UAE Cold Chain Market Growth, Size, Share, Revenue, Competition and Future Trends 2032

UAE Cold Chain Market Size- By Temperature, By Ownership, By Mode of Freight, By Type of Freight, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2032

| Published: Feb-2023 | Report ID: AMIN2321 | Pages: 1 - 103 | Formats*: |

| Category : Automotive & Transportation | |||

- Through the implementation of the Dubai Silk Road Strategy and its advanced logistics infrastructure, the United Arab Emirates aspires to evolve into a key player in the supply chain. This transformation involves manufacturing and exporting pharmaceuticals to in-demand regions like Africa and Asia.

- In 2022: Disrupt-X, a UAE-based IoT Development Company, has unveiled a Cold Storage Monitoring Solution under Ignite Shield, an Intel Market Ready Solution for sensing temperature and humidity levels in cold storage facilities from the comfort of an office to the convenience of a smartphone. Users may also utilise the solution to build personalised reports, which employs AI to provide suggestions based on temperature and humidity measurements.

-01009213022023.jpg)

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Temperature, By Ownership, By Mode of Freight, By Type of Freight, By End User |

| Regions covered | Abu Dhabi, Al Aweer, DIC (Dubai Internet City), DIP (Dubai Investments Park), Dubai, JAFZA (Jebel Ali Free Zone), Sharjah, Others |

| Companies Covered | Agility, Al Futtaim, Bhatia Brothers, CEVA, DB Schenker, DSV Panalpina, GAC, GSL, Hellmann, Khalidia Shipping, Kuehne and Nagel, Mohebi, RHS, RSA Cold Chain, Sharjah Cold Stores, Tameem Logistics, Triburg |

- Food and Beverage Industry

- Government and Regulatory Bodies

- Hospitality and Catering Services

- Logistics and Transportation Providers

- Pharmaceutical and Healthcare Companies

- Retail and E-commerce Platforms

- Technology Providers

- Others

| By Temperature: |

|

| By Ownership: |

|

| By Mode of Freight: |

|

| By Type of Freight: |

|

| By End User: |

|

- UAE Cold Chain Market Size (FY’2022-FY’2032)

- Overview of UAE Cold Chain Market

- Segmentation of UAE Cold Chain Market By Temperature (Ambient, Chilled, Frozen, By Ownership, Contract, Integrated)

- Segmentation of UAE Cold Chain Market By Mode of Freight (Air, Sea, Land)

- Segmentation of UAE Cold Chain Market By Type of Freight (International, Domestic)

- Segmentation of UAE Cold Chain Market By End User (Vegetables and Fruits, Dairy Products, Pharmaceuticals, Meat and Seafood, Others)

- Segmentation of UAE Cold Chain Market By Ownership (Integrated, Contract)

- Statistical Snap of UAE Cold Chain Market

- Expansion Analysis of UAE Cold Chain Market

- Problems and Obstacles in UAE Cold Chain Market

- Competitive Landscape in the UAE Cold Chain Market

- Effects of COVID-19 and Demonetization on UAE Cold Chain Market

- Details on Current Investment in UAE Cold Chain Market

- Competitive Analysis of UAE Cold Chain Market

- Key Market Players in the UAE Cold Chain Market

- SWOT Analysis of UAE Cold Chain Market

- UAE Cold Chain Market Future Outlook and Projections (FY’2022-FY’2032)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

