Internal Bifold Door Market Introduction and Overview

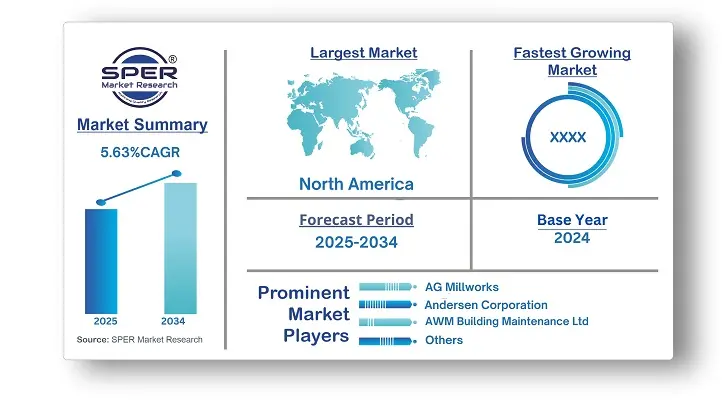

According to SPER Market Research, the Global Internal Bifold Door Market is estimated to reach USD 17.47 billion by 2034 with a CAGR of 5.63%.

The report includes an in-depth analysis of the Global Internal Bifold Door Market, including market size and trends, product mix, Applications, and supplier analysis. The Internal Bifold Door Market is valued at over USD 10.1 billion in 2024, with a growth rate of over 5.63% expected from 2025 to 2034. This growth is linked to the expansion of the construction sector, which involves production and various operations related to building, repairing, and maintaining infrastructure. Increased construction activity, driven by industrialization and urbanization, has led to a higher demand for bifold doors, popular for their reliability and safety features in homes, schools, offices, and government buildings.

By Material Insights

The market segmentation based on material includes Wood, Aluminum, UPVC (Unplasticized Polyvinyl Chloride), Glass, and others. The Aluminum segment led the global internal bifold market in 2024 due to its great durability and strength. Aluminum bifold doors can withstand various environmental conditions without losing their integrity.

Aluminum doors also have a long lifespan, making them popular for homes and businesses. Their resistance to corrosion and rust means they need less maintenance, appealing to consumers seeking a long-term investment. Moreover, aluminum bifold doors offer stability, enhancing property security and ensuring reliable performance over time.

By Application Insights

The internal bifold door market is segmented into Residential, Non-residential, and Institutional categories. In 2024, the Residential segment held the largest market share, driven by the doors' versatility and functionality. Bifold doors are popular among homeowners for enhancing natural light in living areas and creating smooth transitions between indoors and outdoors, improving the home's appeal and living experience. The rise of open-plan living and the desire for better outdoor connectivity are increasing demand for bifold doors

, keeping the Residential segment in the lead as more homeowners recognize their value.

Regional Insights

In 2024, the global market was dominated by North America. This prominent position can be ascribed to the growing need for bifold doors as the area has become more urbanised and electrified. Rapid urbanisation, the growth of international sports, and economic prosperity are expected to boost this region's command of a sizeable portion of the worldwide market. With the increasing pace of urbanisation, more people are moving into cities, raising living standards and creating profitable prospects for bifold door expansion. This trend is further supported by the increase in disposable income.

Market Competitive Landscape

The key players in the market include Jeld-Wen, VELUX Group, Marvin, Horman, and Kawneer, holding a significant market share in 2024. The market is fragmented, featuring established companies as well as smaller niche players and startups with innovative offerings. These companies are launching new, updated products to remain competitive. For example, Inwido focuses on enhancing indoor living with high-quality windows and doors, using a consumer-focused strategy and decentralized operations for growth.

Recent Developments:

Express Bifold Doors begins its nationwide trade service in January 2023, providing trade professionals with same-week access to its top-selling collections. This action shows that the market and demand for premium bifold doors are expanding.

Sheerline, a firm that manufactures aluminium windows, bifold doors, and roof lanterns, has introduced Prestige bifold doors. These doors use Sheerline's multi-chambered Thermlock technology, which ensures superior thermal performance.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product Type, By Material, By Application, By Distribution Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | AG Millworks, Andersen Corporation, Associated Windows & Conservatories, ATIS Group, AWM Building Maintenance Ltd, Hormann, JELD-WEN Inc, Kawneer, Marvin, Milgard Windows & Doors, Pella Corporation, Ply Gem Industries Inc. |

Key Topics Covered in the Report

- Global Internal Bifold Door Market Size (FY’2021-FY’2034)

- Overview of Global Internal Bifold Door Market

- Segmentation of Global Internal Bifold Door Market By Product Type (Single Bifold/Concertina Doors, Room dividers, Bifold Doors with Access Doors)

- Segmentation of Global Internal Bifold Door Market By Material (Wood, Aluminum, UPVC, Glass, other)

- Segmentation of Global Internal Bifold Door Market By Application (Residencial, Commercial, Institutional)

- Segmentation of Global Internal Bifold Door Market By Distribution Channel (Online, Offline)

- Statistical Snap of Global Internal Bifold Door Market

- Expansion Analysis of Global Internal Bifold Door Market

- Problems and Obstacles in Global Internal Bifold Door Market

- Competitive Landscape in the Global Internal Bifold Door Market

- Details on Current Investment in Global Internal Bifold Door Market

- Competitive Analysis of Global Internal Bifold Door Market

- Prominent Players in the Global Internal Bifold Door Market

- SWOT Analysis of Global Internal Bifold Door Market

- Global Internal Bifold Door Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Internal Bifold Door Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Internal Bifold Door Market

7. Global Internal Bifold Door Market, By Product Type (USD Million) 2021-2034

7.1. The Single Bifold/Concertina Doors

7.2. Room dividers

7.3. Bifold Doors with Access Doors

7.4. Other

8. Global Internal Bifold Door Market, By Material (USD Million) 2021-2034

8.1. Wood

8.2. Aluminum

8.3. UPVC (Unplasticized Polyvinyl Chloride)

8.4. Glass

8.5. other

9. Global Internal Bifold Door Market, By Application (USD Million) 2021-2034

9.1. Residencial

9.2. Commercial

9.3. Institutional

10. Global Internal Bifold Door Market, By Distribution Channel (USD Million) 2021-2034

10.1. Online

10.1.1. E-Commerce

10.1.2. Company Website

10.2. Offline

10.2.1. Specialty Stores

10.2.2. Home improvement stores

10.2.3. Furniture stores

11. Global Internal Bifold Door Market, (USD Million) 2021-2034

11.1. Global Internal Bifold Door Market Size and Market Share

12. Global Internal Bifold Door Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. AG Millworks

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Andersen Corporation

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Associated Windows & Conservatories

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. ATIS Group

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. AWM Building Maintenance Ltd

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Hormann

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. JELD-WEN Inc

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Kawneer

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Marvin

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Milgard Windows & Doors

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Pella Corporation

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Ply Gem Industries Inc

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links