Global Vegan Steak Market Introduction and Overview

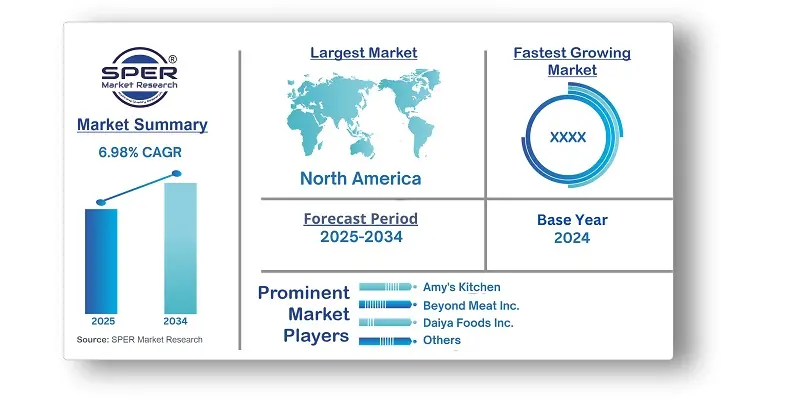

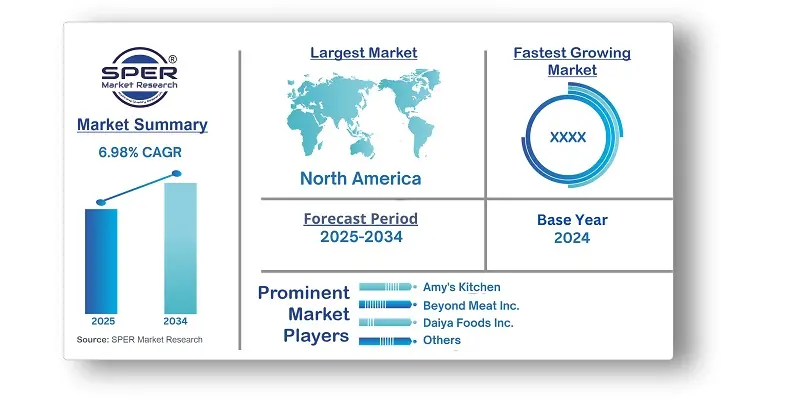

According to SPER Market Research, the Global Vegan Steak Market is estimated to reach USD 1235.11 million by 2034 with a CAGR of 6.98%.

The report includes an in-depth analysis of the Global Vegan Steak Market, including market size and trends, product mix, Applications, and supplier analysis. Growing consumer interest in plant-based diets, driven by health, environmental, and ethical considerations, is fueling a significant increase in the demand for vegan steak. Individuals focused on their well-being are attracted to its tasty and nutritious profile as a substitute for traditional meat. Growing concerns about animal welfare and sustainability further motivate consumers toward cruelty-free and eco-friendly choices. The increasing availability and diverse range of vegan steak products across supermarkets, restaurants, and online platforms are also significantly boosting consumer access and driving this rising demand. However, Challenges in the vegan steak market include achieving a taste and texture that truly satisfies consumers accustomed to traditional steak, and overcoming the perception of a higher price point compared to conventional meat.

By Source:

Soy currently leads the vegan steak market due to its exceptional ability to replicate the texture and protein of traditional steak, making it a versatile and popular substitute. Its easy availability and affordability benefit manufacturers aiming for cost-effective options. Furthermore, soy's rich amino acid content offers nutritional value, and its neutral taste allows for diverse flavor profiles, appealing to many consumers. Its established history in plant-based foods also contributes to its market dominance.

By End User:

The vegan steak market serves various sectors, including packaged food companies, hotels and restaurants, retail food outlets, individual consumers, and others. Currently, home consumers account for a substantial portion of the market, with continued expansion expected. A key factor driving demand is the increasing adoption of plant-based diets in households globally, which has led to a greater need for convenient and flavorful vegan alternatives to traditional meat. With more people preparing meals at home, this segment has become a primary target for vegan steak products.

