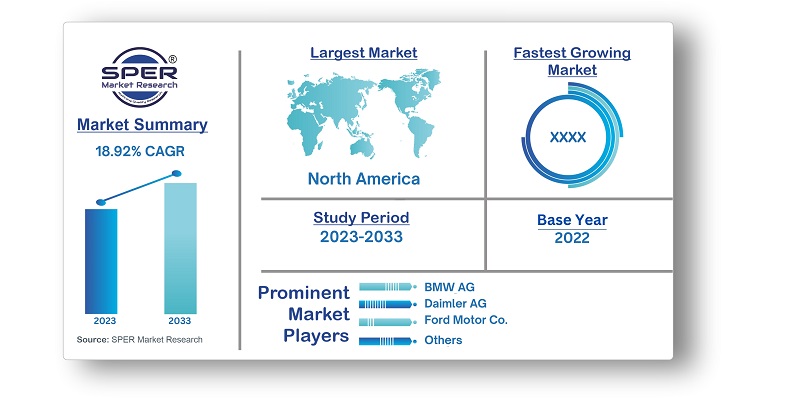

In-Vehicle Payment Services Market Growth, Size, Trends, Demand, Challenges and Future Outlook

Global In-Vehicle Payment Services Market Size- By Payment Mode, By Application, By Offering, By Vehicle Type- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jul-2023 | Report ID: IACT23137 | Pages: 1 - 239 | Formats*: |

| Category : Information & Communications Technology | |||

- May 2023: Sumitomo has formed a partnership with Vodafone to create an in-vehicle payment platform, with the intention of tapping into the emerging market of in-car payments. By recognizing the potential for generating additional revenue, the company seeks to seize new growth opportunities in this sector.

- December 2022: Parkopedia has introduced a new in-vehicle feature in partnership with German automaker BMW. This feature enables BMW users in Germany and Austria to access an in-vehicle payment platform for a seamless parking payment experience. Through the vehicle's dashboard screen, drivers can conveniently locate parking spaces and make payments, offering a user-friendly and efficient parking solution.

- Opportunity:

- Increasing End User Preference for Contactless Payment: The market is experiencing growth due to the rising preference for contactless payment among vehicle users. Increased adoption of contactless payment is driven by its advantages, including cost reduction in cash handling and faster fund transactions. Additionally, the travel and hospitality sectors are rapidly adopting contactless payments for benefits like quicker transactions and enhanced customer experiences at fuel stations.

- An Increase in the Demand for a Simple Payment System at Gas Stations, Toll Plazas and Parking Lots: The worldwide expansion of in-vehicle payment services is propelled by the growing use of digital payment methods (mobile, debit, credit cards), facilitated by high-speed internet at fuel stations. Additionally, increased smartphone adoption and demand for mobile and wearable payments drive market growth.

- Challenge:

- Standardization: For in-vehicle payments, there are no standardised protocols on the market. This can result in problems with compatibility between various automobiles and payment systems.

- Infrastructure Readiness: A strong infrastructure is necessary for widespread adoption, including stable internet access and NFC (Near Field Communication) technologies at petrol stations and parking lots.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Payment Mode, By Application, By Offering, By Vehicle Type |

| Regions covered | Asia Pacific, Europe, Middle East and Africa, North America, Latin America |

| Companies Covered | Amazon, BMW AG, Daimler AG, Ford Motor Co., General Motors Co., Google, Honda Motor Co. Ltd., Hyundai Motor Co., Jaguar Land Rover Automotive PLC, MasterCard, PayPal, Visa, Volkswagen AG, ZF Friedrichshafen AG, Others |

- Automotive Manufacturers

- Commercial Fleets

- Commuters

- Delivery Drivers

- Food and Beverage Services

- Mobile Payment Users

- Ride-hailing and Taxi Services

- Safety-Conscious Consumers

- Tech-Savvy Consumers

- Tourism and Travelers

- Others

| By Payment Mode: |

|

| By Application: |

|

| By Offering: |

|

| By Vehicle Type: |

|

- Global In-Vehicle Payment Services Market Size (FY’2023-FY’2033)

- Overview of Global In-Vehicle Payment Services Market

- Segmentation of Global In-Vehicle Payment Services Market By Payment Mode (App/E-Wallet, Credit/Debit Card, QR Code/RFID, Others)

- Segmentation of Global In-Vehicle Payment Services Market By Application (Food/ Groceries, Fuel/Charging Stations, Toll/Parking, Others)

- Segmentation of Global In-Vehicle Payment Services Market By Offering (Service, Solution)

- Segmentation of Global In-Vehicle Payment Services Market By Vehicle Type (Heavy Duty Vehicle, Light Duty Vehicle)

- Statistical Snap of Global In-Vehicle Payment Services Market

- Expansion Analysis of Global In-Vehicle Payment Services Market

- Problems and Obstacles in Global In-Vehicle Payment Services Market

- Competitive Landscape in the Global In-Vehicle Payment Services Market

- Impact of COVID-19 and Demonetization on Global In-Vehicle Payment Services Market

