Power Management System Market Introduction and Overview

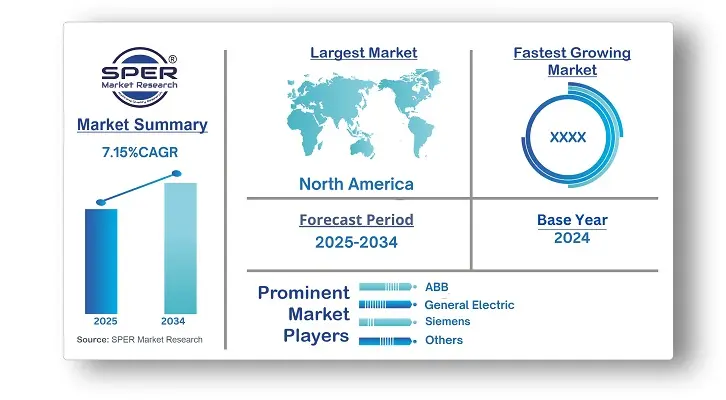

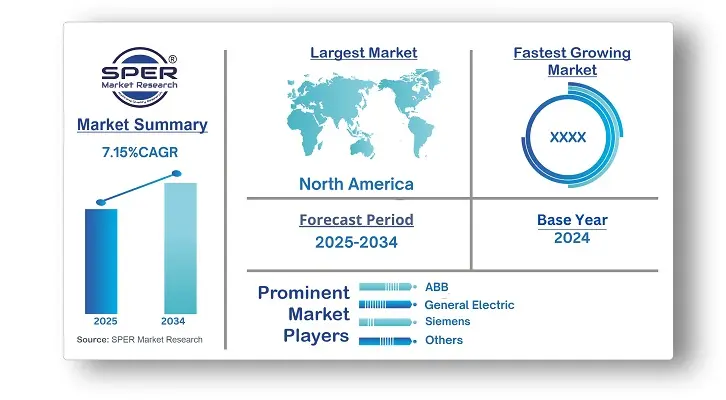

According to SPER Market Research, the Global Power Management System Market is estimated to reach USD 13.10 billion by 2034 with a CAGR of 7.15%.

The report includes an in-depth analysis of the Global Power Management System Market, including market size and trends, product mix, Applications, and supplier analysis. The market for power management systems is growing because of the increasing demand for grid stability, energy efficiency, and the integration of renewable energy sources. Industries like manufacturing, data centers, and utilities depend on these systems to maximize power usage, lower operating costs, and improve reliability. Growing smart grid adoption, government policies encouraging energy conservation, and rising electricity costs are some of the key drivers of this market's growth, but it is also hampered by issues like high initial investment, complex system integration, and cyber security risks. Nevertheless, developments in AI-driven energy management and IoT-enabled monitoring solutions continue to spur innovation, making power management systems vital for sustainable and efficient energy use.

By Component Insights

Power Management System is classified into three categories: Hardware, Software, Services. The market was headed by the hardware sector. As automation becomes more widely used throughout industries, there is a growing need for power management systems. It is projected that during the forecast period, the software segment would experience the fastest CAGR. It is anticipated that the software market would expand as a result of global cloud platforms, IoT, and industry automation.

By Application Insights

The market for Power Management System is segmented based on Applications, including Load Shedding & Management, Power Control & Monitoring, Generator Control, Switching and Safety Management, Power Simulator, Energy Cost Accounting, Data Historian. The segment with the highest CAGR over the forecast period is expected to be power control and monitoring, which includes a network of meters connected to the internet that provide real-time data on the power system in a facility. The segment with the highest global position was load shedding and management, which includes a variety of strategies and technologies that help balance the supply and demand of electricity in a power system.

By End User Insights

The market for Power Management System is divided into many end users, including Oil & Gas, Marine, Metal & Mining, Chemical & Petrochemical, IT & Data Centers, Utilities and Paper & Pulp. The segment with the highest revenue share, according to end-use, was oil and gas. An expansion in oil exploration and production in distant and difficult environments is a result of the rising demand for energy worldwide. The segment with the fastest predicted CAGR is IT & data centers. In the power management market, the IT & Data centers segment has grown as a result of the need for digital services, cloud computing, and data storage.

