UAE Online Grocery Delivery Market Overview

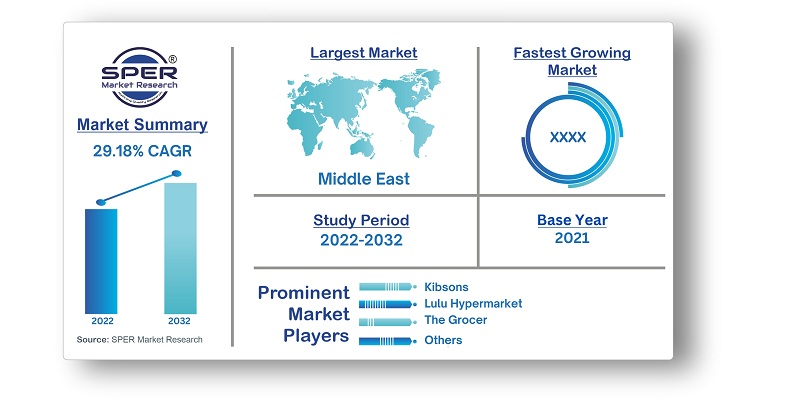

According to SPER Market Research, the UAE Online Grocery Delivery Market is estimated to reach USD 6.87 billion by 2032 with a CAGR of 29.18%.

The UAE's high internet penetration rate, expanding working population, and rising number of single-parent families have all contributed to the expansion of e-grocery services. Over time, there have been more businesses in the UAE offering grocery delivery services. Companies have expanded their product lines to include a wide range of goods, including household goods, fresh food, baby food, fish, and meat, in addition to food and beverages. The demand is anticipated to increase. To fulfil client orders, businesses are expected to concentrate on strengthening their relationships with suppliers and grocery stores. Future technologies like drone delivery, warehouse automation, voice ordering, and others are predicted to fuel demand. Future market consolidation is anticipated as large-cap companies that have a strong brand will buy out smaller firms.

Impact of COVID-19 on the UAE Online Grocery Delivery Market

The global economy's indirect effects of the pandemic and the coronavirus outbreak have had a substantial effect on the UAE's online grocery market. All facilities in the UAE were closed, with the exception of cooperative societies, supermarkets, grocery stores, and pharmacies, in order to stop the spread of COVID-19. Even throughout the period of movement restrictions, they remained open 24/7 to serve the people. To encourage its citizens to stay at home and only out for doing needed errands, the UAE's telecom regulator, the Telecommunications Regulatory Authority (TRA), published a list of several applications of online retailers providing food and other essential things during the epidemic.Due of the corona pandemic, more people are avoiding crowded places and turning to internet shopping, which has caused online food sales in the area to soar recently. The average internet order basket has grown since the corona pandemic.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2019-2032 |

| Base year considered | 2021 |

| Forecast period | 2022-2032 |

| Segments covered | By Product Category, By Platform, By Mode of Payment, By Age Group, By Gender |

| Regions covered | Abu Dhabi, Dubai, Sharjah, Rest of UAE |

| Companies Covered | Amazon, Bawiq, Bulkwhiz, Carrefour, Farmbox, Instashop, Kibsons, Lulu Hypermarket, Noon, The Grocer, Trolley.ae |

Target Audience-

- Online Grocery Delivery Companies

- Supermarkets & Hypermarkets

- E-commerce Companies

- Food Delivery Companies

- Investors

UAE Online Grocery Delivery Market Segmentation:

1. By Product Category:

- Baby Care

- Beauty & Health

- Fresh Foods

- Household Products

- Packaged Foods & Beverages

- Personal Care

2. By Platform:

- Desktop Website

- Mobile Application

3. By Mode of Payment:

- Card on Delivery

- Cash on Delivery

- Pre-Delivery Online Payment

4. By Age Group:

- 18-24 years

- 25-34 years

- 35-44 years

- 45+ years

5. By Gender:

6. By Region:

- Abu Dhabi

- Dubai

- Sharjah

- Rest of UAE

Key Topics Covered in the Report:

- Size of UAE Online Grocery Delivery Market (FY’2019-FY’2032)

- Overview of UAE Online Grocery Delivery Market

- Segmentation of UAE Online Grocery Delivery By Product Category (Baby Care, Beauty & Health, Fresh Foods, Household Products, Packaged Foods & Beverages, Personal Care)

- Segmentation of UAE Online Grocery Delivery Market By Platform (Desktop Website, Mobile Application)

- Segmentation of UAE Online Grocery Delivery Market By Mode of Payment(Card on Delivery, Cash on Delivery, Pre-Delivery Online Payment)

- Segmentation of UAE Online Grocery Delivery Market By Age Group(18-24 years, 25-34 years, 35-44 years, 45+ years)

- Segmentation of UAE Online Grocery Delivery Market By Gender(Female, Male)

