Satellite Modem Market Introduction and Overview

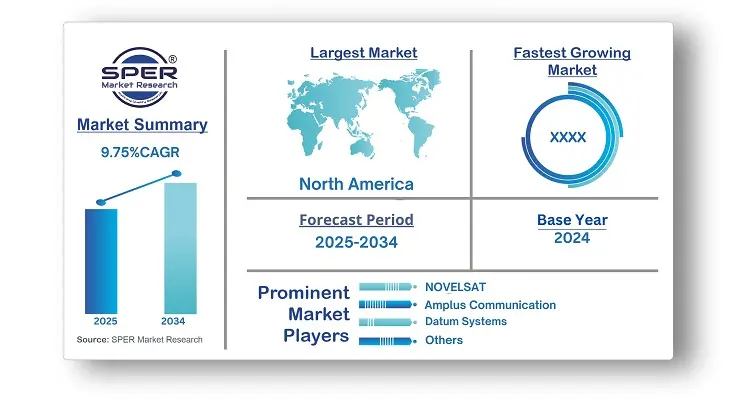

According to SPER Market Research, the Global Satellite Modem Market is estimated to reach USD 1363.48 million by 2034 with a CAGR of 9.75%

The report includes an in-depth analysis of the Global Satellite Modem Market, including market size and trends, product mix, Applications, and supplier analysis. The Satellite Modem market was valued at over USD 537.78 million in 2024 and is expected to grow at a CAGR of more than 9.75% between 2025 and 2034. The increasing usage of satellite networks in military and defence applications is a significant growth factor for the industry. As defence agencies throughout the world rely more on satellite communication for secure and dependable data transmission, there is a growing demand for modern satellite modems that can meet demanding security and performance standards. These modems provide encrypted communication, real-time situational awareness, and command and control capabilities, leading in the creation of specialised, high-performance systems for military needs.

By Channel Type Insights

The satellite modem market is divided into two main types: single channel per carrier (SCPC) modems and multiple channel per carrier (MCPC) modems. The MCPC modem segment is expected to grow significantly.

MCPC modems are becoming more popular because they optimize bandwidth use and improve efficiency in satellite communication. They can transmit various data types like video, audio, and data over the same satellite frequency. This helps maximize limited bandwidth and allows service providers to offer more services and support more users.

MCPC modems provide affordable and scalable satellite communication solutions, making them attractive for broadcasting, telecommunications, and broadband internet access, which drives their market growth.

By End-User Insights

The market is divided based on end-users into various sectors, including energy & utilities, government, marine, media & entertainment, military & defense, mining, oil & gas, telecommunications, transportation & logistics, and others. In 2024, the military & defense segment had the largest market share.

Satellite communication is vital for military operations like command & control, intelligence gathering, and situational awareness due to its secure connectivity. Advances in satellite modem technology enhance security features, meeting the sector's needs. The growth of military satellite constellations and HTS increases the need for high-speed data transmission, driving innovation in the military & defense industry.

Regional Insights

North America dominated the worldwide satellite modem market in 2024. Significant investments in space exploration, satellite communication infrastructure, and military applications are propelling the regional industry forward. Furthermore, rising demand for high-speed internet connection in remote and rural locations is driving the market. Furthermore, the market benefits from technological improvements in the region as well as the strong presence of leading industry competitors. Furthermore, the expansion of satellite-based services in areas such as telecommunications, media, and transportation will increase demand for satellite modems in North America.

Market Competitive Landscape

Viasat, Inc. and Comtech Telecommunications Corp. dominate the market. Viasat, Inc. is a global communications firm that offers satellite-based internet and networking services to residential, commercial, and government customers. The company provides a wide range of satellite modems and related equipment for a variety of applications, such as broadband internet access, in-flight connectivity, military communications, and more. Viasat's considerable experience and innovative technologies contribute significantly to shaping the satellite communication landscape and driving modem industry growth.

