U.S Wires and Cables Market Introduction and Overview

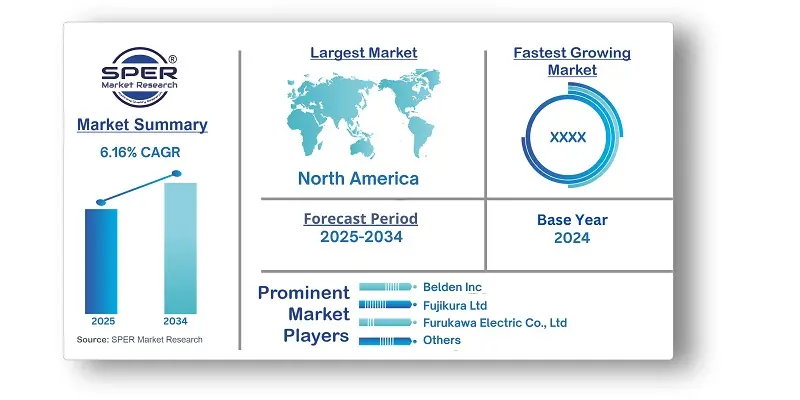

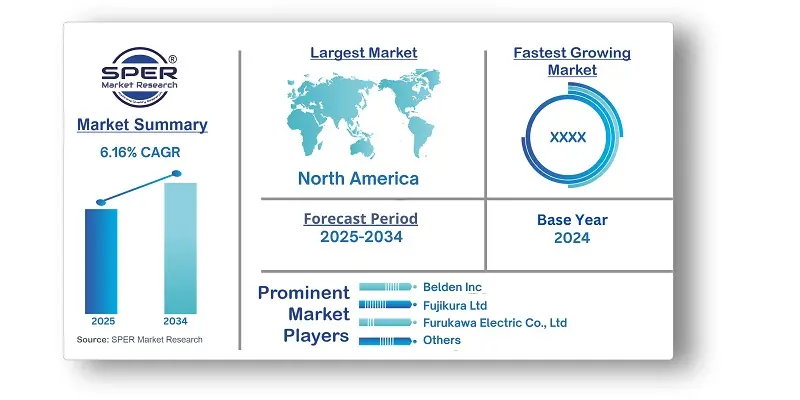

According to SPER Market Research, the U.S Wires and Cables Market is estimated to reach USD 58.41 billion by 2034 with a CAGR of 6.16%.

The report includes an in-depth analysis of the U.S Wires and Cables Market, including market size and trends, product mix, Applications, and supplier analysis. The U.S Wires and Cables market is expected to be worth USD 32.13 billion in 2024, with a CAGR of 6.16% between 2025 and 2034. In recent years, the wires and cables industry in the United States has experienced significant growth and transformation. The adoption of high-performance materials, precision engineering, and customer-centric innovations has redefined industry standards for quality, safety, and reliability. Rising demand across sectors such as construction, telecommunications, electric vehicles, and renewable energy has fueled continuous product development. Technological advancements—including smart cables, AI-assisted design, and 3D modeling—have enhanced cable performance, durability, and customization. The emergence of specialized, application-specific cables and direct-to-consumer distribution models has increased market responsiveness and efficiency. Limited-edition, project-based solutions for infrastructure upgrades and large-scale installations have also generated demand spikes. Furthermore, the renewed focus on grid modernization and retrofitting aging infrastructure has expanded the market base, attracting both public and private investment into advanced cable systems.

By Installation Insights

Overhead Installation continues to dominate the U.S. wires and cables market due to its cost-effectiveness, lower maintenance requirements, and suitability for long-distance electrical transmission. These advantages are driving increased demand across a wide range of applications. For example, PLP, a global leader in electric power infrastructure solutions, introduced its Aeolus Line Monitoring Service—a cutting-edge platform designed to measure and analyse wind-induced conductor motion on overhead lines. This innovation enhances the reliability and efficiency of overhead systems, further reinforcing their widespread adoption in the nation's power transmission networks.

By Voltage Insights

The Low Voltage segment held the largest share of the U.S. wires and cables market in 2024, owing to its broad application across multiple sectors. Nuclear and thermal power plants, automation systems, wind energy installations, and sound and security systems all make substantial use of these lines. Their versatility, safety, and cost-efficiency make them ideal for a wide range of residential, commercial, and industrial applications, thereby significantly contributing to the segment’s continued market growth.

By End User Insight

Power Transmission and Distribution is the dominating segment in the U.S. demand for wires and cables, mostly due to the growth of transmission infrastructure projects nationwide. The growing demand for reliable and efficient power supply in commercial buildings, industrial facilities, and urban developments is a key factor fueling this segment’s growth. As electricity consumption continues to rise, especially in densely populated and industrialized regions, the need for robust transmission and distribution networks is accelerating, further boosting the demand for high-quality wires and cables.

