Military Trucks Market Introduction and Overview

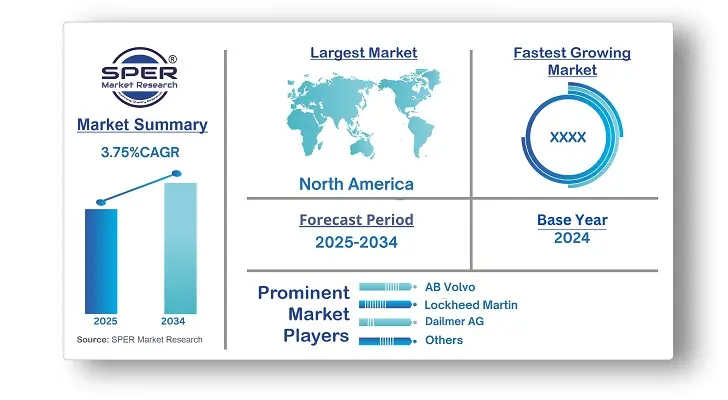

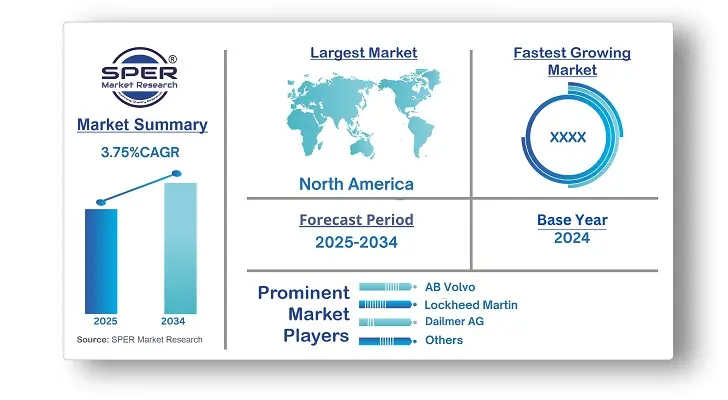

According to SPER Market Research, the Global Military Trucks Market is estimated to reach USD 37.04 billion by 2034 with a CAGR of 3.75%

The report includes an in-depth analysis of the Global Military Trucks Market, including market size and trends, product mix, Applications, and supplier analysis. Military Trucks Market was valued at USD 25.63 billion in 2024 and is expected to grow at a CAGR of more than 3.75% between 2025 and 2034. The military truck market is experiencing a boom in demand as governments invest more in military vehicles. Governments around the world are devoting significant resources to improve their military capabilities, notably in terms of transportation and logistics. Military trucks are critical components of these investments, acting as the foundation for military logistical operations. These vehicles are built to resist harsh environments, transport troops, and move large equipment and supplies efficiently.

American Rheinmetall Vehicles and GM Defence delivered three truck prototypes for the U.S. Army Common Tactical Truck (CTT) Program's initial phase in February 2024. The partnership's contribution, known as the HX3 CTT, is based on the battle-tested HX family of trucks used by NATO and US-allied nations.

In July 2023, Ashok Leyland, the Hinduja Group's Indian flagship and the major provider of logistics trucks to the Indian military, reported that it had received significant orders for defence vehicles totalling USD 10.67 million.

By Truck Insights

The market is classified into three categories of trucks: light-duty vehicles, medium-duty trucks, and heavy-duty trucks. In 2024, the heavy-duty truck sector held the biggest market share. These tough vehicles are essential for carrying personnel, equipment, and supplies over difficult terrain and in hostile situations. As military operations become more complicated and worldwide, there is an increased demand for heavy-duty trucks capable of withstanding the rigours of modern combat. These vehicles provide critical logistical assistance, keeping armed forces mobile and ready in a variety of operational scenarios.

By Application Insights

The military trucks market is divided into two categories based on their application: cargo and personnel transportation and utility. The cargo and troop transportation segment is predicted to have the highest income by 2034. Military trucks are the backbone of logistical operations, allowing troops, equipment, and supplies to travel through a variety of terrains and combat conditions. These vehicles are built to be durable, versatile, and dependable, ensuring the safe and timely movement of personnel and goods throughout diverse operational theatres.

Regional Insights

In 2024, Asia Pacific dominated the worldwide military truck market, accounting for a largest share. With rising tensions and security concerns, many countries in the area are boosting up their defence capabilities, including updating their military vehicle fleets. Modernisation initiatives, territorial disputes, and geopolitical concerns are all driving up demand. Furthermore, the region's diverse geography, which ranges from dense forests to hilly areas, necessitates the use of specialised military trucks that can operate in such circumstances.

As a result, major manufacturers are seeing a surge in orders for military vehicles suited to the Asia-Pacific region's distinct needs and problems, which is boosting market expansion.

Market Competitive Landscape

Lockheed Martin, Iveco S.p.A., and Daimler AG assert their dominance in the military vehicle business, with the biggest market share due to their comprehensive capabilities and global reach. These organisations provide bespoke solutions for military applications based on their significant experience, robust supply networks, and strategic alliances. Their dedication to quality, dependability, and customer satisfaction keeps them at the forefront of the market, fulfilling the unique needs of armed forces worldwide. Lockheed Martin, Iveco S.p.A., and Daimler AG continue to push innovation and set industry standards, consolidating their position as military truck leaders.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Truck, By Fuel, By Application |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe |

| Companies Covered | AB Volvo, Lockheed Martin, Dailmer AG, Navistar Defense, Iveco S.p.A, General Dynamics Land Systems, Mitsubishi Heavy Industries, Ltd, Oshkosh Corporation, Mahindra Emirates Vehicle Armouring, Renault Trucks Defense. |

Key Topics Covered in the Report

- Global Military Trucks Market Size (FY’2021-FY’2034)

- Overview of Global Military Trucks Market

- Segmentation of Global Military Trucks Market By Truck (Light-Duty Trucks, Medium-Duty Trucks, Heavy-Duty Trucks)

- Segmentation of Global Military Trucks Market By Fuel (Diesel, Natural Gas, Hybrid Electric)

- Segmentation of Global Military Trucks Market By Application (Cargo & Troop Transportation, Utility)

- Statistical Snap of Global Military Trucks Market

- Expansion Analysis of Global Military Trucks Market

- Problems and Obstacles in Global Military Trucks Market

- Competitive Landscape in the Global Military Trucks Market

- Details on Current Investment in Global Military Trucks Market

- Competitive Analysis of Global Military Trucks Market

- Prominent Players in the Global Military Trucks Market

- SWOT Analysis of Global Military Trucks Market

- Global Military Trucks Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analysts

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

`2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Military Trucks Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Military Trucks Market

7. Global Military Trucks Market, By Truck (USD Million) 2021-2034

7.1. Light-duty trucks

7.2. Medium-duty trucks

7.3. Heavy-duty trucks

8. Global Military Trucks Market, By Fuel (USD Million) 2021-2034

8.1. Diesel

8.2. Natural gas

8.3. Hybrid electric

8.4. Others

9. Global Military Trucks Market, By Application (USD Million) 2021-2034

9.1. Cargo & troop transportation

9.2. Utility

10. Global Military Trucks Market Forecast, 2021-2034 (USD Million)

10.1. Global Military Trucks Market Size and Market Share

11. Global Military Trucks Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. AB Volvo

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Lockheed Martin

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Dailmer AG

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Navistar Defense

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Iveco S.p.A

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. General Dynamics Land Systems

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Mitsubishi Heavy Industries, Ltd

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Oshkosh Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Mahindra Emirates Vehicle Armouring

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Renault Trucks Defense

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.