Medical Device Outsourcing Market Introduction and Overview

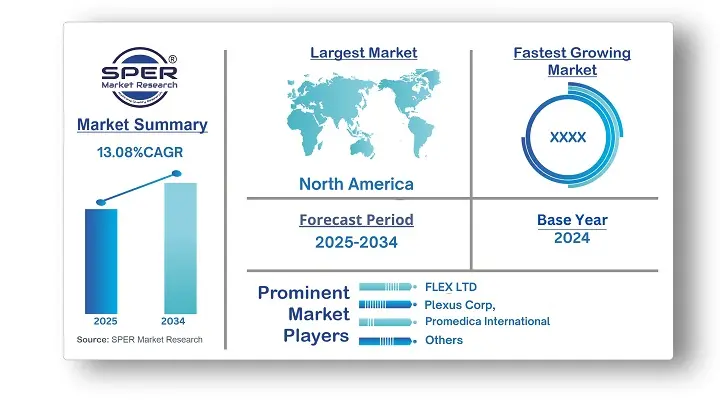

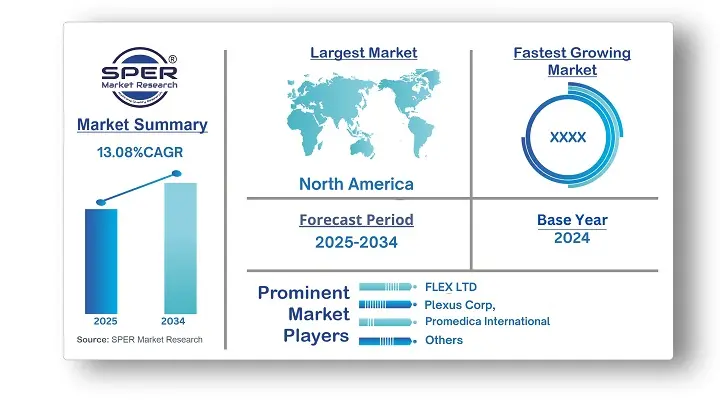

According to SPER Market Research, the Global Medical Device Outsourcing Market is estimated to reach USD 440.33 billion by 2034 with a CAGR of 13.08%.

The report includes an in-depth analysis of the Global Medical Device Outsourcing Market, including market size and trends, Interface mix, Applications, and supplier analysis. Medical device outsourcing involves delegating the design, development, manufacturing, and regulatory compliance processes of medical devices to third-party service providers. This approach helps medical device companies reduce costs, improve efficiency, and accelerate time-to-market while focusing on core competencies like innovation and commercialization. The market is growing due to rising demand for advanced medical devices, stringent regulatory requirements, and increasing adoption of contract manufacturing to manage production complexity. Additionally, advancements in precision manufacturing, automation, and AI-driven quality control enhance outsourcing capabilities. However, challenges such as regulatory compliance variations across regions, intellectual property concerns, and supply chain disruptions pose risks. Ensuring quality control, maintaining data security, and managing vendor relationships remain critical for sustaining growth in the outsourced medical device industry.

By Service Insights

In 2024, the size of the worldwide medical device contract manufacturing market was the highest dominating the market globally. Quality assurance services, regulatory affairs services, product design and development services, testing and sterilization services, product implementation services, product upgrade services, product maintenance services, and contract manufacturing services are the different markets that make up the market.

By Application Insights

In 2024, the cardiology section held the maximum share. As more people and healthcare professionals recognize the importance of early detection and treatment of cardiovascular diseases, the high number of deaths from these conditions is helping to boost the industry's growth. Due to their complexity and need for technical know-how, cardiovascular devices are better off being outsourced. Additionally, market participants must take use of contract manufacturers' production, warehousing, and distribution capabilities to meet the growing demand for cardiovascular devices. This ultimately helps market participants save money and remain competitive.

By Class Insights

Class II type medical devices dominated the market in 2024, and the segment is predicted to grow at the quickest CAGR over the forecast period due to the high cost of medical equipment; almost 43.0% of medical devices come into this category.

