Recombinant Protein Therapeutics CDMO Market Introduction and Overview

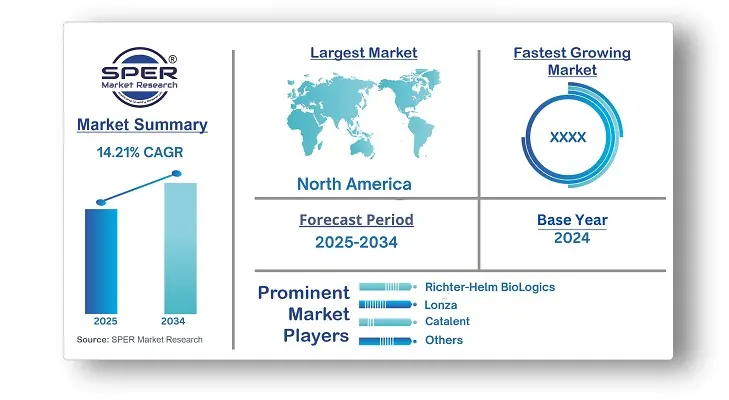

According to SPER Market Research, the Global Recombinant Protein Therapeutics CDMO Market is estimated to reach USD 90.1 billion by 2034 with a CAGR of 14.21%.

The report includes an in-depth analysis of the Global Recombinant Protein Therapeutics CDMO Market, including market size and trends, product mix, Applications, and supplier analysis. The global CDMO market for recombinant protein therapeutics was estimated at USD 23.86 billion in 2024 and is predicted to increase at a compound annual growth rate (CAGR) of 14.21% from 2025 to 2034. This growth is mostly due to the increasing need for biological medications, particularly recombinant protein therapies, to cure illnesses. New methods for producing recombinant protein medications and biotechnology developments also contribute to the market's growth.

By Type Insights

The market is divided into segments: growth hormones, interferons, vaccines, immunostimulating agents, and others. The interferons segment generated the most global revenue in 2024, playing a crucial role in limiting infections. There are three types of interferons: α, β, and γ. The increasing prevalence of diseases is attracting pharmaceutical companies to create new protein therapeutics, leading to more uses of interferons in recombinant treatments for cancers and viral diseases, benefiting the market.

By Source Insights

The market is divided into many groups, including mammalian and microbial systems. Mammalian systems dominated the market and had the largest sales share in 2024. Mammalian cells are commonly used to produce complex human glycoproteins, providing benefits like proper protein folding and modifications after translation. Approximately 60% of therapeutic proteins, particularly antibodies, come from mammalian cells, leading many Contract Development and Manufacturing Organizations (CDMOs) to provide related services. Human retinal cells, CHO, VERO, human embryo kidney, and baby hamster kidney are examples of common cell lines.

By Indication Insights

The market is segmented by indication, including haematological disorders, immunological disorders, metabolic disorders, infectious illnesses, and oncology. In 2024, the segment with the largest market share was metabolic diseases. The rise in metabolic illnesses worldwide is the cause of this growth. Other factors include recombinant protein therapy research, an aging population, and a rise in disease incidence. Urbanisation and changes in lifestyle led to an increase in metabolic illnesses, which fuelled research into treatments.

Regional Insights

The CDMO market for recombinant protein therapies was dominated by North America, which generated the majority of sales in 2024. This is mostly because the United States is the world leader in the production of recombinant protein drugs. The country benefits from strong research and development, a robust biopharmaceutical industry, and advanced manufacturing infrastructure, which includes large-scale production and strict quality control processes.

Over the course of the projection period, the CDMO market for recombinant protein therapeutics in Asia Pacific is expected to expand at the quickest rate. Regional development can be linked to regulatory organisations changing clinical trial evaluation standards to meet global requirements, as well as key firms investing in Asia Pacific.