- Statistical Snap of UAE Online Grocery Delivery Market

- Growth Analysis of UAE Online Grocery Delivery Market

- Problems and Challenges in UAE Online Grocery Delivery Market

- Competitive Landscape in the UAE Online Grocery Delivery Market

- Impact of COVID-19 and Demonetization on UAE Online Grocery Delivery Market

- Details on Recent Investment in UAE Online Grocery Delivery Market

- Competitive Analysis of UAE Online Grocery Delivery Market

- Major Players in the UAE Online Grocery Delivery Market

- SWOT Analysis of UAE Online Grocery Delivery Market

- UAE Online Grocery Delivery Market Future Outlook and Projections (FY’2019-FY’2032)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1 Research data source

2.1.1 Secondary data

2.1.2 Primary data

2.1.3 SPER’s internal database

2.1.4 Premium insight from KOL’s

2.2 Market size estimation

2.2.1 Top-down and Bottom-up approach

2.3 Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2. COVID-19 Impacts of the UAE Online Grocery Delivery Market

5. Market variables and outlook

5.1. SWOT analysis

5.1.1 Strengths

5.1.2 Weaknesses

5.1.3 Opportunities

5.1.4 Threats

5.2. PESTEL analysis

5.2.1 Political landscape

5.2.2 Economic landscape

5.2.3 Social landscape

5.2.4 Technological landscape

5.2.5 Environmental landscape

5.2.6 Legal landscape

5.3. PORTER’S five forces analysis

5.3.1 Bargaining power of suppliers

5.3.2 Bargaining power of Buyers

5.3.3 Threat of Substitute

5.3.4 Threat of new entrant

5.3.5 Competitive rivalry

5.4. Heat map analysis

6. Competitive Landscape

6.1 UAE Online Grocery Delivery Manufacturing Base Distribution, Sales Area, Product Type

6.2 Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in UAE Online Grocery Delivery Market

7. UAE Online Grocery Delivery Market, By Product Category,2019-2032 (USD Million)

7.1 Baby Care

7.2 Beauty & Health

7.3 Fresh Foods

7.4 Household Products

7.5 Packaged Foods & Beverages

7.6 Personal Care

8. UAE Online Grocery Delivery Market, By Platform, 2019-2032 (USD Million)

8.1 Desktop Website

8.2 Mobile Application

9. UAE Online Grocery Delivery Market, By Mode of Payment, 2019-2032 (USD Million)

9.1 Card on Delivery

9.2 Cash on Delivery

9.3 Pre-Delivery Online Payment

10. UAE Online Grocery Delivery Market, By Age Group, 2019-2032 (USD Million)

10.1 18-24 years

10.2 25-34 years

10.3 35-44 years

10.4 45+ years

11. UAE Online Grocery Delivery Market, By Gender, 2019-2032 (USD Million)

11.1 Female

11.2 Male

12. UAE Online Grocery Delivery Market, By Region, 2019-2032 (USD Million)

12.1 UAE Online Grocery Delivery Size and Market Share by Region (2019-2025)

12.2 UAE Online Grocery Delivery Size and Market Share by Region (2026-2032)

12.3 Abu Dhabi

12.4 Dubai

12.5 Sharjah

12.6 Rest of UAE

13. Company Profiles

13.1 Amazon

13.1.1 Company details

13.1.2 Financial outlook

13.1.3 Product summary

13.1.4 Recent developments

13.2 Bawiq

13.2.1 Company details

13.2.2 Financial outlook

13.2.3 Product summary

13.2.4 Recent developments

13.3 Bulkwhiz

13.3.1 Company details

13.3.2 Financial outlook

13.3.3 Product summary

13.3.4 Recent developments

13.4 Carrefour

13.4.1 Company details

13.4.2 Financial outlook

13.4.3 Product summary

13.4.4 Recent developments

13.5 Farmbox

13.5.1 Company details

13.5.2 Financial outlook

13.5.3 Product summary

13.5.4 Recent developments

13.6 Instashop

13.6.1 Company details

13.6.2 Financial outlook

13.6.3 Product summary

13.6.4 Recent developments

13.7 Kibsons

13.7.1 Company details

13.7.2 Financial outlook

13.7.3 Product summary

13.7.4 Recent developments

13.8 Lulu Hypermarket

13.8.1 Company details

13.8.2 Financial outlook

13.8.3 Product summary

13.8.4 Recent developments

13.9 Noon

13.9.1 Company details

13.9.2 Financial outlook

13.9.3 Product summary

13.9.4 Recent developments

13.10 The Grocer

13.10.1 Company details

13.10.2 Financial outlook

13.10.3 Product summary

13.10.4 Recent developments

13.11 Trolley.ae

13.11.1 Company details

13.11.2 Financial outlook

13.11.3 Product summary

13.11.4 Recent developments

14. List of Abbreviations

15. Reference Links

16. Conclusion

17. Research Scope

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.