By Region Insights

The U.S Wires and Cables Market is separated into four regional segments: Northeast, Midwest, West, and South. The Northeastern region is currently leading the market. This is largely due to the presence of major Wires and Cables companies, robust research and development (R&D) infrastructure, and high healthcare expenditure in these areas.

Market Competitive Landscape

The U.S Wires and Cables Industry has major players, including Belden, Inc, Encore Wire Corporation, Fujikura Ltd, Furukawa Electric Co., Ltd, Hitachi, Ltd, LEONI, LS Cable & System Ltd, Nexans, Prysmian Group, Siemon, and Southwire Company, LLC. These companies compete fiercely with each other and local firms that have strong distribution networks and knowledge of suppliers and regulations. Southwire Company, LLC is one of North America’s largest manufacturers of wire and cable, playing a vital role in powering the infrastructure that connects people and communities. Founded in 1950 and headquartered in Carrollton, Georgia, USA, the company produces a wide range of products including building wire, utility cable, industrial power cables, and copper and aluminum rod. Southwire operates across several key segments such as construction, energy, industrial, and OEM markets. It is also a leader in sustainability and innovation, offering solutions that support grid modernization and renewable energy integration.

Recent Developments:

In July 2024: LS Cable & System has secured a contract valued at KRW 100 billion to supply submarine cables to LS Power Grid California, a U.S.-based power grid operator. Under this agreement, the company will provide submarine cables for projects in the western United States. This strategic move is expected to strengthen LS Cable & System’s foothold in the U.S. market and reinforce its position as a key player in the region’s power transmission infrastructure.

In June 2024: LS Cable & System has signed a contract with ELIA Transmission Belgium to supply submarine cables valued at approximately KRW 280 billion. The cables will be delivered to Princess Elizabeth Island, an artificial energy island designed to serve as a critical link between 3.5 GW offshore wind farms and Belgium’s onshore power grid. This floating structure will play a key role in managing and distributing renewable energy, and LS Cable & System’s involvement highlights its growing expertise and presence in large-scale global energy infrastructure projects.

In August 2023: Fujikura Ltd. has developed a new harness cable for automotive side airbags, achieving significant improvements in both weight and size. The newly introduced samples are approximately 30% lighter and have a 10% smaller diameter compared to the company’s existing products, while maintaining the same level of trauma resistance as traditional PVC tubes. This advancement not only enhances durability but also increases flexibility in cable layout, contributing to overall weight reduction in the side airbag system. The innovation underscores Fujikura’s commitment to delivering high-performance, space-efficient solutions for the evolving needs of the automotive industry.

In April 2023: Sumitomo Electric Industries, Ltd. has announced plans to establish a power cable manufacturing facility in Scotland, U.K., to meet the rising demand for power cables in the European market. The U.K. is emerging as one of the largest markets for power cables, driven by its ambitious offshore wind power initiatives aimed at achieving the Scottish government’s net zero target by 2045 and the U.K.’s overall net zero goal by 2050. The new facility will support the growing infrastructure needs associated with renewable energy expansion and reinforce Sumitomo Electric’s presence in the region’s sustainable energy transition.

In February 2023: Nexans, a French cable manufacturing company, has secured a contract to supply subsea cables for the PacWave South site—the first grid-connected wave energy test facility in the United States, located off the coast of Oregon. The project features four berths designed to harness energy from wave motion, marking a significant step in advancing marine renewable energy. Nexans’ involvement highlights its expertise in subsea cable technology and its commitment to supporting innovative, sustainable energy infrastructure in the U.S. market.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Installation, By Voltage, By End User |

| Regions covered | Northeast, Midwest, West, South |

| Companies Covered | Belden, Inc, Encore Wire Corporation, Fujikura Ltd, Furukawa Electric Co., Ltd, Hitachi, Ltd, LEONI, LS Cable & System Ltd, Nexans, Prysmian Group, Siemon, Southwire Company, LLC. |

Key Topics Covered in the Report

- U.S Wires and Cables Market Size (FY’2021-FY’2034)

- Overview of U.S Wires and Cables Market

- Segmentation of U.S Wires and Cables Market, By Installation (Overhead, Underground, Submarine)

- Segmentation of U.S Wires and Cables Market, By Voltage (Low Voltage, Medium Voltage, High Voltage, Extra-High Voltage)

- Segmentation of U.S Wires and Cables Market, By End-User (Aerospace & Defense, Construction, IT & Telecommunication, Power Transmission & Distribution, Oil & Gas, Consumer Electrnoics, Manufacturing, Automative, Others)

