Thrombosis Drugs Market Introduction and Overview

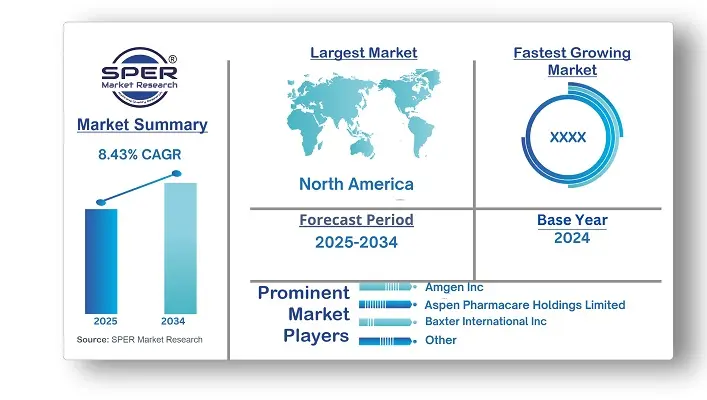

According to SPER Market Research, the Global Thrombosis Drugs Market is estimated to reach USD 76 billion by 2034 with a CAGR of 8.43%.

The report includes an in-depth analysis of the Global Thrombosis Drugs Market, including market size and trends, product mix, Applications, and supplier analysis. The market for thrombosis drugs was expected to be worth USD 33.83 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 8.43% from 2025 to 2034. Numerous factors, such as continuous improvements in drug development, a rise in the incidence of thrombotic disorders, an aging population, an increase in the number of surgical procedures, and the continuous rise in healthcare spending, are responsible for this strong market growth.

By Drug Class Insights

The drug market is divided into three main categories: anticoagulants, antiplatelet drugs, and thrombolytic drugs. The anticoagulants segment includes direct oral anticoagulants, heparin, vitamin K antagonists, and Xa inhibitors, and it was the largest segment in 2024. Technological developments in diagnostic imaging, laboratory tests, and point-of-care testing are improving the early diagnosis and monitoring of thrombotic disorders. These advancements help healthcare providers identify patients at high risk for thrombotic events and customize anticoagulant therapy based on individual needs. Increased awareness among healthcare professionals and patients about thrombosis prevention also boosts the market for anticoagulants. Educational campaigns and guidelines raise knowledge about thrombotic symptoms and treatment, promoting early detection and proper use of anticoagulants.

By Disease Type Insights

The thrombosis drugs market is categorized by disease type, including venous thromboembolism (VTE), deep vein thrombosis, pulmonary embolism, arterial thrombosis, and other conditions. The VTE segment had the largest market share in 2024 and is expected to grow significantly in the coming years. Ongoing research is leading to new thrombosis drugs for VTE prevention and treatment. Novel oral anticoagulants, including factor Xa inhibitors and direct thrombin inhibitors, offer effective alternatives to traditional options like warfarin. The introduction of these new medications with better efficacy and safety profiles encourages market growth in the VTE segment. Pharmaceutical companies are also pursuing expanded uses for existing drugs through clinical trials, allowing for broader patient access.

By Route of Administration Insights

The thrombosis drugs market is divided into oral, parenteral, and topical segments. In 2024, oral drugs held the largest share because they are easy and convenient for patients to take at home. This method allows patients to self-administer medication, reducing the need for frequent healthcare visits and improving adherence to treatment. As a result, it can lead to better health outcomes and lower costs related to hospital stays and complications. By enabling outpatient management, oral medications also reduce the demand for healthcare resources, thus improving overall healthcare efficiency and supporting market growth.

Regional Insights

North America led the thrombosis drugs market in 2024 and is expected to see significant growth. The region has a strong focus on pharmaceutical research and development, with many biopharmaceutical companies and academic institutions involved in discovering new thrombosis drugs and conducting clinical trials. There is a robust pipeline of investigational drugs like new anticoagulants, antiplatelet agents, and thrombolytic drugs. High healthcare spending, driven by technology, treatment costs, and insurance, supports the use of thrombosis drugs for preventing and managing thrombotic disorders. This expenditure enhances the adoption of these drugs in clinical practice.

Market Competitive Landscape

There is intense competition among large international corporations as well as smaller and mid-sized businesses in the thrombosis medication market. Using a variety of technologies, a central market strategy entails ongoing innovation and the launch of cutting-edge products. By satisfying medical demands and gaining market share, this strategy seeks to obtain a competitive advantage. All things considered, in the fiercely competitive thrombosis medication market, innovation is still a key tactic.

Recent Developments:

In April 2024, Cadrenal Therapeutics Inc. announced that the FDA granted Orphan Drug Designation (ODD) to tecarfarin. This designation is for preventing thromboembolism and thrombosis in patients with different implanted mechanical circulatory support devices, such as LVADs, RVADs, biventricular assist devices, and total artificial hearts.

