India Logistics and Warehousing Market Introduction and Overview

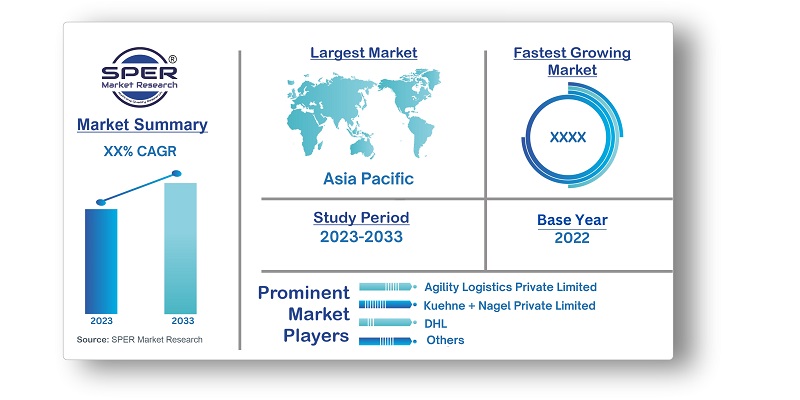

According to SPER Market Research, the India Logistics and Warehousing Market is estimated to reach USD XX billion by 2032 with a CAGR of XX%.

The report includes an in-depth analysis of the India Logistics and Warehousing Market, including market size and trends, distribution channels, product mix and supplier analysis. Logistics and warehousing are essential for the transportation and distribution of goods in India. Logistics is concerned with controlling the movement of products from their origin to consumption, whereas warehousing is concerned with keeping things before final delivery. Because of India's expanding economy and commercial activities, efficient logistics and warehousing are critical. To assist the transfer of commodities, the country has a comprehensive transportation network that includes highways, trains, rivers, and airways. Modern warehouses outfitted with cutting-edge technology ensure proper inventory management and efficient cargo handling. The advent of e-commerce has highlighted the importance of specialist fulfillment centers. Overall, logistics and warehousing enhance India's supply chain by allowing goods to be delivered on time, generating economic growth, and meeting consumer and company demands.

- E-commerce Boom: The rapid growth of India's e-commerce sector has been a major driver for the logistics and storage market. With the growing popularity of online shopping, there has been a surge in demand for efficient and dependable logistics services to ensure timely and cost-effective product delivery.

- Infrastructure Development: The Indian government has made major investments in infrastructure development, including the construction of motorways, expressways, ports, airports, and dedicated freight corridors. These infrastructure upgrades have improved connectivity, cut transportation costs, and increased the overall efficiency of logistics and storage operations.

Market Opportunities and Challenges

In India, the logistics and storage sector offers both opportunities and challenges to growing businesses and investors. One of the most promising opportunities is in the expanding e-commerce sector. With the growing popularity of online shopping comes an increased demand for efficient logistics and warehousing services to ensure timely and smooth delivery of goods. This tendency creates an advantageous environment for entrepreneurs interested in establishing logistics and storage enterprises.

However, the logistics and warehousing industry in India is not without its challenges. One key challenge is the industry's fragmented nature, which is characterized by the presence of multiple small-scale firms. This fragmentation creates intense competition and pricing pressures, making it difficult for new entrants to establish themselves and gain market share. Another problem is the operational complexity involved in managing logistics and warehousing operations. Efficient inventory management, transportation coordination, and order fulfillment necessitate expertise as well as investments in technology and skilled workers.

Market Competitive Landscape

The logistics and warehousing market in India has a competitive market landscape that includes a mix of large established players, regional players, and new startups. Companies with a strong presence and broad networks across the country, including as DHL, Blue Dart, Gati, and Safexpress, are among the market's major players. These established businesses have a competitive edge in terms of infrastructure, technology, and operational skill, allowing them to serve a varied customer base and handle a wide range of logistics needs.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Model Type, By Transportation Model, By End Use

|

| Regions covered | East India, North India, South India, West and Central India.

|

| Companies Covered | Agility Logistics Private Limited, DHL, Expeditors International (India) Private Limited, Fedex Trade Networks Transport and Brokerage Private Limited, Kuehne + Nagel Private Limited. |

In what ways has the COVID-19 pandemic affected India Logistics and Warehousing Market?

