Pet Insurance Market Introduction and Overview

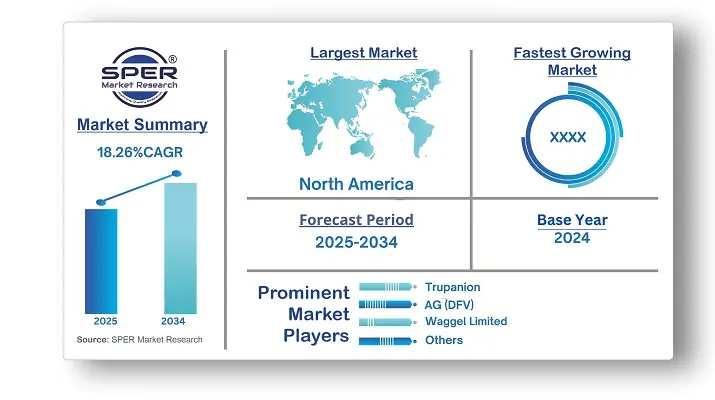

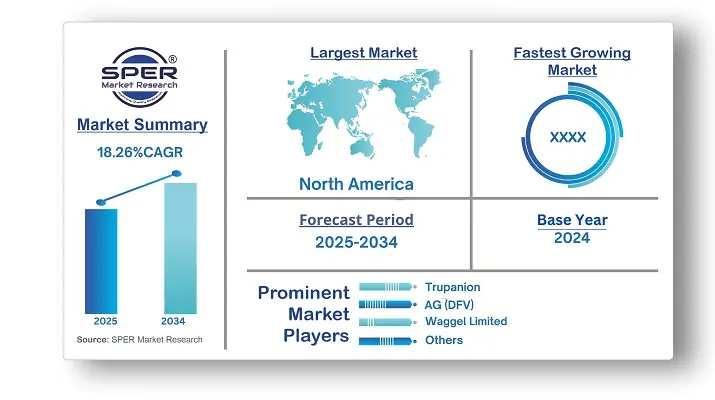

According to SPER Market Research, the Global Pet Insurance Market is estimated to reach USD 98.02 billion by 2034 with a CAGR of 18.26%.

The report includes an in-depth analysis of the Global Pet Insurance Market, including market size and trends, product mix, Applications, and supplier analysis. The growing pet population, increased adoption of insurance in markets with low penetration, rising veterinary care costs, initiatives by leading companies, and the humanization of pets are some of the key factors driving the growth of the pet insurance market. According to the latest findings from the 2024 State of the Industry report by NAPHIA, the number of pets insured in North America has significantly risen compared to previous years. This growth is largely attributed to the rising incidence of diseases in cats and dogs and the ongoing trend of pet adoption. Furthermore, pet insurance is becoming increasingly important to help manage the high costs associated with serious medical conditions such as accidental injuries and cancer, further contributing to market expansion. However, Challenges in the pet insurance market include high customer acquisition costs, low awareness, and concerns over policy coverage limitations and premium affordability.

By Coverage:

The accident and illness segment holds a dominant share of the market due to several key factors, such as the high costs of veterinary treatments and diagnostics, a growing population of companion animals, and increased awareness of the importance of pet insurance. Pet insurance companies generally offer accident and illness policies that provide extensive coverage for a range of conditions, including both acute and chronic diseases, medications, diagnostic tests, and more. Given the broad protection these policies offer pet owners, this segment is expected to continue experiencing strong growth in the near future.

By Animal:

The dogs segment holds the largest share of the market, driven by the widespread adoption of dogs as pets worldwide. For example, a recent study found that a significant portion of households in the U.S. own at least one pet, with a large percentage of those insured pets being dogs, while cats represent a smaller portion of the insured population. The expanding pet population in the region, along with the availability of diverse insurance policies tailored to meet the specific needs of pets, is expected to drive further growth in the market.

By Sales Channel:

The direct sales channel segment holds the largest market share, driven by the significant adoption of direct sales strategies by major pet insurance providers. For instance, Deutsche AG highlighted those direct sales played a key role in their new business growth, marking a notable increase compared to the previous year. Additionally, the company experienced a significant rise in online sales during the same period, further contributing to the growth of this channel.

By Regional Insights

The North America pet insurance market holds the second-largest share in terms of revenue, driven by the growing adoption of pet insurance across the region. This growth is reflected in the substantial increase in premiums for pet insurance in the US and Canada, highlighting a strong upward trend. Meanwhile, the pet insurance market in the Asia Pacific region is expected to grow at a robust pace, fueled by the rising trend of pet adoption and the region's economic development. Additionally, increasing awareness of veterinary health and improvements in veterinary healthcare infrastructure are contributing factors to market growth in this area.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Trupanion, Inc., Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Jab Holding Company, Direct Line, Getsafe GmbH, Waggel Limited, Feather Insurance, Tesco, Sainsbury Bank Plc, Fressnapf Holding SE, MetLife Services and Solutions, LLC.

Recent Developments:

In August 2024, Apollo Insurance, a Canadian insurance broker, introduced a new insurance plan aimed at covering medical expenses for pets, including dogs, cats, and other animals.

In June 2024, Trupanion and Boehringer Ingelheim revealed a partnership aimed at enhancing access to veterinary care by offering Trupanion's clients expert veterinary information and advice curated by Boehringer Ingelheim.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Coverage, By Animal, By Sales Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Trupanion, Inc., Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Jab Holding Company, Direct Line, Getsafe GmbH, Waggel Limited, Feather Insurance, Tesco, Sainsbury Bank Plc, Fressnapf Holding SE, MetLife Services and Solutions, LLC

|

.

Key Topics Covered in the Report

- Global Pet Insurance Market Size (FY’2021-FY’2034)

- Overview of Global Pet Insurance Market

- Segmentation of Global Pet Insurance Market By Coverage (Accident & Illness, Accident only, Others)

- Segmentation of Global Pet Insurance Market By Animal (Dogs, Cats, Others)

- Segmentation of Global Pet Insurance Market By Sales Channel (Agency, Broker, Direct, Bancassurance, Others)

- Statistical Snap of Global Pet Insurance Market

- Expansion Analysis of Global Pet Insurance Market

- Problems and Obstacles in Global Pet Insurance Market

- Competitive Landscape in the Global Pet Insurance Market

- Details on Current Investment in Global Pet Insurance Market

- Competitive Analysis of Global Pet Insurance Market

- Prominent Players in the Global Pet Insurance Market

- SWOT Analysis of Global Pet Insurance Market

- Global Pet Insurance Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Pet Insurance Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Pet Insurance Market

7. Global Pet Insurance Market, By Coverage, (USD Million) 2021-2034

7.1. Accident & Illness

7.2. Accident only

7.3. Others

8. Global Pet Insurance Market, By Animal, (USD Million) 2021-2034

8.1. Dogs

8.2. Cats

8.3. Others

9. Global Pet Insurance Market, By Sales Channel, (USD Million) 2021-2034

9.1. Agency

9.2. Broker

9.3. Direct

9.4. Bancassurance

9.5. Others

10. Global Pet Insurance Market, (USD Million) 2021-2034

10.1. Global Pet Insurance Market Size and Market Share

11. Global Pet Insurance Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Trupanion, Inc.

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Deutsche Familienversicherung AG (DFV)

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Petplan (Allianz)

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Jab Holding Company

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Direct Line

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Getsafe GmbH

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Waggel Limited

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Feather Insurance

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Tesco

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Sainsbury Bank Plc

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Fressnapf Holding SE

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. MetLife Services and Solutions, LLC

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.