- Details on Current Investment in Global In-Vehicle Payment Services Market

- Competitive Analysis of Global In-Vehicle Payment Services Market

- Prominent Players in the Global In-Vehicle Payment Services Market

- SWOT Analysis of Global In-Vehicle Payment Services Market

- Global In-Vehicle Payment Services Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the Global In-Vehicle Payment Services Market

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Global In-Vehicle Payment Services Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global In-Vehicle Payment Services Market

7.1. Global In-Vehicle Payment Services Market Value Share and Forecast, By Payment Mode, 2023-20337.2. App/E-Wallet7.3. Credit/Debit Card7.4. QR Code/RFID7.5. Others

8.1. Global In-Vehicle Payment Services Market Value Share and Forecast, By Application, 2023-20338.2. Food/ Groceries8.3. Fuel/Charging Stations8.4. Toll/Parking8.5. Others

9.1. Global In-Vehicle Payment Services Market Value Share and Forecast, By Offering, 2023-20339.2. Service

9.2.1. Managed Services9.2.2. Professional Services

9.3. Solution

10.1. Global In-Vehicle Payment Services Market Value Share and Forecast, By Vehicle Type, 2023-203310.2. Heavy Duty Vehicle (HDV)10.3. Light Duty Vehicle (LDV)

11.1. Global In-Vehicle Payment Services Market Size and Market Share

12.1. Global In-Vehicle Payment Services Market Size and Market Share By Payment Mode (2019-2026)12.2. Global In-Vehicle Payment Services Market Size and Market Share By Payment Mode (2027-2033)

13.1. Global In-Vehicle Payment Services Market Size and Market Share By Application (2019-2026)13.2. Global In-Vehicle Payment Services Market Size and Market Share By Application (2027-2033)

14.1. Global In-Vehicle Payment Services Market Size and Market Share By Offering (2019-2026)14.2. Global In-Vehicle Payment Services Market Size and Market Share By Offering (2027-2033)

15.1. Global In-Vehicle Payment Services Market Size and Market Share By Vehicle Type (2019-2026)15.2. Global In-Vehicle Payment Services Market Size and Market Share By Vehicle Type (2027-2033)

16.1. Global In-Vehicle Payment Services Market Size and Market Share By Region (2019-2026)16.2. Global In-Vehicle Payment Services Market Size and Market Share By Region (2027-2033)16.3. Asia-Pacific

16.3.1. Australia16.3.2. China16.3.3. India16.3.4. Japan16.3.5. South Korea16.3.6. Rest of Asia-Pacific

16.4. Europe

16.4.1. France16.4.2. Germany16.4.3. Italy16.4.4. Spain16.4.5. United Kingdom16.4.6. Rest of Europe

16.5. Middle East and Africa

16.5.1. Kingdom of Saudi Arabia16.5.2. United Arab Emirates16.5.3. Rest of Middle East & Africa16.6. North America

16.6.1. Canada16.6.2. Mexico16.6.3. United States

16.7. Latin America

16.7.1. Argentina16.7.2. Brazil16.7.3. Rest of Latin America

17.1. Amazon

17.1.1. Company details17.1.2. Financial outlook17.1.3. Product summary17.1.4. Recent developments

17.2. BMW AG

17.2.1. Company details17.2.2. Financial outlook17.2.3. Product summary17.2.4. Recent developments

17.3. Daimler AG

17.3.1. Company details17.3.2. Financial outlook17.3.3. Product summary17.3.4. Recent developments

17.4. Ford Motor Co.

17.4.1. Company details17.4.2. Financial outlook17.4.3. Product summary17.4.4. Recent developments

17.5. General Motors Co.

17.5.1. Company details17.5.2. Financial outlook17.5.3. Product summary17.5.4. Recent developments

17.6. Google

17.6.1. Company details17.6.2. Financial outlook17.6.3. Product summary17.6.4. Recent developments

17.7. Honda Motor Co. Ltd.

17.7.1. Company details17.7.2. Financial outlook17.7.3. Product summary17.7.4. Recent developments

17.8. Hyundai Motor Co.

17.8.1. Company details17.8.2. Financial outlook17.8.3. Product summary17.8.4. Recent developments

17.9. Jaguar Land Rover Automotive PLC

17.9.1. Company details17.9.2. Financial outlook17.9.3. Product summary17.9.4. Recent developments

17.10. MasterCard

17.10.1. Company details17.10.2. Financial outlook17.10.3. Product summary17.10.4. Recent developments

17.11. PayPal

17.11.1. Company details17.11.2. Financial outlook17.11.3. Product summary17.11.4. Recent developments

17.12. Visa

17.12.1. Company details17.12.2. Financial outlook17.12.3. Product summary17.12.4. Recent developments

17.13. Volkswagen AG

17.13.1. Company details17.13.2. Financial outlook17.13.3. Product summary17.13.4. Recent developments

17.14. ZF Friedrichshafen AG

17.14.1. Company details17.14.2. Financial outlook17.14.3. Product summary17.14.4. Recent developments

17.15. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.