Smart Oven Market Introduction and Overview

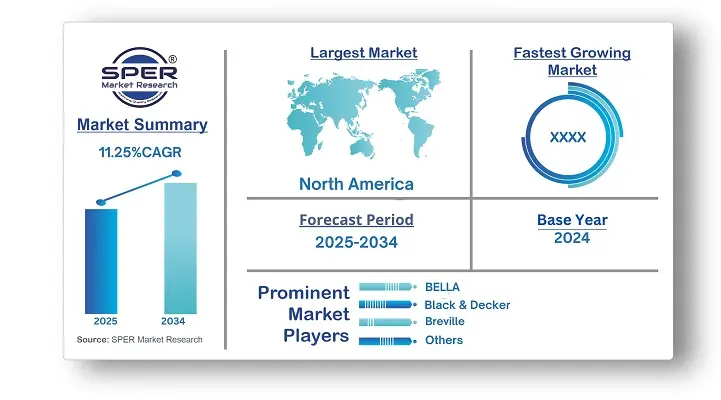

According to SPER Market Research, the Global Smart Oven Market is estimated to reach USD 34930.45 million by 2034 with a CAGR of 11.25%.

The report includes an in-depth analysis of the Global Smart Oven Market, including market size and trends, product mix, Applications, and supplier analysis. Smart Oven Market size was valued at USD 320.4 million in 2024 and is expected to grow at a rate of 11.25% from 2025 to 2034. The increasing preference for convenience and busy lifestyles boosts the demand for small kitchen appliances that simplify cooking. Consumers may also buy other kitchen products like juicers, coffee makers, electric kettles, and microwaves to complement their smart oven, increasing the overall market. Smart ovens provide a quick and easy way to prepare food, which fits with consumers' busy lives.

By Product Type Insights

Based on product type, the market is divided into multi-function and single function. Multi-function dominated the market, having the largest market share in 2024. Multi-function smart ovens are very easy to use and provide many cooking options in one appliance. They can reduce the need for extra kitchen appliances, saving space. This makes them popular for daily use in homes and commercial places like hotels.

Moreover, multi-function smart ovens cook food quickly, which is perfect for busy mornings. Many of these ovens have adjustable settings, such as precise temperature control and programmable options, making cooking faster and saving time and energy.

By Application Insights

The market for smart ovens is divided into two parts based on application: residential and commercial. In 2024, the household segment held a significant market share. Household smart ovens are compact, user-friendly, and more affordable than commercial ones, making them accessible to many people and boosting sales. They are designed for convenience to meet everyday consumer needs and usually require little maintenance, which is ideal for smaller spaces. Modern household smart ovens offer diverse features like convection cooking, precise temperature control, and programmable settings.

Regional Insights

North America dominated the global smart oven market in 2024, as smart ovens are common in kitchens, supporting quick breakfasts in busy lifestyles. The convenience of smart ovens boosts their popularity. North American companies often lead in innovation, introducing features like digital displays, various settings, and smart connectivity options such as temperature probes, sensor control, hands-free operation, voice control, and integration with Alexa. Additionally, the region's high standard of living contributes to a strong demand for household appliances, creating significant opportunities for manufacturers to sell their products in large quantities.

Market Competitive Landscape

Key players in the global smart oven market are investing to expand their manufacturing facilities, which increases their production of advanced ovens. They are also forming collaborations and partnerships to grow their customer base and revenue.

In 2022, Haier launched a new oven with advanced AI technology and innovative PreciTaste features. This high-tech appliance has an automatic start-up sensor for more convenient cooking. With this launch, Haier is broadening its market presence and solidifying its status as a leader in home appliances.

Recent Developments:

Tovala announced in February 2023 that it would be adding the new Tovala smart oven air fryer to its lineup of products. This gadget comes in a sleek, stone-gray colour and has a multi-function mode that ensures optimal cooking.

Panasonic Corporation introduced a new line of small kitchen equipment in January 2022, including a smart microwave oven that can be controlled via Alexa for hands-free and distant cooking mode.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product Type, By Structure Type, By Connectivity, By Application, By Distribution Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | BELLA, Black & Decker, Breville, Cuisinart. De’Longhi S.p.A, Dualit, Hamilton Beach, Kenmore, KitchenAid, Krups, Panasonic Corporation, Sunbeam.

|

Key Topics Covered in the Report

- Global Smart Oven Market Size (FY’2021-FY’2034)

- Overview of Global Smart Oven Market

- Segmentation of Global Smart Oven Market By Product Type (Multi Function, Single Function)

- Segmentation of Global Smart Oven Market By Structure Type (Built-in, Countertop)

- Segmentation of Global Smart Oven Market By Connectivity (Bluetooth, Wi-Fi, Near-Field Communication)

- Segmentation of Global Smart Oven Market By Application (Household, Commercial)

- Segmentation of Global Smart Oven Market By Distribution Channel (Online, Offline)

- Statistical Snap of Global Smart Oven Market

- Expansion Analysis of Global Smart Oven Market

- Problems and Obstacles in Global Smart Oven Market

- Competitive Landscape in the Global Smart Oven Market

- Details on Current Investment in Global Smart Oven Market

- Competitive Analysis of Global Smart Oven Market

- Prominent Players in the Global Smart Oven Market

- SWOT Analysis of Global Smart Oven Market

- Global Smart Oven Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Smart Oven Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Smart Oven Market

7. Global Smart Oven Market, By Product Type (USD Million) 2021-2034

7.1. Multi Function

7.2. Single Function

8. Global Smart Oven Market, By Structure Type (USD Million) 2021-2034

8.1. Built-in

8.2. Countertop

9. Global Smart Oven Market, By Connectivity (USD Million) 2021-2034

9.1. Bluetooth

9.2. Wi-Fi

9.3. Near-Field Communication (NFC)

10. Global Smart Oven Market, By Application (USD Million) 2021-2034

10.1. Household

10.2. Commercial

11. Global Smart Oven Market, By Distribution Channel (USD Million) 2021-2034

11.1. Online

11.2. Offline

11.2.1. Supermarkets/hypermarkets

11.2.2. Convenience stores

11.2.3. Specialty Stores/Brand Stores

12. Global Smart Oven Market, (USD Million) 2021-2034

12.1. Global Smart Oven Market Size and Market Share

13. Global Smart Oven Market, By Region, (USD Million) 2021-2034

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. BELLA

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. Black & Decker

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. Breville

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Cuisinart

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. De’Longhi S.p.A

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. Dualit

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. Hamilton Beach

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. Kenmore

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. KitchenAid

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. Krups

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Panasonic Corporation

14.11.1. Company details

14.11.2. Financial outlook

14.11.3. Product summary

14.11.4. Recent developments

14.12. Sunbeam

14.12.1. Company details

14.12.2. Financial outlook

14.12.3. Product summary

14.12.4. Recent developments

14.13. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links