Rice Syrup Market Introduction and Overview

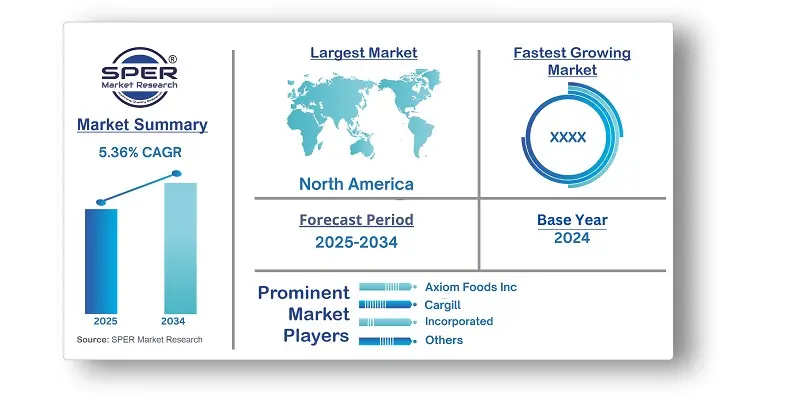

According to SPER Market Research, the Global Rice Syrup Market is estimated to reach USD 3.71 billion by 2034 with a CAGR of 5.36%.

The report includes an in-depth analysis of the Global Rice Syrup Market, including market size and trends, product mix, Applications, and supplier analysis. In 2024, the rice syrup market was valued at USD 2.2 billion, and between 2025 and 2034, it is projected to increase at a compound annual growth rate (CAGR) of 5.36%. Rice syrup consumption is rising mostly due to growing consumer health consciousness. Rice syrup is becoming a popular natural substitute for high-fructose corn syrup and refined sugar. Because it comes naturally from rice, it fits in with the clean food movement, and people who follow vegan and organic diets are increasingly using it.

By Type Insights

In 2024, conventional rice syrup had the highest market share. Traditional rice syrup is quite versatile and may be used in a wide range of foods, such as drinks, baked items, and snacks. Its consistent quality and mild flavour make it a popular option for many applications, which raises demand. Additionally, the need for traditional rice syrup is increasing as processed and convenience meals become more popular, especially in developing countries. Its growing popularity can be attributed to the fact that it is frequently used as a sweetener in a variety of products.

By Application Insights

In 2024, food and drink accounted for the greatest portion of sales. Rice syrup's mild flavour and smooth texture make it an excellent ingredient in a variety of foods, including baked goods, cereals, snacks, and beverages. Its capacity to improve texture, moisture retention, and shelf life without overpowering other flavours has contributed to its growing appeal in the industry. Rice syrup, a natural sweetener with a low glycaemic index, is becoming more popular in the formulation of many food and beverage products.

By Form Insights

The largest market share in 2024 was held by powdered rice syrup. Its powdered form dissolves well in combinations, guaranteeing that finished products have a constant sweetness and texture. When consistency is crucial, such as in baking, snacking, and fast drinks, its solubility is extremely helpful.

The fastest growth is anticipated for liquid rice syrup between 2025 and 2034. It offers a subtle sweetness that increases taste and mouthfeel, and it enhances flavour profiles more effectively than powdered forms. Because of their convenience and adaptability, liquid sweeteners are preferred by both food manufacturers and consumers for mixing and direct application.

By Distribution Channel Insights

Supermarkets and hypermarkets held the most revenue share in 2024. Supermarkets and hypermarkets often stock a wide variety of rice syrup goods to meet the different demands and preferences of its customers. Consumers are asking for traditional rice syrups in powders and liquids. This variety enables customers to compare different brands and items in one location, which improves the purchasing experience.

Regional Insights

In 2024, the North American rice syrup market held the highest revenue share of the worldwide market. The clean label movement, which emphasises simplicity and openness in food components, is becoming more and more popular. Customers seeking cleaner and more recognisable components may find rice syrup appealing as it is seen as a less processed and more natural sweetener than high-fructose corn syrup and artificial sweeteners.

Market Competitive Landscape

The dynamic competitive dynamics of the rice syrup market are influenced by a number of variables, such as changing consumer preferences, regional production capacities, and product innovation. Prominent producers make investments in R&D and technology to produce high-quality, reasonably priced goods.

To bolster their market position and broaden their geographic reach, industry participants are engaging in partnerships, mergers, acquisitions, and joint ventures. In addition, businesses are making sure that they rigorously follow international regulatory standards while educating consumers about the ambiguities of the materials utilised.

Recent Developments:

Rice syrup powder was added to Cargill's plant-based product lineup in 2024. In addition, the business has partnered with organic rice syrup to produce earthy-flavored organic vegan chocolate. With improvements to its Cikande, Indonesia, factory, Cargill has also stated that it will boost its production of organic, non-GMO tapioca syrup, reaching its goal of 12,000 metric tonnes per year by 2024.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application, By Form, By Distribution Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Axiom Foods Inc, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Wuhu Deli Foods Co., Ltd, Habib-ADM Limited, ABF Ingredients (ABFI), Nature Bio-Foods Ltd, WaiLana, Khatoon Industries, California Natural Products. |

Key Topics Covered in the Report

- Global Rice Syrup Market Size (FY’2021-FY’2034)

- Overview of Global Rice Syrup Market

- Segmentation of Global Rice Syrup Market By Type (Organic Rice Syrup, Conventional Rice Syrup)

- Segmentation of Global Rice Syrup Market By Application (Food & Beverage, Infant Formula, Nutritional Supplements, Sauces & Dressings, Others)

- Segmentation of Global Rice Syrup Market By Form (Liquid, Powde)

- Segmentation of Global Rice Syrup Market By Distribution Channel (Supermarkets & Hypermarkets, Convenience stores, Online, Others)

- Statistical Snap of Global Rice Syrup Market

- Expansion Analysis of Global Rice Syrup Market

- Problems and Obstacles in Global Rice Syrup Market

- Competitive Landscape in the Global Rice Syrup Market

- Details on Current Investment in Global Rice Syrup Market

- Competitive Analysis of Global Rice Syrup Market

- Prominent Players in the Global Rice Syrup Market

- SWOT Analysis of Global Rice Syrup Market

- Global Rice Syrup Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Rice Syrup Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Rice Syrup Market

7. Global Rice Syrup Market, By Type (USD Million) 2021-2034

7.1. Organic Rice Syrup

7.2. Conventional Rice Syrup

8. Global Rice Syrup Market, By Application (USD Million) 2021-2034

8.1. Food & Beverage

8.2. Infant Formula

8.3. Nutritional Supplements

8.4. Sauces & Dressings

8.5. Others

9. Global Rice Syrup Market, By Form (USD Million) 2021-2034

9.1. Liquid

9.2. Powder

10. Global Rice Syrup Market, By Distribution Channel (USD Million) 2021-2034

10.1. Supermarkets & Hypermarkets

10.2. Convenience stores

10.3. Online

10.4. Others

11. Global Rice Syrup Market, (USD Million) 2021-2034

11.1. Global Rice Syrup Market Size and Market Share

12. Global Rice Syrup Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Axiom Foods Inc

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Archer Daniels Midland Company (ADM)

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Cargill, Incorporated

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Wuhu Deli Foods Co., Ltd

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

3.5. Habib-ADM Limited

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. ABF Ingredients (ABFI)

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Nature Bio-Foods Ltd

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. WaiLana

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Khatoon Industries

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. California Natural Products

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.