Laser Measuring Instrument Market Introduction and Overview

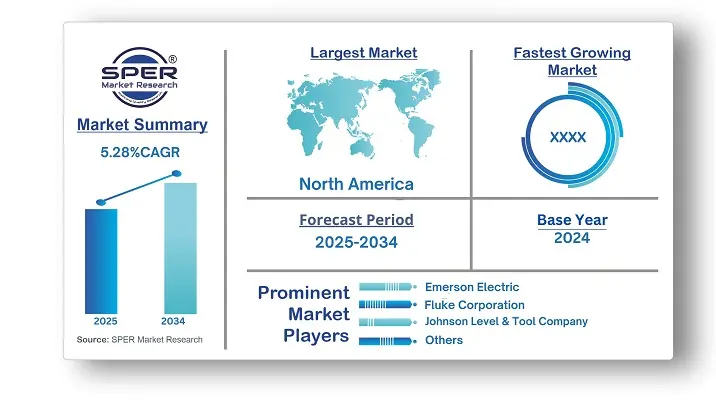

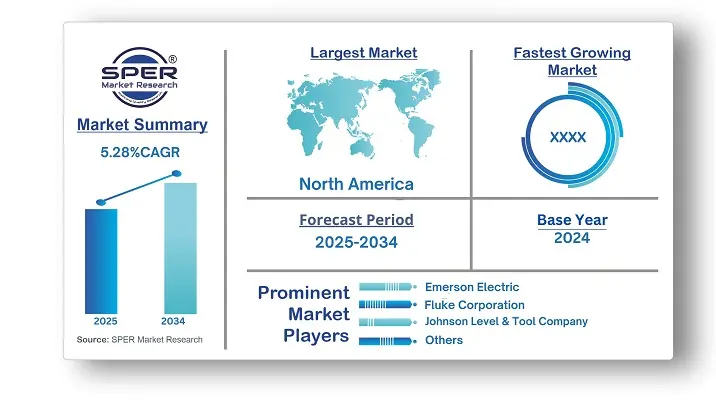

According to SPER Market Research, the Global Laser Measuring Instrument Market is estimated to reach USD 6.69 billion by 2034 with a CAGR of 5.28%.

The report includes an in-depth analysis of the Global Laser Measuring Instrument Market, including market size and trends, product mix, Applications, and supplier analysis. The global rise in construction and real estate sectors significantly boosts demand for laser measuring instruments, essential for accurate site measurements, building inspections, leveling, and alignments. Similarly, the aerospace and automotive industries rely on these tools for precision in quality checks, assembling, and surface measurements. Large-scale infrastructure projects—such as roads, bridges, and railways—further fuel demand, with engineers and surveyors using them for land surveys, mapping, and quality control. However, high initial costs remain a key restraint, particularly for small businesses and DIY users. Additionally, the need for frequent upgrades due to advancing technologies adds to overall expenses. The easy availability of alternative measurement tools also poses a challenge, potentially limiting market growth despite increasing industrial applications.

By Product Type:

Handheld laser measuring instruments are seeing strong growth, driven by their widespread use in construction and renovation projects. These devices are favored for their ability to provide quick and accurate measurements of distances, areas, and volumes—making them valuable tools during structure planning, material estimation, and installation tasks. In the real estate sector, professionals such as agents and property appraisers rely on handheld laser tools for measuring properties, creating floor plans, and conducting valuations. The ability to swiftly measure room dimensions and calculate square footage supports accurate property listings and detailed valuation reports, further boosting the demand for these compact and efficient tools.

By Application:

The construction sector represents a significant portion of the laser measuring instrument market. These tools are essential for delivering precise distance, area, and volume measurements, which are critical for construction planning, site leveling, and building inspections. The industry's strong focus on accuracy and efficiency in tasks such as site preparation, foundation work, and structural assembly continues to drive demand. Additionally, laser measuring instruments play a key role in supporting safety compliance by ensuring accurate measurements for challenging placements, fall protection systems, and equipment positioning.

By Regional Insights

The laser measuring instrument market in North America has shown strong growth, driven by the region's high level of construction activity across residential, commercial, and infrastructure projects. These instruments are vital for tasks such as construction layout, site leveling, and building inspections, making them essential tools for professionals seeking precise measurement solutions to enhance project efficiency and quality. Additionally, industries such as automotive, manufacturing, and aerospace across North America are increasingly adopting automation and robotics, further boosting the demand for laser measuring technologies in precision-driven production processes.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Emerson Electric, Fluke Corporation, Hilti Corporation, Johnson Level & Tool Company, Leica Geosystems, Makita Corporation, RIDGID, Robert Bosch GmbH, Ryobi Limited, Spectra Precision, Stabila, Stanley Black & Decker, Topcon Corporation, Others.

Recent Developments:

In December 2023, Mileseey, a Chinese electronic measurement tool brand, introduced the D9 Pro laser measure, featuring the industry's first visual aligning indicator.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product Type, By Application, By End Use |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Emerson Electric, Fluke Corporation, Hilti Corporation, Johnson Level & Tool Company, Leica Geosystems, Makita Corporation, RIDGID, Robert Bosch GmbH, Ryobi Limited, Spectra Precision, Stabila, Stanley Black & Decker, Topcon Corporation, Others. |

Key Topics Covered in the Report

- Global Laser Measuring Instrument Market Size (FY’2021-FY’2034)

- Overview of Global Laser Measuring Instrument Market

- Segmentation of Global Laser Measuring Instrument Market By Product Type (Handheld, Indoor, Outdoor)

- Segmentation of Global Laser Measuring Instrument Market By Application (Construction, Automotive, Manufacturing, Aerospace & Defense, Telecommunication, Others)

- Segmentation of Global Laser Measuring Instrument Market By End-use (Personal, Commercial, Industrial)

- Statistical Snap of Global Laser Measuring Instrument Market

- Expansion Analysis of Global Laser Measuring Instrument Market

- Problems and Obstacles in Global Laser Measuring Instrument Market

- Competitive Landscape in the Global Laser Measuring Instrument Market

- Details on Current Investment in Global Laser Measuring Instrument Market

- Competitive Analysis of Global Laser Measuring Instrument Market

- Prominent Players in the Global Laser Measuring Instrument Market

- SWOT Analysis of Global Laser Measuring Instrument Market

- Global Laser Measuring Instrument Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Laser Measuring Instrument Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Laser Measuring Instrument Market

7. Global Laser Measuring Instrument Market, By Product Type, (USD Million) 2021-2034

7.1. Handheld

7.2. Indoor

7.3. Outdoor

8. Global Laser Measuring Instrument Market, By Application, (USD Million) 2021-2034

8.1. Construction

8.2. Automotive

8.3. Manufacturing

8.4. Aerospace & Defense

8.5. Telecommunication

8.6. Others

9. Global Laser Measuring Instrument Market, By End-use, (USD Million) 2021-2034

9.1. Personal

9.2. Commercial

9.3. Industrial

10. Global Laser Measuring Instrument Market, (USD Million) 2021-2034

10.1. Global Laser Measuring Instrument Market Size and Market Share

11. Global Laser Measuring Instrument Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Emerson ELectric

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Fluke Corporation

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Hilti Corporation

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Johnson Level & Tool Company

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Leica Geosystems

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Makita Corporation

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. RIDGID

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Robert Bosch GmBh

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Ryobi Limited

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Spectra Precision

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Stabila

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Stanley Black & Decker

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Topcon Corporation

12.13.1. Company details

12.13.2. Financial outlook

12.13.3. Product summary

12.13.4. Recent developments

12.14. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.