Mobility Scooters Market Introduction and Overview

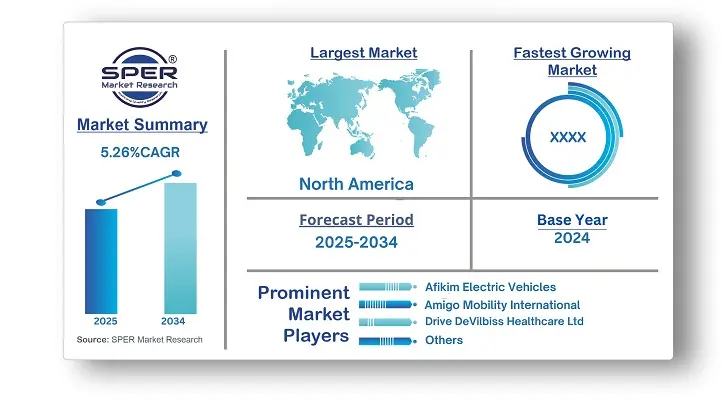

According to SPER Market Research, the Global Mobility Scooters Market is estimated to reach USD 3.69 billion by 2034 with a CAGR of 5.26%.

The report includes an in-depth analysis of the Global Mobility Scooters Market, including market size and trends, product mix, Applications, and supplier analysis. Mobility Scooters Market size was valued at USD 2.21 billion in 2024 and is estimated to grow at a rate of over 5.26% from 2025 to 2034. The increasing aging population worldwide is contributing to this market growth. As people get older, they often face mobility problems due to conditions like arthritis and osteoporosis. Mobility scooters help seniors stay active and independent, allowing them to run errands and socialize, which improves their health. More seniors have financial stability now, enabling them to spend on products like mobility scooters that enhance their quality of life.

By Class Insights

The market is divided into class 1, class 2, and class 3 according to class. In 2024, the class 3 sector dominated the market. Class 3 scooters can typically achieve up to 8 mph (13 km/h), which is faster than Class 1 and Class 2 scooters. Users can travel farther and more effectively over uneven or inclining terrain because to this. These scooters' wide range makes them perfect for going to appointments, running errands, or just taking part in outdoor activities.

By Technology Insights

Based on technology, the mobility scooters market is divided into electric and manual categories. The electric segment had a large market share in 2024. Electric scooters are usually cheaper to operate than gas-powered ones because electricity costs less than gasoline, and electric motors need less maintenance. This leads to significant savings for users over time.

Additionally, electric scooters are much quieter, which benefits users in calm neighborhoods or those who wish to avoid disturbing others. Electric motors are more efficient and waste less energy, allowing for a longer range on a single charge. Many governments offer incentives for Electric Vehicles (EVs), including tax cuts and subsidies, making electric scooters more affordable.

Regional Insights

In 2024, North America accounted for the greatest portion of the global market for mobility scooters. The region has a rapidly aging population, with many reaching retirement age and likely facing mobility issues, increasing the demand for mobility scooters. Significant healthcare spending in North America, especially in the U.S., allows more people to purchase these scooters compared to other regions. Additionally, North American manufacturers are at the forefront of creating innovative scooters with improved features and performance, further boosting the market.

Market Competitive Landscape

The mobility scooter industry is dominated by Invacare Corporation and Pride Mobility Products Corp. Pride Mobility Products Corp. offers mobility scooter customisation and personalisation options, allowing customers to choose from a variety of colours, seating configurations, accessories, and other features to tailor the scooters to their specific mobility needs and personal preferences.

Invacare Corporation plans to strengthen partnerships with healthcare practitioners, rehabilitation centres, and durable medical equipment suppliers in order to supply mobility scooters to people with mobility issues, with the goal of increasing adoption through healthcare recommendations and prescriptions.

Recent Developments:

The WHILL Model Ri, an urban mobility scooter with electronic stability control and an excellent turning radius for active elderly, was introduced in March 2024. It is ISO-certified and offers stability, maneuverability, and portability, making it suitable for busy streets and crowded areas. The Model Ri has a dual motor system, independent suspension, and a stabilizer for electronic stability control, ensuring user safety and comfort.

