Global Prediabetes Market Introduction and Overview

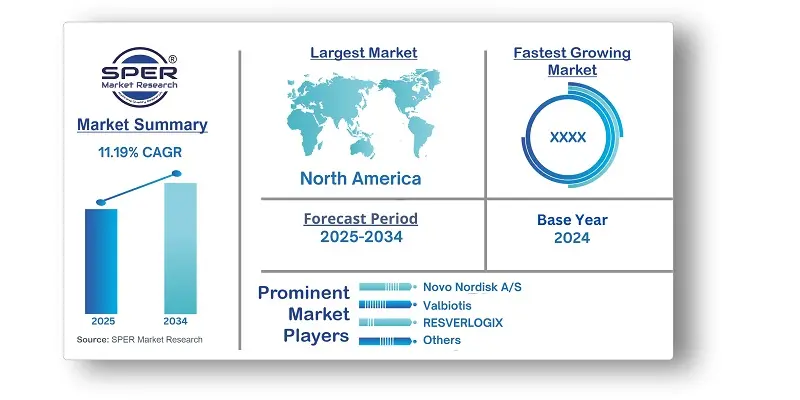

According to SPER Market Research, the Global Prediabetes Market is estimated to reach USD 1021.93 million by 2034 with a CAGR of 11.19%.

The report includes an in-depth analysis of the Global Prediabetes Market, including market size and trends, product mix, Applications, and supplier analysis.The prediabetes market is growing due to increased insulin resistance and impaired glucose metabolism from gene mutations. Prediabetes, characterized by blood sugar levels between 100 and 125 mg/dL, is increasing the demand for effective treatments. The broad adoption of antidiabetic medications such as Metformin—approved by the FDA in 1994 for reducing glucose production and absorption—plays a key role in supporting market growth. The drug’s accessibility in multiple formulations and combinations also helps drive this trend. Nonetheless, limited awareness and frequent underdiagnosis remain major barriers, as a significant number of individuals are unaware they have prediabetes. The limited availability of FDA-approved treatments specifically for prediabetes also poses a significant challenge.

By Drug Class:

Biguanides dominated the 2024 market (78.8% share) due to Metformin's proven ability to manage blood sugar and improve insulin sensitivity. Its affordability, safety profile, and role in preventing type 2 diabetes progression make it a top choice. Increased prediabetes awareness further boosts demand. Conversely, GLP-1 agonists are projected for rapid growth (19.1% CAGR 2025-2030) due to their effectiveness in glycemic control and reducing diabetes risk.

Age Group Analysis

Adults (18-49) held the largest prediabetes market share in 2024 due to growing awareness and risk factors like inactivity, poor diet, and obesity. This health-conscious group actively seeks preventive care, increasing their likelihood of adopting lifestyle changes or medication. The availability of digital health platforms and wellness programs tailored to this demographic offers convenient management and reversal solutions, significantly contributing to the prediabetes industry's expansion.

Regional Insights:

North America led the prediabetes market in 2024, driven by increased GLP-1 agonist use and a stronger focus on personalized treatments. The effectiveness of GLP-1 agonists in controlling blood sugar and aiding weight loss makes them a popular choice for managing prediabetes. Furthermore, the growing trend of personalized medicine, which considers individual genetic makeup and lifestyle, enables more targeted and successful treatment strategies. These advancements contribute to better prediabetes management and market growth in the region.

Market Competitive Landscape

The competitive landscape in the Prediabetes Market is influenced by both new and established competitors. Some of the key market players are Novo Nordisk A/S, Valbiotis, RESVERLOGIX, Caelus Health, Scimar, Boston Pharmaceuticals, APHAIA PHARMA AG, AstraZeneca, Bristol-Myers Squibb Company, Pfizer Inc.

Recent Developments:

Aphaia Pharma reported positive outcomes in June 2024 from their Phase 2 study of APHD-012, an oral glucose formulation intended for prediabetes. The 6-week trial successfully achieved its main goal, demonstrating notable enhancement in glucose tolerance and a favorable safety record.

In September 2023, Novo Nordisk introduced its weight loss injection, Wegovy, to the UK market. This introduction provided a new and innovative treatment option for individuals managing obesity, expanding the availability of effective weight management solutions in the region.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By

Drug Class, By Age Group |

| Regions covered | North America, Latin

America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Novo Nordisk A/S, Valbiotis, RESVERLOGIX, Caelus

Health, Scimar, Boston Pharmaceuticals, APHAIA PHARMA AG, AstraZeneca,

Bristol-Myers Squibb Company, Pfizer Inc. |

Key Topics Covered in the Report

- Global Prediabetes Market Size (FY’2021-FY’2034)

- Overview of Global Prediabetes Market

- Segmentation of Global Prediabetes Market By Drug Class (Diguanide, Thiazolidinediones, Glucagon-like peptide-1 agonists (GLP-1), SGLT2 inhibitors, DPP-4 inhibitors, Others)

- Segmentation of Global Prediabetes Market By Age Group {(Children (12-18 years), Adults (18-49), Elderly (50+)}

- Statistical Snap of Global Prediabetes Market

- Expansion Analysis of Global Prediabetes Market

- Problems and Obstacles in Global Prediabetes Market

- Competitive Landscape in the Global Prediabetes Market

- Details on Current Investment in Global Prediabetes Market

- Competitive Analysis of Global Prediabetes Market

- Prominent Players in the Global Prediabetes Market

- SWOT Analysis of Global Prediabetes Market

- Global Prediabetes Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Prediabetes Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Prediabetes Market

7. Global Prediabetes Market, By Drug Class, (USD Million) 2021-2034

7.1. Diguanide

7.2. Thiazolidinediones

7.3. Glucagon-like peptide-1 agonists (GLP-1)

7.4. SGLT2 inhibitors

7.5. DPP-4 inhibitors

7.6. Others

8. Global Prediabetes Market, By Age Group, (USD Million) 2021-2034

8.1. Children (12-18 years)

8.2. Adults (18-49)

8.3. Elderly (50+)

9. Global Prediabetes Market, (USD Million) 2021-2034

9.1. Global Prediabetes Market Size and Market Share

10. Global Prediabetes Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Novo Nordisk A/S

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Valbiotis

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. RESVERLOGIX

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Caelus Health

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Scimar

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Boston Pharmaceuticals

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. APHAIA PHARMA AG

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. AstraZeneca

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Bristol-Myers Squibb Company

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Pfizer Inc.

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links