Swine Feed Market Introduction and Overview

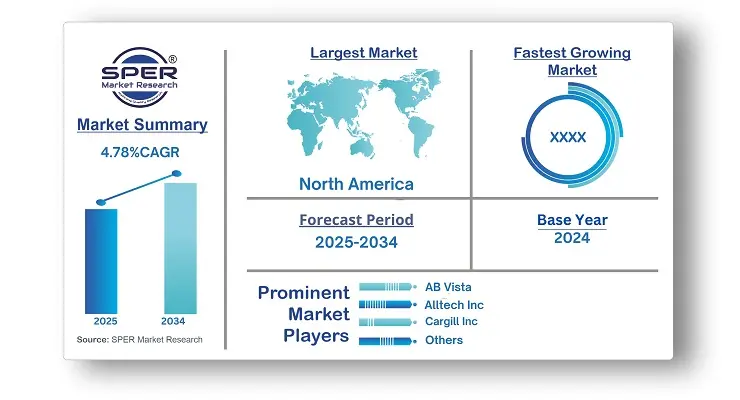

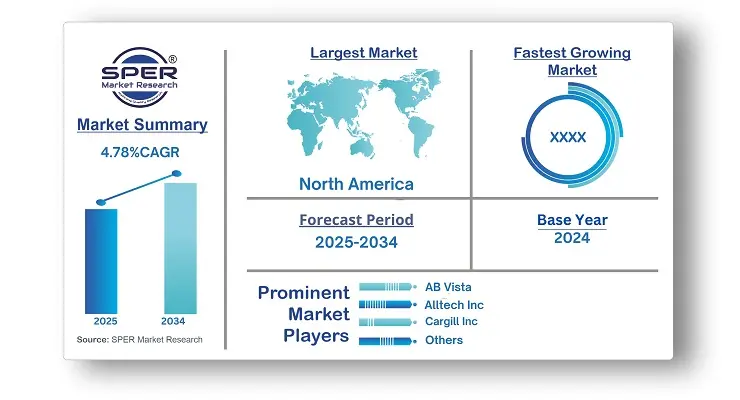

According to SPER Market Research, the Global Swine Feed Market is estimated to reach USD 173.03 billion by 2034 with a CAGR of 4.78%.

The report includes an in-depth analysis of the Global Swine Feed Market, including market size and trends, product mix, Applications, and supplier analysis. The growing demand for pork, especially in regions like Asia, is driving the expansion of the swine feed industry. The market offers various feed types, including starter, grower, finisher, and lactation feeds, formulated to provide essential nutrients such as protein, energy, vitamins, and minerals for optimal swine growth and health. Advances in feed technology, such as the inclusion of enzymes, probiotics, and prebiotics, enhance feed efficiency and swine performance. Sustainability concerns and regulations on feed composition and additives also impact market trends. As global populations and middle classes rise, particularly in Asia and North America, the need for quality swine feed grows, fueled by increasing pork consumption and awareness of its nutritional benefits. However, The swine feed market faces challenges such as fluctuating raw material prices and the need to meet sustainability and regulatory standards. Additionally, balancing feed efficiency with animal health and performance remains a key concern.

By Ingredients:

The swine feed market is primarily driven by ingredients like corn, soybean meal, oats, rice bran, cassava, vegetables, sorghum, and wheat. Corn and soybean meal dominate the market due to their high nutritional value and availability, with corn serving as a key energy source and soybean meal providing essential proteins for swine growth. Oats and wheat contribute additional energy and fiber to diets, while rice bran and cassava offer alternative nutrients, especially in regions where these ingredients are readily available. These diverse ingredients support the nutritional needs of swine at different growth stages.

By Type:

The swine feed market is divided into starter feed, sow feed, and grower feed. Starter feed holds the largest market share, playing a crucial role in providing essential nutrients for piglet development and aiding their transition from sow’s milk to solid food. Sow feed, tailored for pregnant and lactating sows, also maintains a significant share, as it supports the reproductive health of sows and ensures proper piglet development during gestation and lactation. These feed types are essential for promoting the health and growth of swine at various life stages.

