Traffic Signal Controller Market Introduction and Overview

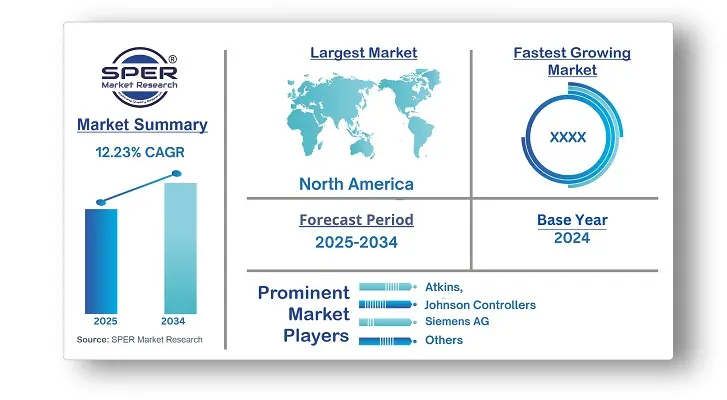

According to SPER Market Research, the Global Traffic Signal Controller Market is estimated to reach USD 18.86 billion by 2034 with a CAGR of 12.23%.

The report includes an in-depth analysis of the Global Traffic Signal Controller Market, including market size and trends, product mix, Applications, and supplier analysis. The Traffic Signal Controller Market was valued at USD 5.95 billion in 2024 and is expected to grow at a CAGR of more than 12.23% between 2025 and 2034. Increased urbanisation and traffic congestion in cities are driving market expansion. As cities get more congested, the number of vehicles on the road automatically increases. Traffic signal controllers are critical tools for managing the increasing traffic volume.

By Component Insights

The market is divided into three segments based on components: services, software, and hardware. In 2024, the software segment had the largest market share. Modern traffic signal controllers depend heavily on software for their main functions. As traffic management systems improve, scalability and adaptability grow in importance. Software is inherently more adaptable than hardware. New features can be added through software updates, letting the system adjust to changing traffic conditions. This scalability is crucial for smart city projects, as traffic management systems must support a growing and dynamic urban setting.

By Application Insights

Based on application, the traffic signal controller market is divided into urban and suburban areas. The urban area segment is expected to have the largest market share by 2034 because urban regions contain far more cars and people than suburbs, leading to a greater need for traffic management to prevent congestion, accidents, and jams. Traffic signal controllers are critical for controlling traffic flow in these congested areas. Urban areas also have more complex road networks, requiring advanced traffic management technologies to enhance traffic flow.

Regional Insights

North America will lead the global traffic signal controller market with the highest revenue in 2024. Rapid urbanization in the region is causing more traffic congestion, raising the demand for effective traffic management systems and modern traffic signal controllers. U. S. governments are also investing in smart city projects to enhance transportation efficiency. Traffic signal controllers are vital to these systems, with innovative technologies like adaptive traffic control and connected vehicle integration driving market growth.

Market Competitive Landscape

There are many domestic and foreign manufacturers engaged in the fiercely competitive traffic signal controller market. Companies in the industry are mainly focused on differentiating their product offerings by using novel technologies such as artificial intelligence and IoT sensors, among others. Key participants in the global market include Siemens, Aldridge Traffic Controllers (ATC), Econolite, Johnson Controls, Sumitomo Electric Industries, SWARCO, Hikvision, KYOSAN, and FAMA Traffic, among others.

Recent Developments:

June 2023: Q-Free displayed its main AI-enabled ARM processor for advanced transportation controllers (ATCs) at the IMSA Forum and Expo 2023 in Reno, Nevada. The company intends to be the first in North America to have a traffic signal controller using modern ARM-based architecture, as well as the first AI-enabled signal controller in the industry.

April 2023: Yunex Traffic launched its Yutraffic Blade Advanced Traffic Controller Platform in the US, featuring a dual-core processor to simplify intersection management and consolidate traffic solutions.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Component, By Control System, By Application, By End User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Atkins, Econolite, Johnson Controllers, PTV Group, Siemens AG, Sumitomo Electric Mfg Co, SWARCO AG, Temple Inc, Traffic Technologies Pty Ltd, Yunex Traffic.

|

Key Topics Covered in the Report

- Global Traffic Signal Controller Market Size (FY’2021-FY’2034)

- Overview of Global Traffic Signal Controller Market

- Segmentation of Global Traffic Signal Controller Market By Component (Hardware, Software, Services)

- Segmentation of Global Traffic Signal Controller Market By Control System (Fixed-time, Actuated, Adaptive)

- Segmentation of Global Traffic Signal Controller Market By Application (Urban Area, Suburbs Area)

- Segmentation of Global Traffic Signal Controller Market By End User (Government, Private Contractors)

- Statistical Snap of Global Traffic Signal Controller Market

- Expansion Analysis of Global Traffic Signal Controller Market

- Problems and Obstacles in Global Traffic Signal Controller Market

- Competitive Landscape in the Global Traffic Signal Controller Market

- Details on Current Investment in Global Traffic Signal Controller Market

- Competitive Analysis of Global Traffic Signal Controller Market

- Prominent Players in the Global Traffic Signal Controller Market

- SWOT Analysis of Global Traffic Signal Controller Market

- Global Traffic Signal Controller Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Timber Laminating Adhesives Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Timber Laminating Adhesives Market

7. Global Timber Laminating Adhesives Market, By Resin type (USD Million) 2021-2034

7.1. Melamine formaldehyde

7.2. Phenol resorcinol formaldehyde adhesives

7.3. Polyurethane

7.4. Emulsion polymer isocyanate adhesives

7.5. Others

8. Global Timber Laminating Adhesives Market, By Application (USD Million) 2021-2034

8.1. Floor beams

8.2. Roof beams

8.3. Window and door headers

8.4. Trusses and supporting columns

8.5. Others

9. Global Timber Laminating Adhesives Market, By End-User (USD Million) 2021-2034

9.1. Residential

9.2. Commercial

9.3. Industrial

9.4. Institutional

9.5. Others

10. Global Timber Laminating Adhesives Market, (USD Million) 2021-2034

10.1. Global Timber Laminating Adhesives Market Size and Market Share

11. Global Timber Laminating Adhesives Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. 3M Company

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Akzo Nobel N.V

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Bostik SA (Arkema Group)

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Dow Chemical Company

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. H.B. Fuller Company

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Henkel AG & Co. KGaA

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Sika AG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links