The epidemic of COVID-19 has a huge impact on India's logistics and warehousing market. Delays in delivery and difficulties in logistics operations were caused by supply chain disruptions, lockdown measures, and manpower shortages. The epidemic, on the other hand, created opportunities, including as increased demand for necessary commodities, a move to e-commerce, and an emphasis on health and safety precautions. Logistics companies were critical in distributing necessary commodities, as e-commerce grew, necessitating last-mile delivery services and warehouse facilities. With the development of automation and digital platforms, the pandemic has hastened digital transformation. Despite the difficulties, the crisis spurred innovation and underlined the significance of effective logistics and warehousing in managing upheavals and fulfilling shifting market demands.

Key Target Audience:

- Retailers and E-Commerce Companies

- Importers and Exporters

- Third-party Logistics

- Transporters and Freight Forwarders

Our in-depth analysis of the India Logistics and Warehousing Market includes the following segments:

|

By Model Type:

|

2 PL

3 PL

4 PL

|

|

By Transportation Model:

|

Airways

Railways

Roadways

Seaways

|

|

By End Use:

|

Automotive

Chemicals

Construction

Consumer Goods

Food and Beverages

Healthcare

IT Hardware

Manufacturing

Oil and Gas

Retail

Telecom

|

Key Topics Covered in the Report:

- India Logistics and Warehousing Market Size (FY’2022-FY’2032)

- Overview of India Logistics and Warehousing Market

- Segmentation of India Logistics Market By Model Type (2 PL, 3 PL, 4 PL)

- Segmentation of India Logistics Market By Transportation Model (Airways, Railways, Roadways, Seaways)

- Segmentation of India Logistics Market By End Use (Automotive, Chemicals, Construction, Consumer Goods, Food and Beverages, Healthcare, IT Hardware, Manufacturing, Oil and Gas, Retail, Telecom, Others)

- Statistical Snap of India Logistics and Warehousing Market

- Expansion Analysis of India Logistics and Warehousing Market

- Problems and Obstacles in India Logistics and Warehousing Market

- Competitive Landscape in the India Logistics and Warehousing Market

- Impact of COVID-19 and Demonetization on India Logistics and Warehousing Market

- Details on Current Investment in India Logistics and Warehousing Market

- Competitive Analysis of India Logistics and Warehousing Market

- Prominent Players in the India Logistics and Warehousing Market

- SWOT Analysis of India Logistics and Warehousing Market

- India Logistics and Warehousing Market Future Outlook and Projections (FY’2022-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the India Logistics Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4. Heat map analysis

6. Competitive Landscape

6.1 India Logistics Market Manufacturing Base Distribution, Sales Area, Product Type

6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in India Logistics Market

7. India Logistics Market, By Model Type, 2019-2032 (USD Million)

7.1 2 PL

7.2 3 PL

7.3 4 PL

8. India Logistics Market, By Transportation Model, 2019-2032 (USD Million)

8.1 Airways

8.2 Railways

8.3 Roadways

8.4 Seaways

9. India Logistics Market, By End Use, 2019-2032 (USD Million)

9.1 Automotive

9.2 Chemicals

9.3 Construction

9.4 Consumer Goods

9.5 Food and Beverages

9.6 Healthcare

9.7 IT Hardware

9.8 Manufacturing

9.9 Oil and Gas

9.10 Retail

9.11 Telecom

9.12 Others

10. India Logistics Market, By Region, 2019-2032 (USD Million)

10.1 India Logistics Size and Market Share by Region (2019-2025)

10.2 India Logistics Size and Market Share by Region (2026-2032)

10.3 North India

10.4 West and Central India

10.5 South India

10.6 East India

11. Company Profiles

11.1 Agility Logistics Private Limited

11.1.1 Company details

11.1.2 Financial outlook

11.1.3 Product summary

11.1.4 Recent developments

11.2 DHL

11.2.1 Company details

11.2.2 Financial outlook

11.2.3 Product summary

11.2.4 Recent developments

11.3 Expeditors International (India) Private Limited

11.3.1 Company details

11.3.2 Financial outlook

11.3.3 Product summary

11.3.4 Recent developments

11.4 Fedex Trade Networks Transport and Brokerage Private Limited

11.4.1 Company details

11.4.2 Financial outlook

11.4.3 Product summary

11.4.4 Recent developments

11.5 Kuehne + Nagel Private Limited

11.5.1 Company details

11.5.2 Financial outlook

11.5.3 Product summary

11.5.4 Recent developments

12. List of Abbreviations

13. Reference Links

14. Conclusion

15. Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.