Nucleic Acid Isolation And Purification Market Introduction and Overview

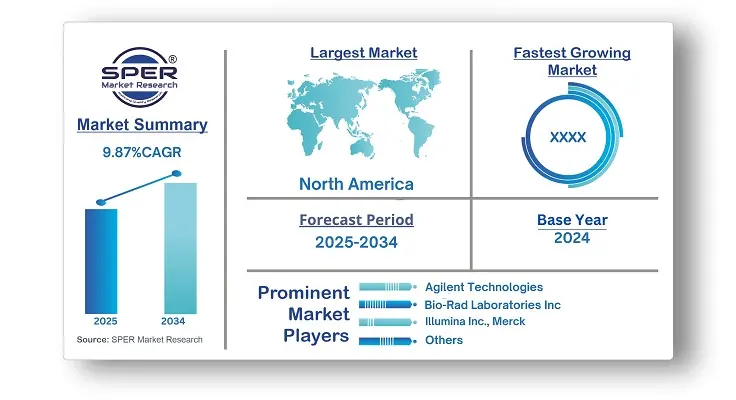

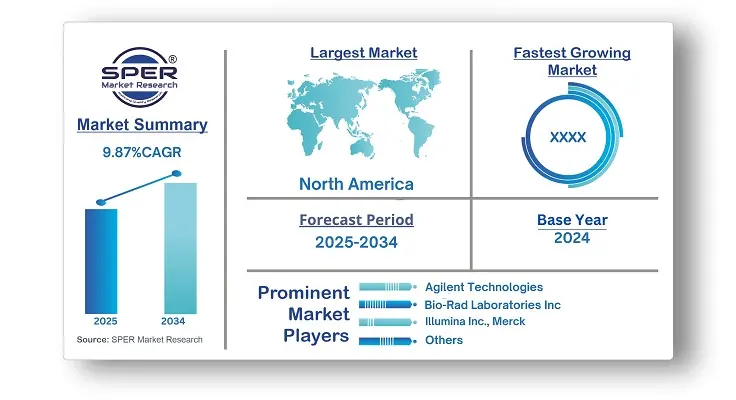

According to SPER Market Research, the Global Nucleic Acid Isolation And Purification Market is estimated to reach USD 14.74 billion by 2034 with a CAGR of 9.87%.

The report includes an in-depth analysis of the Global Nucleic Acid Isolation And Purification Market, including market size and trends, Interface mix, Applications, and supplier analysis. Nucleic acid isolation and purification are essential processes in molecular biology, enabling the extraction of high-quality DNA and RNA for applications in diagnostics, drug discovery, and genomics research. The market is growing due to advancements in biotechnology, increasing demand for personalized medicine, and rising investments in genetic research. The expansion of COVID-19 testing and infectious disease diagnostics has further driven demand for efficient nucleic acid extraction techniques. However, challenges such as high costs of automated purification systems, sample degradation issues, and regulatory complexities hinder market growth. Additionally, the need for standardized protocols and the requirement for high-purity nucleic acids for sensitive downstream applications continue to drive innovation in extraction technologies.

By Product Insights

In 2024, the kits & reagents sector held the largest market share. A large variety of DNA and RNA isolation/extraction and purification kits for sample and library preparation are available in the NAIP market. To meet particular demands, the players are concentrating on launching new products.

By Type Insights

In 2024, the segment that held the largest market share was DNA isolation and purification. Numerous molecular biology applications make use of DNA extraction and purification. Effective extraction and isolation, sufficient DNA for subsequent processes, contamination elimination, and DNA quality and purity are the fundamental requirements that must be fulfilled by every technique for isolating and purifying DNA from any sample. As a result, market participants are spending money on DNA isolation and purification products.

By Method Insights

In 2024, the market was dominated by the magnetic beads category, which had the largest share. Using tiny magnetic beads coated with DNA-binding oxides or antibodies, the magnetic bead method is a highly complex and sophisticated DNA/RNA extraction technique. This technique aids in removing undesirable substances from the sample combination and extracting the purest form of DNA/RNA due to their affinity for DNA molecules. As a result, businesses employ this technique for nucleic acid purification and separation solutions.