- Statistical Snap of U.S Wires and Cables Market

- Expansion Analysis of U.S Wires and Cables Market

- Problems and Obstacles in U.S Wires and Cables Market

- Competitive Landscape in the U.S Wires and Cables Market

- Details on Current Investment in U.S Wires and Cables Market

- Competitive Analysis of U.S Wires and Cables Market

- Prominent Players in the U.S Wires and Cables Market

- SWOT Analysis of U.S Wires and Cables Market

- U.S Wires and Cables Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1.Introduction

1.1.Scope of the report

1.2.Market segment analysis

2.Research Methodology

2.1.Research data source

2.1.1.Secondary Data

2.1.2.Primary Data

2.1.3.SPERs internal database

2.1.4.Premium insight from KOLs

2.2.Market size estimation

2.2.1.Top-down and Bottom-up approach

2.3.Data triangulation

3.Executive Summary

4.Market Dynamics

4.1.Driver, Restraint, Opportunity and Challenges analysis

4.1.1.Drivers

4.1.2.Restraints

4.1.3.Opportunities

4.1.4.Challenges

5.Market variable and outlook

5.1.SWOT Analysis

5.1.1.Strengths

5.1.2.Weaknesses

5.1.3.Opportunities

5.1.4.Threats

5.2.PESTEL Analysis

5.2.1.Political Landscape

5.2.2.Economic Landscape

5.2.3.Social Landscape

5.2.4.Technological Landscape

5.2.5.Environmental Landscape

5.2.6.Legal Landscape

5.3.PORTERs Five Forces

5.3.1.Bargaining power of suppliers

5.3.2.Bargaining power of buyers

5.3.3.Threat of Substitute

5.3.4.Threat of new entrant

5.3.5.Competitive rivalry

5.4.Heat Map Analysis

6.Competitive Landscape

6.1.U.S Wires and Cables Market Manufacturing Base Distribution, Sales Area, Product Type

6.2.Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in U.S Wires and Cables Market

7.U.S Wires and Cables Market, By Installation 2021-2034 (USD Million)

7.1.Overhead

7.2.Underground

7.3.Submarine

8.U.S Wires and Cables Market, By Voltage 2021-2034 (USD Million)

8.1.Low Voltage

8.2.Medium Voltage

8.3.High Voltage

8.4.Extra-High Voltage

9.U.S Wires and Cables Market, By End-User 2021-2034 (USD Million)

9.1.Aerospace & Defense

9.2.Construction

9.3.IT & Telecommunication

9.4.Power Transmission & Distribution

9.5.Oil & Gas

9.6.Consumer Electronics

9.7.Manufacturing

9.8.Automative

9.9.Others

10.U.S Wires and Cables Market, 2021-2034 (USD Million)

10.1.U.S Wires and Cables Market Size and Market Share

11.U.S Wires and Cables Market, By Region, 2021-2034 (USD Million)

11.1.Northeast

11.2.Midwest

11.3.West

11.4.South

12.Company Profile

12.1.Belden, Inc

12.1.1.Company details

12.1.2.Financial outlook

12.1.3.Product summary

12.1.4.Recent developments

12.2.Encore Wire Corporation

12.2.1.Company details

12.2.2.Financial outlook

12.2.3.Product summary

12.2.4.Recent developments

12.3.Fujikura Ltd

12.3.1.Company details

12.3.2.Financial outlook

12.3.3.Product summary

12.3.4.Recent developments

12.4.Furukawa Electric Co., Ltd

12.4.1.Company details

12.4.2.Financial outlook

12.4.3.Product summary

12.4.4.Recent developments

12.5.Hitachi, Ltd

12.5.1.Company details

12.5.2.Financial outlook

12.5.3.Product summary

12.5.4.Recent developments

12.6.LEONI

12.6.1.Company details

12.6.2.Financial outlook

12.6.3.Product summary

12.6.4.Recent developments

12.7.LS Cable & System Ltd

12.7.1.Company details

12.7.2.Financial outlook

12.7.3.Product summary

12.7.4.Recent developments

12.8.Nexans

12.8.1.Company details

12.8.2.Financial outlook

12.8.3.Product summary

12.8.4.Recent developments

12.9.Prysmian Group

12.9.1.Company details

12.9.2.Financial outlook

12.9.3.Product summary

12.9.4.Recent developments

12.10.Siemon

12.10.1.Company details

12.10.2.Financial outlook

12.10.3.Product summary

12.10.4.Recent developments

12.11.Southwire Company, LLC

12.11.1.Company details

12.11.2.Financial outlook

12.11.3.Product summary

12.11.4.Recent developments

12.12.Others

13.Conclusion

14.List of Abbreviations

15.Reference Links