Recent Developments:

In April 2024, Hughes Network Systems, part of EchoStar, received a contract from General Atomics Aeronautical Systems, Inc. to produce an important component for the next-generation Satellite Communications system for the MQ-1C Gray Eagle 25M Unmanned Aircraft System. Hughes will supply advanced HM400T modems that enhance endurance and resilience for various Airborne Intelligence, Surveillance, and Reconnaissance mission needs, especially in contested areas.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Channel Type, By Data Rate, By Application, By End-User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Amplus Communication, AYECKA Ltd, Comtech Telecommunications Corp, Datum Systems, Gilat Satellite Networks Ltd, Hughes Network Systems, ND SATCOM, NOVELSAT, ORBCOMM Inc, SatixFy, ST Engineering, Teledyne Technologies, Viasat, Inc. |

Key Topics Covered in the Report

- Global Satellite Modem Market Size (FY’2021-FY’2034)

- Overview of Global Satellite Modem Market

- Segmentation of Global Satellite Modem Market By Channel Type (Single Channel Per Carrier Modem, Multiple Channel Per Carrier Modem)

- Segmentation of Global Satellite Modem Market By Data Rate (High Speed, Mid Range, Entry Level)

- Segmentation of Global Satellite Modem Market By Application (Broadcast, Enterprise & Broadband, In-flight Connectivity, IP Trunking, Mobile & Backhaul, Offshore Communication, Tracking & Monitoring, Others)

- Segmentation of Global Satellite Modem Market By End User (Energy & Utilities, Government, Marine, Media & entertainment, Military & Defense, Mining, Oil & Gas, Telecommunications, Transportation & Logistics, Others)

- Statistical Snap of Global Satellite Modem Market

- Expansion Analysis of Global Satellite Modem Market

- Problems and Obstacles in Global Satellite Modem Market

- Competitive Landscape in the Global Satellite Modem Market

- Details on Current Investment in Global Satellite Modem Market

- Competitive Analysis of Global Satellite Modem Market

- Prominent Players in the Global Satellite Modem Market

- SWOT Analysis of Global Satellite Modem Market

- Global Satellite Modem Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Satellite Modem Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Global Power Rental Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Satellite Modem Market

7. Global Satellite Modem Market, By Channel Type (USD Million) 2021-2034

7.1. Single Channel Per Carrier (SCPC) Modem

7.2. Multiple Channel Per Carrier (MCPC) Modem

8. Global Satellite Modem Market, By Data Rate (USD Million) 2021-2034

8.1. High Speed

8.2. Mid Range

8.3. Entry Level

9. Global Satellite Modem Market, By Application (USD Million) 2021-2034

9.1. Broadcast

9.2. Enterprise & Broadband

9.3. In-flight Connectivity

9.4. IP Trunking

9.5. Mobile & Backhaul

9.6. Offshore Communication

9.7. Tracking & Monitoring

9.8. Others

10. Global Satellite Modem Market, By End User (USD Million) 2021-2034

10.1. Energy & Utilities

10.2. Government

10.3. Marine

10.4. Media & entertainment

10.5. Military & Defense

10.6. Mining

10.7. Oil & Gas

10.8. Telecommunications

10.9. Transportation & Logistics

10.10. Others

11. Global Satellite Modem Market, (USD Million) 2021-2034

11.1. Global Satellite Modem Market Size and Market Share

12. Global Satellite Modem Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Amplus Communication

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. AYECKA Ltd

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Comtech Telecommunications Corp

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Datum Systems

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Gilat Satellite Networks Ltd

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Hughes Network Systems

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. ND SATCOM

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. NOVELSAT

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. ORBCOMM Inc

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. SatixFy

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. ST Engineering

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Teledyne Technologies

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Viasat, Inc

13.13.1. Company details

13.13.2. Financial outlook

13.13.3. Product summary

13.13.4. Recent developments

13.14. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links