By Application Insights

In 2024, the diagnostic sector held the largest market share. This is because normal sample processing is increasingly using DNA and RNA isolation to identify infections. To quickly identify bacteria, for example, PCR techniques are frequently used. This was previously not feasible with conventional microbiological detection methods. As a result, businesses are introducing novel diagnostic tools.

By End Use Insights

In 2024, the hospitals and diagnostics centers segment had the highest revenue share. This is because hospitals and diagnostic centers are increasingly using nucleic acids for a variety of healthcare applications, including genetic fingerprinting, prenatal testing, and liquid biopsies. Certain genetic illnesses, including sickle cell anemia, hemophilia A, fragile X syndrome, cystic fibrosis, Down syndrome, and Tay-Sachs disease, can be effectively diagnosed using DNA and RNA isolation and purification procedures. Therefore, it is anticipated that the inexpensive cost of these technologies would accelerate their uptake in hospitals and diagnostic facilities.

By Regional Insights

In 2024, North America accounted for the greatest revenue share. The region's growth is expected to be driven by the numerous market participants present and their activities. Furthermore, the market is anticipated to be driven throughout the projection period by sustained R&D initiatives, a favorable regulatory environment, and leveraged government backing. Additionally, the local presence of a number of significant U.S. companies, including Agilent Technologies and Thermo Fisher Scientific, Inc., propels technical advancement in the industry. These companies are working hard to create automated techniques for purifying nucleic acids for use in real-time PCR and next-generation sequencing, among other downstream applications.

Market Competitive Landscape

To improve their market position, a lot of businesses are aiming for new launches and approvals. Additionally, they are collaborating and expanding regionally to boost manufacturing capacity and share technologies in order to create effective solutions for nucleic acid separation and purification. Some of the prominent players in Global Nucleic Acid Isolation And Purification Market are Agilent Technologies, Bio-Rad Laboratories Inc., Danaher, F. Hoffmann-La Roche Ltd, Illumina Inc., Merck, Promega Corporation, QIAGEN, Takara Bio Inc., Thermo Fisher Scientific Inc.

Recent Developments:

- In December 2023, Thermo Fisher Scientific Inc. has introduced the Thermo Scientific KingFisher Apex Dx and the Applied Biosystems MagMAX Dx Pathogen/Viral NA Isolation Kit, which separate and purify bacterial and viral pathogens from biological materials.

- In November 2023, LGC Biosearch Technologies has announced the acquisition of PolyDesign, a manufacturer of solid support embedded frits used in DNA/RNA oligonucleotide synthesis and purification. The patented frit technology is compatible with LGC's Nucleic Acid Chemistry product portfolio.

- In August 2023, CD Bioparticles has introduced a new line of DNA extraction and purification kits. The kits are intended for the reliable and quick isolation of DNA, including plasmid DNA, genomic DNA, cell-free DNA (cfDNA), mitochondrial DNA, tissue DNA, and PCR products.

- In July 2023, INOVIQ Limited and Promega Corporation have signed a global collaborative marketing agreement to offer Promega Nucleic Acid purification equipment and EXO-NET exosome capture technology.

- In February 2023, Agilent Technologies, Inc. has selected Fluor Corporation's Advanced Technologies & Life Sciences business to expand its oligonucleotide therapeutics production facility in Colorado. This laboratory allows for the synthesis, lyophilization, and purification of unique nucleic acid therapies.

- In January 2023, QIAGEN has announced the release of the EZ2 Connect MDx platform for automated sample processing in diagnostic labs, which allows for the purification of DNA and RNA from 24 samples simultaneously in under 30 minutes.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Type, By Method, By Application, By End Use |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Agilent Technologies, Bio-Rad Laboratories Inc., Danaher, F. Hoffmann-La Roche Ltd, Illumina Inc., Merck, Promega Corporation, QIAGEN, Takara Bio Inc., Thermo Fisher Scientific Inc.

|

Key Topics Covered in the Report

- Global Nucleic Acid Isolation And Purification Market Size (FY’2021-FY’2034)

- Overview of Global Nucleic Acid Isolation And Purification Market

- Segmentation of Global Nucleic Acid Isolation And Purification Market By Product (Kits & Reagents and Instruments)

- Segmentation of Global Nucleic Acid Isolation And Purification Market By Type (DNA Isolation & Purification and RNA Isolation & Purification)