By Regional Insights

In 2024, Asia Pacific dominated the global market. The other supportive elements that are expected to propel this regional market are the existence of market participants and competitive pricing. Additionally, the growing number of patients with infectious and chronic illnesses is driving up demand for medical equipment, which is driving market expansion in this area.

Market Competitive Landscape

Medical Device Outsourcing market is highly competitive. Major contract manufacturers invest in automation, AI, and IoT-driven production processes to enhance efficiency and compliance. Some of the prominent players in Global Medical Device Outsourcing Market are Celestica Inc, FLEX LTD, ICON plc, IQVIA Inc, Jabil Inc, Med pace, Plexus Corp, Promedica International, Sanmina Corporation, Tecomet Inc.

Recent Developments:

In May 2023, Emergo cooperated with the Shanghai Center for Medical assessment and Inspection (CMTC) to conduct continuing usability assessment of medical equipment in China. This collaboration was supposed to assure usability testing by adhering to the Human Factors Engineering (HFE) principles established by China's National Medical Products Administration (NMPA).

In August 2023, Eurofins Scientific, a global provider of testing services, expanded its medical device testing capabilities to meet the growing demand for outsourced services.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Service, By Application, By Class |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Celestica Inc, FLEX LTD, ICON plc, IQVIA Inc, Jabil Inc, Med pace, Plexus Corp, Promedica International, Sanmina Corporation, Tecomet Inc. |

Key Topics Covered in the Report

- Global Medical Device Outsourcing Market Size (FY’2021-FY’2034)

- Overview of Global Medical Device Outsourcing Market

- Segmentation of Global Medical Device Outsourcing Market By Service (Quality Assurance, Regulatory Affairs Services, Product Design & Development Services, Product Testing & Sterilization Services, Product Implementation Services, Product Upgrade Services, Product Maintenance Services and Contract Manufacturing)

- Segmentation of Global Medical Device Outsourcing Market By Application (Cardiology, Diagnostic imaging, Orthopedic, IVD, Ophthalmic, General & plastic surgery, Drug delivery, Dental, Endoscopy, Diabetes care and Others)

- Segmentation of Global Medical Device Outsourcing Market By Class (Class I, Class II and Class III)

- Statistical Snap of Global Medical Device Outsourcing Market

- Expansion Analysis of Global Medical Device Outsourcing Market

- Problems and Obstacles in Global Medical Device Outsourcing Market

- Competitive Landscape in the Global Medical Device Outsourcing Market

- Details on Current Investment in Global Medical Device Outsourcing Market

- Competitive Analysis of Global Medical Device Outsourcing Market

- Prominent Players in the Global Medical Device Outsourcing Market

- SWOT Analysis of Global Medical Device Outsourcing Market

- Global Medical Device Outsourcing Market Future Outlook and Projections (FY’2025-FY’2034)

1.Introduction

1.1.Scope of the report

1.2.Market segment analysis

2.Research Methodology

2.1.Research data source

2.1.1.Secondary Data

2.1.2.Primary Data

2.1.3.SPER’s internal database

2.1.4.Premium insight from KOL’s

2.2.Market size estimation

2.2.1.Top-down and Bottom-up approach

2.3.Data triangulation

3.Executive Summary

4.Market Dynamics

4.1.Driver, Restraint, Opportunity and Challenges analysis

4.1.1.Drivers

4.1.2.Restraints

4.1.3.Opportunities

4.1.4.Challenges

5.Market variable and outlook

5.1.SWOT Analysis

5.1.1.Strengths

5.1.2.Weaknesses

5.1.3.Opportunities

5.1.4.Threats

5.2.PESTEL Analysis

5.2.1.Political Landscape

5.2.2.Economic Landscape

5.2.3.Social Landscape

5.2.4.Technological Landscape

5.2.5.Environmental Landscape

5.2.6.Legal Landscape

5.3.PORTER’s Five Forces

5.3.1.Bargaining power of suppliers

5.3.2.Bargaining power of buyers

5.3.3.Threat of Substitute

5.3.4.Threat of new entrant

5.3.5.Competitive rivalry

5.4.Heat Map Analysis

6.Competitive Landscape

6.1.Global Preclinical CRO Market Manufacturing Base Distribution, Sales Area, Interface Type

