Healthcare Fabrics Market Introduction and Overview

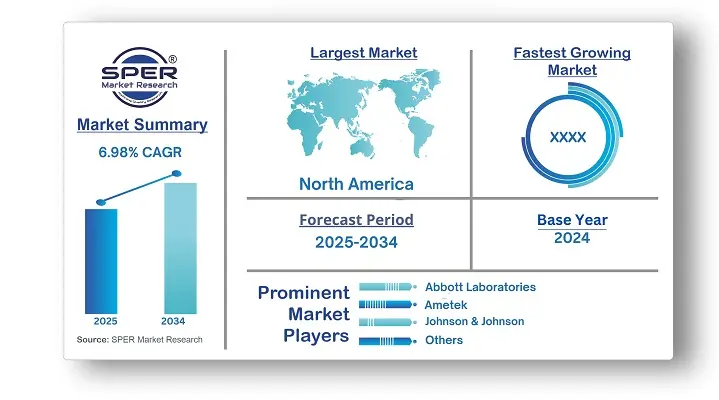

According to SPER Market Research, the Global Healthcare Fabrics Market is estimated to reach USD 40.32 billion by 2034 with a CAGR of 6.98%.

The global Healthcare Fabrics market was estimated at USD XX billion in 2024 and is expected to increase at a compound annual growth rate (CAGR) of XX% between 2024 and 2034. Product complexity, increased competition, an increase in the number of small-sized medical device makers, and stringent approval standards are important industry drivers. In addition, the COVID-19 pandemic has intensified global demand for testing services. Favorable government backing is expected to propel the sector. To get licenses and clearances, organizations must adhere to a detailed list of standards provided by regulatory agencies and maintain thorough documentation of the same.

In July 2023: Uson, L.P. formed a partnership with PAC, one of the world's top manufacturers of analytical instruments for laboratories and online process applications, to better service their respective customer segments while also focusing on new product development.

In May 2022: Pfeiffer Vacuum GmbH created a new leak detection and vacuum technology plant in Indianapolis, Indiana, with the goal of improving its leak detection capabilities.

By Raw Material:

In 2024, Polypropylene emerged as the dominating player in the worldwide healthcare fabric market. Polypropylene has grown in prominence as medical treatments and textile technology has advanced. This adaptable material's most promising end use is in hygiene and medical applications, particularly in the creation of high-quality nonwoven textiles. These materials are used to shield patients and create infection-free surgical drapes. Cotton is expected to grow at the fastest rate in the healthcare fabric market between 2024 and 2034. Cotton has a variety of properties that make it an excellent choice in healthcare settings. It is not only absorbent and soft but also safe to use with various sterilizing methods such as steam, ethylene oxide, and gamma radiation.

By Application:

The Hygiene Products segment is expected to expand rapidly during the forecast period. The healthcare fabrics market is expanding significantly due to rising demand for hygiene goods. Gowns, hats, face masks, pads, and sanitary napkins are all essential for maintaining adequate hygiene and preventing infection transmission. Both developed and developing countries are making significant investments in healthcare infrastructure, which directly contributes to the growth of the hygiene products market. Among the major segments, dressing items are predicted to grow the fastest during the projection period. This is due to the increasing number of accidents and the necessity for appropriate wound care solutions.

By Regional:

In 2024, Asia Pacific emerged as the dominating player in the Global Healthcare Fabrics Market, accounting for the greatest market share by value. The healthcare fabrics market in Asia-Pacific is expanding rapidly, owing mostly to growing consumption of feminine hygiene products. According to the Indian Nonwovens Industry Association, the market penetration rate for sanitary napkins in India increased dramatically in 2014. This increase in usage can be ascribed to a variety of causes, including increased knowledge of hygiene habits and the availability of cost-effective and creative solutions. Furthermore, the healthcare fabrics market in the region is benefiting from favorable government laws that encourage the use of high-quality and safe materials in medical applications.

Market Competitive Landscape

The Global Healthcare Fabrics Market is highly consolidated. Some of the market players are Abbott Laboratories, Ametek, Becton Dickinson, Boston Scientific, Fluke Biomedical, GE Healthcare, Johnson & Johnson, KLA Corporation, Mettler-Toledo, Medtronic and others.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Raw Material, By Type, By Application |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe |

| Companies Covered | Abbott Laboratories, Ametek, Becton Dickinson, Boston Scientific, Fluke Biomedical, GE Healthcare, Johnson & Johnson, KLA Corporation, Mettler-Toledo, Medtronic and others.

|

Key Topics Covered in the Report

- Global Healthcare Fabrics Market Size (FY’2025-FY’2034)

- Overview of Global Healthcare Fabrics Market

- Segmentation of Global Healthcare Fabrics Market By Raw Material (Polypropylene, Polyester, Polyethylene, Cotton and Other Materials)

- Segmentation of Global Healthcare Fabrics Market By Type (Woven, Non-Woven and Knitted)

- Segmentation of Global Healthcare Fabrics Market By Application (Privacy Curtains, Wall Coverings, Hygiene Products, Dressing Products, Bedding and Other Applications)

- Statistical Snap of Global Healthcare Fabrics Market

- Expansion Analysis of Global Healthcare Fabrics Market

- Problems and Obstacles in Global Healthcare Fabrics Market

- Competitive Landscape in the Global Healthcare Fabrics Market

- Details on Current Investment in Global Healthcare Fabrics Market

- Competitive Analysis of Global Healthcare Fabrics Market

- Prominent Players in the Global Healthcare Fabrics Market

- SWOT Analysis of Global Healthcare Fabrics Market

- Global Healthcare Fabrics Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Healthcare Fabrics Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Healthcare Fabrics Market

7. Global Healthcare Fabrics Market, By Raw Material 2021-2034(USD Million)

7.1. Polypropylene

7.2. Polyester

7.3. Polyethylene

7.4. Cotton

7.5. Other Materials

8. Polypropylene, Viscose, Cotton, Polyester, Others

9. Global Healthcare Fabrics Market, By Type 2021-2034(USD Million)

9.1. Woven

9.2. Non-Woven

9.3. Knitted

10. Global Healthcare Fabrics Market, By Application 2021-2034(USD Million)

10.1. Privacy Curtains

10.2. Wall Coverings

10.3. Hygiene Products

10.4. Dressing Products

10.5. Bedding

10.6. Other Applications

11. Global Healthcare Fabrics Market, 2021-2034 (USD Million)

11.1. Global Healthcare Fabrics Market Size and Market Share

12. Global Healthcare Fabrics Market, By Region, 2021-2034 (USD Million)

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Berry Global Inc.

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Brentano Fabrics

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Carnegie Fabrics, LLC

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Designtex

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. DuPont de Nemours, Inc.

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Eximius Incorporation

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Freudenberg Group

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Herculite

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Kimberly-Clark Worldwide, Inc.

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Knoll, Inc.

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links