By Distribution Channel:

Distribution of vegan steak involves channels such as supermarkets/hypermarkets, convenience stores, specialty stores, online platforms, and others. Supermarkets and hypermarkets presently hold the largest market share. These major retailers offer a broad selection of vegan products, including steak alternatives, catering to both mainstream shoppers and those transitioning to plant-based diets. These stores provide significant visibility for vegan steak brands through extensive shelf space. Consumers often prefer these outlets due to the convenience of comprehensive shopping and the ability to easily compare different products.

By Regional Insights:

The North American vegan steak market is experiencing considerable growth. This is fueled by the rising popularity of plant-based diets, which is, in turn, driven by greater awareness of health, environmental sustainability, and ethical concerns. The region's innovative food culture promotes the development and acceptance of new plant-based options, such as vegan steak. Furthermore, North America's well-established retail infrastructure, encompassing supermarkets, specialty stores, and online platforms, enables vegan steak brands to effectively reach a diverse consumer base.

Market Competitive Landscape:

The competitive landscape of the vegan steak market is moderately consolidated. Key players in this market include Amy's Kitchen, Beyond Meat, Inc., Daiya Foods Inc., Danone S.A, Earth’s Own Food Company Inc., Eat Just, Inc., Field Roast, Gardein, Impossible Foods Inc., and Ripple Foods Inc.

Recent Developments:

In March 2024, Planted, a prominent Swiss company in the European plant-based meat industry, introduced a clean-label, whole-cut vegan steak. This innovative product utilizes a unique fermentation method to achieve appealing flavor, nutritional benefits, and environmental advantages simultaneously.

In July 2022, Beyond Meat expanded its plant-based offerings by launching a new vegan steak product. The company, known for its meat-free alternatives, introduced these steak slices to broaden its range.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Source, By End

User, By Distribution Channel |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East

& Africa |

| Companies Covered | Amy's

Kitchen, Beyond Meat, Inc., Daiya Foods Inc., Danone S.A, Earth’s Own Food

Company Inc., Eat Just, Inc., Field Roast, Gardein, Impossible Foods Inc., and

Ripple Foods Inc. |

Key Topics Covered in the Report

- Global Vegan Steak Market Size (FY’2021-FY’2034)

- Overview of Global Vegan Steak Market

- Segmentation of Global Vegan Steak Market By Source (Soy, Almond, Wheat, Others)

- Segmentation of Global Vegan Steak Market By End User (Packaged Food Industries, Hotels and Restaurants, Retail Food Shops, Domestic Consumers, Others)

- Segmentation of Global Vegan Steak Market By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Platforms, Others)

- Statistical Snap of Global Vegan Steak Market

- Expansion Analysis of Global Vegan Steak Market

- Problems and Obstacles in Global Vegan Steak Market

- Competitive Landscape in the Global Vegan Steak Market

- Details on Current Investment in Global Vegan Steak Market

- Competitive Analysis of Global Vegan Steak Market

- Prominent Players in the Global Vegan Steak Market

- SWOT Analysis of Global Vegan Steak Market

- Global Vegan Steak Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Vegan Steak Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Vegan Steak Market

7.Global Vegan Steak Market, By Source, (USD Million) 2021-2034

7.1. Soy

7.2. Almond

7.3. Wheat

7.4. Others

8. Global Vegan Steak Market, By End User, (USD Million) 2021-2034

8.1. Packaged Food Industries

8.2. Hotels and Restaurants

8.3. Retail Food Shops

8.4. Domestic Consumers

8.5. Others

9. Global Vegan Steak Market, By Distribution Channel, (USD Million) 2021-2034

9.1. Supermarkets/Hypermarkets

9.2. Convenience Stores

9.3. Specialty Stores

9.4. Online Platforms

9.5. Others

10. Global Vegan Steak Market, (USD Million) 2021-2034

10.1. Global Vegan Steak Market Size and Market Share

11. Global Vegan Steak Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Amy's Kitchen

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Beyond Meat, Inc.

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Daiya Foods Inc.

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Danone S.A

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Earth’s Own Food Company Inc.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Eat Just, Inc.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7.Field Roast

12.7.1.Company details

12.7.2.Financial outlook

12.7.3.Product summary

12.7.4.Recent developments

12.8. Gardein

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Impossible Foods Inc.

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Ripple Foods Inc

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11.Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.