In January 2024, Bounce teamed with SUN Mobility to deploy 30,000 electric scooters across India, beginning in Bangalore and Hyderabad and expanding to Mumbai, Pune, and Delhi NCR. These electric two-wheelers (e2W) are powered by SUN's battery-swapping network, which allows customers to use charging stations around the country.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Class, By Technology, By Application, By Capacity, By End User |

| Regions covered | merica, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Afikim Electric Vehicles, Amigo Mobility International, Inc, Drive DeVilbiss Healthcare Ltd, Golden Technologies, Invacare Corporation, KYMCO Healthcare, Merits Health Products Co., Ltd, Pride Mobility Products Corp, Sunrise Medical Limited, TGA Mobility.

|

Key Topics Covered in the Report

- Global Mobility Scooters Market Size (FY’2021-FY’2034)

- Overview of Global Mobility Scooters Market

- Segmentation of Global Mobility Scooters Market By Class (Class 1, Class 2, Class 3)

- Segmentation of Global Mobility Scooters Market By Technology (Electric, Manual)

- Segmentation of Global Mobility Scooters Market By Application (Indoor, Outdoor, Off-road)

- Segmentation of Global Mobility Scooters Market By Capacity (Light-Duty, Medium-Duty, Heavy-Duty)

- Segmentation of Global Mobility Scooters Market By End User (Personal, Commercial)

- Statistical Snap of Global Mobility Scooters Market

- Expansion Analysis of Global Mobility Scooters Market

- Problems and Obstacles in Global Mobility Scooters Market

- Competitive Landscape in the Global Mobility Scooters Market

- Details on Current Investment in Global Mobility Scooters Market

- Competitive Analysis of Global Mobility Scooters Market

- Prominent Players in the Global Mobility Scooters Market

- SWOT Analysis of Global Mobility Scooters Market

- Global Mobility Scooters Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

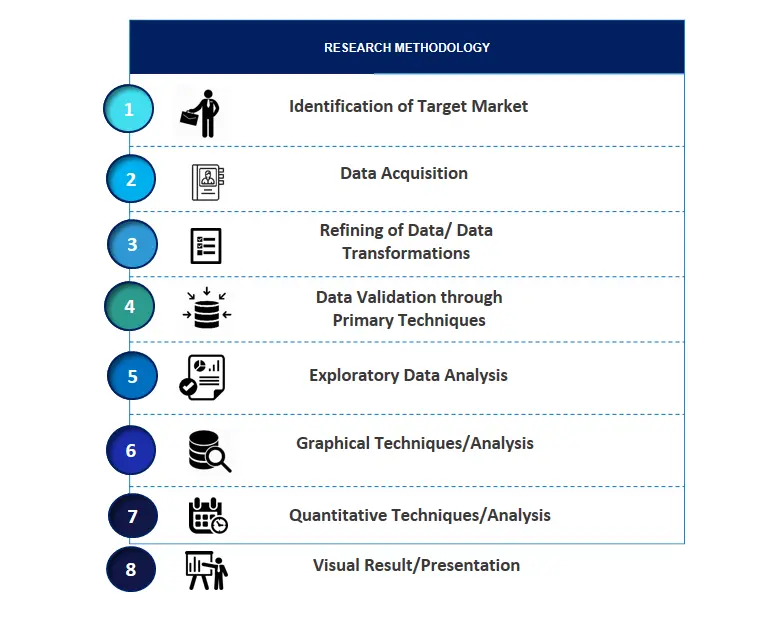

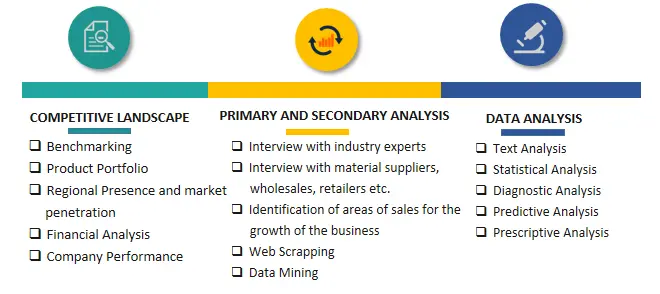

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Mobility Scooters Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Mobility Scooters Market

7. Global Mobility Scooters Market, By Class (USD Million) 2021-2034

7.1. Class 1

7.2. Class 2

7.3. Class 3

8. Global Mobility Scooters Market, By Technology (USD Million) 2021-2034

8.1. Electric

8.2. Manual

9. Global Mobility Scooters Market, By Application (USD Million) 2021-2034

9.1. Indoor

9.2. Outdoor

9.3. Off-road

10. Global Mobility Scooters Market, By Capacity (USD Million) 2021-2034

10.1. Light-duty

10.2. Medium-duty

10.3. Heavy-duty

11. Global Mobility Scooters Market, By End User (USD Million) 2021-2034

11.1. Personal

11.2. Commercial

12. Global Mobility Scooters Market, (USD Million) 2021-2034

12.1. Global Mobility Scooters Market Size and Market Share

13. Global Mobility Scooters Market, By Region, (USD Million) 2021-2034

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. Afikim Electric Vehicles

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Amigo Mobility International, Inc

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. Drive DeVilbiss Healthcare Ltd

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Golden Technologies

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. Invacare Corporation

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. KYMCO Healthcare

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. Merits Health Products Co., Ltd

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. Pride Mobility Products Corp

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Sunrise Medical Limited

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. TGA Mobility

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links