- Segmentation of Global Nucleic Acid Isolation And Purification Market By Method (Column based, Magnetic Beads, Reagent based and Others)

- Segmentation of Global Nucleic Acid Isolation And Purification Market By Application (Precision Medicine, Diagnostics, Drug Discovery & Development, Agriculture & Animal Research and Other Applications)

- Segmentation of Global Nucleic Acid Isolation And Purification Market By End Use (Academic Research Institutes, Diagnostic Laboratories, Contract Research Organizations, Hospitals & Diagnostic Centers and Other End-use)

- Statistical Snap of Global Nucleic Acid Isolation And Purification Market

- Expansion Analysis of Global Nucleic Acid Isolation And Purification Market

- Problems and Obstacles in Global Nucleic Acid Isolation And Purification Market

- Competitive Landscape in the Global Nucleic Acid Isolation And Purification Market

- Details on Current Investment in Global Nucleic Acid Isolation And Purification Market

- Competitive Analysis of Global Nucleic Acid Isolation And Purification Market

- Prominent Players in the Global Nucleic Acid Isolation And Purification Market

- SWOT Analysis of Global Nucleic Acid Isolation And Purification Market

- Global Nucleic Acid Isolation And Purification Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Nucleic Acid Isolation And Purification Market Manufacturing Base Distribution, Sales Area, Interface Type

6.2. Mergers & Acquisitions, Partnerships, Interface Launch, and Collaboration in Global Nucleic Acid Isolation And Purification Market

7. Global Nucleic Acid Isolation And Purification Market, By Type 2021-2034 (USD Million)

7.1. Kits & Reagents

7.2. Instruments

7.2.1. Manual

7.2.2. Automatic

8. Global Nucleic Acid Isolation And Purification Market, By Type 2021-2034 (USD Million)

8.1. DNA Isolation & Purification

8.1.1. Genomic DNA Isolation & Purification

8.1.2. Plasmid DNA Isolation & Purification

8.1.3. Viral DNA Isolation & Purification

8.1.4. Other

8.2. RNA Isolation & Purification

8.2.1. miRNA Isolation & Purification

8.2.2. mRNA Isolation & Purification

8.2.3. Total RNA Isolation & Purification

8.2.4. Other

9. Global Nucleic Acid Isolation And Purification Market, By Method 2021-2034 (USD Million)

9.1. Column based

9.2. Magnetic Beads

9.3. Reagent based

9.4. Others

10. Global Nucleic Acid Isolation And Purification Market, By Application 2021-2034 (USD Million)

10.1. Precision Medicine

10.2. Diagnostics

10.3. Drug Discovery & Development

10.4. Agriculture and Animal Research

10.5. Other Applications

11. Global Nucleic Acid Isolation And Purification Market, By End Use 2021-2034 (USD Million)

11.1. Academic Research Institutes

11.2. Diagnostic Laboratories

11.3. Contract Research Organizations

11.4. Hospitals and Diagnostic Centers

11.5. Other End-use

12. Global Nucleic Acid Isolation And Purification Market, 2021-2034 (USD Million)

12.1. Global Nucleic Acid Isolation And Purification Market Size and Market Share

13. Global Nucleic Acid Isolation And Purification Market, By Region, 2021-2034 (USD Million)

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. Agilent Technologies

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Interface summary

14.1.4. Recent developments

14.2. Bio-Rad Laboratories Inc.

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Interface summary

14.2.4. Recent developments

14.3. Danaher

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Interface summary

14.3.4. Recent developments

14.4. F. Hoffmann-La Roche Ltd.

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Interface summary

14.4.4. Recent developments

14.5. Illumina Inc.

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Interface summary

14.5.4. Recent developments

14.6. Merck

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Interface summary

14.6.4. Recent developments

14.7. Promega Corporation

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Interface summary

14.7.4. Recent developments

14.8. QIAGEN

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Interface summary

14.8.4. Recent developments

.9. Takara Bio Inc.

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Interface summary

14.9.4. Recent developments

14.10. Thermo Fisher Scientific Inc.

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Interface summary

14.10.4. Recent developments

15. Conclusion

16. List of Abbreviations

17. Reference Links