America Solar PV Market Introduction and Overview

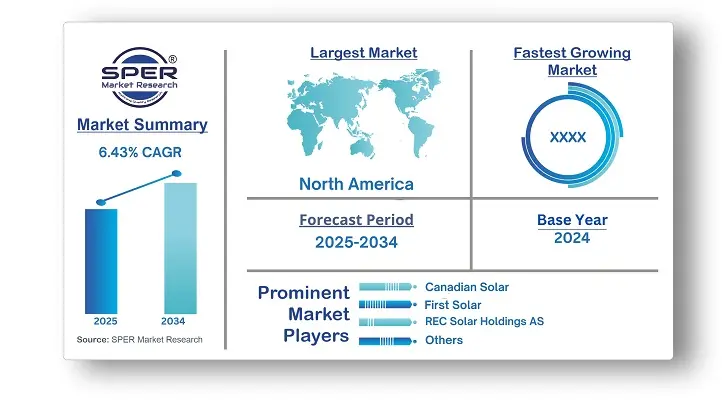

According to SPER Market Research, the North America Solar PV Market is estimated to reach USD 58.15 billion by 2034 with a CAGR of 6.43%.

The report includes an in-depth analysis of the North America Solar PV Market, including market size and trends, product mix, Applications, and supplier analysis. The North American solar PV market was estimated to be worth USD 31.18 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 6.43% between 2025 and 2034. The market outlook will be driven by a spike in solar PV installations as well as increased efforts by utilities, consumers, and corporations to achieve sustainability and carbon reduction targets. Furthermore, PV systems provide a sustainable energy option that reduces environmental effect and helps to battle climate change, aligning with various stakeholders' sustainability goa

By Connectivity Insights

The on-grid solar PV category is anticipated to lead the market in 2024 based on connectivity due to the increasing use of better, more affordable, and scalable units for the creation of large-scale projects. As improved performance systems and components continue to be introduced, the business environment will be enhanced. Major contractors are now able to create projects with increased capacity, which will increase demand for the product, thanks to the notable decrease in the cost of PV components brought about by the increase in taxes and tariffs.

By Mounting Insights

The ground mounted solar PV market is predicted to expand at the quickest compound annual growth rate (CAGR) through 2034 due to rising research and development efforts to lower PV system costs and consumers' shifting preferences towards affordable, sustainable electricity generation. Significant benefits that will increase the product's penetration are reduced operating costs, increased efficiency, improved hybrid operation with other fuels, and better land usage.

By End-User Insights

Utility solar PV accounted for the greatest portion of the market in 2024. The industry landscape will be strengthened by growing interest in reducing reliance on conventional fuels and creating a robust supply chain of materials and components for project development. The business scenario will also be advanced by continuous breakthroughs and product advances, such as bifacial panels, smart inverters, energy storage integration, and solar cells with improved efficiency.

Regional Insights

The US led the North American solar photovoltaic market in 2024. Growing rooftop solar unit installation across establishments and rising need for commercially available, reliable, and efficient solutions would both favourably impact the industry outlook. The business statistics will change as more advantageous government incentives are introduced to increase PV capacity and promote the production of clean electricity.

Market Competitive Landscape

The North America Solar Photovoltaic (PV) Market is competitive, with well-established companies, newcomers, and technology innovators. Key participants include solar PV module manufacturers, system integrators, developers, and energy firms. Leading companies have a strong global presence and provide a variety of solar PV products. They invest in research and development to improve solar panel efficiency. The market includes strategic partnerships, collaborations, and acquisitions to expand market share and geographic reach.

Recent Developments:

First Solar stated in November 2024 that it would expand its manufacturing facility in Ohio, boosting its thin-film solar module production capacity to meet North America's growing demand for renewable energy solutions.

SunPower Corporation unveiled its new high-efficiency solar panels in October 2024, with the goal of providing more energy output for home installations and strengthening the company's commitment to sustainable energy solutions.

In August 2024, NextEra Energy finalised the acquisition of a big solar energy project in Texas, solidifying its position as North America's leading renewable energy provider.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Connectivity, By Mounting, By End-User |

| Regions covered | Canada, Mexico, United States |

| Companies Covered | Canadian Solar, First Solar, GCL-SI, JA SOLAR Technology Co., Ltd, Jinko Solar, LG Electronics, Q CELLS, REC Solar Holdings AS, Solaria Corporation, SunPower Corporation, Trina Solar, Vikram Solar Ltd.

|

Key Topics Covered in the Report

- North America Solar PV Market Size (FY’2021-FY’2034)

- Overview of North America Solar PV Market

- Segmentation of North America Solar PV Market By Connectivity (On Grid, Off Grid)

- Segmentation of North America Solar PV Market By Mounting (Ground Mounted, Rooftop)

- Segmentation of North America Solar PV Market By End-User (Residential, Commercial & Industrial, Utility)

- Statistical Snap of North America Solar PV Market

- Expansion Analysis of North America Solar PV Market

- Problems and Obstacles in North America Solar PV Market

- Competitive Landscape in the North America Solar PV Market

- Details on Current Investment in North America Solar PV Market

- Competitive Analysis of North America Solar PV Market

- Prominent Players in the North America Solar PV Market

- SWOT Analysis of North America Solar PV Market

- North America Solar PV Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. North America Solar PV Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in North America Solar PV Market

7. North America Solar PV Market, By Connectivity (USD Million) 2021-2034

7.1. On Grid

7.2. Off Grid

8. North America Solar PV Market, By Mounting (USD Million) 2021-2034

8.1. Ground Mounted

8.2. Roof-Top

9. North America Solar PV Market, By End User (USD Million) 2021-2034

9.1. Residential

9.2. Commercial & Industrial

9.3. Utility

10. North America Solar PV Market, (USD Million) 2021-2034

10.1. North America Solar PV Market Size and Market Share

11. North America Solar PV Market, By Region, (USD Million) 2021-2034

11.1. Canada

11.2. Mexico

11.3. United States

12. Company Profile

12.1. Canadian Solar

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. First Solar

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. GCL-SI

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. JA SOLAR Technology Co., Ltd

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Jinko Solar

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. LG Electronics

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Q CELLS

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. REC Solar Holdings AS

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Solaria Corporation

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. SunPower Corporation

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Trina Solar

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Vikram Solar Ltd

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.