Get more information on this report: Download Free Sample PDF

Market Competitive Landscape

There is a wide range of participants in the recombinant protein therapies CDMO market, from small businesses to big enterprises. Big international CDMOs that control a sizable amount of the market share include WuXi Biologics, Catalent, and Lonza Group. These companies offer a wide range of services, from early development to large-scale production. They do this by utilising their worldwide presence, vast infrastructure, and varied service offerings to meet the needs of a broad spectrum of clients.

Recent Developments:

In June 2023, Catalent announced the extension of their biologics services platform, OneBio, which includes capabilities for antibody and recombinant protein development and manufacture, cell and gene treatments, and messenger RNA. This strategic move enabled the corporation to expand its offerings and generate more income.

Richter-Helm BioLogics announced in June 2023 that it was expanding its production plant in Bovenau. Additionally, the company will triple production capacity with the two fully equipped and adaptable production trains that have interchangeable product flow installments, enabling late-stage and commercial product capabilities, at an investment of €95 million (USD 103.33 million).

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Source, By Indication |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Richter-Helm BioLogics, Lonza, Catalent, Inc, FUJIFILM Diosynth Biotechnologies, WuXi Biologics, Curia Global, Inc, Batavia Biosciences B.V, HALIX B.V, BIOVIAN, Enzene Biosciences Ltd. |

Key Topics Covered in the Report

- Global Recombinant Protein Therapeutics CDMO Market Size (FY’2021-FY’2034)

- Overview of Global Recombinant Protein Therapeutics CDMO Market

- Segmentation of Global Recombinant Protein Therapeutics CDMO Market By Type (Growth Hormones, Interferons, Vaccines, Immunostimulating Agents, Others)

- Segmentation of Global Recombinant Protein Therapeutics CDMO Market By Source (Mammalian Systems, Microbial Systems, Others)

- Segmentation of Global Recombinant Protein Therapeutics CDMO Market By Indication (Oncology, Infectious Diseases, Immunological Disorders, Metabolic Disorders, Hematological Disorders, Others)

- Statistical Snap of Global Recombinant Protein Therapeutics CDMO Market

- Expansion Analysis of Global Recombinant Protein Therapeutics CDMO Market

- Problems and Obstacles in Global Recombinant Protein Therapeutics CDMO Market

- Competitive Landscape in the Global Recombinant Protein Therapeutics CDMO Market

- Details on Current Investment in Global Recombinant Protein Therapeutics CDMO Market

- Competitive Analysis of Global Recombinant Protein Therapeutics CDMO Market

- Prominent Players in the Global Recombinant Protein Therapeutics CDMO Market

- SWOT Analysis of Global Recombinant Protein Therapeutics CDMO Market

- Global Recombinant Protein Therapeutics CDMO Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2 Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3 Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Recombinant Protein Therapeutics CDMO Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Recombinant Protein Therapeutics CDMO Market

7. Global Recombinant Protein Therapeutics CDMO Market, By Type (USD Million) 2021-2034

7.1. Growth Hormones

7.2. Interferons

7.3. Vaccines

7.4. Immunostimulating Agents

7.5. Others

8. Global Recombinant Protein Therapeutics CDMO Market, By Source (USD Million) 2021-2034

8.1. Mammalian Systems

8.2. Microbial Systems

8.3. Others

9. Global Recombinant Protein Therapeutics CDMO Market, By Indication (USD Million) 2021-2034

9.1. Oncology

9.2. Infectious Diseases

9.3. Immunological Disorders

9.4. Metabolic Disorders

9.5. Haematological Disorders

9.6. Others

10. Global Recombinant Protein Therapeutics CDMO Market, (USD Million) 2021-2034

10.1. Global Recombinant Protein Therapeutics CDMO Market Size and Market Share

11. Global Recombinant Protein Therapeutics CDMO Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Richter-Helm BioLogics

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Lonza

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Catalent, Inc

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. FUJIFILM Diosynth Biotechnologies

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. WuXi Biologics

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Curia Global, Inc

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Batavia Biosciences B.V

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. HALIX B.V

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. BIOVIAN

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Enzene Biosciences Ltd

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links