6.2.Mergers & Acquisitions, Partnerships, Interface Launch, and Collaboration in Global Preclinical CRO Market

7.Global Preclinical CRO Market, By Service 2021-2034 (USD Million)

7.1.Bioanalysis and DMPK studies

7.1.1.In vitro ADME

7.1.2.In-vivo PK

7.2.Toxicology Testing

7.2.1.GLP

7.2.2.Non-GLP

7.3.Compound Management

7.3.1.Process R&D

7.3.2.Custom Synthesis

7.3.3.Others

7.4.Chemistry

7.4.1.Medicinal Chemistry

7.4.2.Computation Chemistry

7.5.Safety Pharmacology

7.6.Others

8.Global Preclinical CRO Market, By Model Type 2021-2034 (USD Million)

8.1.Patient Derived Organoid (PDO) Model

8.2.Patient derived xenograft model

9.Global Preclinical CRO Market, By End Use 2021-2034 (USD Million)

9.1.Biopharmaceutical Companies

9.2.Government and Academic Institutes

9.3.Medical Device Companies

10.Global Preclinical CRO Market, 2021-2034 (USD Million)

10.1.Global Preclinical CRO Market Size and Market Share

11.Global Preclinical CRO Market, By Region, 2021-2034 (USD Million)

11.1.Asia-Pacific

11.1.1.Australia

11.1.2.China

11.1.3.India

11.1.4.Japan

11.1.5.South Korea

11.1.6.Rest of Asia-Pacific

11.2.Europe

11.2.1.France

11.2.2.Germany

11.2.3.Italy

11.2.4.Spain

11.2.5.United Kingdom

11.2.6.Rest of Europe

11.3.Middle East and Africa

11.3.1.Kingdom of Saudi Arabia

11.3.2.United Arab Emirates

11.3.3.Qatar

11.3.4.South Africa

11.3.5.Egypt

11.3.6.Morocco

11.3.7.Nigeria

11.3.8.Rest of Middle-East and Africa

11.4.North America

11.4.1.Canada

11.4.2.Mexico

11.4.3.United States

11.5.Latin America

11.5.1.Argentina

11.5.2.Brazil

11.5.3.Rest of Latin America

12.Company Profile

12.1.Charles River Laboratories International Inc

12.1.1.Company details

12.1.2.Financial outlook

12.1.3.Interface summary

12.1.4.Recent developments

12.2.Crown Bioscience

12.2.1.Company details

12.2.2.Financial outlook

12.2.3.Interface summary

12.2.4.Recent developments

12.3.Eurofins Scientific

12.3.1.Company details

12.3.2.Financial outlook

12.3.3.Interface summary

12.3.4.Recent developments

12.4.Intertek Group Plc

12.4.1.Company details

12.4.2.Financial outlook

12.4.3.Interface summary

12.4.4.Recent developments

12.5.LABCORP

12.5.1.Company details

12.5.2.Financial outlook

12.5.3.Interface summary

12.5.4.Recent developments

12.6.Medpace Inc

12.6.1.Company details

12.6.2.Financial outlook

12.6.3.Interface summary

12.6.4.Recent developments

12.7.PPD

12.7.1.Company details

12.7.2.Financial outlook

12.7.3.Interface summary

12.7.4.Recent developments

12.8.PRA Health Sciences Inc.

12.8.1.Company details

12.8.2.Financial outlook

12.8.3.Interface summary

12.8.4.Recent developments

12.9.SGA SA

12.9.1.Company details

12.9.2.Financial outlook

12.9.3.Interface summary

12.9.4.Recent developments

12.10.Wuxi AppTec

12.10.1.Company details

12.10.2.Financial outlook

12.10.3.Interface summary

12.10.4.Recent developments

13.Conclusion

14.List of Abbreviations

15.Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.