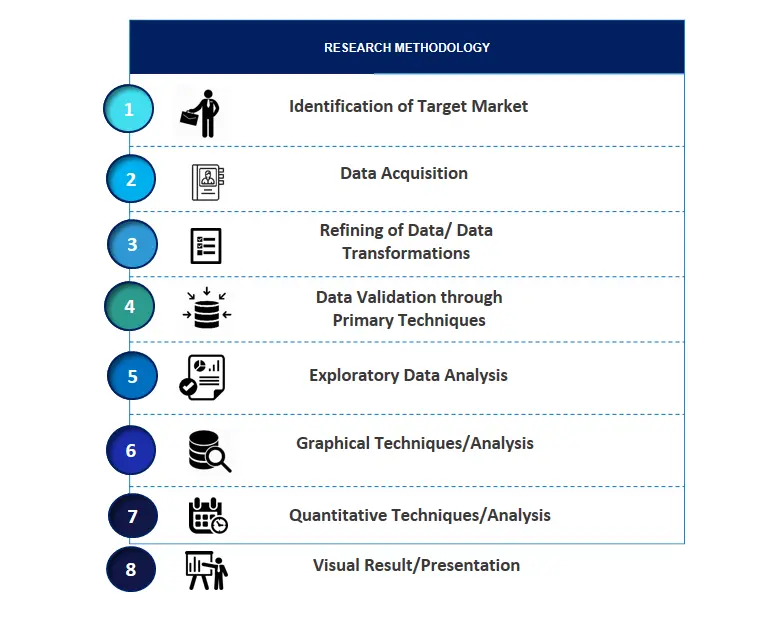

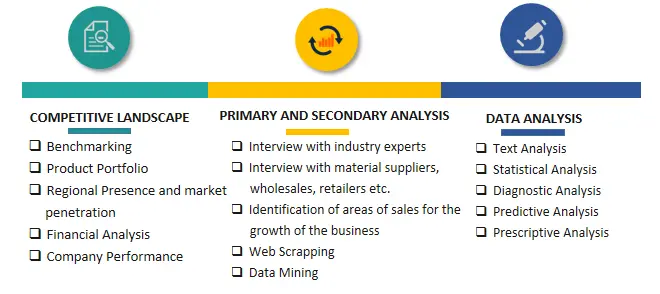

2.1 Research data source2.1.1 Secondary data2.1.2 Primary data2.1.3 SPER’s internal database2.1.4 Premium insight from KOL’s2.2 Market size estimation2.2.1 Top-down and Bottom-up approach2.3 Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1 Drivers4.1.2 Restraints4.1.3 Opportunities4.1.4 Challenges4.2. COVID-19 Impacts of the UAE Cold Chain Market

5.1. SWOT analysis

5.1.1 Strengths5.1.2 Weaknesses5.1.3 Opportunities5.1.4 Threats5.2. PESTEL analysis5.2.1 Political landscape5.2.2 Economic landscape5.2.3 Social landscape5.2.4 Technological landscape5.2.5 Environmental landscape5.2.6 Legal landscape5.3. PORTER’S five forces analysis5.3.1 Bargaining power of suppliers5.3.2 Bargaining power of Buyers5.3.3 Threat of Substitute5.3.4 Threat of new entrant5.3.5 Competitive rivalry5.4. Heat map analysis

6.1 UAE Cold Chain Manufacturing Base Distribution, Sales Area, Product Type6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in UAE Cold Chain Market

7.1 Ambient7.2 Chilled7.3 Frozen

8.1 Contract8.2 Integrated

9.1 Air9.2 Land9.3 Sea

10.1 Domestic

10.2 International

11.1 Dairy Products11.2 Meat and Seafood11.3 Pharmaceuticals11.4 Vegetables and Fruits11.5 Others

12.1 UAE Cold Chain Size and Market Share by Region (2019-2025)12.2 UAE Cold Chain Size and Market Share by Region (2026-2032)12.3 Abu Dhabi12.4 Al Aweer12.5 DIC (Dubai Internet City)12.6 DIP (Dubai Investments Park)12.7 Dubai12.8 JAFZA (Jebel Ali Free Zone)12.9 Sharjah12.10 Others

13.1 Agility13.1.1 Company details13.1.2 Financial outlook13.1.3 Product summary13.1.4 Recent developments13.2 Al Futtaim13.2.1 Company details13.2.2 Financial outlook13.2.3 Product summary13.2.4 Recent developments13.3 Bhatia Brothers13.3.1 Company details13.3.2 Financial outlook13.3.3 Product summary13.3.4 Recent developments13.4 CEVA13.4.1 Company details13.4.2 Financial outlook13.4.3 Product summary13.4.4 Recent developments13.5 DB Schenker13.5.1 Company details13.5.2 Financial outlook13.5.3 Product summary13.5.4 Recent developments13.6 DSV Panalpina13.6.1 Company details13.6.2 Financial outlook13.6.3 Product summary13.6.4 Recent developments13.7 GAC13.7.1 Company details13.7.2 Financial outlook13.7.3 Product summary13.7.4 Recent developments13.8 GSL13.8.1 Company details13.8.2 Financial outlook13.8.3 Product summary13.8.4 Recent developments13.9 Hellmann13.9.1 Company details13.9.2 Financial outlook13.9.3 Product summary13.9.4 Recent developments13.10 Khalidia Shipping13.10.1 Company details13.10.2 Financial outlook13.10.3 Product summary13.10.4 Recent developments13.11 Kuehne and Nagel13.11.1 Company details13.11.2 Financial outlook13.11.3 Product summary13.11.4 Recent developments13.12 Mohebi13.12.1 Company details13.12.2 Financial outlook13.12.3 Product summary13.12.4 Recent developments13.13 RHS13.13.1 Company details13.13.2 Financial outlook13.13.3 Product summary13.13.4 Recent developments13.14 RSA Cold Chain13.14.1 Company details13.14.2 Financial outlook13.14.3 Product summary13.14.4 Recent developments13.15 Sharjah Cold Stores13.15.1 Company details13.15.2 Financial outlook13.15.3 Product summary13.15.4 Recent developments13.16 Tameem Logistics13.16.1 Company details13.16.2 Financial outlook13.16.3 Product summary13.16.4 Recent developments13.17 Triburg13.17.1 Company details13.17.2 Financial outlook13.17.3 Product summary13.17.4 Recent developments

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.