By Regional Insights

Market dominance was held by North America. Because smart grids and IoT technologies enable improved monitoring and control of energy consumption, their use is propelling the rise of power management systems. The growing need for IoT-enabled technologies has led to major firms investing heavily in new production facilities and power management systems.

Market Competitive Landscape

The industry is marked by fierce competition, with major players implementing tactics like mergers and acquisitions, partnerships, and collaborations to obtain a competitive edge. Leading players in the Power Management System Market are investing in R&D to introduce innovative products and solutions that meet the changing needs of customers. Some of the key market players are ABB, General Electric, Siemens, Eaton, Schneider Electric, Emerson Electric Co., MITSUBISHI HEAVY INDUSTRIES, LTD., Rockwell Automation, Honeywell International Inc., Fuji Electric Co., Ltd., LARSEN & TOUBRO LIMITED and OMRON Corporation.

Recent Developments:

In January 2025, to automate and enhance household energy use, EcoFlow announced Oasis, an AI-powered home energy management system.

In October 2024, General Motors developed its residential energy management products with the launch of the PowerBank home battery unit.

In December 2023, Eaton created the Gigabit Network Card (Network-M3), improving cyber security features in linked backup power solutions.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Component, By Application, By End User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ABB, General Electric, Siemens, Eaton, Schneider Electric, Emerson Electric Co., MITSUBISHI HEAVY INDUSTRIES, LTD., Rockwell Automation, Honeywell International Inc., Fuji Electric Co., Ltd., LARSEN & TOUBRO LIMITED, OMRON Corporation.

|

Key Topics Covered in the Report

- Global Power Management System Market Size (FY'2021-FY'2034)

- Overview of Global Power Management System Market

- Segmentation of Global Power Management System Market By Component (Hardware, Software, Services)

- Segmentation of Global Power Management System Market By Application (Load Shedding & Management, Power Control & Monitoring, Generator Control, Switching and Safety Management, Power Simulator, Energy Cost Accounting, Data Historian)

- Segmentation of Global Power Management System Market By End User (Oil & Gas, Marine, Metal & Mining, Chemical & Petrochemical, IT & Data Centers, Utilities, Paper & Pulp)

- Statistical Snap of Global Power Management System Market

- Expansion Analysis of Global Power Management System Market

- Problems and Obstacles in Global Power Management System Market

- Competitive Landscape in the Global Power Management System Market

- Details on Current Investment in Global Power Management System Market

- Competitive Analysis of Global Power Management System Market

- Prominent Players in the Global Power Management System Market

- SWOT Analysis of Global Power Management System Market

- Global Power Management System Market Future Outlook and Projections (FY'2025-FY'2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Power Management System Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Power Management System Market

7. Global Power Management System Market, By Component 2021-2034 (USD Million)

7.1. Hardware

7.1.1. Controllers

7.1.2. Sensors

7.1.3. Switches, Relays, & Gateways

7.2. Software

7.2.1. Supervisory Control & Data Acquisition (SCADA)

7.2.2. Advanced Distribution Management Components (ADMS)

7.2.3. Outage Management Component (OMS)

7.2.4. Generation Management Components (GMS)

7.3. Services

8. Global Power Management System Market, By Application 2021-2034 (USD Million)

8.1. Load Shedding & Management

8.2. Power Control & Monitoring

8.3. Generator Control

8.4. Switching and Safety Management

8.5. Power Simulator

8.6. Energy Cost Accounting

8.7. Data Historian

9. Global Power Management System Market, By End User 2021-2034 (USD Million)

9.1. Oil & Gas

9.2. Marine

9.3. Metal & Mining

9.4. Chemical & Petrochemical

9.5. IT & Data Centers

9.6. Utilities

9.7. Paper & Pulp

10. Global Power Management System Market, 2021-2034 (USD Million)

10.1. Global Power Management System Market Size and Market Share

11. Global Power Management System Market, By Region, 2021-2034 (USD Million)

.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ABB

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Eaton

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Emerson Electric Co.

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Fuji Electric Co., Ltd.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. General Electric

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Honeywell International Inc.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. LARSEN & TOUBRO LIMITED

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. MITSUBISHI HEAVY INDUSTRIES, LTD.

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. OMRON Corporation

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Rockwell Automation

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links