental, Kirchhoff Group, Mack Trucks (AB Voloo), McNeilus Truck and Manufacturing Inc, Peterbilt, Shandong Wuzheng Group Co., Ltd, Terberg Environmental, XCMG Group. |

Key Topics Covered in the Report

- Global Garbage Truck Market Size (FY’2021-FY’2034)

- Overview of Global Garbage Truck Market

- Segmentation of Global Garbage Truck Market By Type (Front Loader, Rear Loader, Side Loader)

- Segmentation of Global Garbage Truck Market By Fuel Type (Electric, Gasoline, Diesel)

- Segmentation of Global Garbage Truck Market By Technology (Manual, Automatic, Semi-automatic)

- Segmentation of Global Garbage Truck Market By End User (Municipal, Industrial)

- Statistical Snap of Global Garbage Truck Market

- Expansion Analysis of Global Garbage Truck Market

- Problems and Obstacles in Global Garbage Truck Market

- Competitive Landscape in the Global Garbage Truck Market

- Details on Current Investment in Global Garbage Truck Market

- Competitive Analysis of Global Garbage Truck Market

- Prominent Players in the Global Garbage Truck Market

- SWOT Analysis of Global Garbage Truck Market

- Global Garbage Truck Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Garbage Truck Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Garbage Truck Market

7. Global Garbage Truck Market, By Truck (USD Million) 2021-2034

7.1. Rear loader

7.2. Front loader

7.3. Side loader

8. Global Garbage Truck Market, By Fuel (USD Million) 2021-2034

8.1. Electric

8.2. Gasoline

8.3. Diesel

9. Global Garbage Truck Market, By Technology (USD Million) 2021-2034

9.1. Manual

9.2. Automatic

9.3. Semi-automatic

10. Global Garbage Truck Market, By End User (USD Million) 2021-2034

10.1. Municipal

10.2. Industrial

11. Global Garbage Truck Market Forecast, 2021-2034 (USD Million)

11.1. Global Garbage Truck Market Size and Market Share

12. Global Garbage Truck Market, By Region, 2021-2034 (USD Million)

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Dongfeng Motor Corporation Ltd

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. FULONGMA GROUP Co, Ltd

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Heil Environmental

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Kirchhoff Group

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Mack Trucks (AB Voloo)

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

.6. McNeilus Truck and Manufacturing Inc

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Peterbilt

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Shandong Wuzheng Group Co., Ltd

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Terberg Environmental

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. XCMG Group

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links