thc-water-market Introduction and Overview

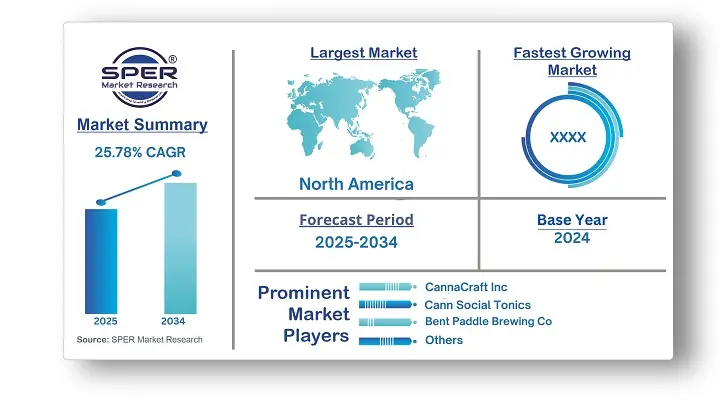

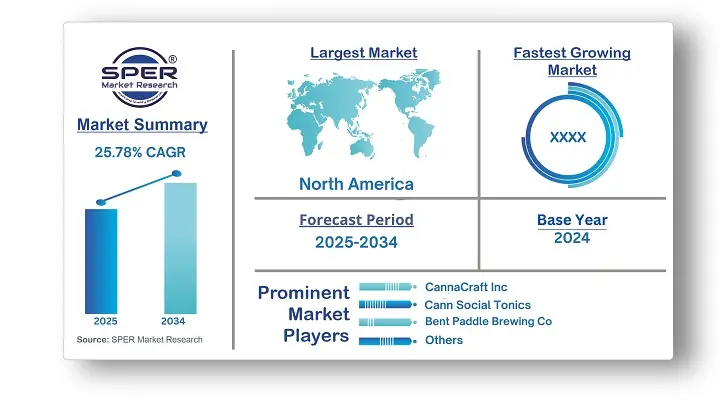

According to SPER Market Research, the Global THC Water Market is estimated to reach USD 843.95 million by 2034 with a CAGR of 25.78%.

The report includes an in-depth analysis of the Global THC Water Market, including market size and trends, product mix, Applications, and supplier analysis. The market for THC water is growing in popularity as a discreet, smokeless, and practical way to experience the benefits of THC alternative to traditional cannabis use. The increased demand for functional beverages from consumers, the legalization of cannabis, and the trend toward healthier consumption are the main drivers of this industry. Both recreational and wellness-conscious users find THC-infused water appealing because it promises therapeutic and relaxing effects. However, there are obstacles such as intricate regulatory structures, uneven dosage guidelines, and the requirement for cutting-edge water-soluble THC technology to guarantee stability and effectiveness. Further impeding market expansion are distribution limitations and low consumer awareness, but continued innovations and legislative developments are anticipated to support future growth.

By Flavor Insights

THC Water is classified into four categories based on Flavor: Citrus, Berry, Tropical, Herbal. The market for THC water with a citrus Flavor is dominated. Due to a mix of consumer preferences, sensory appeal, and market trends that support such flavors, citrus-flavored THC water is currently ruling the global market. The market for THC water with a berry Flavor is anticipated to expand rapidly. Berries are frequently linked to cleanliness, freshness, and a restorative impact.

By Distribution Channel Insights

The market for THC Water is segmented based on Distribution Channel, including Hypermarkets & Supermarkets, Specialty Stores and Online. Supermarkets and hypermarkets are the main outlets for THC water sales. Supermarkets and hypermarkets provide customers with unparalleled specialty. Customers no longer need to make separate journeys to specialty shops or specialist dispensaries because they can get THC water while they're doing their usual supermarket shopping. It is anticipated that demand for THC water via internet retail channels will increase at a substantial CAGR. Online merchants frequently provide special promotions and low pricing that are unavailable in physical stores.

By Regional Insights

The THC water market is dominated in North America. A significant factor impacting the THC water market is the continuous legalization of cannabis throughout North America. The market for cannabis products infused with THC, such as THC water, is expanding quickly as more states and provinces legalize cannabis for both medical and recreational purposes. In addition to improving consumer access, this legal extension expands market prospects for both established and emerging businesses.

Market Competitive Landscape

Manufacturers in the market for THC water are using a range of tactics to take advantage of the growing demand for drinks that include cannabis. These tactics are complex, emphasizing marketing campaigns, strategic alliances, product innovation, and regulatory compliance to maintain a competitive edge in the changing market. Some of the key market players are CannaCraft Inc., Cann Social Tonics, Keef Brands, Bent Paddle Brewing Co, Drink Delta, Sensi Co., Calexo, Snapdragon Hemp, WLD WTR and Climbing Kites.

Recent Developments:

In December 2024, Houseplant, a lifestyle brand controlled by Seth Rogen, released a flavored sparkling water with THC in the United States, providing a smokeless, low-dose cannabis consumption option.

In November 2024, According to a report, marijuana companies including Green Thumb Industries and Tilray Brands are investigating THC products made from hemp that might increase market share but present legal challenges.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Flavor, By Distribution Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | CannaCraft Inc., Cann Social Tonics, Keef Brands, Bent Paddle Brewing Co, Drink Delta, Sensi Co., Calexo, Snapdragon Hemp, WLD WTR, Climbing Kites. |

Key Topics Covered in the Report

- Global THC Water Market Size (FY’2021-FY’2034)

- Overview of Global THC Water Market

- Segmentation of Global THC Water Market By Flavor (Citrus, Berry, Tropical, Herbal)

- Segmentation of Global THC Water Market By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online)

- Statistical Snap of Global THC Water Market

- Expansion Analysis of Global THC Water Market

- Problems and Obstacles in Global THC Water Market

- Competitive Landscape in the Global THC Water Market

- Details on Current Investment in Global THC Water Market

- Competitive Analysis of Global THC Water Market

- Prominent Players in the Global THC Water Market

- SWOT Analysis of Global THC Water Market

- Global THC Water Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global THC Water Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global THC Water Market

7. Global THC Water Market, By Flavor 2021-2034 (USD Million)

7.1. Citrus

7.2. Berry

7.3. Tropical

7.4. Herbal

8. Global THC Water Market, By Distribution Channel 2021-2034 (USD Million)

8.1. Hypermarkets & Supermarkets

8.2. Specialty Stores

8.3. Online

9. Global THC Water Market, 2021-2034 (USD Million)

9.1. Global THC Water Market Size and Market Share

10. Global THC Water Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Bent Paddle Brewing Co.

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Calexo

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. CannaCraft Inc.

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Cann Social Tonics.

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Climbing Kites.

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Drink Delta

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Keef Brands

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Sensi Co.

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Snapdragon Hemp

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. WLD WTR

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.