By Form:

The swine feed market is divided into pellets, mash, and crumbles. Pellets hold the largest market share due to their compressed and uniform shape, making them easy to handle and feed to swine. They offer precise control over feed intake and nutrient consumption, promoting efficient feed use and reducing waste. Mash, made up of finely ground ingredients in a loose form, also maintains a significant market share. It provides flexibility in feed formulation and is favored by producers who wish to customize diets or incorporate additives with ease.

By Regional Insights

Asia Pacific led the global swine feed market in 2023, driven by a large, growing population and increasing disposable incomes, resulting in significant demand for pork products. China, in particular, plays a central role in the region, being the world’s largest consumer and producer of pork. The demand for swine feed in China is largely driven by its expansive swine farming industry, which not only meets domestic consumption needs but also supports export markets. This growing demand in the region continues to fuel the market for swine feed.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are AB Vista, Alltech Inc., Archer Daniel Midland (ADM) Company, Cargill Inc., Chr Hansen, CPF Worldwide, DLG, ForFarmers UK, Growel Agrovet Private Limited, KENT Feeds, Nutreco, Pancosma, and others.

Recent Developments:

In January 2023, Cargill enhanced its partnership with BASF in the field of animal nutrition, focusing on research, development, and expanding market access for feed enzymes. This strengthened collaboration aimed to create and deliver enzyme products and solutions tailored to customers, benefiting a range of animals, including swine.

In July 2023, Elanco Animal Health Incorporated announced the integration of Microtracer technology into Skycis 100, a feed additive aimed at improving weight gain in growing-finishing swine.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Ingredients, By Type, By Form |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | AB Vista, Alltech Inc., Archer Daniel Midland (ADM) Company, Cargill Inc., Chr Hansen, CPF Worldwide, DLG, ForFarmers UK, Growel Agrovet Private Limited, KENT Feeds, Nutreco, Pancosma, and others.

|

Key Topics Covered in the Report

- Global Swine Feed Market Size (FY’2021-FY’2034)

- Overview of Global Swine Feed Market

- Segmentation of Global Swine Feed Market By Ingredients (Corn, Soyabean Meal, Oats, Rice bran, Cassava, Vegetables, Sorghum, Wheat, Other)

- Segmentation of Global Swine Feed Market By Type (Starter feed, Sow feed, Grower feed)

- Segmentation of Global Swine Feed Market By Form (Pellets, Mash, Crumbles)

- Statistical Snap of Global Swine Feed Market

- Expansion Analysis of Global Swine Feed Market

- Problems and Obstacles in Global Swine Feed Market

- Competitive Landscape in the Global Swine Feed Market

- Details on Current Investment in Global Swine Feed Market

- Competitive Analysis of Global Swine Feed Market

- Prominent Players in the Global Swine Feed Market

- SWOT Analysis of Global Swine Feed Market

- Global Swine Feed Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Swine Feed Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Swine Feed Market

7. Global Swine Feed Market, By Ingredients, (USD Million) 2021-2034

7.1. Corn

7.2. Soyabean Meal

7.3. Oats

7.4. Rice bran

7.5. Cassava

7.6. Vegetables

7.7. Sorghum

7.8. Wheat

7.9. Other

8. Global Swine Feed Market, By Type, (USD Million) 2021-2034

8.1. Starter feed

8.2. Sow feed

8.3. Grower feed

9. Global Swine Feed Market, By Form, (USD Million) 2021-2034

9.1. Pellets

9.2. Mash

9.3. Crumbles

10. Global Swine Feed Market, (USD Million) 2021-2034

10.1. Global Swine Feed Market Size and Market Share

11. Global Swine Feed Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

.1. AB Vista

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Alltech Inc.

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Archer Daniel Midland (ADM) Company

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Cargill Inc.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Chr Hansen

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. CPF Worldwide

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. DLG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. ForFarmers UK

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Growel Agrovet Private Limited

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

.10. KENT Feeds

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Nutreco

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Pancosma

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.