In February 2024, Bayer started a Phase II clinical trial called the SIRIUS study for BAY3018250, an anti-alpha2 antiplasmin antibody for deep vein thrombosis patients, indicating it could be a promising therapy.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Drug Class, By Disease Type, By Route of Administration, By Distribution Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Amgen Inc, Aspen Pharmacare Holdings Limited, Baxter International Inc, Bayer AG, Boehringer Ingelheim GmbH, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Limited, GlaxoSmithKline plc, Janssen Pharmaceuticals, Inc, Novartis AG, Pfizer Inc.

|

Key Topics Covered in the Report

- Global Thrombosis Drugs Market Size (FY’2021-FY’2034)

- Overview of Global Thrombosis Drugs Market

- Segmentation of Global Thrombosis Drugs Market By Drug Class (Anticoagulants, Antiplatelet Drugs, Thrombolytic Drugs)

- Segmentation of Global Thrombosis Drugs Market By Disease Type (Venous thromboembolism, Deep vein thrombosis, Pulmonary embolism, Arterial thrombosis, Other disease types)

- Segmentation of Global Thrombosis Drugs Market By Route of Administration (Oral, Parenteral, Topical)

- Segmentation of Global Thrombosis Drugs Market By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies)

- Statistical Snap of Global Thrombosis Drugs Market

- Expansion Analysis of Global Thrombosis Drugs Market

- Problems and Obstacles in Global Thrombosis Drugs Market

- Competitive Landscape in the Global Thrombosis Drugs Market

- Details on Current Investment in Global Thrombosis Drugs Market

- Competitive Analysis of Global Thrombosis Drugs Market

- Prominent Players in the Global Thrombosis Drugs Market

- SWOT Analysis of Global Thrombosis Drugs Market

- Global Thrombosis Drugs Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2 .Market segment analysis

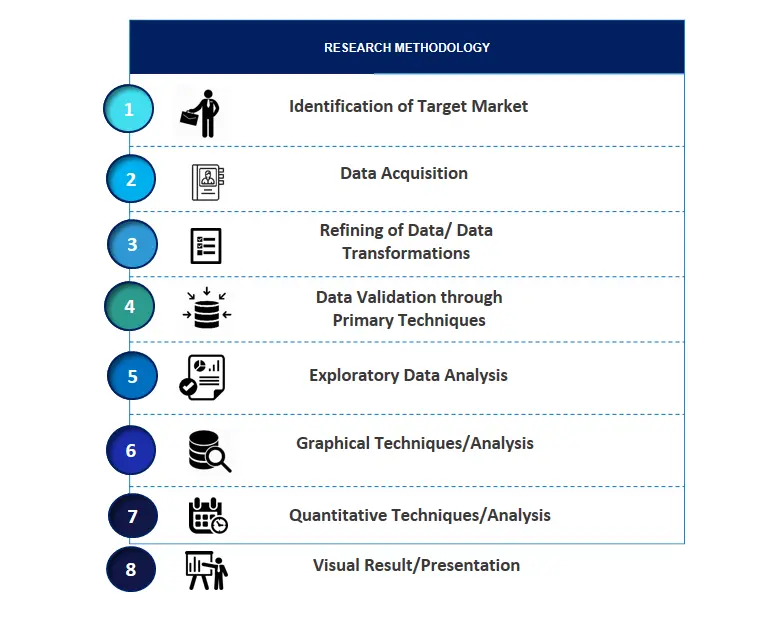

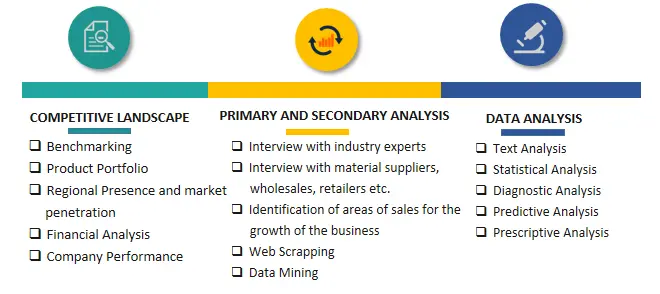

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4 .Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 .Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3.PORTER Five Forces

5.3.1.Bargaining power of suppliers

5.3.2.Bargaining power of buyers

5.3.3.Threat of Substitute

5.3.4.Threat of new entrant

5.3.5.Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Thrombosis Drugs Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Thrombosis Drugs Market

7. Global Thrombosis Drugs Market, By Drug Class (USD Million) 2021-2034

7.1. Anticoagulants

7.1.1. Direct oral anticoagulants

7.1.2. Heparin

7.1.3. Vitamin K antagonists

7.1.4. Xa Inhibitor

7.2. Antiplatelet drugs

7.2.1. P2Y12 platelet inhibitor

7.2.2. Aspirin

7.2.3. Glycoprotein IIb/IIIa inhibitors

7.3. Thrombolytic drugs

8. Global Thrombosis Drugs Market, By Disease Type (USD Million) 2021-2034

8.1. Venous thromboembolism

8.2. Deep vein thrombosis

8.3. Pulmonary embolism

8.4. Arterial thrombosis

8.5. Other disease types

9. Global Thrombosis Drugs Market, By Route of Administration (USD Million) 2021-2034

9.1. Oral

9.2. Parenteral

9.3. Topical

10. Global Thrombosis Drugs Market, By Distribution Channel (USD Million) 2021-2034

10.1. Hospital pharmacies

10.2. Retail pharmacies

10.3. Online pharmacies

11. Global Thrombosis Drugs Market, (USD Million) 2021-2034

11.1. Global Thrombosis Drugs Market Size and Market Share

12. Global Thrombosis Drugs Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3 .India

12.1.4 .Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5 .United Kingdom

12.2.6 .Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1.Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Amgen Inc

13.1.1. Company details

13.1.2 .Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Aspen Pharmacare Holdings Limited

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Baxter International Inc

13.3.1. Company details

13.3.2. Financial outlook

13.3.3 .Product summary

13.3.4. Recent developments

13.4. Bayer AG

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Boehringer Ingelheim GmbH

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Bristol-Myers Squibb Company

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Daiichi Sankyo Company, Limited

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. GlaxoSmithKline plc

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Janssen Pharmaceuticals, Inc

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Pfizer Inc

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links